The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

The U.S. stock market has long provided the highest average return among all financial assets. According to figure 1, stocks earned significantly higher average returns over the last 68 years than other financial assets, such as corporate bonds or Treasury bills. While the stock returns shown in figure 1 are impressive, investors are more concerned with inflation-adjusted returns. Panel B of figure 1 presents average real returns after adjusting for inflation. The stock market’s performance has been even more remarkable in recent years. Figure 2 presents data on average real returns over the past 12, 24, and 36 months. The market’s superior performance has led investment advisors to recommend stocks for retirement saving and has prompted calls for privatizing Social Security so that individuals can exploit these exceptional returns. In a December 1996 Wall Street Journal article, one-time presidential hopeful Steve Forbes compared the “historic 9% to 10% annual returns from stock market investments” to the “lifetime return of only about 2.2%” a worker receives from the current social security system.1 His argument for privatization seems especially compelling given the stock market’s recent performance.

1. Nominal and real returns

| A. Nominal returns | ||

| 1927-95 | 1946-95 | |

| (percent per year) | (percent per year) | |

| Stocks | 9.54 | 11.23 |

| Corporate bonds | 5.39 | 5.46 |

| Government bonds | 4.85 | 5.04 |

| Treasury bills | 3.64 | 4.72 |

| B. Real returns | ||

| 1927-95 | 1946-95 | |

| (percent per year) | (percent per year) | |

| Stocks | 6.43 | 7.03 |

| Corporate bonds | 2.28 | 1.25 |

| Government bonds | 1.74 | 0.84 |

| Treasury bills | 0.52 | 0.52 |

Source: University of Chicago, Center for Research on Security Prices (CRSP).

2. Average stock returns

| Period | Real return |

| (percent per year) | |

| 1995 | 19.61 |

| 1994-95 | 17.13 |

| 1993-95 | 11.88 |

Source: CRSP.

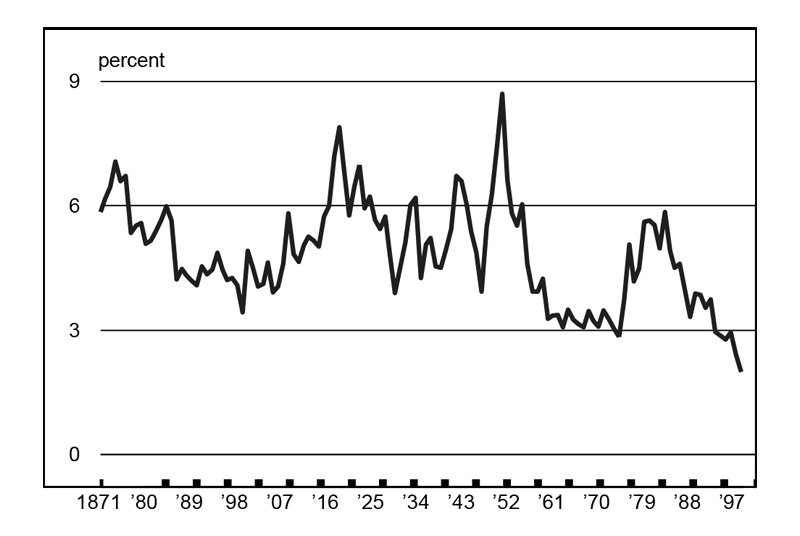

There is, however, a downside to the recent run-up in stock prices: The currently high stock market valuation may actually forecast low future returns. There are many ways to determine whether stock prices are “high.” For example, the ratio of stock prices to either earnings, book value, or cash flows provides a measure of the relative level of stock prices. In this Fed Letter, we use the dividend yield, defined as the ratio of dividends to stock prices. When the dividend yield is low, stock prices are considered relatively high and vice versa. As figure 3 indicates, the average dividend yield from 1927 to 1995 was about 4.4%. Figure 4 displays the level of dividend yields over time and shows that the average dividend yield in 1997 was at a historic low of 2%. According to the figure, the current high level of U.S. stock prices (as measured by dividend yields) is without precedent.

