The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

The dramatic change resulting in the dissolution of the Soviet Union and the formation of the Commonwealth of Independent States (CIS) has excited much discussion among economists concerning the problems and opportunities involved in moving from a planned economy to a market economy. Of particular importance are questions concerning the form Western aid to the CIS should take, as well as what opportunities will exist for Western entrepreneurs and investors. This discussion has often focused on so-called macroeconomic problems such as controlling inflation, stabilizing the ruble, decreasing budget deficits, and so forth. However, it is also important to focus on microeconomic problems, that is, the problems involved in developing the institutions and mechanisms whereby a planned economy can be transformed into a market economy.

During a recent trip to the CIS in conjunction with the International Monetary Fund, I had a chance to observe firsthand the status and moves for change in the CIS republics. In this Chicago Fed Letter I discuss the current economic situation in the CIS in order to provide some insights into some of the problems involved in moving from a planned economy to a market economy.

The profit motive and privatization

Currently in the CIS, most companies are government-owned, as they were in the old, planned economy. However, in an effort to make firms more profitable, legal restrictions have been relaxed in order to give managers more control over firm resources. In any system in which the managers of a firm are not the owners there will likely be “agency problems,” that is, managers will be inclined to pursue their own self-interest rather than maximize firm value. In a market economy, publicly held firms are owned by the shareholders who have a variety of methods for putting pressure on management to maximize firm value. For example, shareholders can sell their shares, causing share prices to decrease and signaling to capital suppliers that investment in the firm is not a good idea. They can vote for directors on the board who can discipline or replace top management.

In actual market economies there are problems in the system for pressuring management; however, the important point is that firm owners—the shareholders—have the right incentives to discipline firm management. They benefit if firm value increases and lose if firm value decreases.

The problem in the CIS is that the government officials who are supposed to regulate firm managers do not have the right incentives to ensure that managers maximize firm value. The officials do not profit if firm value increases or lose if firm value decreases. Government firms in the CIS are owned by everyone; this means that nobody benefits directly by increases in firm value. Thus, the result of relaxing restrictions on managers’ control of firm resources has been an increase in agency problems rather than firm profits. For example, managers from several firms have used the combined cash flow from their firms as capital to start a private bank. Problems with regulating firm management are exacerbated by the fact that the republics’ governments do not have sufficient resources or manpower to oversee managers of all government-owned firms.

One obvious solution to the agency problem is to privatize government-owned companies, for example, by selling shares in the company. One difficulty for this idea is the lack of capital in private hands. Some republics plan to solve the capital problem by issuing vouchers to citizens. These vouchers could be used to purchase only either shares in newly privatized companies or dwellings. Once companies are privatized, a capital market could emerge. Market forces could then function as they do in Western countries, to discipline firm managers, thus relieving government of some of the regulatory responsibility.

Some republics have moved further toward privatization than others. One area of success is in agriculture: In most of the republics, much of the agricultural land is owned by private citizens. Farmers sell their produce in markets in nearly every city in the CIS. These produce markets existed even before the breakup of the Soviet Union and are the most successful examples of the move toward a market economy in the CIS.

A separate problem concerning firm profitability and manager incentives arises from the price instability currently in the CIS. Ideally, managers should be rewarded for increasing the value of the firm. In fact, in the CIS, as in many other economies, manager performance is evaluated on the basis of profits, that is, on firm earnings after expenses. The problem with this type of incentive structure is that managers can manipulate profits by, for example, cutting back on discretionary expenses such as advertising or capital spending. Also, firm profits are affected by things other than management skill, such as general economic conditions. This latter problem is particularly acute in the CIS because of price instability. Frequent, drastic price changes mean that reported profits are a very poor indicator of true economic gains or losses and therefore of management skill. For example, energy prices are expected to increase tenfold in September. After the price change, energy-producing industries will likely show very high profits while energy-consuming firms may show sharply declining profits. Obviously, these changes in profitability would not show that managers of energy-producing firms are doing a good job while managers of energy-consuming firms are doing a poor job.

Monopoly power

Under a planned economy, it may be easier and more economical to build one plant or factory rather than several plants in order to produce a particular type of good. As a result, there are a large number of firms in the CIS with monopoly power. In a market economy, a monopoly can restrict output and raise prices. Because buyers have little power, a monopoly producer has little incentive to increase product quality. Because of the lack of competition, monopolies have little incentive to increase production efficiency. Consequently, in the U.S., for example, government regulation restricts monopolies in order to avoid these problems and protect consumers.

