Outcome-Based Monetary Policy

Due to weather-related travel problems, Chicago Fed President Charles Evans canceled his attendance July 13 at the Ninth Annual Rocky Mountain Economic Summit in Victor, Idaho, hosted by the Global Interdependence Council. This is the outline of the speech he was to deliver.

- Before I begin, I need to remind you that my comments this morning are my own and not necessarily those of the Federal Reserve System or the Federal Open Market Committee (FOMC).

- I’ve been involved in a number of conferences and other public forums recently discussing the monetary policy lessons learned from our experience at the zero lower bound (ZLB).

- There is always a lot of debate at these events about the efficacies of unconventional policies, such as negative interest rates, quantitative easing (QE), and forward guidance.1 Such debate is natural: First of all, as economists, we love to argue; but more importantly, we just don’t have a lot of historical experience with such policies to provide definitive answers.

- Still, one consistent lesson I’ve taken away is that a key element to success is strong policymaker focus on mandated objectives—something I like to call “outcome-based” policy. Indeed, this focus is important for the conduct of monetary policy not just at the ZLB, but also in more conventional policy regimes.

- All central banks have mandates: All have inflation objectives, and the Federal Reserve has a dual mandate that includes supporting maximum employment.2 Some commentators judge central banks by how good our forecasts are or how closely monetary policy follows a particular rule. Although these are instructive ingredients for the policy process, they are not the ultimate goal. Our goal is to hit our objectives. Therefore, to judge success, the appropriate metrics are how actual outcomes for inflation and employment measure up against our mandated policy goals. And to achieve success, central bankers need to keep their scorecards with these metrics in mind.

- Today I will discuss three lessons around this theme that struck home for me from our experience in the aftermath of the Great Financial Crisis and to the current environment, in which the real economy is performing well, though inflation remains stubbornly below our 2 percent objective:3

- First, outcome-based policies are especially critical during crises—and they are indispensable in the face of the zero lower bound.

- Second, a symmetric inflation target is a challenging policy objective for conservative central bankers to deliver on.

- And third, given the ZLB, risk management likely will remain a key best-practice consideration for policy decision-making for some time to come.

- Lesson #1: Let’s start with the lesson that outcome-based policies become even more critical during crises and are indispensable in the face of the ZLB.

- Tough monetary policy challenges are not new. Economic fundamentals are subject to varying degrees of volatility over time. But there were crucial differences between the Great Financial Crisis and previous episodes.

- First, there were the historically large magnitudes of the shortfalls from our policy objectives.

- Second, the earlier episodes began with the policy rate high enough above zero such that there was substantial cushion for cutting rates. This cushion allowed the Fed to successfully combat disinflationary forces. Unfortunately, during this cycle, we ran out of any cushion in December 2008. That is when the policy rate was reduced to the 0 to 1/4 percent range—the effective lower bound.

- In such circumstances, it is essential to credibly commit to achieving our policy goals. Stating the goals clearly is crucial, but so are actions that display a “do whatever it takes” mentality. This requires a willingness to take bold steps.

- You all are familiar with the impressive set of unconventional monetary policy tools the FOMC used after hitting the ZLB: for instance, QE1, QE2, calendar-date forward guidance, and the 2011 maturity extension program.4 (And I am deliberately omitting the special liquidity programs.) But all of these still were not enough to meet our policy mandates.

- By the fall of 2012, the FOMC, as well as other policymakers around the globe, had recognized the need for further actions to achieve their policy objectives. At the Fed, we made what I think were two of our most important and successful nontraditional policy moves that year.

- The first was our open-ended QE3, which began in September 2012 and committed us to purchase long-term assets until we saw evidence of substantial improvement in the labor market.5 The second was our December 2012 forward guidance that stated we would hold the fed funds rate at the ZLB at least as long as unemployment was above 6.5 percent and while inflation didn’t exceed 2.5 percent.6

- I believe the explicit linking of these expansionary policies to economic outcomes was key to their success. And it makes them outstanding examples of outcome-based policies.