3. Yields, returns, and growth, 1927–95

| 1927-95 | 1927-45 | 1946-95 | 1927-71 | 1972-95 | |

| (percent per year) |

(percent per year) |

(percent per year) |

(percent per year) |

(percent per year) |

|

| Dividend yield | 4.37 | 4.95 | 4.14 | 4.51 | 4.14 |

| Real returns | 6.43 | 4.86 | 7.03 | 6.73 | 6.40 |

| Real dividend growth | 1.12 | -1.62 | 2.15 | 0.71 | 2.34 |

| Average model error | 0.009 (.4752) |

0.0142 (.2836) |

0.007 (.3943) |

0.0147 (.5741) |

0.004 (.1499) |

Source: CRSP.

4. Dividend yields, 1871-1997

Source: Robert J. Shiller, Market Volatility, chapter 26.

A look back at stock returns

In the past, very high stock prices have not been good news for future stock returns. In a recent Economic Perspectives article, John Cochrane shows that over long horizons (five years), low dividend yields tend to be associated with low future stock returns.2 Over time, the dividend yield tends to move toward its mean. When stock prices are relatively high, the dividend yield can be restored to its mean by either having future stock prices fall or having dividends rise to restore the ratio’s mean. Historically, the former has been the case: Future stock prices, not dividends, adjust to move the dividend yield back to its long-run average. Therefore, in times of high stock prices, future returns generally fall. It is important to note, however, that these adjustments occur over long periods of time. While stock returns may be expected to fall, the decline usually occurs gradually. Therefore, a low dividend yield does not necessarily forecast a crash or lower returns in the immediate future; rather, it forecasts lower returns over the next several years.

How much lower will future stock returns be? While we can’t say for sure, we can get some insight into this question by using a very simple model of stock prices proposed by Gordon and Shapiro.3 Their model relates the dividend yield to stock returns and per-share dividend growth rates. Gordon and Shapiro make two simplifying assumptions.4 First, they assume that expected returns to stocks are steady. Second, they assume that dividends per share are expected to grow at a steady rate. Under these assumptions, the future dividend yield is simply the difference between the expected stock return and the expected dividend growth rate per share:

Dividend Yield = Expected Stock Return - Expected Dividend Growth Rate Per Share.

Because our focus is on the long run, the simplifying assumptions aren’t unreasonable. This model may still aid in understanding the implications of the currently low dividend yields.

According to figure 3, the simple Gordon-Shapiro model fits the historical data quite well. Figure 3 presents mean dividend yields, stock returns, and dividend growth rates from January 1927 to December 1995 as well as for the pre- and post-war periods. The last row in figure 3, “average model error,” shows the difference between the Gordon-Shapiro model and the actual data. During every period but two, which include Great Depression data, this difference is less than 1%. Furthermore, statistical tests indicate that the difference is approximately zero.5 Therefore, over the periods we study, mean dividend yields are not substantially different from stock returns less dividend growth rates.

What does the future hold?

What does the past tell us about future stock returns? Suppose the dividend to price ratio remains permanently lower. According to Gordon and Shapiro’s model, stock returns will permanently decrease or dividend growth rates will permanently increase. Let’s assume stocks will continue to provide real annual returns of 11.9%, the average return over the past three years. If the dividend to price ratio stabilizes at 2%, the model would require that dividends per share grow at an inflation-adjusted rate of 9.9%. This level of dividend growth would be truly remarkable. The average real dividend growth has been only 1.4% over the past ten years. According to figure 3, for the entire period we studied, real dividend growth has averaged only 1.1%. In other words, per-share dividend growth rates would have to be 900% higher than their historical average if stock returns remain permanently high and dividend yields remain permanently low. Suppose instead that stocks will provide returns that are equal to their post-war historical average of 7%. A 2% dividend yield would then require real dividend growth of 5%, which is more than three times the average growth rate over the past ten years. In fact, from 1927 to the present, there have never been ten consecutive years when dividends per share grew at an average rate exceeding 4.85%. If we exclude 1955 (when dividends grew at an extraordinary rate of 16.3%), there is no ten-year period when dividend growth exceeded 4%. We conclude that to achieve historical stock returns in the future, we would need implausibly high dividend growth rates.

