The Future of Odyssean and Delphic Guidance

Executive summary1

Today, in discussing “Delphic” and “Odyssean” forward guidance, I am going to expand a bit beyond narrow, technical definitions.2 In a recent NBER Macroeconomics Annual Conference paper, my colleagues Jeffrey Campbell, Jonas Fisher, Alejandro Justiniano, and Leonardo Melosi developed an empirical framework to assess Delphic versus Odyssean contributions for post-financial-crisis Fed actions (Campbell et al., 2017). They found important roles for both.

I want to relate this language to some broader issues regarding monetary policy frameworks. Specifically, I will talk about Delphic communications as those associated with a well-functioning, well-understood monetary policy framework. A foundation for these communications is a variety of state-contingent responses to economic developments that are well understood and well expected by the public.

I’ll refer to Odyssean communications as those arising when unexpected events expose weaknesses and shortcomings in a Delphic framework. In such times, the need for outcome-based policies is paramount, and policymakers may be compelled to take less-well-understood actions to meet their mandated goals. These actions may dispense with usual norms and could entail entirely new commitments about future central bank behavior. As such, these Odyssean policies might be difficult to communicate and might lack strong credibility. These shortcomings could dilute their effectiveness. So my question is this: How do you convert nonstandard Odyssean policies into a better-understood and more effective Delphic framework?

Well, you do so by strengthening your current monetary policy framework. Ben Bernanke’s recent proposal at the Peterson Institute for International Economics regarding temporary price-level targeting (PLT) is one such example.3

Furthermore, the journey from the Fed’s 2010 policy debates about temporary price-level targeting at the zero lower bound (ZLB) to Bernanke’s recent proposal illustrates the challenges in transforming Odyssean policies into Delphic ones. I will get to this story momentarily, but let me develop the Delphic and Odyssean issues a bit more first.

Central bank communications—Delphic and Odyssean

Central banks employ a wide variety of communications. Just for a moment, let me ask, why do central banks need to communicate anything?

One reason is to inform the public about the broad contours of the likely path of monetary policy over the next three to five years. Clear and transparent communications help both the public and the policymakers. Information about the likely path of future policy helps shape the public’s expectations of key economic factors that, in turn, influence their spending and investment decisions. Clear communications also make monetary policy more effective by better aligning private sector expectations with the actions central banks take to achieve their goals.

One can imagine that—in an ideal world—it would be enough for a central bank to describe the goals of monetary policy, provide the economic outlook, explain how it would adjust the policy tools in order to achieve these goals over the appropriate time period, and leave it at that.

In earlier times, we at the Fed didn’t think we needed to do much communicating. Indeed, before 1994, Fed communications following a Federal Open Market Committee (FOMC) meeting was simply: “The FOMC meeting has ended.” Markets had to figure out the policy decision from the New York Fed trading desk’s daily trading actions. Minutes and the actual directive to the trading desk were published three months later, after the next meeting ended. Back in the late 1980s, most other central banks shared the Fed’s lack of transparency.

Since then, policymakers have come to appreciate more fully the critical role of clear communications in setting policy and achieving their goals. Starting with innovators such as the Bank of England and the Reserve Bank of New Zealand, central banks have come a long way. They set specific inflation targets, publish inflation reports, provide economic and policy rate projections, hold press conferences, and so on.

Still, these communications channels, by and large, are about business-as-usual monetary policy in normal times. However, as you know, the challenges of the past ten years exposed the shortcomings of these channels. In light of this experience, how should we use communications to implement effective and credible monetary policy going forward? Does the nature of the uncertainty over different policy actions require different forms of communications?

Let’s start by framing our past communications in the Delphic and Odyssean terminology I introduced at the start of my talk.

