The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

During the first half of this year, oil prices rose sharply, prompting headlines suggesting the return to an era of high oil prices. The spot price for West Texas Intermediate crude increased from about $14 per barrel in December 1993 to a peak of more than $20 per barrel in July. World oil demand has picked up in response to increased economic activity. However, since the beginning of the year—indeed, over the last four years—world crude oil production has remained stable. Are we once again facing a protracted period of rising oil prices and oil-price-induced adjustments reminiscent of the 1970s and 1980s? A brief look at the historical record may shed some light on this question.

The rude awakening

In October 1973, the world entered a new phase in the economic and political process when a group of economically less-developed oil-producing countries, which 13 years earlier had banded together to form an ineffectual cartel called the Organization of Petroleum Exporting Countries (OPEC), launched a bold experiment in international coercion. Unified by the 1973 war between Israel and several Middle Eastern countries, the Arab members of the cartel sought to persuade the industrial nations to intervene on behalf of the Arab participants. On the whole, those nations did not react favorably, so OPEC demonstrated its power by turning down the marginal supply of the world’s exportable oil. The result was a dramatic increase in world oil prices—an outcome bolstered by a strong world demand for oil and a tightening of oil supplies from non-OPEC sources.

While OPEC’s objective with regard to the Middle East conflict failed, its restriction of oil supplies commanded the world’s attention. OPEC’s imposing influence over the world’s economies continued for about a decade, peaking in 1979-82, when crude oil imported into the United States reached a nominal price about 14 times that of early 1973—a monthly average price of more than $36 per barrel.1 (Adjusted for inflation, the increase was more than six times.) The oil crises of 1973-74 and 1979-81 left the world markedly different. Indeed, they laid important stepping stones over which the U.S. has been dragged toward the reality, if not the acceptance, of international interdependence.

It didn’t all begin in 1973

There is a popular perception that the modern preoccupation with oil began with OPEC’s restriction of supplies in 1973. Yet oil’s volatile history is longer than that. Beginning in the 1940s, a series of developments gradually produced an environment in which a cartel could manipulate world oil markets. The availability of oil played a crucial role in World War II. Strategic access to reliable oil supplies was a motivation for the German invasion of Central Europe, German and Italian actions in North Africa and around the Suez Canal, and the Japanese conquest of Southeast Asia. Equally important, the U.S. possessed large oil resources of its own, a fact that was critical to the Allies’ successful prosecution of the war.

With the end of the war and of rationing in August 1945, the production capabilities of the U.S. oil industry were well-positioned for the transition to a peacetime economy. Oil soon became a resource that was largely taken for granted in the U.S. Throughout the 1950s and 1960s it was plentiful and cheap, especially with new oil fields opening up in the Middle East, Southeast Asia, and Africa. During the 1950s, annual imports of crude oil and refined oil products increased 176%, while domestic consumption of petroleum products rose about 65%; net imports as a share of domestic consumption rose from 6% to 17% over the period. Oil was so cheap that in 1959, the domestic oil industry persuaded the Eisenhower Administration to impose import quotas on crude oil and petroleum products to protect against foreign competition.2 The intent was to protect domestic oil prices and profits in order to promote domestic exploration and production. During the decade after the imposition of quotas, imports grew more slowly, increasing 77%; consumption growth also slowed somewhat, increasing 48%.3 Even so, imports continued to take a larger portion of the domestic market; the net import share rose to 22% in 1969.

During the period 1969-72 the oil picture in the U.S. changed markedly. The supply/consumption relationship became increasingly tight. Domestic crude production peaked in 1970 as domestic fields became less productive; it then began a gradual decline that continues to date. (That decline was interrupted briefly by the opening of the Trans-Alaska oil pipeline in 1977.) Consumption continued to expand, increasing 16% between 1969 and 1972. Crude oil prices, which had been rising at an average annual rate of about 1.25%, rose nearly 8% in 1971 alone. As a share of domestic consumption, net imports of crude oil and oil products rose to 28% in 1972. Throughout the period, pressures intensified to remove import controls on these commodities.

