The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

In a move reminiscent of the 1930s, the governor of Rhode Island recently declared a state banking holiday. A short time ago, the Bank of New England became the fourth large bank failure since 1984, estimated to cost the insurance fund more than $1 billion. Rumors persist that the FDIC fund may be insolvent if existing losses at operating but insolvent, or soon-to-be insolvent, institutions are considered. All of this follows the recent savings and loan debacle, which may cost taxpayers something approaching $200 billion.

As a result of these events and others, there has been significant debate recently about reforming the regulatory structure of the financial services industry. It is typically during such catastrophic times that major legislative reforms are enacted; currently there is no shortage of reform proposals.1 Some adjust incentive distortions resulting from mispriced deposit insurance by introducing coinsurance, decreasing the levels of coverage, or introducing risk-based premiums. Others limit insured banks to a narrow array of services, requiring additional services to be lodged in uninsured affiliates. Finally, others propose progressive regulatory intervention through increased capital levels and/or early closure rules to protect the insurance fund from losses during financial “rescues.”

In this Chicago Fed Letter I discuss how the current situation in the banking industry has evolved. I then argue that market discipline should have an integral role in any solution to the current problems. Given the importance of that role, I offer a solution which, in my opinion, is superior to the other proposals but has not received adequate consideration.

What’s the problem?

Conceptually, the business of financial intermediation is fundamentally simple. Bankers purchase short-term funds in the marketplace and transform them into earning assets with longer maturities. Absent deposit insurance, the providers of these funds, i.e., depositors, are at risk. They safeguard their investment by monitoring the banks’ activities to ensure that the assets are of acceptable quality. If the quality declines then the depositors either demand a higher return commensurate with the investment risk or simply withdraw their funds. The banks, in order to keep their funding costs low, have an incentive to maintain high quality asset portfolios. If, for some reason, a significant withdrawal of funds does occur, the banks, having converted a large portion of deposits to illiquid assets, may have difficulty meeting reserve requirements or additional deposit withdrawals. To meet the need for liquidity, they may borrow funds in the marketplace. As long as solvent firms have access to a funding source (e.g., a lender of last resort) the liquidity problem can be resolved. Insolvent firms can be closed with losses being absorbed by depositors.

Things get more complicated, however, if policymakers believe that deposit withdrawals (bank runs) are contagious, i.e., they can spread from bad to good banks, thereby causing an otherwise safe and solvent bank to fail. If this is a concern then policy makers may refuse to allow bank runs, consequently the disciplinary influence of deposit withdrawals is lost. One way to stem the potential for bank runs is to introduce deposit insurance. Obviously, if all deposits are insured, depositors will have no incentive to discipline banks. This necessitates oversight by regulators to substitute for the disciplining influence of depositors. However, this is costly and, as recent events show, not totally effective. Another alternative is to limit deposit insurance to some subset of depositors, allowing the remaining ones to impose the necessary discipline. The problem with this approach is that any subgroup of uninsured depositors large enough to discipline banks is also large enough to pose the contagion problems policymakers perceive. This is essentially the current deposit insurance situation in which holders of large deposits are relied upon to provide discipline. However, contagion fears have prompted regulators to intervene and protect these depositors from loss. This suggests that the ideal situation would be one in which discipline is imposed by the marketplace, but bank deposit runs would not occur.

The solution: subordinated debt

It is possible to devise such an environment. In fact, it is quite easy. It can be achieved by using subordinated debt as the instrument to cushion the deposit insurance fund and to impose discipline on financial firms.2 Underlying this approach are the following basic premises: Market forces can serve as an effective complement to regulatory discipline; stability of the banking system (not its individual components) is of paramount concern; and the current means used to price deposit insurance (i.e., risk invariant, flat rate premiums) and resolve bank failures are inadequate. The proposal requires that a significant portion of the total capital held to satisfy the current risk-based capital requirements take the form of subordinated debt. For example, the 8% minimum capital requirement could be restructured to require a minimum of 4% equity and 4% subordinated debt.3 In order to provide bankers with appropriate incentives to control risk and provide a formal problem-bank resolution process, the new debt would have to have certain attributes. It would have to contain covenants stating that the bank’s dividends, growth, and deposit rates would be restricted if core (equity) capital fell below some minimum level (perhaps 2% of risk assets); it would have to be converted into an equity stake in the bank in the event that equity capital were exhausted; and it would have to carry maturities sufficiently short that the bank would be required to go to the market to roll over debt on a regular ongoing basis.4

This relatively minor adjustment in the capital structure of banks would serve to alter significantly the disciplinary influence to which they are subject. Because holders of the subordinated debt would obviously be risk sensitive, they would continuously monitor bank behavior and would demand a higher interest rate from riskier banks. Because the size of the equity cushion would affect debt prices, banks may increase equity capital levels in their efforts to minimize the total cost of capital. That is, over some range, additional equity capital could lower the cost of subordinated debt by an amount sufficient to offset the costs of the additional equity. Although this is an empirical question, we do know that banks held significantly higher levels of capital before the introduction of federal deposit insurance greatly reduced depositor’s incentives to monitor bank risk-taking. The introduction of subordinated debt, by restoring market discipline, would move the industry back toward that earlier environment.