- Now, as former Federal Reserve Chair Ben Bernanke likes to say, while QE doesn’t work in theory, it does work in practice.7

- The FOMC was pretty confident that QE3 and threshold-based forward guidance would provide stimulus. But there was substantial uncertainty over how and when these policies would affect the economy. So by linking the policies’ open-ended duration to progress toward our policy mandates, we assured markets we were committed to doing whatever it took to improve outcomes. This bolstered the important self-reinforcing linkages between more positive private sector expectations and better current economic outcomes.

- In my opinion, these policies successfully demonstrated strong commitment to our objectives—and they produced results.

- Unemployment began to fall more quickly than anticipated in 2013, and as a result we were able to scale back the QE3 purchases beginning in late 2013 and the threshold-based forward guidance ended in March 2014. Today, we have essentially returned to full employment in the U.S.—indeed, at 4.4 percent, the unemployment rate is somewhat below the range FOMC participants see as the long-run normal level.

- What comes next for outcome-based monetary policy?

- To be sure, gross domestic product (GDP) growth was weak in the first quarter. But that seems to have been transitory. The data in hand and our forecasts point to continued improvements in real activity.

- Last month, the FOMC released its quarterly Summary of Economic Projections (SEP).8 The median participant sees GDP growth of 2.2 percent for 2017 and a slightly more modest pace of expansion in 2018 and 2019.

- The unemployment rate is expected to be about 4-1/4 percent throughout the projection period, and this is moderately below the longer-run level of 4.6 percent.

- Unfortunately, low inflation continues to be a challenge. From 2009 to the present, core PCE inflation has generally underrun 2 percent—and often by substantial amounts.9 This is over eight full years below target. This is a serious policy outcome miss.

- The U.S. economy made some noticeable progress toward the FOMC’s inflation goal when core PCE inflation rose from 1.4 percent in 2015 to 1.7 percent in 2016. But, as of last May, it had slipped back to 1.4 percent. Furthermore, with energy prices and the dollar stabilizing and resource slack diminishing, this slowdown has occurred as some of the earlier headwinds holding down inflation have receded.

- The median FOMC participant now forecasts core PCE inflation to be 1.7 percent this year (this is two-tenths below the March projection). But the median participant also sees it rising to our 2 percent target by the end of 2018.10

- My inflation outlook is not quite as sanguine as this projection. I also see downside risks to this outlook. So I believe we need to demonstrate a strong commitment to hitting our symmetric inflation objective sooner rather than later. That is, we need to pursue an outcome-based policy to actually help us achieve our symmetric inflation goal.

- To be sure, gross domestic product (GDP) growth was weak in the first quarter. But that seems to have been transitory. The data in hand and our forecasts point to continued improvements in real activity.

- Tough monetary policy challenges are not new. Economic fundamentals are subject to varying degrees of volatility over time. But there were crucial differences between the Great Financial Crisis and previous episodes.

- This leads me to Lesson #2: A symmetric inflation target can be a tough policy objective for conservative central bankers to deliver on.

- In addition to core inflation underrunning 2 percent for some time, there has been accumulating evidence since the summer of 2014 that long-run inflation expectations have drifted down.

- The declines in TIPS (Treasury Inflation-Protected Securities) inflation breakevens and consumer surveys are particularly telling.

- And clearly, lower inflation expectations make it all the more difficult for the central bank to achieve its inflation objective.

- Low energy prices, the lack of international inflationary pressures, and the low core inflation experience certainly have contributed to this drop in expectations. But I think there is an institutional factor in play, too. Namely, it is difficult for some central bankers to tolerate above-target inflation even for limited and controlled periods of time. And when the public recognize this low-inflation bias, they form expectations accordingly.

- Here, I am thinking of the solution to the Barro–Gordon (1983) dilemma of time-inconsistent decision-making as articulated by Ken Rogoff (1985). This theory emerged to explain how a well-intentioned Federal Reserve could end up delivering the excessively high inflation we experienced in the 1970s.

- In the classic Barro–Gordon world, benevolent central bankers seek to bring the unemployment rate below its sustainable natural rate11 and they set policy with discretion every period. The public recognize the policymakers’ bias and know that it would be against their best interests to ignore its impact on inflation. So they adjust their expectations accordingly. In the Barro–Gordon model, this combination of policy bias and public expectations generates above-target inflation.

- Central bankers wish to avoid such inflationary outcomes. But how do you do that? Many economists and policymakers think the solution lies in central banks following policy rules rather than discretion. But Professor Kenneth Rogoff provides a different solution that doesn’t involve policy rules.