In 1970, a presidential commission recommended the elimination of oil import quotas. In mid-1972 a court challenge to the legality of the import quotas was filed by several northeastern states, where it was easier and cheaper to get oil from abroad than from Texas. In late 1972 President Nixon relaxed quotas on gasoline and heating fuel to stave off threatened shortages. Nonetheless, oil shortages and rising prices persisted during the early months of 1973, with no sign of relief from domestic production. Quotas were relaxed further in January of that year and again in April and were finally ended by executive order on May 1. By September 1973, one month before the initial supply cuts by the Arab producers, the U.S. producer price index for crude oil had risen nearly 17% from its January level. U.S. crude oil producers had little excess production capacity and dwindling oil field reserves; thus, even at higher prices, they were unable to respond in the short term. The stage was set for OPEC to step into the spotlight.

The OPEC adventure

International oil markets responded quickly to the tight supply/consumption situation. The U.S. monthly average import price for crude oil stood at $2.75 per barrel in January 1973; by September it had increased 23% to $3.38. In October 1973 the Persian Gulf members of OPEC doubled the price of their crude oil, then in January 1974 doubled it again. By that time the average price in the U.S. for imported oil had more than doubled to $6.92 per barrel, and by March it had increased to $11.10. Prices drifted upward during the next four years and held around $13.50 per barrel throughout 1978. By the late 1970s higher oil prices had elicited increased oil production not only from OPEC, but also from elsewhere, especially Mexico, the Alaskan North Slope, and the newly opened fields in the North Sea. At the same time, energy conservation measures were on the verge of significantly cutting oil consumption in the industrial countries.

Faced with the prospect of losing some control over the market, OPEC again asserted its influence in 1979 by cutting production and raising prices. This development was aided by the late 1979 Iranian revolution that deposed the Shah. Uncertainty about the security of Middle East oil supplies was again at a high level. By mid-1980 the official price for benchmark Saudi Arabian light crude had been raised to $32 per barrel. In October 1981 it was raised further to $34, and quality premiums pushed some crude prices above $40.4 The U.S. average monthly import price for crude hit a peak of $36.95 per barrel in April 1981. The inflationary impact and central banks’ response to it once again helped push most of the world’s major economies into recession. The consequent reduction in oil consumption along with accelerated conservation measures and higher non-OPEC oil output began putting pressure on OPEC’s ability to maintain its set price. The unity of the cartel began to crack as individual members cheated on the cartel, attempting to increase their national revenues by boosting their own oil output and surreptitiously selling more than their OPEC quota (at reduced prices) on world markets. As prices began to fall, there was an incentive for individual OPEC members to lower prices even further (and sell more product) in the attempt to maintain revenues by increasing market share. This breakdown in cartel discipline, a key weakness in the maintenance of any cartel, eventually contributed to a break in oil prices.

By the mid-1980s energy conservation efforts in the industrial countries were in full swing. Oil production by non-OPEC countries was steadily increasing. These developments placed additional pressure on cartel discipline. By early 1983 imported oil prices in the U.S. had dropped below $30 per barrel. Then, during the first half of 1986, oil prices precipitously dropped even further, from nearly $26 per barrel of crude in January to about $10 in August, the lowest price since February 1974. Subsequently, prices recovered somewhat and generally have held close to a range of $15-$20 per barrel. The major upside exception was a brief but sharp run-up in prices in late 1990 generated, once again, by uncertainty over Middle East oil supplies during the Gulf War.

1994: A new exercise of OPEC market power?

After the Gulf War, recession and/or sluggish economic growth in the world’s industrial economies contributed to weak oil markets, with prices generally in the $15-$20 range or lower. Indeed, in January of this year the monthly average U.S. import price for crude dropped to $11.60 per barrel. But the second-quarter surge in oil prices recalled OPEC’s old market power and renewed questions as to whether OPEC could or would try to reassert that power. When OPEC decided in March to hold production ceilings unchanged despite rising prices, rather than reduce production in an attempt to push prices further upward, the oil-importing countries breathed a sigh of relief. OPEC’s meeting in October will be watched with even greater interest, especially since oil prices have recently declined from their mid-year peak.

