The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

“Tell me your industries, and I’ll tell you your…fortune,” wrote economist Wilbur Thompson in describing regional economics. For most of the 20th century, the engine that has driven the Great Lakes economy has been manufacturing.1 Economists predicting the future of the Great Lakes region looked at steel, autos, machine tools and machinery, and other manufacturing industries.

But the much-ballyhooed economic shift from manufacturing to services in recent decades raises many important questions about the validity of that long-standing relationship. In earlier years, it was possible to monitor the Great Lakes economic performance by examining its manufacturing sector. Now the region’s growth in manufacturing output trails total regional product, and manufacturing’s employment share has plummeted.

This Chicago Fed Letter asserts that despite these changes and shifts the manufacturing sector retains its critical role as the engine of the Great Lakes economy. When compared to the U.S., the manufacturing sector remains highly concentrated in the region. Moreover, in viewing the manufacturing sector alone, the importance of manufacturing to the Great Lakes economy proves to be understated. While the manufacturing sector has lost ground to the service sector, this can be partly explained by the transfer of some work from manufacturing companies to the service sector. These activities include such functions as clerical, maintenance, R&D, legal services, advertising, and data processing, which are often purchased by manufacturing companies from service sector firms. When the manufacturing sector is broadly defined to include such activities, the region’s economic ties to manufacturing remain very strong.

Direct earnings from manufacturing

The traditional way of measuring a region’s ties to the manufacturing sector is to look at labor earnings paid out to the region’s residents by manufacturing firms. These earnings indicate the current share of income flowing into the pockets of the region’s residents from the manufacturing sector.

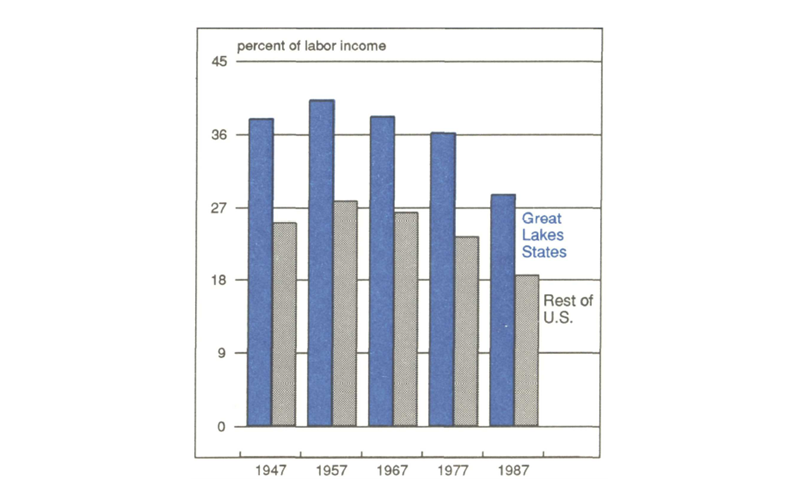

As recently as 1967, 38% of the region’s earnings were derived from manufacturing in comparison to 26% for the remainder of nation. These shares were about the same in 1947 (see figure 1). By 1987, however, manufacturing’s share of labor income had dropped precipitously in both the Great Lakes region and the U.S. Nationally, manufacturing accounted for only 18% to 19% of labor income by 1987. In the Great Lakes region, the share had fallen to 29% of labor income.

1. Manufacturing income down

In absolute terms the manufacturing industry has been shrinking as a source of earnings for the region. Relative to the nation, however, the region remains highly specialized in manufacturing even with this narrow definition. The implication is that manufacturing fortunes continue to have a magnified effect on the household incomes of Great Lakes residents in comparison to the nation.

Purchased services: The hidden manufacturing sector

In tracking the manufacturing sector’s contribution to the region’s income, we must examine the other components as well. Many activities involved in producing a product can be transferred from the manufacturing sector to service firms as the underlying economics of the firm dictate. For example, a steel-producing company may shed its maintenance workforce and contract out or “outsource” maintenance work to a service sector company in order to trim overhead costs. Accordingly, an activity which was formerly counted as manufacturing output could now be counted in the service sector even though the physical amount of steel produced by the economy has remained the same.