- Rogoff suggests appointing conservative central bankers who place less weight on achieving lower unemployment. This will correct for the upward inflation bias that Barro and Gordon noted and can deliver inflation at target through standard period-by-period decision-making.

- Now, a crucial element underlying the Barro–Gordon excess inflation result is that soft-hearted policymakers will try to pursue unemployment below the sustainable natural rate. But if central bankers learn they should not attempt to permanently deliver unsustainable levels of unemployment, then no correction for inflation bias is needed. Indeed, I think the economic literature and actual high inflation experience of the 1970s and ’80s taught all monetary economists this lesson.

- I spent my formative high school and college years in the 1970s, when inflation ranged between 6 percent and 10 percent. And then I spent my formative years as a monetary economist in the disinflations of the 1980s and 1990s.

- During most of this time, the direction of monetary policy was always pretty clear: Inflation was much too high—well above any sensible inflation objective—and monetary policy tried to engineer lower inflation whenever it was opportune.

- And there were some truly substantial Fed tightenings to bring inflation down, some of which were associated with very painful recessions.12 Cumulatively, the FOMC’s resolve to pursue low and stable inflation in the Volcker–Greenspan era was strong and obvious—and it was successful.

- So, central bankers appear to have learned to avoid the Barro–Gordon inflationary bias. Indeed, the May 2003 FOMC statement13 even explicitly acknowledged a new two-sided risk, as inflation at that time was flirting with uncomfortably low levels.

- After a brief respite from 2004 to 2008, we have again been living with the risk of too-low inflation. Unlike the 1970s, ’80s, and ’90s, when policymakers were starting from inflation and inflation expectations that were too high, today we are starting from a position in which they are too low.

- But Rogoff-appointed conservative central bankers may find it difficult to believe there is no upward inflation bias to correct. Indeed, think how often you hear economists and policymakers say that discretionary policy leads to excess inflation without also stating the necessary precondition that the public believe policymakers are pursuing unsustainably low unemployment. Such misreading would lead conservative central bankers to pursue overly restrictive conditions on average and deliver lower-than-optimal inflation.

- To state this a bit differently, conservative central bankers will find it difficult to ever deliver inflation above the policy objective. In this case, our 2 percent target would not be a level around which inflation fluctuates symmetrically. Instead, it would become a ceiling for inflation.

- Moreover, the public make inferences regarding the inflation target based on our past performance, not just on our words. When they see inflation below 2 percent for eight-plus years, they might logically think 2 percent is a ceiling. If so, the public would likely push down their expectations for average inflation over the longer run, making it all the more difficult for the central bank to achieve its inflation objective.

- Note that the original Barro–Gordon problem and the conservative central banker bias both arise because policymakers fail to focus on actual outcomes relative to their ultimate objectives.

- The scorecard for the soft-hearted central banker has inflation averaging above target over the long run, while the scorecard for the conservative central banker records persistent downside misses on inflation.

- In either case, policymakers would score better if they focused on the outcomes—that is, if they would recognize their biases and adjust policy accordingly to eliminate the persistent misses.

- In addition to core inflation underrunning 2 percent for some time, there has been accumulating evidence since the summer of 2014 that long-run inflation expectations have drifted down.

- Aligning policy to avoid the risk of biased outcomes can be a meaningful feature of monetary policy more generally. Indeed, the current situation provides an important example.

- As I and many of my FOMC colleagues have noted, lower productivity and labor force growth appear to have reduced long-run output growth in the U.S. Along with massive global demand for safe assets, these trends result in lower equilibrium real interest rates.14 Lower equilibrium real rates and, if it holds, lower expected inflation add up to lower nominal policy rates in the steady state.

- This then means monetary policy will likely have less headroom to provide adequate rate cuts when large disinflationary shocks hit the economy. In other words, the odds of returning to the ZLB—and the associated risks to our employment and inflation objectives—may be higher than we would like for some time.

- This brings me to my third and final lesson, which is about managing against this risk.