Why the renewed concern that oil prices are once again headed for the high road? In part it stems from the knowledge that in the longer term, oil is a limited (that is, nonrenewable) resource that over time will become more costly to produce. There are also memories of the numerous forecasts in the 1970s and early 1980s that suggested the world would “hit the wall” on oil production during the 1990s and that consumers would face high and ever-higher oil prices. These forecasts have not come true, but the mid-1990s are here and the memory persists. Will the shoe drop after all?

Overlying such latent worries is the recent shift in the world’s economic environment. Continental European economies are pulling out of an extended recession, and Japan shows some signs that an economic upturn is in its near future. The economies of the English-speaking countries continue to expand, and economic growth in the industrializing nations of Southeast Asia is booming. These conditions clearly contribute to increasing demand for oil. Indeed, not only is total consumption increasing, but at least in the U.S., per capita consumption has also turned upward.

At the same time, non-OPEC as well as OPEC production is holding stable. The combination of increasing consumption and stable production has been absent from the oil market for at least five years, and it clearly contains the potential for increasing prices. Upward price pressures during the second quarter of 1994 were also provided by a seasonal response to the heavy gasoline use that normally occurs during the summer months. Concern about the potential for disruptions in the supply of crude oil because of labor unrest in Nigerian oil fields and civil war in Algeria also placed upward pressure on prices. So, is another oil price shock on the near horizon? For several reasons, it does not seem likely.

First, the reaction of the industrial oil importers to the dramatic price increases of 1973-74 and 1979-80 conveyed an important message to OPEC oil ministers. Initially, the dramatically higher prices caused consumers to reduce their demand for oil. Over time, the economies of the oil consumers adjusted to the new mix of energy prices, and demand for oil changed such that the increase in revenue to oil producers backed off further.5 In part, this stems from conservation efforts as well as the fact that in many uses there are substitutes for oil, especially when oil prices are high relative to other forms of energy.

Second, if and when Iraq complies with U.N. requirements on arms control, and the U.N relaxes the embargo on Iraqi oil, Iraq’s production will add substantial quantities to available world oil supplies. In such circumstances, other OPEC members may cut back on production to compensate for the increased flow from Iraq. Nonetheless, the return of Iraqi oil may moderate the upward pressure on oil prices. This development will serve to exacerbate the inherently unstable nature of the cartel.

Third, while the industrial economies remain heavily dependent on oil, they are less so than they were during the 1970s and 1980s. This is due to the substitution of other energy sources (in particular, natural gas and coal) for oil and to increased efficiency in use. In the U.S. the amount of oil consumed per billion dollars in real GDP declined nearly 37% between 1973 and 1993. Furthermore, oil’s share of U.S. energy consumption has declined substantially, from 47% in 1973 to 40% in 1993.

Finally, the worry of a generation ago that oil prices are on an ever-upward trend may be a valid concern for the long term, but the long term is a process, not a point in time. An interesting and generally ignored fact in this regard is that the real (inflation-adjusted) price for oil is at its lowest level in more than 40 years.

Summing up

The current conditions of world oil supply and demand contain some of the preconditions for oil prices to trend upward. Consumption is increasing in line with more expansive economic growth. At the same time, production has increased more slowly. OPEC’s share of world production is gradually moving upward again, providing the cartel with potentially increased leverage on the world market. Nevertheless, it seems unlikely that the cartel will seriously attempt to abuse that leverage again. In addition, over the relatively near future, the U.N. holds a strong bargaining chip with its control over the embargo of Iraqi oil.