In the CIS a number of factors inhibit the government from reducing monopoly power. Local government officials fear that restricting prices may result in the demise or downsizing of a large plant. The resulting worker layoffs might cause social unrest.

One of the main impediments to reducing the power of CIS monopolies is that the managers of many of these large plants have developed close personal ties with government officials. Consequently, they are able to influence government policy to favor continuing monopoly power and higher prices. The relationship between firm managers and government officials developed in the old, planned economy. In that system the central government appointed managers of firms and supervised the distribution of supplies, products, and capital. Thus, managers depended on government offices called ministries for supplies, capital, and markets for their products. The ministries in turn depended upon managers to keep the distribution system running smoothly. This distribution system is largely still in place. In particular, the same government ministries still control distribution both within and between republics and the same managers run the monopolies. Both of these groups want to retain monopoly power and keep control of distribution; thus, they resist movement toward market determined prices and distribution. This situation is complicated by the fact that the ministries controlling distribution were part of the central government, not the local republic governments. Now they are controlled by the republic governments; however, these governments have no experience controlling the distribution of goods. Thus, they cannot simply dismantle the present distribution system because there is nothing to take its place.

Continuing monopoly power as well as the ministry control of distribution and trade create powerful barriers to entry for new firms, allowing the existing monopolies to remain entrenched. Western countries contemplating aid to the CIS countries should keep the distribution situation in mind in determining how to administer financial assistance. If, for example, aid given to the republic governments ends up in the hands of the ministries, then it may well help maintain the present system. If Western countries wish to encourage the move toward a market economy, in particular, to reduce monopoly power and encourage the creation of a market distribution system, a better idea might be to give grants to entrepreneurs trying to start new firms rather than aid to government agencies.

Impediments to trade between republics

Under the old Soviet planned economy, the government determined how much each factory would produce and distributed the goods from the producers to consumers. In particular, the government determined what, and how many, goods and services each republic would receive, as well as the price. Thus, the government determined how big the total “pie” of goods and services would be as well as how to slice it—that is, how many of the goods and services would go to each republic. As a result, each republic would try to acquire as large a slice of the total pie as possible both by receiving goods produced in other republics and by keeping locally produced goods and services for consumption in the republic. Thus, in the old planned economy it was in each republic’s interest to maximize imports into the republic and minimize exports.

In a market economy, by contrast, exports and prices are determined by external demand for a region’s goods. Higher levels of exports increase the inflow of payments into a region and increase economic activity. Consequently, increased exports are generally beneficial for a region’s economy. Of course, countries in the process of developing a market economy may have to increase imports in the effort to obtain resources needed for economic development. However, the status of trade in the CIS is more the result of trade barriers enacted to preserve the old system in which the government controlled trade between republics.

Currently in the CIS, trade between republics is controlled by the same ministries, discussed above, who control trade within republics. In many cases, to export goods from republic A to republic B, producers in A must sell their goods to the government of A, who sells them to the government of B, who in turn sells them to consumers in B. This process is less efficient than allowing producers in A to contract directly with consumers in B. Trade between republics is similar to a barter system, although the transactions include the exchange of rubles. For example, republic A may agree to sell wheat to republic B if B agrees to sell oil to A. Republic A may agree to sell wheat at a lower price than it could get elsewhere, in order to get the oil. This is similar to a barter system because it is the exchange of goods that determines which transactions will take place, rather than the price of the goods involved. Trade agreements may also be independent of demand. Suppose, for example, that republic A has a good that all the other republics want. Then ministers from the other republics will all come to A to try to negotiate a trade. One would think that A could then get a very high price for its good, or at least the best barter. However, what may actually happen is that A will agree to trade with B because the ministers controlling trade in A and B are friends. This happens because the ministers do not gain from selling goods at a higher price or bartering for better goods.1 You might say that demand for a republic’s goods does not increase prices, it only increases ministers!

The implicit barter arrangements between republics explains why many prices in the CIS countries are below world market prices in spite of price liberalization. Government restrictions on most price movements were eliminated in January 1992, except for a few food items for low-income families and medical, educational, and some other services. Nevertheless, the price of natural gas in Turkmenistan, for example, is 40 times lower than the price in the world market. Such low prices are the result of voluntary price controls between republics. Each republic views extreme price increases as a threat to its economic survival. Since the minimum price for one republic’s output depends on the input prices of other goods from other republics, each republic fears a chain reaction triggered by increases in any input good. Consequently, the republics conspire to control prices. These voluntary controls are possible only because trade with foreign countries is even more restricted than trade between republics.