- Lesson #3: Unconventional tools are effective, but they are unconventional because conventional tools are stronger. So the more likely we are to encounter shocks that might take us to the ZLB in the future, the stronger we should lean policy ex ante in the direction of accommodation—that is, we need to manage against the risks of the ZLB. And with a greater likelihood of low equilibrium real rates, we now might be facing more elevated ZLB risks than in earlier times.

- Back in 2015 I wrote a Brookings conference paper with three of my colleagues at the Chicago Fed—Jonas Fisher, François Gourio, and Spencer Krane.15 In that paper, we formalized these risk-management arguments in the workhorse forward-looking New Keynesian model, as well as in a second standard backward-looking macro model.

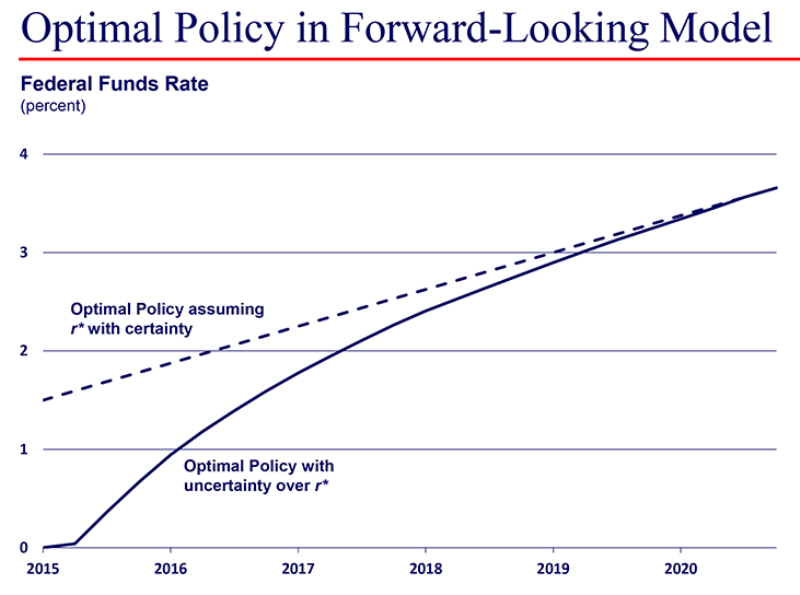

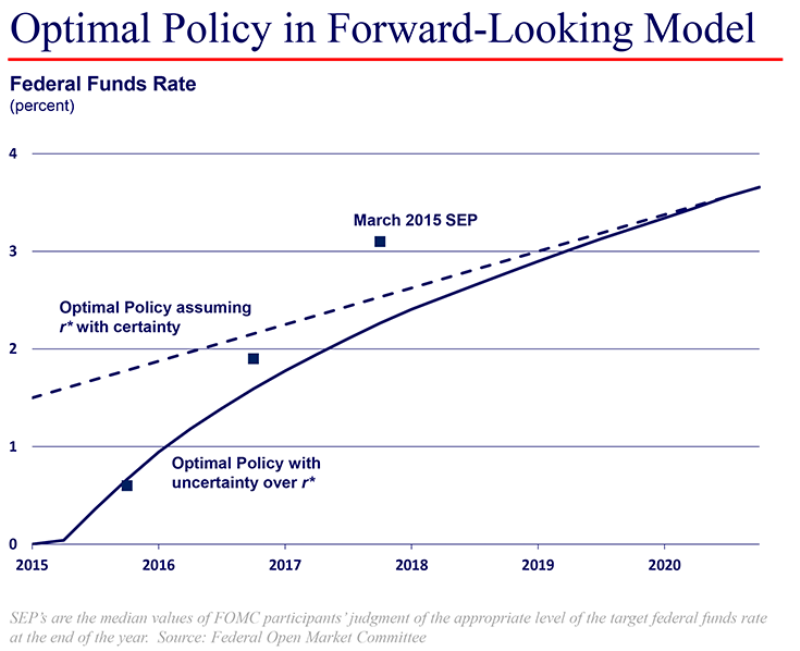

- We considered a scenario in which the current natural real interest rate, or r*, was temporarily low and expected to rise slowly over time. But the actual path for the rate was subject to random (and serially correlated) shocks. This means that a bad shock could drive you to the ZLB. If r* was known with certainty, the optimal policy would set the policy rate to follow upward the path for the equilibrium rate. But with an uncertain r* and concerns about ZLB risks, we show that optimal policy prescribes a lower rate path to reduce the risk that future unexpected shocks would drive the economy to the ZLB.

