The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

In a rapidly expanding derivatives market, today’s “latest thing” may soon be listed at trillions of dollars.1 It is the prospect of improved methods for managing an old risk that has piqued the interest of bankers. Derivatives dealers are similarly interested in the prospect of booking derivative contracts for bank loans recently valued at $2.7 trillion.2 The “old risk” is the risk of loan default, and it is the size of the loan market that is motivating dealers to make sizable investments to develop the technology to manage this risk.

This Chicago Fed Letter first defines the category of contracts labeled credit derivatives, then compares those contracts to traditional credit-risk management tools. Lastly, the article reviews some problems facing this contract market.

What is a credit derivative?

In short, a credit derivative is a contract that transfers credit risk. We can define credit risk as any loss that stems from a change in the ability of a borrower to repay a debt. Clearly, the borrower’s declaration of bankruptcy constitutes such a change, because repayment of any outstanding debt becomes subject to legal proceedings. While these bankruptcy events have been frequent in a historical sense, they tend to be much less frequent than changes in a firm’s bankruptcy prospects. Changes in the prospects for bankruptcy are any changes that alter the likelihood that a firm will later become insolvent. Among these would be a downgrade in a debt-rating agency’s classification of a company’s debt, e.g., from “single A” to “triple B”; the onset of a recession resulting in increases in personal bankruptcies; or economic problems affecting the ability of a nation to repay its debt. Except for the sovereign debt of the world’s most-developed countries, most debt has some degree of credit risk. Each of these events is an important concern for debt holders. Credit derivatives provide a mechanism for managing this risk.

Credit derivatives are similar to other derivatives in that they transfer risk between firms. The distinction is that credit derivatives transfer credit risk rather than price or interest rate risk. Much like insurance companies, firms develop specialties in managing certain types of risk. Credit derivatives enable firms to carve out the credit exposures inherent in certain debt obligations and transfer that risk to other firms better adapted to manage that risk. For example, a regional bank may have credit risks owing to its inability to diversify its loan portfolio with loans made in its geographic region. From the perspective of this bank, risk transfers make sense when the cost of managing an uncompensated risk exceeds the cost of transferring it. If the bank taking on the risk can manage the risk at a cost lower than the fee paid by the risk-transferring bank, the contract is an attractive one. The economy benefits from the transfer because it results in a better match between the risk and the resources devoted to risk management.

While the purpose of a credit derivative contract is clear, the precise form of the contract is more difficult to explain. In fact, there is no generic contract form. All contracts conveying credit risk between counterparties can be labeled credit derivatives. Unlike swaps, where nearly all contracts are variations of the interest rate swap, credit derivatives are not nearly so standardized. In a 1996 survey, the British Banker’s Association identified the following four distinct categories of credit derivative contracts: credit default contracts, total return swaps, credit spread contracts, and credit linked notes.3

To get the flavor of these contracts, consider a credit default swap. In this contract, the insured makes a periodic payment to the insurer. In return, in the event of a default, the insurer makes a payment to the insured. Should no credit event occur, the insured receives no payment. For example, a bank having credit exposure from loans the bank previously made to a firm may agree to pay the insurer 20 basis points per quarter. In this instance the credit event is defined as a rating downgrade of the firm’s other debt; if such a downgrade occurs, the bank receives a prearranged cash payment.

Putting this example into perspective, the bank holding the debt of this firm has three choices. First, it can continue to hold the debt. Doing so, it incurs the costs of capital and loss provisions needed to support that risk level. Second, it can sell the debt, in this case incurring costs associated with debt sales. Third, it can insure fully or partially against loss by entering into a credit derivative contract. Comparing its alternatives, the bank should adopt the least costly of the three. In some instances, the least-cost course will be the credit derivative. Particularly attractive is the ability to write the contract to obtain a good fit with the needs of the institution. In contrast to the loan-sale alternative, which sells bundles of risks, the credit derivative enables the bank to insure specific risk attributes when the cost of this insurance is low, while holding capital against those risks when insurance costs are relatively high. For some institutions, the preferred approach may be a mix of credit derivatives with capital holdings against those risks retained.4

An alternative to loan loss provisions

Loan loss provisions are the traditional means by which banks manage their credit exposures. However, while loss reserves serve as a buffer stock for banks, they carry an opportunity cost. In certain circumstances, credit derivatives may be used to mitigate this cost.