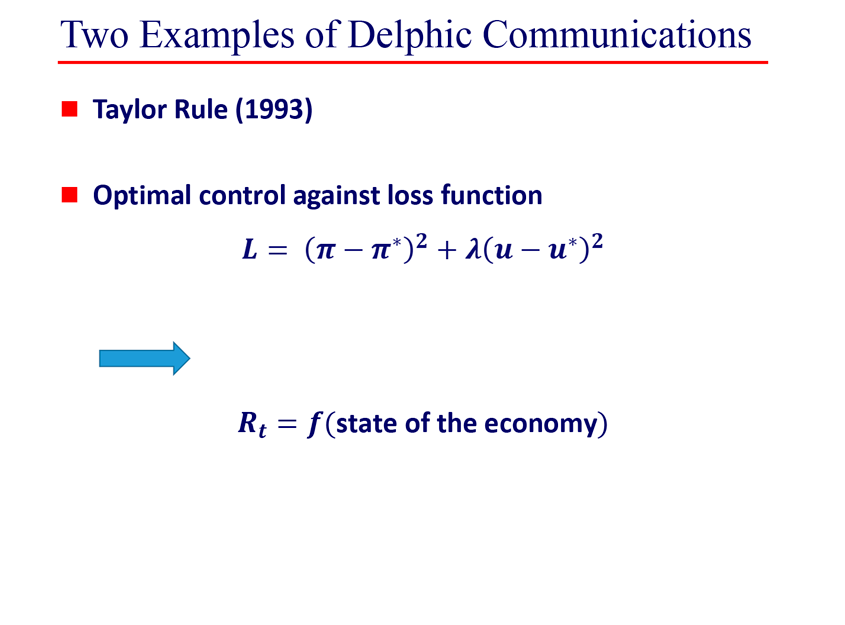

Delphic communications is about conveying monetary policy during normal times. This is when the central bank—based on forecast inferences and a well-understood policy framework—gives its best assessments of where monetary policy is likely to be going. This framework can encompass the responses to even large shocks if there is ample scope to adjust the policy instrument accordingly. Inflation and monetary policy reports are central bank documents that support these communications. Ideally, 1) the framework is credible; 2) it encompasses a variety of economic conditions; 3) it can be described by objectively measured variables; and 4) it has well-defined and verifiable policy goals. Delphic communications would then be a central bank describing its policy response function—say, either as a traditional Taylor rule4 or as the solution of an optimal control problem.

But the macroeconomic environment can change beyond the scope of an existing policy framework. In the aftermath of the Great Financial Crisis, a large variety of unconventional monetary policies were developed and deployed around the world. Generally, such new tools begin as small adjustments to more conventional and Delphic policies. But at some point, in extreme circumstances, monetary policy is more likely to enter the realm of Odysseus. The new tools required new communications.

Let me use the Fed’s recent experiences at the ZLB to illustrate what I mean.