Because we consider these high dividend growth rates to be unrealistic, let’s look at stock returns given more realistic dividend growth rates. If dividends per share grow at an inflation-adjusted rate of 2.5% (a high but plausible figure, given the results in figure 3) and dividend yields remain at 2%, the Gordon-Shapiro model implies that real stock returns will average only 4.5% annually, substantially below the post-war average of 7%.

Thus far, we have assumed that dividend yields will remain at their current low levels indefinitely. Suppose instead that the dividend yield adjusts back to its mean. In this case, either stock prices will fall or dividends will increase. On March 14, Warren Buffett, chairman of Berkshire Hathaway, Inc., told stockholders that he believes the historically high stock prices are justified as long as interest rates remain low and corporations continue to produce “remarkable” returns on equity.6 Buffett apparently believes that future dividends will rise to justify the low dividend to price ratio. Unfortunately, history tells a different story. It is adjustments in stock prices, not dividends, that historically have driven the dividend yield back toward its mean value. If dividend yields do revert to their long-run mean over the next few years, the long-term prospects for the stock market over this period are not favorable.

Our results have important implications for those saving for retirement. Many retirement planners base their investment allocation strategies on the continued strong performance of the stock market. If stock returns decline to a new, permanently lower level of 4.5%, many retirees will have under-saved for retirement. Similarly, those who advocate privatizing Social Security argue that individuals could more effectively save for their retirement by investing their Social Security contributions in the stock market. This argument assumes that stocks will continue to provide investors with the same outstanding returns that they have historically provided. Our analysis casts doubt on this assumption. Therefore, estimates of the benefits of Social Security privatization, like retirement savings strategies, should consider both pessimistic and optimistic forecasts of future stock returns.

Conclusion

What might account for the current low dividend yields and the implied low expected future returns? At this point, we can only form tentative conjectures. One theory is that members of the Baby Boom generation had not adequately saved for retirement in their early working years. Now that they are in their prime earning years, they are making up for lost time. The resulting flood of retirement savings both drives asset prices up and indicates that savers are willing to accept a lower return in order to secure some reasonable parking place for their money.

The problem with this theory is that it implies that all expected returns (not just stock returns) should drop. However, we find, along with Cochrane, that the equity premium (the expected equity return above the Treasury bill rate) has dropped in recent years. In other words, expected future stock returns are lower relative to alternative assets. The equity premium is properly understood as a compensation for risk. Why would today’s investors require a lower compensation for bearing the considerable risk of the stock market? Three possibilities emerge. Perhaps the current generation is simply less risk averse. The per-capita wealth of investors is higher than in the past. It is reasonable to believe that wealthier investors are more willing to bear investment risk. Perhaps the stock market is less risky now than in the past. This is a possibility, but arguments of this type have been made before only to be refuted by the next crash. Consider, for example, the following: “For the last five years we have been in a new industrial era in this country. We are making progress industrially and economically not even by leaps and bounds, but on a perfectly heroic scale.” This quotation appeared in Forbes magazine in June 1929, and the sentiment reflects a popular opinion of the current American economy as well. Finally, some investors today may truly misperceive the amount of risk in the market. They do not share their parents’ memories of the stagflation of the 1970s or their grandparents’ memories of the Great Depression of the 1930s. Only time will tell which of these explanations proves most satisfactory.

