According to participants in the Chicago Fed’s annual Economic Outlook Symposium, the U.S. economy is forecasted to grow at a pace slightly above average in 2017, with inflation moving higher and the unemployment rate remaining low.

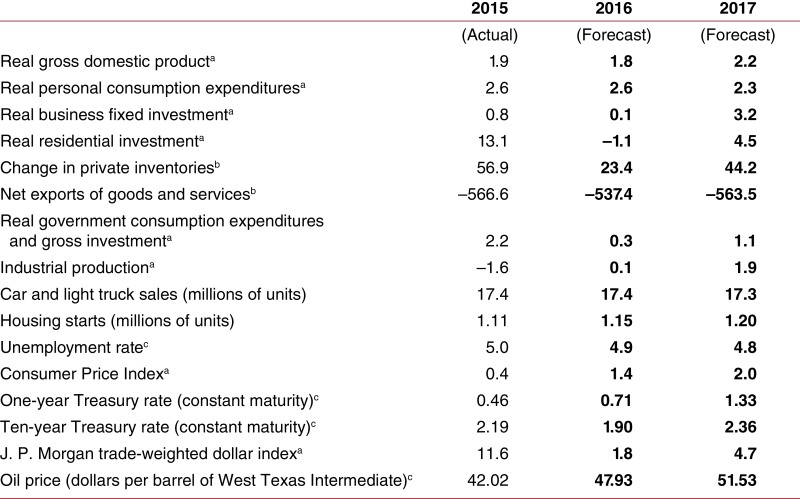

The Federal Reserve Bank of Chicago held its 30th annual Economic Outlook Symposium (EOS) on December 2, 2016. More than 100 economists and analysts from business, academia, and government attended the conference. This Chicago Fed Letter reviews the forecasts for 2016 from the previous EOS, and then analyzes the forecasts for 2017 (see figure 1) and summarizes the presentations from the most recent EOS.

The U.S. economy entered the eighth year of its expansion in the third quarter of 2016. While the nation’s real gross domestic product (GDP) is at its highest level in history, the rate of economic growth since the end of the Great Recession in mid-2009 has been very restrained. During the 29 quarters following the second quarter of 2009, the annualized rate of real GDP growth was 2.1%—just slightly above what is considered the long-term rate of growth for the U.S. economy. Additionally, the annualized rate of real GDP growth over the first three quarters of 2016 was 0.2 percentage points below the average of the current expansion.

The biggest drags on economic growth during 2016 were weak investment (both business and residential) and government spending. Real business fixed investment decreased at an annualized rate of 0.4% in the first three quarters of 2016. Possible culprits for this anemic performance were moderate growth in the overall economy; excess capacity remaining in the industrial sector; the collapse of energy prices lowering investment in this sector; the strong international value of the U.S. dollar; and economic uncertainty during this past presidential election year. Real residential investment decreased at an annualized rate of 1.6% during the first three quarters of 2016, after increasing at an annualized rate of 9.4% between the third quarter of 2010 and the final quarter of 2015. Even though residential spending declined, the annualized rate of housing starts increased to 1.16 million units for the first 11 months of 2016—up 5.4% relative to the same period in 2015. Real government spending grew at an annualized rate of 0.2% during the first three quarters of 2016—well below the 1.2% it has averaged over the past 20 years.

1. Median forecasts of real gross domestic product and related items

bBillions of chained (2009) dollars in the fourth quarter at a seasonally adjusted annual rate.

cFourth quarter average.

Notes: These values reflect forecasts made in November 2016.

Source: Actual data from authors’ calculations and Haver Analytics; median forecasts from Economic Outlook Symposium participants.

Energy prices remained quite low in 2016. Specifically, the price of West Texas Intermediate oil averaged $49 per barrel in the final quarter of 2016—above the $42 it averaged in the fourth quarter of 2015, but still well below the nearly $80 per barrel it averaged in the ten years before the collapse of oil prices in the middle of 2014.

Consumer spending expanded at a solid pace last year: Real personal consumption expenditures grew at an annualized pace of 3.0% during the first three quarters of 2016. In particular, light vehicle sales (car and light truck sales) remained very strong in 2016, edging higher to a new record of 17.5 million units. Given energy prices continued to stay low in 2016, more consumers chose to purchase larger and less fuel-efficient vehicles than in the year before: Sales for light trucks (including sport utility vehicles) were up 7.1% in 2016 compared with the previous year, while sales for passenger cars were down 8.5%. This dramatic shift in consumer demand led to a record-setting share for light trucks of 60.6% of overall light vehicle sales in 2016.

