The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Significant declines in expected revenues are forcing states to make dramatic cuts to their budgets; this makes it all the more critical to carefully assess which particular investments should be made. A recent conference at the Chicago Fed challenged policymakers to explore methods for pricing and managing our infrastructure assets to ensure that infrastructure investments are efficient and productive.

On September 25, 2002, participants from government, academia, and business gathered at the Federal Reserve Bank of Chicago to discuss the role of infrastructure in the growth of the economy. The conference, cosponsored by the National Association of State Budget Officers (NASBO), was designed to assess the condition of the region’s infrastructure and to discuss approaches to valuing, maintaining, and investing in these assets. This was the fourth conference in the Chicago Fed’s Midwest Infrastructure Program.

In his welcoming remarks, Michael H. Moskow, president and chief executive officer of the Chicago Fed, noted that infrastructure systems, such as roads, water systems, energy, and telecommunications, are critical to the economic health of any region. Moskow added that infrastructure is one function that the public counts on government to provide. However, many analysts believe we are underinvesting in these critical assets. Moskow pointed out that steep drops in expected revenues are forcing states to make dramatic cuts to their budgets and that this is making it all the more critical to carefully assess which particular investments should be made. He challenged the conference participants to explore methods for pricing and managing our infrastructure assets to ensure that infrastructure investments are efficient and productive.

Scott Pattison, executive director of conference cosponsor, NASBO, noted in his opening remarks that the conference was particularly timely given the extraordinarily difficult budget challenges facing the states. While last year’s budget strain was very painful, most states have managed to balance their budgets without massive program cuts or tax increases. Preliminary evidence suggests that conditions continue to deteriorate and that next year’s state fiscal positions will be even worse. With operating budgets being strained, there is a concern that investments in infrastructure may suffer. Pattison said that in this context, it is particularly important that policymakers understand the contribution of infrastructure to their state’s economy.

What is the condition of the basic infrastructure of the region?

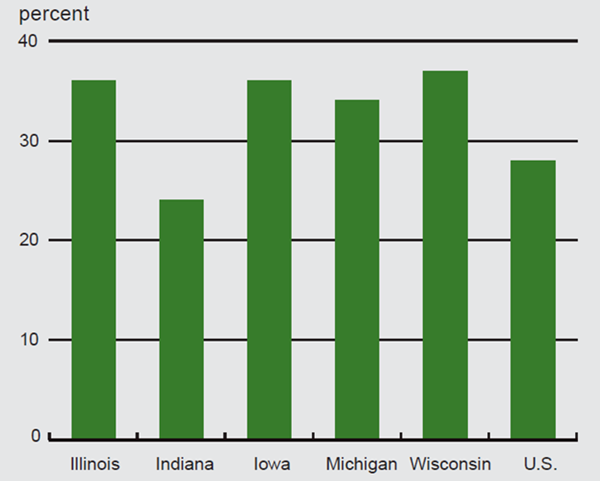

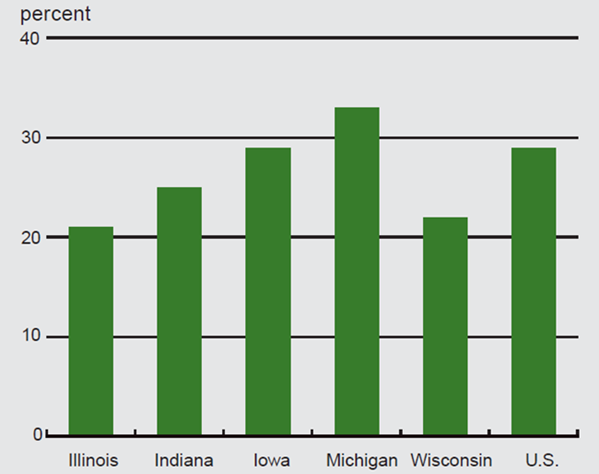

Rick Mattoon, a senior economist at the Chicago Fed, provided an overview of the condition of the basic infrastructure assets of the five states (Illinois, Indiana, Iowa, Michigan, and Wisconsin) that comprise the Seventh Federal Reserve District. While the condition of roads, water systems, and buildings is generally similar to that of the rest of the nation, various measures do suggest that the condition of the Midwest’s infrastructure assets could be improved upon (see figures 1 and 2). For example, Illinois, Iowa, and Wisconsin all reported slightly over 35% of their road pavement as being in either poor or mediocre condition. The national average is 27%. Indiana and Michigan fared only slightly better, reporting scores of 24% and 34%.