The true value of any proposal, however, lies in its success during times of stress. Under this approach, moral hazard problems would be minimized by the continuous application of debt holder discipline, thereby decreasing the probability of bank failure. However, if insolvency did threaten, discipline would be applied via a slow, methodical “meltdown” during which maturing debt could not be rolled over, rather than through a run on deposits. Refusal by the market to accept the new debt would be a clear signal of a solvency problem. Once the bank’s debt capital fell below the required level, existing subordinated debt holders would have a prespecified period (less than a year) to recapitalize the bank or find an acquirer; failing that, the firm would be auctioned off or liquidated. Potential losses to the insurance fund would be less under the debt proposal because debt holders would absorb losses once equity was eliminated. This group would have both strong incentives to avoid forbearance and its associated costs, and the power to place the bank in liquidation. Thus, the debt holders would act before insolvency. Because depositors would have the debt holders as an additional cushion protecting them from losses, they would have no reason to withdraw deposits. Contagion would not be a problem because debt holders cannot run; they can only “walk” as successive issues of debt mature. Consequently, failure resolution could proceed in an orderly manner. Thus, the most attractive feature of this proposal is that market discipline is imposed without runs by either debt holders or depositors.

There are several alternative events that could trigger the recapitalization process. First, and most obvious, the inability of the bank to roll over maturing debt would indicate that the market believes the equity cushion has been depleted. Alternatively, if the regulators had superior information concerning the viability of the bank, they could require recapitalization even when the market was willing to accept the new debt. Finally, the debt holders could be allowed to force recapitalization or closure via court petition.5

Is subordinated debt preferable?

How does the effectiveness of the subordinated debt proposal compare with other reform proposals? First, many of the other proposals are designed to increase reliance on market forces to oversee bank behavior. The current proposal would accomplish this without the much-feared side effects of deposit runs. Additionally, it would eliminate the inequitable treatment of uninsured depositors at “too-big-to-fail” banks. Early closure proposals provide a means to minimize (or eliminate) losses to the insurance fund by constraining the behavior of the bank once it reaches a certain capital threshold. The bank is finally closed at some positive level of net worth. The debt proposal provides a mechanism to achieve this and more by eliminating the arbitrary threshold and continuously applying increased pressure to banks to manage risk. Thus, banks have more incentive to avoid financial difficulty. If financial difficulties do occur, an orderly work out procedure can be implemented once capital has been depleted to some unacceptable (but positive) level. Whereas some proposals attempt to increase regulatory stringency, this approach combines regulatory and market discipline. With both forces operative, delays in recapitalization are less likely than under an early closure rule based solely on regulator-estimated firm value. Finally, the debt proposal would appear to be more politically palatable than reducing deposit insurance coverages and more easily implemented than regulator-determined risk-based insurance premiums.6

Will it work?

There will no doubt be skeptics; therefore, let me address a few of the most commonly stated concerns regarding the effectiveness of the debt proposal. First, what is to prevent the value of the firm from deteriorating quickly and exhausting both the equity capital and subordinated debt and impacting depositors? There is nothing in the proposal that guarantees that this could not happen. However, evidence suggests that market values of assets do not usually change that quickly. During the 1980s Texas land values dropped significantly, but the decline occurred over a number of years. The major bank failures of the past decade, such as First Republic, MCorp, Continental Illinois, and the Bank of New England, were all forecasted well before regulators decided to take action.

Second, even if the proposal worked well for large banks, would small banks be able to issue the new debt? There is reason to believe that they could do so relatively easily. Discussions with investment bankers suggest that there is a market for these instruments, and some have even indicated an interest in establishing mutual funds to invest in the subordinated debt of small banks. But even if small banks found it infeasible to issue subordinated debt, or politicians found it infeasible to include them in the plan, their exclusion would not be fatal to the proposal. For example, the proposal could be limited to banks over a certain asset size (perhaps $1 billion) or to banks wishing to utilize expanded bank powers.

Third, what is to prevent regulators from rescuing the subordinated debt holders, just as they have uninsured depositors when a large bank encounters difficulty? It is imperative for the success of the proposal that debt holders react as if they are subject to losses; otherwise, they will not exert discipline on the bank. However, regulators would have little incentive to avoid imposing losses on debt holders because they cannot start a run. Also, because banks are not subject to bankruptcy laws, their subordinated debt holders could not bargain for a senior position by refusing to accept the bankruptcy reorganization plan. They would truly be subordinated. In the worst- case scenario, they would start the methodical reorganization discussed above. But this is precisely what we want—an orderly resolution process.