Against this backdrop, the economy continued to increase employment in 2016: 2.16 million jobs were added last year. Moreover, in the final quarter of 2016, the unemployment rate stood at 4.7%—a rate that would normally be associated with full employment. However, other measures of the labor market suggest that slack is still present. For instance, by historical standards, there remains an outsized number of part-time workers who desire full-time employment and a large percentage of unemployed workers who have been out of work for more than six months.

Inflation, as measured by the Consumer Price Index (CPI), had increased from an extremely low 0.4% in 2015 to a still quite low year-over-year rate of 1.7% by November 2016.

Results versus forecasts

According to the consensus forecast from the most recent EOS, the growth rate of real GDP in the fourth quarter of 2016 relative to the fourth quarter of 2015 is estimated to be 1.8%—lower than the 2.6% rate predicted at the previous EOS. (For the remaining comparisons of GDP components, annual values are calculated based on the consensus estimates for the fourth quarter of 2016 from the most recent EOS.) While growth in real personal consumption expenditures was very close to what was forecasted, growth in real business fixed investment and real residential investment came in significantly weaker than expected. The unemployment rate was actually 4.7% in the fourth quarter of 2016—0.2 percentage points lower than the value forecasted for the final quarter of 2016. Inflation, as measured by the CPI, is now expected to be 1.4% in 2016—0.5 percentage points below the previously predicted rate of 1.9% for the year. Oil’s actual average price in the fourth quarter of 2016 was $49.20 per barrel—lower than its predicted average price of $53.25 per barrel. Light vehicle sales actually came in at 17.5 million units for 2016—slightly below the 17.6 million units forecasted. The annualized rate of housing starts was 1.16 million units for the first 11 months of 2016; so, total housing starts in 2016 are expected to fall short of the 1.24 million units previously predicted. The one-year Treasury rate in fact moved up to 0.76% in the fourth quarter of 2016—below the 1.04% forecasted. The ten-year Treasury rate actually decreased to 2.13% by the end of 2016, instead of increasing to the predicted rate of 2.70%.

Economic outlook for 2017

The forecast for 2017 is for the pace of economic growth to be just above the long-term average. In 2017, the growth rate of real GDP is expected to be 2.2%—an improvement from the projected 1.8% rate for 2016. The quarterly pattern reveals a fairly steady performance for real GDP growth throughout 2017. Given that the economic growth rate is forecasted to be only slightly above its historical average, the unemployment rate is expected to be 4.8% in the final quarter of 2017. Inflation, as measured by the CPI, is predicted to increase from an estimated 1.4% in 2016 to 2.0% in 2017. Oil prices are anticipated to increase, but still remain fairly low; they are predicted to average $51.53 per barrel in the final quarter of 2017. Real personal consumption expenditures are forecasted to expand at a rate of 2.3% in 2017. Light vehicle sales are expected to ease to 17.3 million units this year. The growth rate of real business fixed investment is anticipated to rebound to a solid 3.2% in 2017. Industrial production is forecasted to grow by 1.9% this year—below its historical average rate of growth.

The housing sector is predicted to improve and continue its slow march toward normalization in 2017. The growth rate of real residential investment is forecasted to be a solid 4.5% in 2017. And housing starts are anticipated to rise to 1.20 million units in 2017—but still well below the 20-year annual average of roughly 1.32 million starts.

The one-year Treasury rate is expected to rise to 1.33% in 2017, and the ten-year Treasury rate is forecasted to increase to 2.36%. The trade-weighted U.S. dollar is predicted to rise an additional 4.7% in 2017, and the nation’s trade deficit (i.e., net exports of goods and services) is anticipated to increase to $563.5 billion by the final quarter of 2017.

Consumer and banking outlook

Carl Tannenbaum, executive vice president and chief economist, Northern Trust, presented his outlook for consumers and the banking sector. Tannenbaum stressed the need to look “beneath the surface” of headline economic numbers in order to understand some Americans’ current disappointment with the economy. According to one Gallup poll, the state of the economy is among the chief concerns for Americans today. To illuminate this polling result, Tannenbaum presented several trends for the U.S. economy. First, Tannenbaum identified some positive trends. The recovery from the Great Recession has been going fairly well, though its pace has been rather slow, he said. Consumer spending has been restrained since the financial crisis, and households have repaired their balance sheets, increasing their savings rate to just below 6% of their disposable income (a healthy rate, according to Tannenbaum). Joblessness is down a lot relative to 2009, when the Great Recession ended. Indeed, the official unemployment rate has fallen to pre-recessionary levels, but there’s still room for improvement if individuals marginally attached to the labor force and those working part time for economic reasons are accounted for. Citing the increases in real personal consumption expenditures and the Conference Board’s Consumer Confidence Index, Tannenbaum explained that, on the whole, consumers have felt optimistic enough about the overall economy and their personal financial situations to increase their spending in recent years.