1. Roads in poor or mediocre condition, 2001

2. Deficient or obsolete bridges, 1999

Mattoon noted that a particular challenge lies ahead related to the drinking and wastewater systems. The Environmental Protection Agency has estimated that over the next 20 years, $137 billion will be needed to improve drinking water systems and $139 billion for wastewater systems. In the Seventh District, estimated costs for improving drinking water are $5.3 billion in Illinois, $1.7 billion in Indiana, $2.3 billion in Iowa, $4.4 billion in Michigan, and $1.9 billion in Wisconsin. Estimates for wastewater infrastructure costs are $11.2 billion in Illinois, $5.3 billion in Indiana, $1.2 billion in Iowa, $5.1 billion in Michigan, and $2.3 billion in Wisconsin.

One source of relatively good news for the District is the states’ capital management practices. A 2001 study by Governing magazine found that District states are making progress in establishing the systems that will help track the condition of their infrastructure and are taking steps to catch up on their maintenance backlog. District state scores ranged from a high of A– in Michigan to a low of B– in Indiana. High marks were not necessarily given to states that had the best infrastructure, but rather to those that were establishing systems for assessing their infrastructure condition and maintaining their infrastructure assets. For example, the study found that general infrastructure conditions in Indiana were pretty good but faulted the state for funding too much infrastructure out of surplus general operating funds rather than any dedicated capital account.

Infrastructure and economic development

Next, Geoffrey Hewings, director of the Regional Economics Applications Laboratory at the University of Illinois, presented evidence of the changing role (and growing importance) of transportation infrastructure in the Midwest economy. Hewings emphasized that various parts of the region have become increasingly interrelated due to fragmentation of production. This changing relationship between producers and suppliers has made transportation infrastructure a critical component in reducing costs and enhancing competitiveness. For example, in the Chicago area the average firm is more dependent on external sources of supplies and external markets than was the case in the 1970s and 1980s. This has left firms more dependent on interregional trade. The efficiency with which this interregional trade is conducted is largely dependent on a well-functioning transportation network. In this context, Hewings stressed that transportation infrastructure should be seen as an input to efficient production in competition with other inputs such as raw materials, labor, and capital.

Hewings cited empirical evidence that transportation infrastructure is a major contributor to economic growth and that regions that provide more of these services dominate growth. In addition, increases in interstate and international trade have changed the Midwest’s relationship with the rest of the world over the last 20 years. He presented a model for describing the changing relationship between producers and suppliers, which is driving the growth in interregional trade.

Hewings emphasized the importance of this trade to the Illinois economy, noting that it dwarfs international trade in the region; Hewings estimates that it is nearly four to five times larger in value. For example, in 1997, Illinois interstate commodity trade was $224 billion compared to $34 billion for international trade. It is this interstate trade that is so highly reliant on regional infrastructure. One interesting effect of this interstate trade is that the industrial structure of the Midwest is converging, with more similar industries growing in most states. Also, like any good trading relationship, gains in one state’s exports have beneficial effects for other states in the region.

Finally, Hewings warned about the effect that bottlenecks in transportation could have on the economic development of the region. For example, if the Chicago railroad transportation system were constrained at its 2005 capacity, Hewings estimates such a bottleneck would cost the region almost $2 billion in lost output and nearly 18,000 jobs by 2020.

Chicago’s railroad freight infrastructure was the topic of the presentation by Karyn Romano, transportation director with the Metropolitan Planning Council. The council was the lead agency in a coalition of groups that produced a 2001 study, “Critical Cargo,” which suggested a regional strategy for enhancing the freight transit system. Romano noted Chicago’s dominant role as a freight hub. The freight system contributes $8 billion to the region’s economy and is responsible for 117,000 jobs. Chicago is the third largest intermodal shipping hub in the world, with over half of total U.S. container traffic passing through the region. Romano reported that freight volumes are expected to rise significantly through 2020; however, the system needs significant improvements to ensure Chicago’s premier position in moving freight.