Recently, the corporate structure of U.S. companies has been rapidly changing through takeovers and mergers as U.S. companies have divested and regrouped activities under new corporate umbrellas. This is seen as part of a broader restructuring in which organizations of all kinds, including manufacturing companies, have been “unbundling” support services such as clerical and maintenance.2

In order to boost productivity and to trim costs, companies choose to purchase these support services from outside firms rather than continue to generate the services in-house.

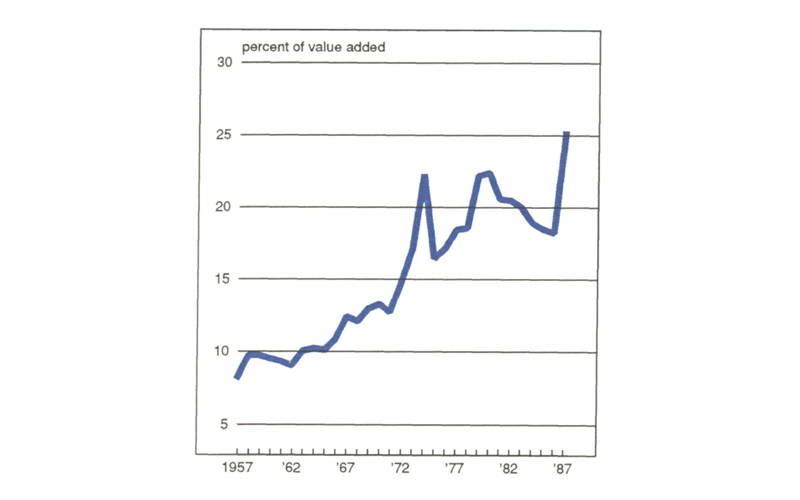

The overall effect of these changes on the manufacturing sector has been the shedding of service activities by manufacturers. This can be seen by examining the growing purchases of services by manufacturers from other industry sectors.3 In the process of producing manufactured goods, manufacturing companies purchase important services whose value becomes embodied into the final value of the manufactured goods. These business service sectors include computer and data processing, telecommunications, temporary office help, accounting, finance, insurance, real estate, wholesaling, advertising, and managerial consulting. Purchased services as a share of value added in manufacturing can be seen in figure 2. These services made up less than 10% of manufacturing value added in 1957. By 1977, this figure had climbed to over 18%. In 1987, the last reported year, purchased services were estimated to represent 25% of overall manufacturing activity.4

2. Manufacturing buys services

Augmented manufacturing

The upshot of the increasing service orientation of manufacturing is that a growing segment of the Great Lakes economy that was formerly recognized as manufacturing has moved into the service sector. Consequently, by attributing these activities to the service sector, we may be understating manufacturing’s contribution to the national and regional economy.

Accordingly, it is helpful to redefine the manufacturing-related sector to include these services to identify any real changes to the region’s economic base. Services purchased locally by manufacturers, as part of the region’s traded-goods sector, are conceptually the same as manufacturing so that we can define the manufacturing sector broadly to include these purchased services. In doing so, our reckoning of the region’s economic structure and base will not be affected by the movement of these services between the manufacturing and service industry sectors.