- The chart displays the results from the New Keynesian model. The dashed line shows the optimal nominal rate if policymakers and the private sector assumed there would be no future shocks to the path for the real rate. (The nominal federal funds rate starts off at 1-1/2 percent in 2015. This is simply adding the minus 1/2 percent real equilibrium federal funds rate assumed to prevail in 2015 and the 2 percent inflation target.) The solid line shows the optimal policy that accounts for uncertain shocks that may drive the economy to the ZLB. This risk-management adjustment is quite large, particularly early in the simulations.

- For reference, the squares here are the median end-of-year forecasts for the federal funds rate from the March 2015 SEP.16 As you can see, the median SEP policy path for 2015–16 wasn’t that different from the optimal policy prescription of this simple model.

- In this exercise, the starting point was calibrated to economic conditions that existed in the first quarter of 2015. Again, we assumed that the real equilibrium interest rate was minus 1/2 percent and would slowly trend up over time to 1-3/4 percent. Given our 2 percent inflation objective, this is consistent with the 3-3/4 percent forecast for the long-run nominal federal funds rate in the FOMC’s March 2015 Summary of Economic Projections.17

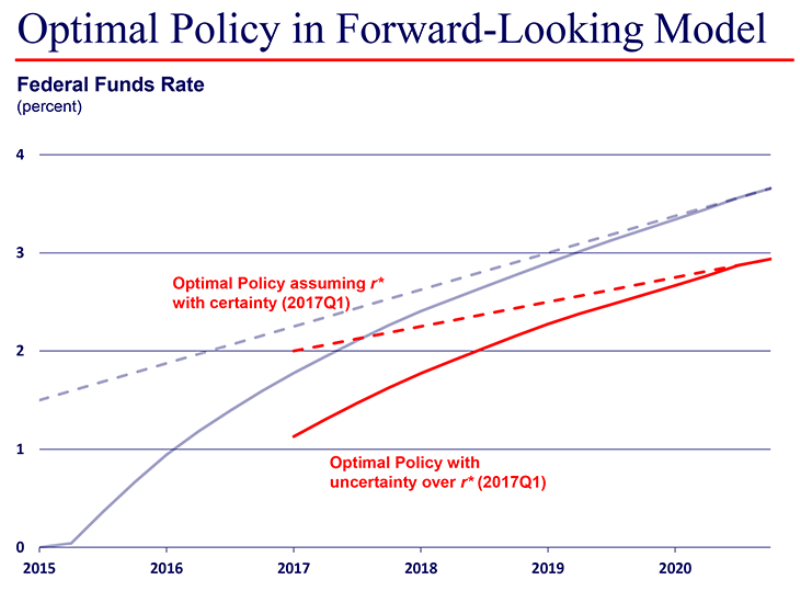

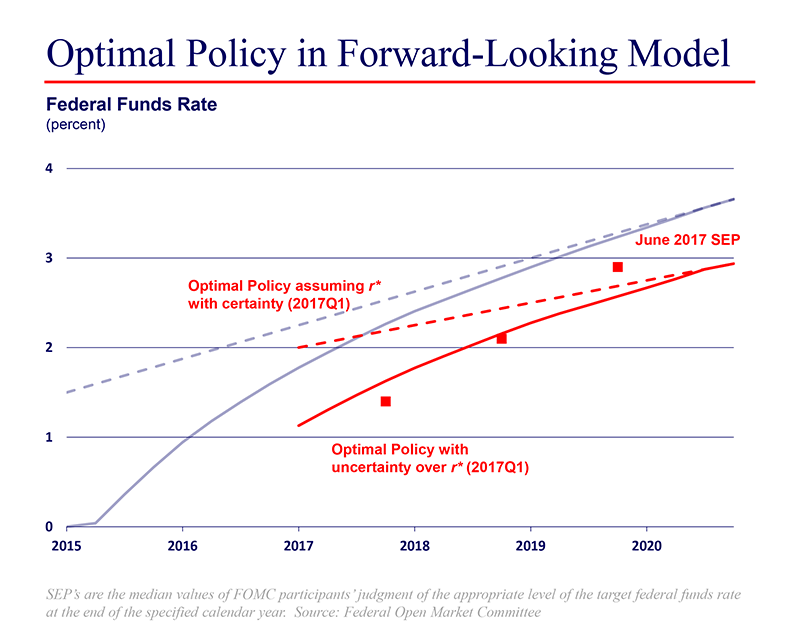

- However, today, a little over two years later, most economists now believe the long-run real rate in the U.S. is lower—probably more like 1 percent or lower, according to the June 2017 SEP.18 The next figure displays how this new endpoint influences our results.