Most of the costs referred to in the description of the loan-sale alternative above are reasonably predictable. One cost that is not so predicable is what economists call an “adverse selection premium.” Banks that are unable to credibly reveal their valuations of the loans they put up for sale will generally find that these loans must be sold at a discount to the bank’s assessed valuations. This is because potential purchasers of the debt will presume the bank is selling its weakest credits; that is, it is selling its “lemons.” The difference between the market price and the bank’s valuation is the adverse selection premium, which compensates the purchaser against the risk that the bank is selling its weakest loans. Such revenue shortfalls can impair the bank’s ability to meet its financial obligations. To protect against these circumstances, banks traditionally have maintained inventories of liquid assets that can be sold without discount. Using the proceeds to fund the bank’s other obligations, the bank maintains its value as an ongoing institution. These holdings give the bank time to shop the loans it sells, thereby reducing the loss the bank would incur if it were forced to sell its loans more rapidly.

From this perspective, the bank faces an inventory problem. It must maintain an inventory of liquid assets sufficient to meet its future loan loss experience. However, investments made in this inventory generally yield a lower return than the bank’s other uses for its funds. Hence, the bank incurs an opportunity loss for maintaining an inventory of loan loss reserves. A credit derivative strategy may be employed to mitigate this loss.

The credit derivative strategy can be construed as dynamically provisioning against loan losses. Contrast this with the static inventory allocation represented by loan loss provisions. With credit derivatives, the bank maintains an off-balance-sheet position that delivers funds as needs arise, rather than maintaining a funds inventory. The “just-in-time” arrival of funds via a credit derivative contract can fulfill the bank’s needs for immediate funds to meet financial obligations. Like manufacturing firms that adopt just-in-time inventory systems, this can be a more cost-efficient solution to funding bank operations.

Problems facing the market for credit derivatives

The credit derivative market faces two challenges that, if overcome, should result in growth along the lines of that realized in interest rate contracts. The first challenge is to find a balance between standardization and customization. From a pure risk reduction perspective, the insurance aspect of a credit derivative is most effective when the contract’s cash-flow driver, that is, the price that determines the payment made to the insured, is the value of the debt being insured. This is often impractical. First, valuations of many debt contracts are not publicly available. Second and equally problematic, the insuring institution will often have an information advantage over the insurer. Thus, a credit derivative contract written against debt for which the bank has an information advantage entails an adverse selection premium. Unless this premium is less than that incurred on the sale of the debt, the credit derivative presents no advantage over a loan sale.

To avoid these problems, the cash-flow driver for the credit derivative must be publicly available and not give the bank an information advantage. Most often, this will be a publicly available price or index correlated with the bank’s exposure to credit loss. For example, a bank loan to a developing country might be insured using the publicly traded debt of that country. Often the prospects for both will change together, though not precisely. This lack of precise cash-flow matching reduces the insurance value of the contract. Thus, credit derivatives are likely to succeed when contracts can be written against standard benchmarks. An example is the Quarterly Bankruptcy Index (QBI) contract recently proposed by the Chicago Mercantile Exchange. The QBI is an index of personal bankruptcy in the U.S. that has historically been strongly correlated with the loss experience of the largest credit-card issuers. Since the index includes all U.S. personal bankruptcies, no one institution has a significant information advantage, so the adverse selection premium is likely to be small.