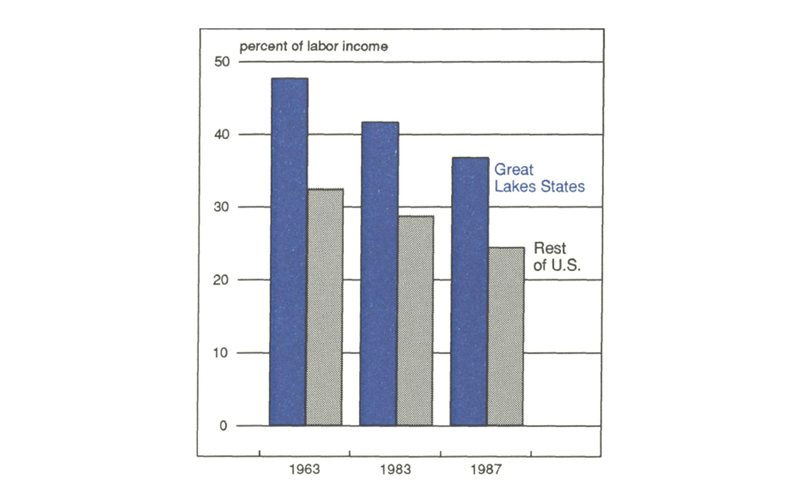

In considering such an augmented manufacturing sector that includes purchased services, a far different picture of the importance of manufacturing to the region emerges (see figure 3). For the U.S. (excluding the Great Lakes) the decline in the share of manufacturing earnings is significantly muted by the inclusion of purchased services, although it has still declined, from 32% to 24% over the past 24 years.5

3. “Augmented” manufacturing

In the Great Lakes region, the role of augmented manufacturing as a source of regional income is also pronounced. When services purchased by Great Lakes manufacturers are included in the manufacturing sector proper, labor income derived from this sector amounted to 37% in 1987. Moreover, the region’s concentration in manufacturing continued to exceed the nation’s by more than half (see Figure 3).

A word of caution is required. These estimates depend on the crucial assumption that the region contains a proportionate share of manufacturing-related activities in its service sector. This means that services purchased by Great Lakes manufacturing companies are purchased locally and not from outside the region. Or, alternatively, service exports by the region’s service sectors to outside manufacturers are sufficient to offset any “leakages,” i.e., services purchased by Great Lakes manufacturers from outside the region.

Where do the services come from?

There is a wide geographic range over which services are traded. Services are increasingly “exported” across regional boundaries.6 This implies that services purchased by manufacturers cannot be thoughtlessly assigned to the same location as the manufacturers themselves.

There is little direct evidence on the inter-regional flows of services. However, studies suggest that service flows will, if anything, tend to originate in those regions that have concentrations of corporate headquarters of manufacturers and flow toward those peripheral regions that are specialized in branch production plants.7 Those regions with ample shares of corporate headquarters, R&D labs, and other specialized service establishments of manufacturing companies—the so-called auxiliary establishments—are also likely to retain a healthy share of services that are directly purchased by manufacturers from service firms. Frequently, central administrative offices are large purchasers of specialized services, many of which are then distributed to operating plants within the firm. In addition, the amenities that attract central administrative offices to a region are also those that attract manufacturing-related service firms, so there is a tendency for business service firms and auxiliary establishments to locate in the same regions.

The Great Lakes region has managed to hold on to its share of the nation’s auxiliary activities over the past three decades. The Great Lakes’ share of the nation’s payroll for auxiliary manufacturing establishments has held constant at 31% to 32% of the national total. This is surprising in light of the fact that the region’s share of total payroll has concurrently slipped to 27% and payroll at operating establishments (including production plants) slipped to 26%.

As a result, the region’s economic specialization in auxiliary activity has increased. In 1958, the region’s economy was no more specialized in these auxiliary service activities than the nation. Since that time, the Great Lakes region has developed a presence in auxiliary activity that was approximately 19% greater than the nation’s in 1986.8

Nor has the region’s increasing auxiliary activity specialization occurred solely because manufacturing production activity has migrated to other regions, leaving behind an isolated corporate headquarters presence. The auxiliary establishment base has grown in absolute terms. While the region lost over 500,000 jobs in total manufacturing between 1976 and 1986, manufacturing employment at auxiliary establishments is estimated to have increased by over 33,000.9

The fact that the region has a significantly larger share of its manufacturing activity in auxiliary activity than the nation suggests that the region is a net exporter of inter-regional service flows between the service and manufacturing sectors. The often-overlooked service purchases by manufacturers are, if anything, more pronounced in the Great Lakes than in the nation.

Conclusion

The role of the Great Lakes region continues to evolve away from manufacturing production and toward service activity. But this does not mean that the region now has a weak link to manufacturing. In fact, much of the apparent growth in service activity is closely tied to manufacturing activity within the region and elsewhere. Moreover, manufacturing activity itself, as measured by labor income derived from this industry, remains significantly above the national average. For these reasons, the manufacturing sector’s fortunes will continue to call the tune of the Great Lakes economy in the foreseeable future.