Tracking Midwest manufacturing activity

Manufacturing output indexes (1992=100)

| May | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 126.4 | 126.1 | 121.3 |

| IP | 131.5 | 131.2 | 125.7 |

Motor vehicle production (millions, seasonally adj. annual rate)

| May | Month ago | Year ago | |

|---|---|---|---|

| Cars | 5.6 | 5.5 | 5.8 |

| Light trucks | 6.5 | 6.4 | 5.5 |

Purchasing managers' surveys: net % reporting production growth

| June | Month ago | Year ago | |

|---|---|---|---|

| MW | 56.8 | 63.0 | 55.8 |

| U.S. | 50.7 | 54.1 | 56.0 |

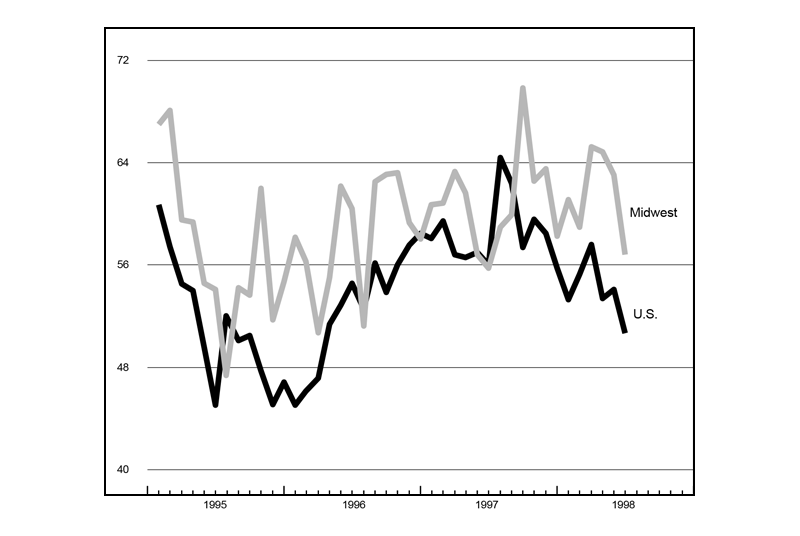

Purchasing managers’ surveys (production index)

The Midwest purchasing managers’ composite index (weighted average of the Chicago, Detroit, and Milwaukee surveys) for production decreased to 56.8% in June from 63% in May. Purchasing managers’ indexes decreased in Chicago and Detroit but increased slightly in Milwaukee. The national purchasing managers’ composite index also decreased from 54.1% in May to 50.7% in June.

The CFMMI increased 0.2% in May following a revised increase of 0.6% in April. The Federal Reserve Board’s IP rose 0.2% in May after increasing 0.5% in April. Total light motor vehicle production (seasonally adjusted annual rate) increased from 11.9 million units in April to 12.1 million units in May. In May, light truck production increased from 6.4 million in April to 6.5 million units and car production increased from 5.5 million to 5.6 million units.

Notes

1 Steve Forbes, “How to replace Social Security,” The Wall Street Journal, December 18, 1996, p. 20.

2 John H. Cochrane, “Where is the market going? Uncertain facts and novel theories,” Economic Perspectives, Federal Reserve Bank of Chicago, Vol. 21, No. 6, November/December 1997.

3 M. J. Gordon and E. Shapiro, “Capital equipment analysis: the required rate of profit,” Management Science, Vol. 3, 1956, pp. 102–110.

4 The model also requires the additional technical assumption that dividends per share are greater than zero. The model does not, however, require that cash dividends are the only way cash is disbursed from firms to shareholders. In a recent article, (“Cash distributions to shareholders,” Journal of Economic Perspectives, Vol. 3, No. 3, Summer 1989, pp. 129–140), Laurie Simon-Bagwell and John Shoven show that in recent years over half of all cash disbursements are made in the form of share repurchases and other cash tender offers. Because share repurchases reduce the number of shares outstanding, a share repurchase will cause dividends per share to increase for a given dividend payout. Therefore, as long as dividends are paid, the trend toward non-dividend cash disbursements does not affect the validity of our study.

5 In particular, the t-statistics (in parenthesis) are less than 1.96.

6 James P. Miller, “Buffett sees stock prices as justifiable,” The Wall Street Journal, March 16, 1998, p. 1.