The current system is burdened by congestion and engineering problems, such as an excessive number of railroad grade crossings. Average train speeds across the region range from 6.8 miles per hour to 12 miles per hour. Average truck speeds are under 15 miles per hour. The region has 1,953 railroad grade crossings and must support 3,500 daily truck trips between rail yards. The system also lacks efficiency in terms of transferring rail freight. Freight transfer often requires the use of trucks rather than a more efficient system that would operate from one train to another train.

Romano noted that the study makes three recommendations for improving the region’s rail infrastructure. First, there is a need to organize public and private support for a package of capital improvements, including establishing a freight corridor, building grade separations, and upgrading intermodal connector routes. The region’s existing freight corridors are at or near capacity and various proposals exist for building an additional fright corridor. Recently, California has used public and private funding to build the Alameda freight corridor to improve its freight congestion.

Second, the report recommends aggressively pursuing federal funding. Strategies for securing federal funds include heightening the awareness of the region’s role as an interstate and global commerce center that contributes to U.S. economic growth and targeting funds from the reauthorization of TEA-21 (the Transportation Equity Act for the 21st Century) in October 2003. Finally, it recommends creating a regional public /private freight entity to help manage the region’s freight system. Options for such an entity could include a fourth Regional Transit Authority service board, a stand-alone regional freight authority, a consolidated port authority, or a regional coordinating council.

Romano concluded by suggesting several regional benefits from an improved freight system, including economic growth, dominance as a freight transportation center, coordinated transportation and development, less rail and road congestion, and lower cost of goods.

How productive are infrastructure investments?

The last panel of the morning discussed the productivity of infrastructure investments. Senior economist John Fernald of the Chicago Fed presented his research on the returns to investments in highways. The correlation between the value of road stock and changes in labor productivity since World War II has interested macroeconomists as a research question. The challenge has been to establish the causality of this relationship. Does public capital increase productivity or does increased productivity encourage new investments in public capital? It is also possible that this is a spurious correlation or reflects a set of common factors affecting both measures.

Fernald summarized the macroeconomic literature as being split in its findings.

Studies have found highway investments to be either enormously productive (Aschauer, Munell, and others) or unproductive or counterproductive. Fernald also outlined the advantages and disadvantages of aggregate econometric studies. On the plus side, aggregate studies help measure whether individual projects provide widespread benefits. In particular, network benefits that may be difficult to capture on the individual project basis may be easier to measure in aggregate studies. On the negative side, aggregate studies have statistical problems disentangling cause and effect and often yield imprecise estimates. Perhaps most importantly for policymakers, aggregate studies don’t tell you much about where to spend the marginal infrastructure dollar.

In his research, Fernald attempts to measure the relationship between roads and productivity by allowing roadbuilding activities to respond to overall economic conditions. He also tries to relate the dependence of individual industries on roads to increases in productivity in their industry. Presumably, industries with lots of vehicles use roads more intensively and should receive a significant benefit from road investment. Finally, his model allows for roads to be subject to congestion. Fernald’s study finds that the rate of return for roads was significantly higher before 1973 (when the interstate highway system was being built) than in the period that followed. He estimates that before 1973 the return to highway infrastructure was about 100% per year. He estimates a rate of return of about 30% per year since 1973, but this estimate is not statistically significant. Fernald suggested that while building a first interstate highway system would be highly productive, building a second system would obviously be more duplicative and less productive. He also finds that vehicle-intensive industries benefited disproportionately from the interstate highway system, but the data did not support the view that roads offer an abnormal return on the margin. Fernald concluded by suggesting that the macroeconomic literature has not made the work of policymakers much easier. They still must answer the question of where infrastructure projects make the most sense and which specific projects at the margin reflect the best investment.

Randy Eberts, executive director of the Upjohn Institute, offered his views on the value of the transportation system to the region’s economy. Eberts noted that transportation systems are the backbone of developed market economies and are essential for getting goods to market and workers to businesses. Transportation systems also facilitate communication and, since World War II, the economy has grown increasingly dependent upon highways for both passenger and freight transportation.