In short, current conditions suggest that oil prices are not likely to decline appreciably from current levels, and thus will not continue to contribute to lower inflationary pressures, as they did during most of the period since 1981. On the other hand, oil prices per se are not likely to be a strong inflationary factor in the world economy for the foreseeable future.6 That is not to say that higher taxes and/or increased costs of environmental controls will not significantly increase the price of petroleum products to consumers. They very likely will—but that is a different issue.

Tracking Midwest manufacturing activity

Manufacturing output index (1987=100)

| July | Month ago | Year ago | |

|---|---|---|---|

| MMI | 131.9 | 131.8 | 119.6 |

| IP | 118.7 | 118.3 | 111.6 |

Motor vehicle production (millions, seasonally adj. annual rate)

| July | Month ago | Year ago | |

|---|---|---|---|

| Cars | 6.0 | 6.2 | 5.4 |

| Light trucks | 4.7 | 5.1 | 4.0 |

Purchasing managers’ surveys: production index

| August | Month ago | Year ago | |

|---|---|---|---|

| MW | 61.7 | 69.3 | 56.3 |

| U.S. | 58.1 | 61.0 | 52.2 |

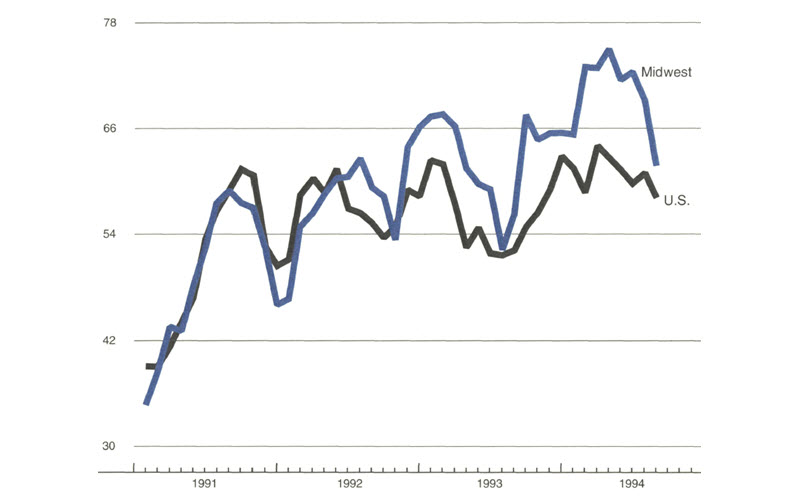

Purchasing managers' surveys (production index)

Purchasing managers’ surveys pointed to slower but continued growth in industrial output in recent months. The apparent weakening in the Midwest during August was largely determined by a sharp decline in survey results in Detroit, but the Detroit survey does not fully adjust for seasonal changes unique to the auto industry, and auto output is currently scheduled to strengthen as the year draws to a close. The production components of the Chicago and Milwaukee surveys remained at relatively high levels during August. The overall Midwest composite index remains consistent with moderate gains in output, although growth may have slowed somewhat since early 1994.

Notes

1 U.S. Department of Commerce, Bureau of the Census, Summary of U.S. Export and Import Merchandise Trade, No. FT 900, various years. Unless otherwise noted, import prices cited throughout this article are from this source.

2 Quotas were initially imposed under executive order. They were later given statutory authority in the Trade Expansion Act of 1962.

3 U.S. Department of Commerce, Bureau of Economic Analysis, Business Statistics: Supplement to the Survey of Business, various years.

4 Federal Reserve Bank of Chicago, International Letter, various years.

5 The initial response of the reduction in oil supply (a backward shift in the supply function) is a higher price and somewhat reduced quantity of oil used as the demand moves up the supply curve. Over time, the composition of factors that affect demand adjusts (that is, demand shifts downward) and the quantity of oil used declines further and the price falls. The magnitude of these changes depends on, among other things, oil‘s quantity/price relationship and the degree of substitutability of other resources for oil.

6 This abstracts from potential changes in exchange rates. Oil is priced in U.S. dollars on world markets. An appreciable change in the dollar exchange rate could have a substantial impact on the foreign currency price of oil.