Fed unconventional policies and Odyssean guidance

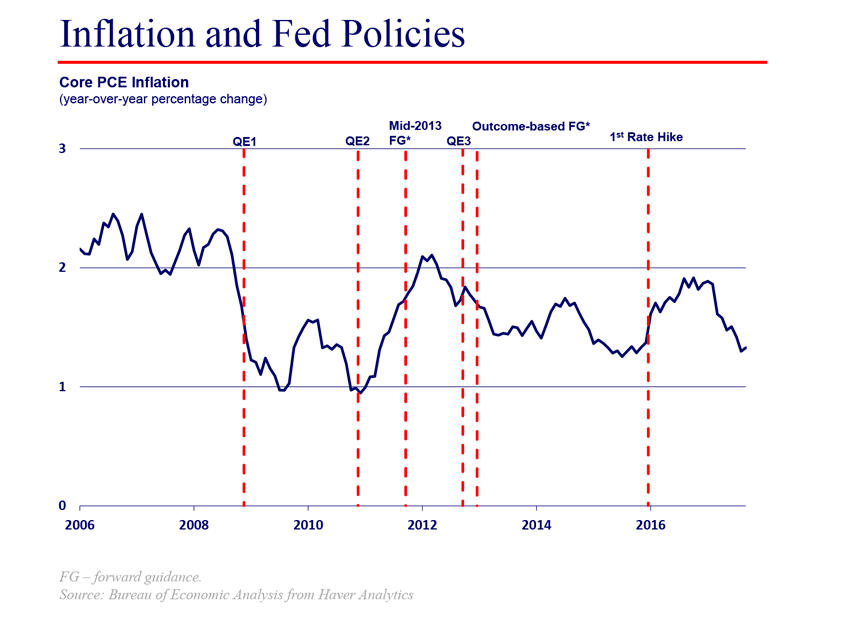

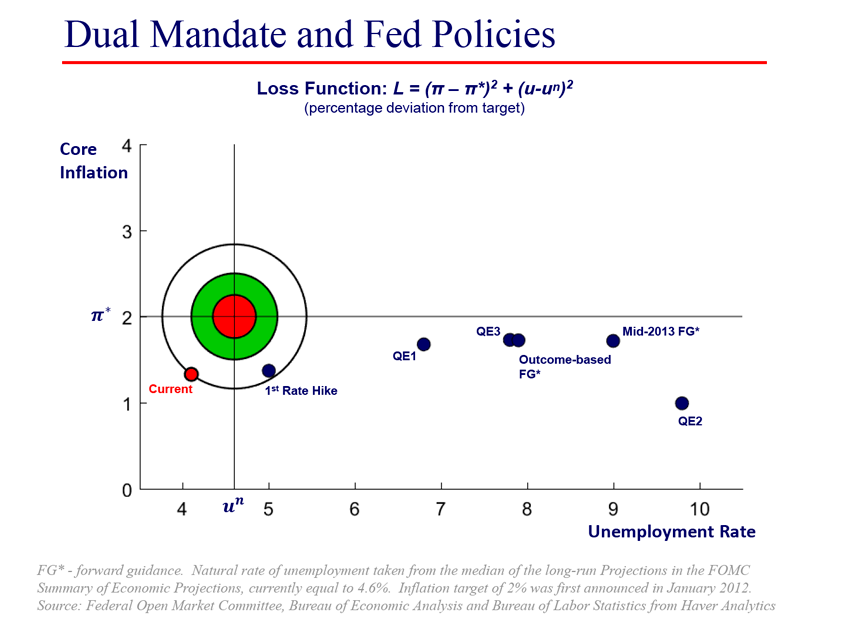

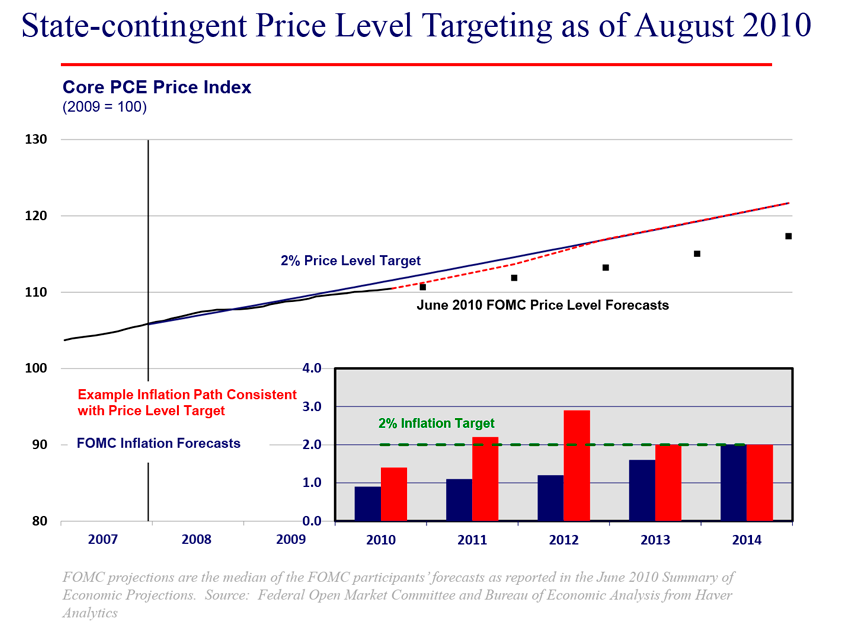

In March 2009, the FOMC initiated QE1 that expanded its balance sheet by nearly $2 trillion.5 The hope was that $2 trillion would be sufficient to support a strong rebound in activity. But in the summer of 2010, the core PCE inflation rate6 in the U.S. was below 1.5 percent and the unemployment rate was near 10 percent. Moreover, no significant improvements were projected in the near term. As a result, the Taylor rule at that time prescribed setting the U.S. policy rate roughly at −5 percent.7 Clearly, such a negative rate was far beyond the scope of the existing monetary policy framework.

Nonetheless, more stimulus was needed. In the fall of 2010, the consensus of the FOMC was to initiate another $600 billion of asset purchases (QE2).8 Economic and inflation improvements through mid-2011 gave rise, once again, to the hope that this additional $600 billion would be sufficient. Indeed, the FOMC began to publicly plan for unwinding the stimulus, publishing a set of “Exit Strategy Principles” following the June 2011 meeting.9 But only a month later, it became clearer that more action was needed to achieve our policy goals of maximum employment and price stability.