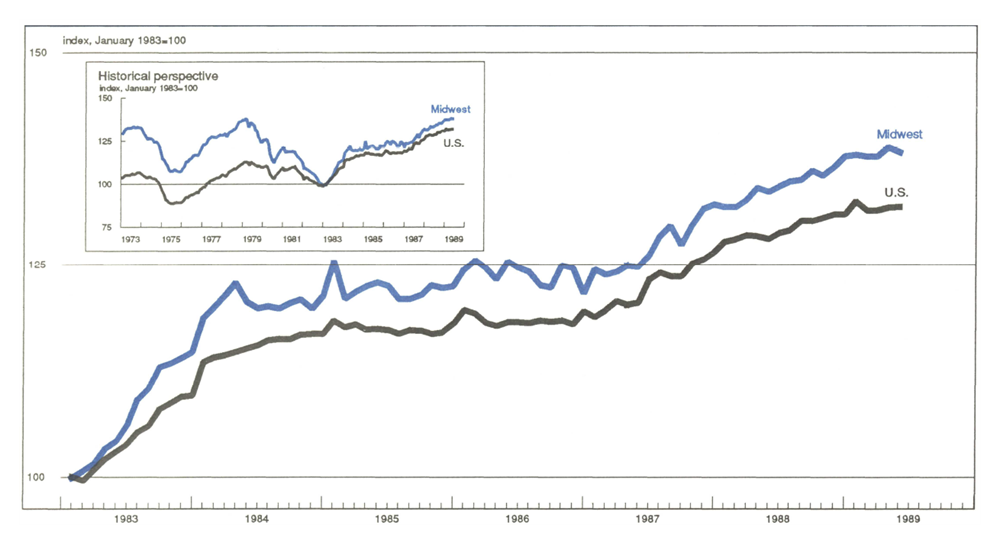

MMI—Midwest Manufacturing Index: Current expansion

Manufacturing activity in the nation, measured by the U.S. Manufacturing Index, was unchanged in May. A solid gain in the food and kindred products industry was offset by modest declines in most of the other 16 industries comprising the index.

Midwest manufacturing activity declined 0.4% in May. The chemical industry accounted for nearly half of that drop, after the industry recorded a strong gain in April. Since March the region has kept pace with the nation, however, and has outperformed the nation on a year-over-year basis.

Notes

1 The Great Lakes region is defined to include the six states of Illinois, Indiana, Michigan, Minnesota, Ohio, and Wisconsin.

2 For a discussion, see Peter F. Drucker, “Sell the Mailroom,” Wall Street Journal, July 25, 1989, p. 16.

3 This trend can be illustrated for the Great Lakes manufacturing sector by taking the simple difference between the Bureau of the Census value added for the nation and the Bureau of Economic Analysis’ estimate of manufacturing activity. The BEA’s “gross product originating” in manufacturing includes indirect taxes (except property) while Census value added in manufacturing does not. For comparison purposes with Census value added, the BEA figure is accordingly reduced by 4%. The other notable difference is that the Census calculates inventory change using the data as reported by the manufacturer. BEA adds to these “book value” inventories an inventory valuation adjustment that converts them to a replacement cost valuation (see U.S. Bureau of the Census, Census of Manufactures, 1977, p. XXIII).

4 This only suggests the overall growth of the service inputs into the manufacturing process. The value of purchased services themselves will include purchases from other sectors including manufacturing, construction, and government. In other words, the value of purchased services is not strictly a “value added” by the service sector alone.

5 The methodology is as follows: We estimated the purchased services percent of manufacturing value added (BEA) for each 2-digit manufacturing industry using the 1963 and 1983 Input-Output Tables of the United States which are produced by the Bureau of Economic Analysis. For each industry, this percent or augmentation factor was then applied to both the industry-specific earnings distribution for the Great Lakes region and for the U.S. Accordingly, the differing industry mix between the region and U.S. affected the estimated volume and proportion of purchased services.

6 For a literature review, see William A. Testa, Manufacturing and Related Services in the Great Lakes Economy, Regional Working Paper, Federal Reserve Bank of Chicago, 1989.

7 ibid.

8 As measured by payroll data from the Census of Manufactures.

9 According to U.S. Department of Commerce, County Business Patterns data.