Finally, the most serious question is whether debt holders would actually impose discipline on the bank. Economic theory suggests they would. More significantly, there are in fact substantial differences in the rates on subordinated debt offered by different bank holding companies. But even in the unlikely case that debt holders would be unable to differentiate between banks with respect to quality, they would still serve as an additional cushion to the insurance fund. Furthermore, any losses would be incurred by individuals making a deliberate decision to bear risks and not, as is becoming all too common, by naive, unsuspecting depositors or uninvested taxpayers.

Conclusions

Given recent events, regulatory reform of the financial services industry is probably inevitable. At the current stage it is important that policymakers consider the costs and benefits of alternative proposals before the debate over regulatory reform results in a narrowing and hardening of positions. Otherwise, the advantages of the subordinated debt plan are likely to be overlooked. Comparing alternative bank regulatory reform proposals, the use of subordinated debt would appear to merit placement at the top of the list.

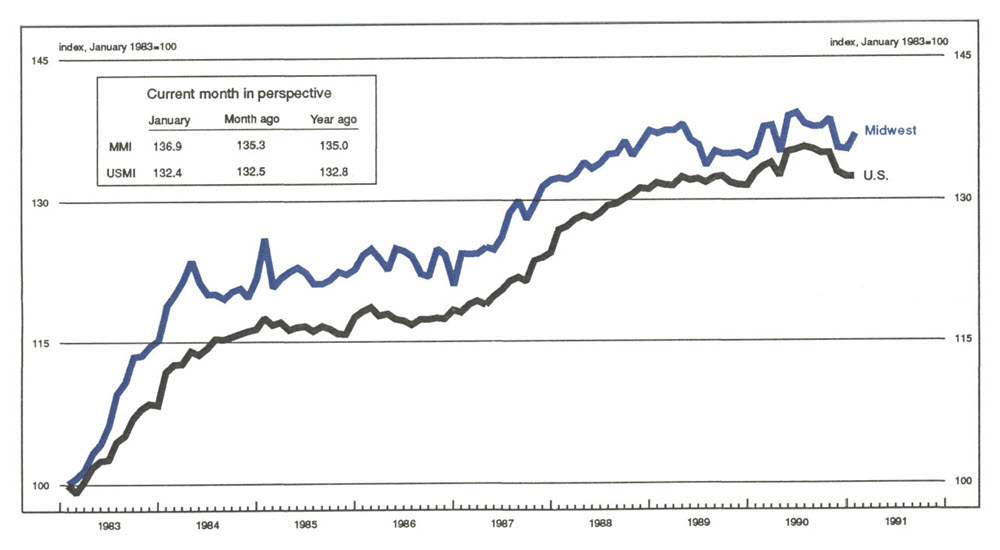

MMI-Midwest Manufacturing Index: Current expansion

While most economic news indicated weakness, the MMI for January rose 1.2 percent. This marks its first rise since October of last year, while the USMI continued to edge downward. However, January’s rise seems to reflect the intervening weakness more than real strengthening.

The MMI ended last year at its lowest level since the beginning of 1990, when the auto industry was virtually shut down for inventory corrections. Weak auto production depressed end-of-year activity and extended into January. However, other sectors, notably metalworking and machinery, sprang back from depressed levels. While still very low relative to last October, these sectors provided much of the boost to the MMI.

Notes

1 Most of these are summarized in Philip Bartholomew, Reforming federal deposit insurance, United States Congressional Budget Office, September 1990. Herb Baer discusses problems with the existing deposit insurance scheme in Chicago Fed Letter, July 1990.

2 For more detail on proposals employing subordinated debt see Silas Keehn, Banking on the balance: powers and the safety net, Federal Reserve Bank of Chicago, 1989.

3 The percentages offered should not be considered definitive. They simply “fit” well within the existing capital guidelines and would appear to be reasonable. Because the role of deposit insurance would be less important with the debt proposal in place, the politically sensitive issue of alternative levels of coverage could be considered, e.g., 100% coverage, deductibles, etc.

4 The maturity would have to be long enough to tie the debt holders to the firm and make the inability to run meaningful (perhaps five years), and sufficiently staggered to enable the firm’s behavior to be disciplined by the necessity to frequently approach the market (perhaps semiannually).

5 In “A plan for reducing future deposit insurance losses: puttable subordinated debt,” Economic Review, Federal Reserve Bank of Atlanta, July/August 1989, Larry Wall offers an alternative approach in which the debt would have a put option enabling the holder to return it to the firm whenever the firm’s solvency was in doubt. Thus, discipline would continually be applied without the firm having to incur the costs of rolling over maturing issues of debt.

6 Actually, subordinated debt could serve a valuable role under any of the proposals. By indicating which institutions were in most need of supervision, the debt prices could be used to allocate regulatory resources. If risk-based insurance premiums were utilized, the subordinated debt prices could be used as the basis for the differentials.