Eberts suggested that the key question in assessing the value of infrastructure is not whether transportation systems are important to the economy but rather whether additional investments in transportation systems contribute to economic growth. Part of the challenge of answering this question is that economic development is a complex process affecting income and product generated within a region. Increases in these factors can in turn lead to gains in jobs, income, quality of life, environmental preservation, and even sustainable development. Transportation infrastructure can support these outcomes by improving access to employment or production and improving connectivity between cities.

Eberts noted that policymakers want answers to a series of questions regarding how highway investments may aid the economy. These questions include:

- Does highway investment improve productivity?

- Does it increase value added (personal income)?

- Does it create new jobs?

- Does it improve environmental quality?

- Does it enhance the quality of life?

- Does it improve low-wage workers’ access to jobs?

Eberts suggested two tools for assessing the contribution of transportation infrastructure to these economic development goals—benefit–cost analysis and macroproduction function estimates. Benefit–cost analysis computes a benefit to cost ratio that allows policymakers the opportunity to rank projects and choose a cutoff point below which projects will not be funded. Macroproduction functions allow the user to estimate the contribution of the investment to output and develop rates of return for various types of investments. Making these assessments requires understanding the complex relationship between infrastructure system facility characteristics (such as lane miles, and grade and pavement conditions), facility outputs (access, traffic flow, speed, and reliability) and outcomes (productivity, income / output generation, job creation, and business location). It also requires understanding and measuring the indirect effects of the investment and accurate measures of the infrastructure capital stock. In particular, the indirect benefits of the investment can be significant, including spillover of benefits into regions outside the vicinity of the project and the ability to attract nontransportation-related economic activity. For example, highways may attract or expand private capital, make other inputs more productive, or affect environmental quality. These types of investments can possibly elevate an economy to a higher stage of development and clearly can produce network benefits.

Reviewing the literature on returns to investment from highways, Eberts noted that recent macroeconomic studies have provided output elasticity estimates ranging from 0.04 to 0.08. Generally speaking, studies suggest that the U.S. is currently not underinvesting in transportation infrastructure. The one-time super returns to highway projects have been replaced by normal returns that are typically less than returns to private capital. Further, studies have suggested that the spillover effects from these investments are minimal. However, Eberts cautioned that individual regions may be over- or underinvesting in transportation depending on the needs of their economy. While highways are clearly necessary to stimulate growth, they cannot do so in the absence of other factors.

Finally, Eberts turned to the question of the decision-making process for transportation investments. He stressed that in the current environment, coalition building is critical to gaining support for infrastructure investments. The maturity of the transportation system increases its impact on other areas of decision-making, such as the environment, noise, traffic flows, and neighborhood safety. Policymakers need to build coalitions that address these issues in order to gain support for new road projects.

Keynote address—Infrastructure and Chicago

Keynote speaker Dave Schulz, director of Northwestern University’s Infrastructure Technology Institute, described the role of infrastructure in the Chicago economy. Schulz suggested that Chicago’s economy, as well as much of the Midwest economy, has been built on big infrastructure. However, the city and the region seem to be losing that advantage and are facing significant infrastructure challenges. Schulz noted that infrastructure is what made Chicago a dominant location in the country. This infrastructure included work on ports and rivers, pollution control, potable water, rail construction, public transportation, airports, and highways. These investments created assets that allowed Chicago to thrive.