From this point on, the FOMC undertook several additional actions. In August 2011, the FOMC used calendar-date forward guidance to communicate that it anticipated keeping the funds rate at zero at least until mid-2013.10 And shortly afterward we announced the Maturity Extension Program, or Operation Twist, both to further support the credibility of the calendar-date forward guidance and to extend the portfolio balance effect.11

Even though these policies were nominally conditional on economic outcomes, the first-order inference was that—like Odysseus—we had bound ourselves to the mast of a time-inconsistent policy to keep rates on hold until mid-2013. But if inflation and activity accelerated in 2012, would the public really believe that we would follow through on our promise? As we all know, such doubts about credibility dilute the effects of any policy, but they are particularly damaging for Odyssean actions.

In the end, more actions were needed—and were taken. I strongly believe our unconventional policy moves at the ZLB were effective. But there is no doubt that they were challenging to communicate. And I have little doubt that the policy actions might have been even more effective if they were part of a previously established, well-understood, and credible framework.

At this point, you have to ask yourself a number of questions. What are the challenges of introducing a new framework in the midst of a crisis? How important is it to develop the framework before the crisis? How do you ensure it is effective and credible? Let me address these questions with a story that takes us back a few years. In the summer of 2010, the FOMC was looking at FRB/US simulations12 that showed optimal policy with a real federal funds rate of −6 percent or so.13 As I mentioned earlier, at that time, we were well short of both legs of our dual mandate, with forecasts pointing to continued shortfalls from our goals for the foreseeable future.

At the ZLB, the only way we could come anywhere close to −6 percent was through a dose of higher expected inflation.

One option I pitched to the Committee was to administer that dose through state-contingent price-level targeting. This was quite similar to Bernanke’s recent proposal. This policy would hold the funds rate at the ZLB until the price level recovered to a 2 percent trend line starting from the end of the previous expansion. If successful, the U.S. economy would experience a temporary period of above-2 percent inflation, which would lower real interest rates and boost economic activity. I first spoke about this issue at the August 2010 FOMC meeting, circulated a written proposal for the September meeting, and gave a public presentation at a Boston Fed conference that fall.14

Now recall that around this time Blanchard, Dell’Ariccia, and Mauro (2010) and others were suggesting—in the spirit of blue-sky thinking—that central banks could consider raising their long-run inflation objective to something like 4 percent in order to avoid the threat of the ZLB. But at the August 2010 Jackson Hole conference, Chairman Bernanke said that the FOMC had no taste for inflation much higher than 2 percent over the medium term, which was loosely what he was referring to as “price stability” in 2010.15

Now, one issue with price-level targeting is that its promise of above-target inflation for a limited period of time could be confused with the central bank raising its longer-run target. Given the prominent public debate over inflation targets in 2010, avoiding the misperception of a stealth increase in the inflation target would have required Odyssean communications of enormous (Herculean) proportions.

And indeed, my state-contingent price-level targeting proposal didn’t gain any traction. Read the September 2010 FOMC transcript16 and note the unsympathetic but wise reaction from soon-to-be Vice Chair Yellen. This example illustrates the difficulties of introducing a new framework in the midst of unfamiliar circumstances. If you want to use policies that are outside of the current framework, then you need to do some very elaborate promising and hard work to establish the credibility of those actions. And this just may not be possible to do when you’re in such uncharted waters.

Ultimately, the FOMC did adopt a series of policies that had a mild Odyssean flavor. The continued disappointing economic performance into 2012 convinced the Committee that it was worth taking these additional actions. But we never did get to something as extreme as temporary price-level targeting.

Turning Odyssean policies into Delphic ones

Fast forward to about a month ago. As I mentioned before, at a conference at the Peterson Institute—Rethinking Macroeconomic Policy—Ben Bernanke proposed a new state-contingent monetary policy framework.17 In normal times, the framework calls for business-as-usual policy. But, if constrained by the ZLB, the framework would switch to temporary price-level targeting. This is a well-defined change in the monetary policy rule, objectively triggered by the federal funds rate falling to zero.

So what has changed between 2010 and 2017 to make temporary price-level targeting more feasible?

Well, we face better and calmer economic circumstances. More importantly, though, we now recognize that we could face more frequent and prolonged bouts of policy constrained by the ZLB than we had ever previously imagined. So it is now more apparent that we should think ahead about how our framework can be adjusted to more effectively address this circumstance. I applaud efforts such as the Peterson Institute conference and the one here today as important contributions for our future work.