The second challenge facing the credit derivative market is a regulatory matter. Regulatory capital is broken into tiers. Tier 1 capital consists of proceeds from the sale of stock and accumulated retained earnings. Tier 2 capital includes these items and other market issuances, as well as provisions for loan losses subject to two limitations. The first limitation is that loan loss provisions included as capital cannot exceed 1.25% of gross risk-weighted assets. The second is that the total value of these provisions cannot exceed that of all other forms of tier 2 capital. With tier 2 capital requirements at 8% of risk-weighted assets, loan loss provisions are an important component of regulatory capital. Proponents of the new risk-adjusted methods of managing bank capital such as RAROC argue that, on a correctly risk-adjusted basis, tier 2 capital levels should be around 5%. This implies that institutions that currently have excess balances of liquid assets are bearing a large cost for holding these balances. Banks can be expected to seek ways to lower their costs by pushing for regulations that permit substitution of credit derivative contracts for loan loss provisioning. Thus far, the regulatory response in the U.S. and elsewhere has focused primarily on the prospect that banks will use credit derivatives to increase risk rather than on their risk-reducing potential.

The Bank of England published a provisional letter on credit derivatives in late 1996. British regulators classify bank assets as “trading book” or “loan book.” Capital charges for loan-book assets are larger, reflecting their lesser liquidity. The Bank of England judged the credit derivative market to be insufficiently liquid to permit the more favorable trading-book classification. The view of people at the trading desks is that an exchange-traded contract would add the liquidity needed to obtain trading-book treatment in the U.K. To the extent that regulatory capital requirements are binding on these institutions, this regulatory cost limits the use of credit derivatives.

In the U.S., the Federal Reserve and the Office of the Comptroller of the Currency (OCC) have taken different paths. The OCC holds that the credit derivative market is too new to take broad regulatory measures. The OCC is concerned that moving too quickly would adversely affect the innovation process and is evaluating institutions’ credit derivative positions on a case-by-case basis. Since these evaluations involve proprietary information, the trend in these decisions is not apparent. In principle, the regulators seem to be aware of the potential for increasing the efficiency of risk transfers, and they view their case-by-case approach as supporting this emerging market segment.

The Federal Reserve has published two guidelines on credit derivatives. The first was a Supervisory and Regulation (SR) letter released in August 1996.5 This letter primarily covers credit contracts held in the banking book, so it affects the end users of these contracts. The letter directs bank examiners to base capital requirements for a credit contract on the credit exposure of the reference asset. Drawing an analogy between its present treatment of letters of credit and its intended treatment of credit derivatives, the Fed aims to ascertain the credit exposure of the underlying credit, determine the proportion of that credit exposure present in the credit contract, and apply the capital charge for credit exposures to the product of these. This treatment does not appear to recognize risk reductions obtained through holding a diversified portfolio of credits. In addition, the letter identifies counterparty default on the credit derivative as a credit exposure and requires the bank to hold capital against this. This requirement primarily affects dealers.

The Fed published its second guideline in an SR letter released in June 1997.6 This letter is primarily intended to provide guidance for examinations of trading accounts. It categorizes trading book contracts as either open positions, matched positions, or offsetting positions and identifies the types of risk for each: counterparty credit risk, market risk, and credit risk from the underlying asset position. Open positions have exposure to all three risk types. Matched positions only have exposure to counterparty credit risk, the other two risk types being offset. Offsetting positions, e.g., positions whose payouts match in some but not all states, also have counterparty risk but their exposure to market and credit risk is mitigated, not eliminated. Examiners are directed to classify risks according to this matrix and apply standard capital charges. Additionally, if the underlying reference credit is an investment grade, the equity capital charge is applied; if the reference credit is a speculative grade, the commodity capital charge is applied. This treatment does appear to permit consideration of diversification.

Except for bank trading books, regulators have placed significant restrictions on the use of credit derivatives. Credit derivatives used to insure assets held in the banking books, i.e., most loans, must replicate the loss experience of the loan to obtain reductions in regulatory capital requirements. This restriction implies that banks incur the full adverse-selection premium as if the institution had sold the loan. In addition, the bank can be required to hold capital against any counterparty risk encountered should the bank’s counterparty fail to perform. Thus, the credit derivative strategy will generally be dominated by a strategy of selling loans. Hence, institutions that have previously maintained inventories of loan loss provisions will generally find these preferable to credit derivatives.