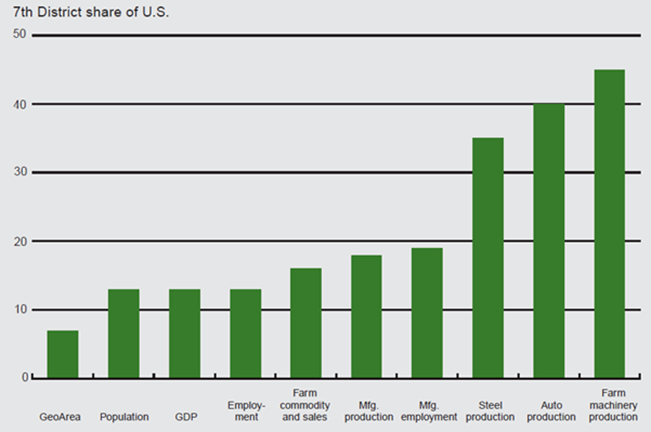

Schulz noted that the profile of the Seventh Federal Reserve District economy shows that the region has a significant share of infrastructure-dependent industries (figure 3). Congestion is limiting the productivity of many of the assets that these industries depend on. For example, regional airport capacity needs to be expanded. Interstates and tollways need greater capacity and rebuilding. New infrastructure is needed to deal with suburban and exurban (development that is neither fully urban nor rural) congestion. In addition, existing mass transit needs rehabilitation and expansion. Other infrastructure needs are improvements to freight systems, renewing older urban infrastructure, ensuring a reliable energy supply, and sorting out telecommunications. Schulz suggested that a particular opportunity for the region would be a high-speed rail network linking midwestern cities. He added that this could help integrate the region’s economy, while maintaining Chicago’s dominance as its hub.

3. Infrastructure-dependent characteristics in the District

In conclusion, Schulz asked, “Why can’t we build big infrastructure anymore?” He suggested that the region suffers from a loss of vision and has come to take its infrastructure for granted. The public has also lost confidence in government to carry out large projects efficiently. He also suggested the growing amount of litigation in our society has allowed veto power for projects to be ceded to a small minority in many cases. In particular, we have been unable to confront land use issues.

To overcome these obstacles and start building infrastructure again, Schulz suggested several strategies. Among these were:

- Educating people about the importance of infrastructure;

- Restoring public confidence in the infrastructure industry;

- Taking measures to mitigate negative impacts from projects;

- Building interdisciplinary project teams (whose disciplines include engineering, finance, environmental, planning, public relations /political science, management, and legal) to design and build infrastructure;

- Investigating sustainable development strategies that require smaller infrastructure investments; and

- Taking advantage of technological innovation in designing and building projects.

Most of all, Schulz emphasized that we need to make big visionary plans that integrate all phases of the infrastructure life cycle from planning and design to construction, to operations and maintenance, to monitoring and evaluation. Schulz concluded his push for reinvigorating Chicago’s infrastructure by quoting Teddy Roosevelt, who said “Make the dirt fly!”

Infrastructure asset management and accounting

The next conference session addressed best practices for infrastructure asset management. Roemer Alfelor from the Office of Asset Management of the Federal Highway Administration described work underway to provide guidance to states on how to best manage their transportation assets. Alfelor provided a definition of asset management as a “strategic approach to optimal allocation of resources for the management, operation, and preservation of transportation infrastructure.” A good asset management system creates a feedback loop that links six key elements, ranging from data collection and inventory through performance monitoring, and developing alternatives to program development, implementation, and monitoring. Asset management is becoming easier as new tools and analytic techniques are available that improve the quality of information necessary for decision support. Some of these tools and techniques include new data collection technologies such as ground penetrating radar, acoustic devices, videolog and photolog systems, global positioning systems, and portable data recorders. Some of the analytic tools available include benefit–cost analysis, resource allocation /trade-off analysis, deterioration modeling, performance evaluation, and life-cycle cost analysis. There are also new information technology tools available.

Alfelor reported that state departments of transportation are beginning to adopt asset management programs, particularly since the public is demanding greater accountability for maintaining the roads. Among the lead states in adopting asset management is Michigan. Alfelor said that the importance of asset management has risen as our highway infrastructure has aged and states have taken on a larger role in highway maintenance. He concluded by noting that it is the role of the Office of Asset Management to provide technical assistance and leadership in encouraging states to use asset management principles.

James Fountain, assistant research director for the Government Accounting Standards Board (GASB), followed with a presentation on the impact of GASB Standard 34 on the reporting of capital assets by state and local governments. GASB 34 focuses on government performance by requiring state and local governments to report the value of capital assets. This makes it easier to know whether capital assets are being properly maintained. Fountain noted that there are several reasons to report capital assets. First, this helps users determine whether the current-year revenues cover the cost of current-year services. Second, it allows an assessment of the service efforts and costs of programs. Third, it allows a better assessment of the deterioration or improvement in a government’s financial position. Finally, it allows an assessment of the service potential of long-lived physical assets.

