The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

To signify the importance of a financial news event, the media often present pictures of excited traders screaming their orders in the pits of the futures exchanges. But such events are transient. More important is the way these exchange trades are handled after leaving the pits: They are multilaterally cleared, that is, through a third-party clearinghouse.

Over-the-counter (OTC) derivatives, by contrast, are not traded on organized exchanges, but rather via electronic communications networks. Such products include swap contracts, forward contracts, options, and a variety of hybrids. Unlike futures, they are cleared bilaterally, that is, directly between originating counterparties. As the number of OTC transactions has increased, so have proposals that they be cleared multilaterally.

While such proposals tend to be motivated by a concern for private economies, regulators find multilateral clearing attractive because of its public economies. This Chicago Fed Letter explores multilateral clearing in the context of OTC derivatives. It identifies the private economies that multilateral clearing would yield, as well as its potentially even greater public benefits.

What is multilateral clearing?

Clearing is the back-office processing of traded contracts. It involves determining the amounts due between counterparties and, through cash transfers, settling these amounts. While spectacular gains or losses get attention, back-office events are regular and dependable, so they rarely attract notice. This probably explains why the public knows little about clearing systems, even though futures markets have used multilateral clearing procedures for nearly 70 years.

But this hasn’t always been the case. Prior to the adoption of multilateral systems, futures markets cleared bilaterally. In those days, exchange members suffered the consequences of trades placed with financially weak members. To avoid these consequences, members attempted to avoid trading with weak members when possible and imposed margin requirements to mitigate the remaining risks. Despite these efforts, failures were frequent and sometimes extensive. For example, the 1902 bankruptcy of G.D. Phillips resulted in losses for over 40% of the members of the Chicago Board of Trade.

Since 1925, all U.S. futures exchanges have used multilateral clearing systems. This means that all traded contracts are cleared through a member of an exchange-affiliated clearinghouse. The clearinghouse is interposed in each contract between a buyer and a seller so that the original contract is replaced by two contracts. As a result, the original seller obtains a contract to sell to the clearinghouse, and the original buyer obtains a contract to buy from the clearinghouse. Substituting the clearinghouse for the original counterparties implies that the financial standing of the counterparties is not a consideration in the trade.1 Rather, the clearinghouse guarantees all positions created between its clearing members. The presence of this guarantee exposes the clearinghouse to losses which, in turn, creates a powerful incentive for the clearinghouse to monitor the financial ability of its clearing members. This monitoring further strengthens the surety of contracts placed with clearing members.

How well does multilateral clearing work? The best evidence is the performance of the futures markets. Since multilateral clearing was introduced in 1925, all losses due to failure of a counterparty have been covered by exchange-affiliated clearinghouses. In contrast with earlier years, losses such as those realized in the Phillips bankruptcy have been prevented from propagating. This isolation of risk gives the public a layer of protection from contract default.

Private economies

In recent years, some have encouraged multilateral clearing for OTC derivatives because of the significant private benefits it would yield. Under bilateral contracting, counterparties are obligated to make due-to and due-from payments. A simpler form of this process is to net payments bilaterally; that is, to net the payments due on all contracts between each pair of counterparties and then have a single payment made between the pair. Bilateral netting clearly reduces the number of payments required between counterparties. Further economies can be obtained if payments are netted across many different counterparties—a practice called multilateral netting. For instance, banks placing contracts on behalf of their customers often create positions that offset their previous exposure to market risks. Despite this mitigation of market exposure, such banks retain payment obligations to each of their counterparties. Making payments is costly. A system of multilateral clearing substantially reduces these costs.

Other costs, too, can be reduced through multilateral clearing. Because a contract exposes counterparties to credit risks, collateral is frequently required for each contract even when any price-change exposure stemming from the position has been offset. As assets dedicated to collateral purposes generally have more valuable uses, maintaining this redundancy imposes cost burdens. Substituting the clearinghouse for the original counterparties collapses the separate contract obligations into a single net contract and a single collateral obligation. For an institution with an extensive gross contract position (many contracts with many different counterparties), this represents a significant cost reduction. The combined costs of operating a payments facility and maintaining collateral deposits in excess of actual risk levels represent a strong incentive to pursue multilateral clearing arrangements, which directly reduce those costs.

Monitoring is an important component of the risk management activity of bilateral contractors. As each contractor must monitor the financial ability of each of its counterparties, much of this activity is redundant. Centralizing monitoring activity at the clearinghouse ensures that each market participant is monitored at significantly reduced cost.