- Fisher, Gourio, and Krane (2017) separately reran our Brookings exercise calibrating economic conditions to the first quarter of 2017 and assuming r* trends up from zero to 1 percent. As before, the solid and dashed red lines in this chart are the resulting policies with and without adjustment for uncertainty over r*.

- A few things to note on the chart. First, look at how in 2017:Q1 the blue and red dashed lines are pretty close. So our current starting point isn’t far from the 2015 exercise. Second, notice the new lower r* endpoint of 1 percent on the red lines means higher odds of hitting the ZLB. Hence, the adjustment for risk management—the difference between the dashed and solid red lines—is even greater now than it was at this point in the 2015 simulations. Third, note that the solid and dashed lines do not converge until the policy rate is nearly back to neutral, meaning the role for risk management persists until that time.

- I should emphasize that these are very stylized models, calibrated to approximate just a few macroeconomic data. The analysis also abstracts from a range of important modeling and monetary policy issues. So these results are mostly illustrative rather than strictly prescriptive.

- Nevertheless, they do suggest that ZLB risks associated with a low long-run value of the natural rate of interest have the potential to influence risk-management considerations for some time during the policy rate normalization process.

- So the takeaway from Lesson #3 is as follows: Taking extra care to avoid the substantial costs of hitting the ZLB increases the odds for achieving the central bank’s policy goals over the medium term.

- Back in 2015 I wrote a Brookings conference paper with three of my colleagues at the Chicago Fed—Jonas Fisher, François Gourio, and Spencer Krane.15 In that paper, we formalized these risk-management arguments in the workhorse forward-looking New Keynesian model, as well as in a second standard backward-looking macro model.

- Let me conclude with a brief discussion of the current monetary policy environment.

- As you know, in June the Committee voted to increase the target range for the federal funds rate to 1 to 1-1/4 percent.19 I think the improvements in the real economy to date justified this move.

- In the Summary of Economic Projections from that meeting, the median participant thought that appropriate policy would incorporate one more 25 basis point rate hike in 2017—bringing the total for this year to three—and then three more increases in each of 2018 and 2019.20 And as Chair Yellen stated in her post-meeting press conference, the Committee expects to begin gradually reducing the size of the Fed’s balance sheet sometime this year.21

- It remains to be seen whether there will be two rate hikes this year or three or even four—and exactly when we will start paring back reinvestments of maturing assets. Regardless, the important feature is that the current environment supports very gradual rate hikes and slow predetermined reductions in our balance sheet.

- I have already touched on the reasons why I support this approach. So, let me recap.

- In my view, slow removal of accommodation by the FOMC is necessary to boost inflation and symmetrically achieve our 2 percent inflation goal in a timely fashion. We also have to assure the public that we are concerned about the current challenges to our inflation objective and that we are not overly conservative central bankers who view our inflation target as a ceiling.

- Furthermore, given that we may be facing more elevated ZLB risks for some time, risk-management considerations argue for tilting toward accommodative policies that help reduce the odds of returning to the ZLB.

- Much ink will be spilled on the importance of the exact number of rate increases we’ll see this year and on various subplots regarding our balance sheet policy. I don’t want to get hung up over small differences. Ultimately, our exact actions will appropriately be driven by how events transpire to influence the outlook for achieving our policy goals. This steadfast adherence to meeting the Federal Reserve’s mandated objectives will be the overarching determinant of monetary policy.

Notes

1 For further details on the quantitative easing (QE) programs (or large-scale asset purchases) and forward guidance, see the Board of Governors of the Federal Reserve System (2015a, 2015b).