Turning to the negative trends, Tannenbaum noted that lingering debt remains a major issue. For instance, student loan debt continues to rise, impairing household formation. Moreover, although the housing market has been generally improving, approximately 12% of Americans with single-family home mortgages remain “underwater” on them. According to Tannenbaum, this might be keeping job vacancies in certain labor markets from being filled because potential workers cannot sell their homes and move to different geographical locations for work. In the current economic expansion, those with at least a bachelor’s degree have experienced greater gains in employment and income than those with more modest levels of educational attainment, Tannenbaum stated. Additionally, those in the bottom half of the income distribution are much more likely to experience job disruptions, he said. Among the challenging economic conditions Americans face today, Tannenbaum highlighted the federal debt and deficit, rising health care costs, and the negative consequences of potentially reducing trade with other countries.

Shifting to the banking sector, Tannenbaum observed that bank stocks have been doing well and lending has been increasing. Tannenbaum stated the nation’s largest banks are well capitalized, partly because of mandatory Federal Reserve stress testing, which assesses how well these banks would cope in a future crisis.1 In addition, credit conditions are accommodative (e.g., borrowing costs are historically low), he said. However, public pension systems are struggling with low interest rates, as pension debt continues to rise and pension funding ratios (assets-to-liabilities ratios) fall. Tannenbaum warned that low interest rates may influence some investors to “reach for yield” by investing in less familiar and riskier instruments than government bonds. Yet, Tannenbaum was generally optimistic about the near-term prospects of the U.S. banking sector.

Automotive industry outlook

Michael Robinet, managing director, automotive advisory solutions, IHS Markit, presented his outlook for the automotive industry. According to Robinet, global light vehicle production is expected to increase from 91.4 million units in 2016 to 92.8 million units in 2017. Auto production is expected to increase at an annual rate of 2.2% from 2016 through 2023. He noted that although the automotive sector had been a significant driver of global economic activity over the past couple of years, the industry is now expected to grow at a more muted pace. Following the Great Recession, global light vehicle production increased by approximately 29 million units, or about 50%, from 2009 through 2015. He said he anticipates auto production to increase by approximately 17 million units from 2016 through 2023. The two most populous economies in the world are the primary drivers for this anticipated increase: China is expected to account for about 40% of this growth, and India for about 30%, Robinet said. Europe’s auto production has not contributed to global growth in light vehicle production as much as in the past, partly because of its political and economic issues (e.g., the Greek debt crisis and Brexit). However, European auto production should play a larger role in the future. Lastly, over this forecast period, the subcompact and compact segments should experience the most growth globally, he indicated.

Turning to North America, Robinet said he projects annual light vehicle production to reach 18 million units in 2017 and 18.6 million units by 2023. U.S. light vehicle sales are projected to peak at 17.5 million units in 2017 (a somewhat higher estimate than the symposium’s consensus median forecast of 17.3 million units) and then gradually decline through 2023. The prices of vehicles have risen on account of inflation, additional regulations (such as those to improve safety and fuel efficiency), and the incorporation of new vehicle features (such as integrated Internet connectivity) that the market demands, Robinet contended.

Finally, Robinet discussed trends in the geographical distribution of North American auto production, as well as the shift toward technology that improves fuel efficiency in new vehicles. Much of the industry has been projected to continue shifting toward Mexico, in part because of lower costs associated with transporting vehicles to final markets and holding inventories. Already a global exporter of vehicles, Mexico will keep adding auto production capacity in the coming years. In regard to technologies that raise fuel economy, Robinet said he expects further incorporation of automated rapid start–stop systems for internal combustion engines (which reduce engine idling time) and greater use of mild or full hybrid drivetrains going forward. Robinet indicated that beyond 2020, he envisions even greater electrification of automobiles (including more cars running exclusively on electricity) than there is today.