Fountain outlined other benefits from GASB 34. Since maintenance often has a low priority in many public agencies, the reporting of assets will make it easier to determine if sufficient revenues are available to maintain assets. In addition, the new financial statements will account for all infrastructure assets and highlight their condition. GASB 34 will also help bridge the gap between government financial managers and infrastructure managers by improving the financial reporting system. Most of all, GASB 34 will make it easier to assess the full cost of government services.

GASB has allowed some flexibility in how governments account for their capital assets. Two methods are permitted. A government can base its infrastructure reporting on the historical cost/depreciation of the infrastructure (or if records are inadequate, the estimated historical cost) or it can use the modified approach, which relies on condition assessments of infrastructure at least every three years. Currently, many governments are opting for the modified approach, but Fountain noted that this approach is no less rigorous. It requires that assets must be maintained at or above the level initially set by the governmental entity. Unlike the historical cost method, costs that extend the life of the infrastructure are immediately expensed rather than capitalized and depreciated. In summary, Fountain defined a performance-based asset management system as “a holistic and systematic approach to asset development and preservation that promotes maximum service performance at minimum life-cycle costs.”

Fountain also discussed two other projects underway at GASB. The first is the Service Efforts and Accomplishments Reporting system, which is designed to improve performance measurement for government. The second project deals with citizen input on what types of government reporting are most useful.

Fountain said that citizens want short and concise information that links spending to performance. They also want input in selecting the performance measure to be used.

Regional governance for infrastructure

Cameron Gordon, executive director of the Advisory Council on Intergovernmental Relations, next turned to the topic of optimal regional governance for making infrastructure investments. Gordon noted that understanding the value of infrastructure is a tricky process. Often the benefits go beyond the obvious physical value of the structure to indirect benefits such as changes in organization and management. For example, when the railroads were built, organizational and management changes introduced time zones and standardized schedules that were benefits above and beyond the rails themselves.

Gordon said that four organizational factors should be kept in mind when managing regional infrastructure. These are scale (size of operations), scope (range of activities), structure (internal patterns of authority and communication), and strategy (long-range objectives). The goal is to combine these four factors to produce infrastructure synergies that decrease unit costs for scale, scope, and structure.

Gordon noted that it was important for regional public infrastructure to combine the goals of good governance with good management. In this context, he defined governance as the exercise of public power on behalf of the public good. Management is the direct enterprise for achieving specific objectives.

Next, Gordon discussed the complexity of defining appropriate infrastructure regions in the context of the American federalist system. These can include:

- Economic regions—who produces, consumes, and distributes what;

- Fiscal regions—who pays and benefits; and

- Administrative regions—who governs.

In an optimal configuration, regional infrastructure governance would find the overlapping territory between these three regions and effectively govern the infrastructure in this newly defined region.

Without formal guidelines, regional infrastructure arrangements have ranged from coalitions, to compacts, to multistate commissions, to regional authorities. Examples have included the Appalachian Regional Commission and the Midwest Regional Rail Initiative. The success of regional infrastructure governing structures is hard to assess, but systems can be designed to create measures for establishing new regional government systems.

Finally, Gordon provided a checklist for planning regional infrastructure systems. The checklist requires analyzing a project’s dimensions by characteristics such as service area, infrastructure service provided, physical assets, jurisdictions involved, and management and fiscal capacity. Each of these characteristics needs to be assessed against the criteria of scale, scope, structure, and strategic objectives to properly assess its contribution to the region. With a rising need for regional infrastructure, establishing effective governance structures will be critical to planning, building, and managing regional projects.

Conclusion

The presentations at the conference clearly demonstrated that it is critical for policymakers to understand the economic value of infrastructure. This goes beyond accounting for the condition of infrastructure to an understanding of the specific value of individual infrastructure projects to economic growth. For policymakers to make informed choices about scarce resources, more work needs to be done to assess the margin value of specific infrastructure projects.