2 For more details on the Fed’s dual mandate, see https://www.chicagofed.org/research/dual-mandate/dual-mandate.

3 In January 2012, the FOMC set 2 percent inflation—measured by the annual change in the Price Index for Personal Consumption Expenditures (PCE)—as the explicit inflation target consistent with our price stability mandate. See Federal Open Market Committee (2012c).

4 For further details on the maturity extension program, see the Board of Governors of the Federal Reserve System (2013).

5 See Federal Open Market Committee (2012b).

6 See Federal Open Market Committee (2012a).

7 Berkowitz (2014).

8 See Federal Open Market Committee (2017a) for the most recent summary.

9 While our objective is in terms of overall PCE inflation, core inflation—which strips out the volatile food and energy sectors—is a better gauge of sustained inflationary pressures.

10 Federal Open Market Committee (2017a).

11 The natural rate of unemployment refers to the rate of unemployment that would predominate over the longer run in the absence of shocks to the economy.

12 Romer dates and Rudebusch’s 1988 event are good examples of substantial policy tightenings. See Romer and Romer (1989) and Rudebusch (1995).

13 Federal Open Market Committee (2003).

14 Equilibrium real interest rates are the rates consistent with the full employment of the economy’s productive resources. The equilibrium interest rate is sometimes called the “natural” or “neutral” interest rate.

15 Evans et al. (2015).

16 Federal Open Market Committee (2015).

17 Ibid.

18 Federal Open Market Committee (2017a). The 1 percent real rate is inferred from the SEP median long-run nominal federal funds rate forecast of 3 percent and the FOMC’s 2 percent inflation target.

19 Federal Open Market Committee (2017b).

20 Federal Open Market Committee (2017a).

21 Yellen (2017).

References

Barro, Robert J., and David B. Gordon, 1983, “A positive theory of monetary policy in a natural rate model,” Journal of Political Economy, Vol. 91, No. 4, August, pp. 589–610.

Berkowitz, Ben, 2014, “Bernanke cracks wise: The best QE joke ever!,” CNBC, January 16.

Board of Governors of the Federal Reserve System, 2015a, “What were the Federal Reserve’s large-scale asset purchases?,” Current FAQs, December 22.

Board of Governors of the Federal Reserve System, 2015b, “What is forward guidance and how is it used in the Federal Reserve's monetary policy?,” Current FAQs, December 16.

Board of Governors of the Federal Reserve System, 2013, “Maturity extension program and reinvestment policy,” webpage, August 2.

Evans, Charles L., Jonas D. M. Fisher, François Gourio, and Spencer Krane, 2015, “Risk management for monetary policy near the zero lower bound,” Brookings Papers on Economic Activity, Vol. 46, No. 1, Spring, pp. 141–196.

Federal Open Market Committee, 2017a, Summary of Economic Projections, Washington, DC, June 14.

Federal Open Market Committee, 2017b, press release, Washington, DC, June 14.

Federal Open Market Committee, 2015, Summary of Economic Projections, Washington, DC, March 18.

Federal Open Market Committee, 2012a, press release, Washington, DC, December 12.

Federal Open Market Committee, 2012b, press release, Washington, DC, September 13.

Federal Open Market Committee, 2012c, press release, Washington, DC, January 25.

Federal Open Market Committee, 2003, press release, Washington, DC, May 6.

Fisher, Jonas D. M., François Gourio, and Spencer Krane, 2017, “Changes in the risk-management environment for monetary policy,” Chicago Fed Letter, Federal Reserve Bank of Chicago, No. 377.

Rogoff, Kenneth, 1985, “The optimal degree of commitment to an intermediate monetary target,” Quarterly Journal of Economics, Vol. 100, No. 4, November, pp. 1169–1189.

Romer, Christina D., and David H. Romer, 1989, “Does monetary policy matter? A new test in the spirit of Friedman and Schwartz,” in NBER Macroeconomics Annual 1989, Vol. 4, Olivier Jean Blanchard and Stanley Fischer (eds.), Cambridge, MA: MIT Press, pp. 121–170.

Rudebusch, Glenn D., 1995, “Federal Reserve interest rate targeting, rational expectations, and the term structure,” Journal of Monetary Economics, Vol. 35, No. 2, April, pp. 245–274.

Yellen, Janet, 2017, transcript of Federal Reserve Chair press conference, Washington, DC, June 14.