Conclusion

This Chicago Fed Letter introduces credit derivatives as a tool for achieving cost-effective management of credit risk, illustrates the point with an important form of these contracts, the credit default swap, and compares the risk reduction capacity of credit derivatives with the use of loan loss provisioning. Finally, some conditions for the success of these contracts are identified.

Tracking Midwest manufacturing activity

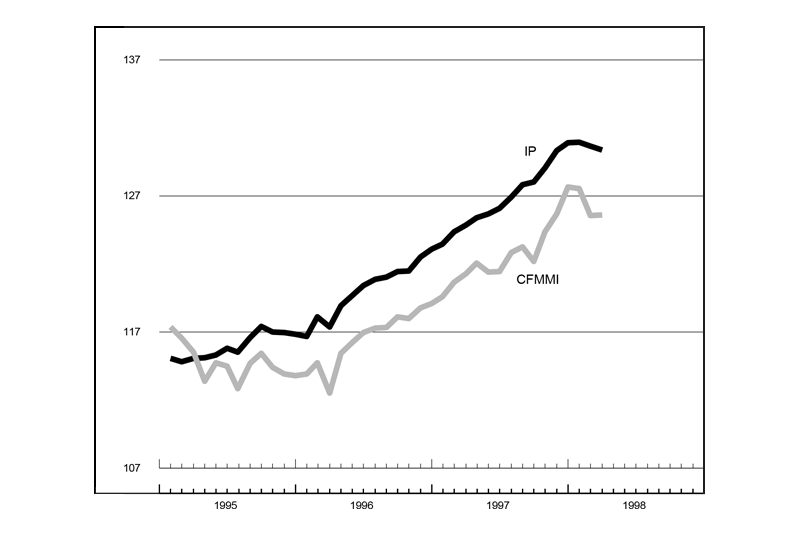

Manufacturing output indexes (1992=100)

| March | Month ago | Year ago | |

|---|---|---|---|

| CFMMI | 125.6 | 125.6 | 121.3 |

| IP | 130.4 | 130.7 | 124.9 |

Motor vehicle production (millions, seasonally adj. annual rate)

| March | Month ago | Year ago | |

|---|---|---|---|

| Cars | 5.3 | 5.4 | 6.1 |

| Light trucks | 6.2 | 6.3 | 5.9 |

Purchasing managers’ surveys: net % reporting production growth

| April | Month ago | Year ago | |

|---|---|---|---|

| MW | 64.9 | 65.3 | 61.7 |

| U.S. | 53.4 | 57.6 | 56.6 |

Manufacturing output indexes (1992=100)

The Chicago Fed Midwest Manufacturing Index (CFMMI) was unchanged in March from its revised February level of 125.6 (1992=100). The Federal Reserve Board’s Industrial Production Index (IP) for manufacturing declined from 130.7 in February to 130.4 in March. The Midwest purchasing managers’ composite index for production decreased to 64.9% in April from 65.3% in March. Purchasing managers’ indexes decreased in Chicago and Detroit but increased in Milwaukee. The national purchasing managers’ composite index decreased from 57.6% in March to 53.4% in April.

Light truck production decreased from 6.3 million units in February to 6.2 million units in March and car production decreased from 5.4 million units to 5.3 million units.

Notes

1 Growth figures vary considerably, but no one disputes that the rate of growth is large. For example, the notional value of interest rate swaps has grown from about zero in 1984 to over $40 trillion today.

2 Board of Governors of the Federal Reserve System, Bulletin, February 1998.

3 British Bankers’ Association, Credit Derivatives Survey of the London Market, November 1996.

4 The bank has a fourth alternative; it can securitize the loan by offering structured notes. Structured notes are financially engineered products that shift the loan off the bank’s books while retaining the credit risk portion. In some instances, the bank obtains a reduction in capital requirements. The structure adds complexity to the cost comparison used above but, in broad terms, a similar cost comparison would be made.

5 See Board of Governors of the Federal Reserve System, “Supervisory guidance for credit derivatives,” SR letter, No. 96-17, 1996.

6 See Board of Governors of the Federal Reserve System, “Application of market risk capital requirements to credit derivatives,” SR letter, No. 97-18, 1997.