Developing a new framework prior to the next ZLB episode allows time for a shift in the nature of forward guidance—and communications more generally. Suppose, for example, the FOMC were to adopt Bernanke’s proposal today. If we then hit the ZLB, the contours of the unconventional PLT policy would already be known. All that would be left is communication of its technical parameters. In other words, the policy would be essentially Delphic instead of Odyssean.

Adopting this policy in the fall of 2010 was asking a great deal. The forward guidance needed to communicate the brand-new state-contingent price-level targeting would have been a lot for the public to absorb without any credible prior experience. We need to prepare the public ahead of time for implementing unconventional policies in unconventional times. The policies would then be better understood ex ante, better studied, and better critiqued and refined; they would, therefore, likely be more effective.

Furthermore, policymakers need to prepare themselves. Delphic forward guidance is the most likely strategy that can garner a consensus position because it is close to a standard operating procedure and because it largely entails technical, quantitative guidance. Of course, adequate policy flexibility and reach requires a robust framework with many state-contingent branches worked out ahead of time. A number of policies could fit into the mix, but you need to get agreement on them ex ante. With regard to price-level targeting, it may be possible to implement now following careful analysis and deliberative discussions; but in 2010, it was just too hard.

Let me be very clear: My aim today is not to argue for state-contingent price-level targeting. That may be a good way to go, but at this point I just don’t know.

My point is that we should be planning for these inevitable future situations today. A good starting point may be to consider nonstandard policies that are not very far from our familiar operating framework. The thresholds-based forward guidance the FOMC adopted in December 2012 was one such example;18 so was the optimal-control-based “lower-for-longer” policy path that Chair Yellen discussed in a June 2012 speech.19 Still, the new quantitative commitments in even such less radical policies may be difficult to grasp. But a key to success is keeping any nonstandard policies outcome-based. This is crucial to guiding policymakers and informing the public about where we aim to go.

Finally, for new policies to have a chance of succeeding, at a minimum, it’s essential to ensure policy remains credible in more normal circumstances. I’ve spoken on this many times elsewhere. I believe our credibility challenge in the U.S. today is delivering on the FOMC’s symmetric 2 percent inflation target. If we fail to do so under our current relatively normal circumstances, why then would the public believe us in the future when we try again to implement unconventional policies? And what if the circumstances are so large that they require Odyssean efforts? Where would we be then?

Thank you.

Notes

1 The views expressed here are my own and do not necessarily reflect those of my colleagues on the Federal Open Market Committee or within the Federal Reserve System.

2 The terms “Delphic” and “Odyssean” are used to describe different types of monetary policy communications. For more details, see Campbell et al. (2012).

3 See Bernanke (2017) for details of the proposal.

4 Taylor (1993).

5 See Federal Open Market Committee (2009) for details. For more information on the quantitative easing (QE) programs (or large-scale asset purchases), see the Board of Governors of the Federal Reserve System (2015a).

6 By PCE inflation, I mean inflation measured by the annual change in the Price Index for Personal Consumption Expenditures. Core PCE inflation strips out the volatile food and energy sectors.

7 The economic projections of the Board staff, as well as the prescriptions from a variety of policy rules, as of August 2010 are available in Board of Governors of the Federal Reserve System (2010a, 2010b). The projections made by the FOMC participants in June 2010 are in Federal Open Market Committee (2010d).

8 The FOMC announced its intention to purchase an additional $600 billion of longer-term Treasury securities following its November meeting. This came to be known as QE2. Details can be found in Federal Open Market Committee (2010a).

9 See Federal Open Market Committee (2011c) for details.

10 See Federal Open Market Committee (2011b). For more on the FOMC’s use of forward guidance, see Board of Governors of the Federal Reserve System (2015b).

11 See Federal Open Market Committee (2011a). For more on the Fed’s Maturity Extension Program, see Board of Governors of the Federal Reserve System (2013).

12 The FRB/US model is a large-scale estimated macroeconomic model developed and used by the staff at the Board of Governors of the Federal Reserve System. Information about this model is available online.

13See Board of Governors of the Federal Reserve System (2010a).

14 See Federal Open Market Committee (2010b, 2010c) for the transcripts of the FOMC meetings and Evans (2010) for my speech at the Boston Fed.