Steel industry outlook

Robert DiCianni, manager of marketing and analysis, ArcelorMittal USA, said he had an optimistic outlook for the steel industry in 2017, after a year in which overall U.S. steel consumption was down somewhat. Domestic steel consumption decreased by 1% in 2016 from the previous year, to 105 million tons. Nonresidential construction, the largest final market for steel, grew quite modestly in 2016, following a small dip in activity in 2015. Moreover, industrial production (including mining and utilities) slowed in 2016, reducing the demand for steel. For instance, the energy industry, which uses a lot of steel for extracting and transporting oil and gas, decreased its steel consumption by approximately 3.5 million tons. Steel service centers, which serve as a bridge between steel producers and final consumers, have liquidated their inventories, he said. Indeed, steel inventories have been low since 2015. The U.S. steel industry’s capacity utilization2 is below its long-term trend of 70%, which DiCianni indicated may be due to service centers not being in the market for steel. On the whole, the market for steel has been weak or tepid over the past year or so. That said, DiCianni noted he expects the steel industry to have a better year in 2017. According to his forecast, U.S. steel consumption is expected to grow approximately 3% in 2017, reaching 108 million tons (lower than the 120 million tons that are consumed in a normal good year). Nonresidential construction is predicted to increase its consumption of steel by 6% in 2017, adding about 1.2 million tons to steel demand. The energy sector is expected to increase steel consumption by about 2 million tons this year. Although auto sales are expected to be flat or slightly down in 2017, steel should maintain its market share above other metals used in auto production, such as aluminum, he said. Steel inventories are expected to begin rebuilding in the first quarter of 2017, he indicated.

Global steel consumption is projected to grow 0.5% in 2017, to 1.51 billion metric tons. North America’s and Europe’s steel consumption is predicted to increase 2.9% and 1.4%, respectively. In contrast, China’s steel consumption is expected to decrease 2%, reflecting the slowing growth of its economy. One trend in the global steel industry that DiCianni highlighted is an increase in steel prices, which is partly due to a pickup in global steel demand and rulings on international trade that have decreased the supply of steel in certain countries.

Heavy machinery outlook

Deanne Short, Americas regional chief economist, Caterpillar, presented a positive outlook for the heavy machinery industry. Short began by noting that world real GDP growth is forecasted by the International Monetary Fund to be 2.8% in 2017. When world real GDP growth is above 2.7%, there is typically better growth for heavy machinery sales, she noted. Short said that the North American heavy machinery industry has some upside in 2017 on account of several factors. In October 2016, U.S. annualized housing starts were up sharply, and modest improvements in both housing permits and starts are expected for 2017, she said. Additionally, the National Association of Realtors’ Housing Affordability Index is well above 100, which suggests that conditions are very favorable for home purchases. Examining banks’ historical year-over-year changes in both residential and commercial real estate lending, Short argued that at present, credit is easily available and is not choking off demand. Given the passage of the FAST Act3 in late 2015, spending on building or improving highways, streets, and other transportation infrastructure is expected to increase in 2017. Short also mentioned there were some referendums recently passed at the state and local levels that should support infrastructure projects, but the economic impact from these projects may not be felt until 2018. In addition, if any new major public–private partnership deals for infrastructure projects are struck, their effects may not be seen until 2019 or later. All of these recent developments and forecasts are favorable for future heavy machinery sales, Short stated.

Turning to the mining, oil, and gas industries, Short noted their capacity utilization has been down, which is a negative sign for future heavy machinery sales. Short said she expects mining to remain depressed in 2017. However, she did note that the global mining industry’s earnings margins and capital expenditures have begun to recover, which likely bodes well for heavy machinery sales beyond 2017.

Outside of North America, demand for heavy machinery equipment has been falling in the past few years, said Short. This is likely due to the growing pains associated with China’s economic and financial reforms, the excess supply of certain metal commodities (which have depressed their prices), and various political crises across the globe. But Short indicated heavy machinery sales outside North America are nearing a bottom and will probably begin to rise again in 2017.

Covering Chicago manufacturing from high above

Kris Habermehl, airborne reporter, WBBM-AM (a Chicago-based all-news radio station), presented helicopter footage of Chicago’s Calumet Harbor in the 1990s and early 2010s. Habermehl spoke about various vessels that have traversed Lake Michigan and docked at the harbor and nearby facilities that were used for industrial production. A substantial amount of the industrial space has been repurposed or turned into green space, he said. Habermehl said that in his reportage on manufacturing he wished to provide a historical perspective of how things were done in the past, as well as how they are being done more efficiently today.

Conclusion

In 2016, the U.S. economy expanded at a pace roughly in line with the historical average. The economy in 2017 is forecasted to grow at a slightly faster rate than it did in 2016. Business investment and the housing sector are predicted to rebound in 2017. The unemployment rate is expected to be 4.8% by the end of 2017, and inflation is predicted to rise to 2%.

1 For more details on Federal Reserve stress testing for large bank holding companies, see https://www.federalreserve.gov/bankinforeg/dfa-stress-tests.htm.

2 Capacity utilization is calculated as the actual output produced with installed equipment divided by the potential output that could be produced with it if used to its full capacity.

3 For details on the FAST (Fixing America’s Surface Transportation) Act, see https://www.transportation.gov/fastact.