As the number of transactions in foreign currency markets has grown rapidly since 1971, the economies available from a multilateral system have become especially attractive to potential and actual participants. Pursuit of such economies has motivated a group of 12 banks to develop a proposal for a multilateral clearing system called MULTINET for institutions transacting in foreign currency markets. The system would begin with multilateral clearing of U.S. and Canadian dollar transactions and ultimately would handle transactions in all the world’s major currencies.

Similarly, the Chicago Board of Trade is developing a system called the Hybrid Instruments Trading System (HITS) that will permit multilateral clearing of OTC swap contracts. This system will be implemented in three stages. First, facilities will be provided to handle payments and collateral requirements between counterparties. Second, models will be evaluated to determine the amounts required to settle contracts. Third, guarantees of payment obligations will be extended by interposing the exchange clearinghouse as counterparty to all swap contracts cleared through HITS. In this third stage, swap contracts will trade with the same nondefault guarantees that futures contracts have had since 1925.

Public economies

In addition to the private economies outlined above, multilateral clearing also offers public economies. In bilateral systems, counterparties have incentives to collect credit information on their counterparties to protect against contract default. However, a full assessment of any single counterparty requires complete knowledge of all its outstanding contracts. Since any single institution has full knowledge of only the positions between itself and its counterparties, it can only estimate the extent to which it may be exposed to contract defaults affecting its immediate counterparties. For example, suppose institution A has a contract with institution B. Assume further that institution A can correctly assess its exposure to default on that contract. At the same time, however, institution B also has a contract outstanding with institution C. Should C default on its contract, B may become financially weaker, thereby increasing the exposure A faces from B. Assessing this indirect exposure is both difficult and costly. Further, if an institution underestimates its indirect exposure, it may inadequately protect itself against the risk of loss.

Multilateral clearing systems solve this problem by shifting contract loss exposure to the clearinghouse. Such a shift is efficient because the clearinghouse has full knowledge of the contracting activities of all its members; thus, the shift yields an economy in information collecting. Moreover, centralizing the information gathering substantially improves the ability of members to react appropriately. Where a single member in a bilateral arrangement can estimate its exposure from default propagation, it will tend to protect itself against its own estimation error. With a central clearinghouse, the individual estimates made by individual institutions are replaced with full-information estimates made by the clearinghouse. Thus, centralization concentrates information at the point where it is best utilized.

Centralization has a further benefit. While each participant in a bilateral system has incentives to protect itself from contract defaults by its counterparties, its interests end there. No participant has an incentive to concern itself with system-wide risks. The members of a multilateral clearing system, on the other hand, are exposed to defaults created by system-wide problems. As each clearing member accepts the liabilities entered into by the cleared trades of every other member, each member has strong incentives to monitor this risk. This mutualization of risk ensures that contracts accepted by clearing members will be scrutinized for their system-wide risk implications. Members can be expected to adopt trading rules that lessen the probability that a buildup of these risks will occur, and they can be expected to respond quickly to any unanticipated buildup. In sum, a multilateral system has incentives to identify systemic risks and has the resources to respond to these incentives. It is this combination that best explains the success of the futures markets in controlling contract defaults since 1925.

Regulatory authorities represent an alternative mechanism for dealing with system-wide risks. Legislation entitles the regulatory agencies to access defined categories of information. Legislation also stipulates the steps that regulators may take to mitigate systemic risks. As legislation develops slowly, often in response to actual problems, regulatory agencies are less capable of responding quickly to rapid buildups in system-wide risks. The ability of multilateral clearinghouses to adapt more quickly makes them particularly useful. This rapid-response feature is especially beneficial in the derivatives markets, where contracting activity has grown exponentially and innovation may be exceeding the capacity of regulators to keep pace.

These circumstances have piqued the interest of banking regulators in multilateral clearing arrangements. While they recognize the dangers posed by poorly structured clearinghouse arrangements,2 the possibility of obtaining a facility whose operations are consistent with the public’s interest in controlling system-wide risks is attractive. The clearinghouses operated by the futures exchanges for most of this century offer an excellent model for how these benefits can be obtained for the broader category of derivative products that trade today.

Regulators are now in the process of evaluating multilateral clearing arrangements. The Lamfalussy Report offers guidelines for operating a multilateral clearing facility in foreign exchange.3 It does not address multilateral clearing of derivative products, an area that poses special problems. Most important, in contrast to foreign exchange contracts, cash settlements do not extinguish the exposures that remain in an outstanding derivatives contract. Since a derivatives contract may not expire for years, each contract may represent a considerable dollar amount of exposure. It is important for clearinghouse settlements to extinguish as much current exposure as possible. Futures markets accomplish this by marking the contract to market daily, using in most cases the market-determined settlement price for each contract. This approach is based on the idea that market prices provide the best possible estimate of current value. When publicly observed prices are less informative, as in a customized OTC derivative, they must be replaced by calculated values. Development of a satisfactory multilateral clearing facility will require an effective approach to solving this issue.