15 See Bernanke (2010) for the full speech. In January 2012, the FOMC set 2 percent inflation—measured by the annual change in the Price Index for Personal Consumption Expenditures (PCE)—as the explicit inflation target consistent with our price stability mandate; see Federal Open Market Committee (2012b).

16 Federal Open Market Committee (2010b).

17 Bernanke (2017).

18 See Federal Open Market Committee (2012a).

19 See Yellen (2012).

References

Bernanke, Ben S., 2017, “Monetary policy in a new era,” paper presented at the Peterson Institute for International Economics conference, Rethinking Macroeconomic Policy, Washington DC, October 12–13, available online.

Bernanke, Ben S., 2010, “The economic outlook and monetary policy,” speech by Federal Reserve Chair at the Federal Reserve Bank of Kansas City Economic Symposium, Macroeconomic Challenges: The Decade Ahead, Jackson Hole, WY, August 27, available online.

Blanchard, Olivier, Giovanni Dell’Ariccia, and Paolo Mauro, 2010, “Rethinking macroeconomic policy,” Journal of Money, Credit, and Banking, Vol. 42, No. s1, September, pp. 199–215.

Board of Governors of the Federal Reserve System, 2015a, “What were the Federal Reserve's large-scale asset purchases?,” Current FAQs, December 22, available online.

Board of Governors of the Federal Reserve System, 2015b, “What is forward guidance and how is it used in the Federal Reserve's monetary policy?,” Current FAQs, December 16, available online.

Board of Governors of the Federal Reserve System, 2013, “Maturity extension program and reinvestment policy,” webpage, August 2. available online.

Board of Governors of the Federal Reserve System, 2010a, Report to the FOMC on Economic Conditions and Monetary Policy: Book B—Monetary Policy: Strategies and Alternatives, Washington, DC, August 5, available online.

Board of Governors of the Federal Reserve System, 2010b, Report to the FOMC on Economic Conditions and Monetary Policy: Book A—Economic and Financial Conditions: Current Situation and Outlook, Washington, DC, August 4, available online.

Campbell, Jeffrey R., Charles L. Evans, Jonas D. M. Fisher, and Alejandro Justiniano, 2012, “Macroeconomic effects of Federal Reserve forward guidance,” Brookings Papers on Economic Activity, Vol. 43, No. 1, Spring, pp. 1–54, available online.

Campbell, Jeffrey R., Jonas D. M. Fisher, Alejandro Justiniano, and Leonardo Melosi, 2017, "Forward guidance and macroeconomic outcomes since the financial crisis," in NBER Macroeconomics Annual 2016, Martin Eichenbaum and Jonathan A. Parker (eds.), NBER Macroeconomics Annual, Vol. 31, Chicago: University of Chicago Press, pp. 283-357.

Evans, Charles L., 2010, “Monetary policy in a low-inflation environment: Developing a state-contingent price-level target,” speech at the Federal Reserve Bank of Boston’s 55th Economic Conference, Revisiting Monetary Policy in a Low Inflation Environment, Boston, October 16, available online.

Federal Open Market Committee, 2012a, press release, Washington, DC, December 12, available online.

Federal Open Market Committee, 2012b, press release, Washington, DC, January 25, available online.

Federal Open Market Committee, 2011a, press release, Washington, DC, September 21, available online.

Federal Open Market Committee, 2011b, press release, Washington, DC, August 9, available online.

Federal Open Market Committee, 2011c, minutes of the FOMC meeting of June 21-22, 2011, Washington, DC, July 12, available online.

Federal Open Market Committee, 2010a, press release, Washington, DC, November 3, available online.

Federal Open Market Committee, 2010b, transcript of the FOMC meeting on September 21, 2010, Washington, DC, September 21, available online.

Federal Open Market Committee, 2010c, transcript of the FOMC meeting on August 10, 2010, Washington, DC, August 10, available online.

Federal Open Market Committee, 2010d, Summary of Economic Projections, Washington, DC, June 22–23, available online.

Federal Open Market Committee, 2009, press release, Washington, DC, March 18, available online.

Taylor, John B., 1993, “Discretion versus policy rules in practice,” Carnegie-Rochester Conference Series on Public Policy, Vol. 39, Vol. 1, December, pp. 195–214, available online.

Yellen, Janet L., 2012, “The economic outlook and monetary policy,” speech by Federal Reserve Vice Chair at Money Marketeers of New York University, New York, April 11, available online.