Government control over trade between republics means that disputes between republics have serious consequences for trade. For example, no trade takes place between the CIS republics of Azerbaijan and Armenia because of a territorial dispute. In contrast, the citizens of Arab countries can obtain Israeli goods so long as they are willing to pay a high enough price, in spite of the disputes between Israel and her Arab neighbors.

The ministries claim that control over trading is necessary in order to ensure that the republics have a supply of the necessary commodities. They argue that the producers of goods are too inexperienced to conduct trade. Of course, the government officials also don’t want to give up their positions of power in the trading network. Like the monopoly situation, the trade situation is the result of a vicious circle. The ministries preserve their control over distribution both within and between republics because there is no other distribution system to replace it. But so long as the ministries maintain their control, a market system cannot develop.

Conclusion

Problems with the microeconomic institutions and mechanisms of the CIS countries are inhibiting the move toward capitalism. Neither the managers nor the government officials in charge of regulation have the incentives to increase profits of government-owned firms. Efforts toward privatization have been hampered by the lack of capital, the existence of monopolies, and restrictions on trade within and between republics. In particular, change has been slowed by government control of the distribution of supplies and finished goods.

Creating smaller privately owned firms and breaking up large firms would help the move toward privatization and reduce monopoly power. Increasing the number of independent firms would also encourage the development of an independent distribution system. Reducing monopoly power is the first step in reducing government control of distribution and encouraging the development of a market system for the distribution of goods.

Western countries could support the creation of small and medium-sized firms through loan guaranties to entrepreneurs willing to develop joint ventures with CIS businesses. Western countries could also make loans to employees of CIS firms in order to enable employee buyouts of government-owned firms. Lower import tariffs and fewer restrictions on CIS products would encourage CIS governments to move toward free trade. Free trade and the development of a market economy in the CIS countries will benefit Western countries by providing new markets for Western products in the CIS.

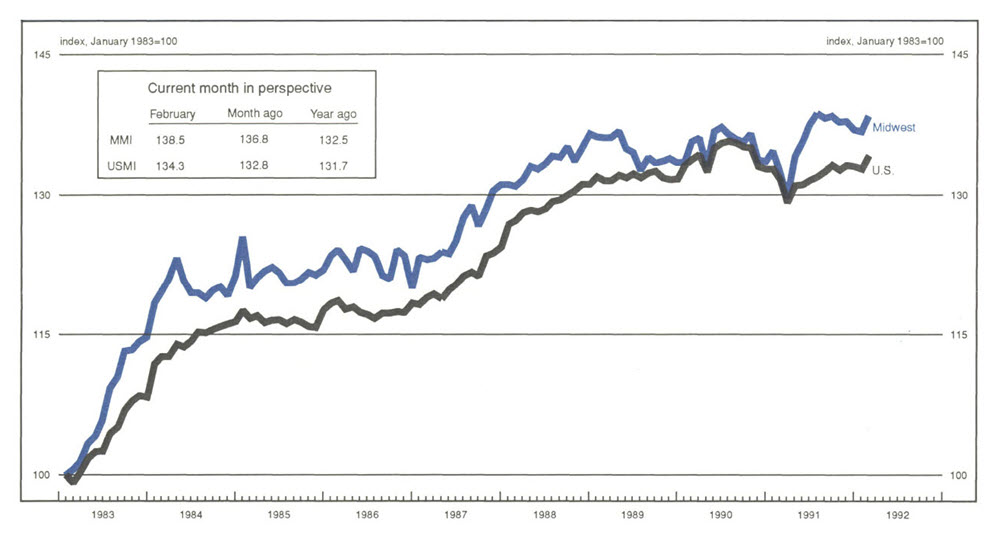

MMI-Midwest Manufacturing Index: Current expansion

Midwest manufacturing activity in February staged its first significant increase (up 1.2%) since September of last year. While gains were widespread, much of the strength was centered in the metalworking and transportation sectors. In addition, the labor component (hours worked) of the index led the capital component (electrical power usage), offering encouragement that producers may be gearing up for further production increases in the months ahead.

After lagging the nation in recent months, the MMI slightly outperformed the nation average (up 1.1%). The region benefited from doing well in those sectors, especially auto-related industries, where much of the growth national was concentrated.

Notes

Philip Israilevich was born in Riga, Latvia. He received his master’s in mathematical economics from Novosibirisk University in Russia before emigrating to the U.S., where he received his Ph.D. in economics from the University of Pennsylvania.

1 The fact that trade between republics often takes the form of barter does not mean that the ruble has no market power, as some economists have concluded. Rather, as I have explained, the barter system is the result of government officials adhering to the old planned economy. Transactions such as the payment of wages and trade between individual producers and consumers take place in rubles.