As noted earlier, the search for private economies has motivated many of the proposals for multilateral clearing arrangements. Assessments of these proposals need to focus on both the operating procedures for these proposed organizations and on the strength of clearinghouse incentives to adapt to the innovations occurring in our evolving markets. At this date, attention has focused on the operating procedures with little recognition of the power brought to bear when loss-sharing arrangements cause private firms to have loss exposures stemming from systemic problems. For example, the Lamfalussy guidelines do not cover the loss-sharing arrangements adopted by the clearing organization. As loss-sharing arrangements determine how the organization mutualizes its exposure to counterparty risk, this is a significant omission.

Summary

Multilateral clearing presents opportunities for substantial economies. In terms of private economies, it reduces the costs of making contractual payments, of collateralizing payment obligations, and of monitoring the financial well-being of counterparties. These benefits motivate private institutions to adopt multilateral systems.

In addition, multilateral clearing offers public economies, including the centralization of information gathering and the mutualization of risks. From a public interest perspective, it is these public economies that are of greatest significance. Centralized information gathering makes it possible for multilateral systems to identify system-wide problems that may escape notice in bilateral arrangements. As the clearinghouse may be exposed to system-wide risks, it has incentives to develop means of managing them. Moreover, unlike a public regulator, the clearinghouse can adapt rapidly to changing market conditions.

Tracking Midwest manufacturing activity

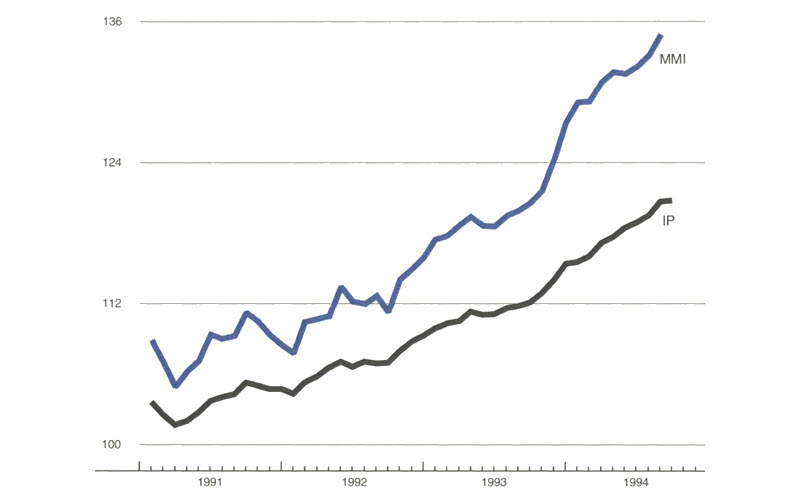

Manufacturing output indexes (1987=100)

| August | Month ago | Year ago | |

|---|---|---|---|

| MMI | 135.0 | 133.2 | 120.0 |

| IP | 120.7 | 119.4 | 111.8 |

Motor vehicle production (millions, seasonally adj. annual rate)

| September | Month ago | Year ago | |

|---|---|---|---|

| Cars | 6.3 | 6.4 | 5.3 |

| Light trucks | 5.3 | 5.5 | 4.6 |

Purchasing managers’ surveys: net % reporting production growth

| September | Month ago | Year ago | |

|---|---|---|---|

| MW | 68.7 | 61.7 | 58.4 |

| U.S. | 61.2 | 58.1 | 53.7 |

Manufacturing output indexes, 1987=100

Manufacturing output gathered increased momentum in the region during recent months, according to the Midwest Manufacturing Index. Production in cyclically sensitive sectors such as industrial machinery, fabricated metals, transportation equipment, and chemicals accounted for much of the renewed momentum.

Purchasing managers’ surveys point to further strengthening during September, particularly in Detroit and western Michigan.

Notes

1 The term for the substitution of counterparties is “novation.”

2 Patrick Parkinson presented these views at the 1993 annual Conference on Bank Structure and Competition of the Federal Reserve Bank of Chicago. For a summary, see James T. Moser, “Systemic risk in interbank markets,” Summary: FDICIA: An Appraisal, Federal Reserve Bank of Chicago, May 1993, pp. 20-24.

3 See Group of Ten, Committee on Interbank Netting Schemes of Central Banks, “The Lamfalussy report,” Basel, Switzerland, November 1990.