Chicago companies…..a changing town?

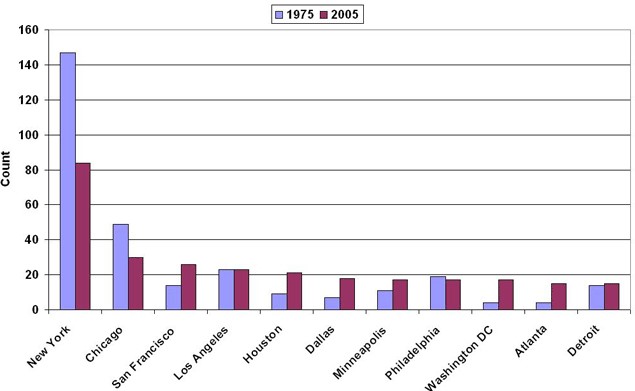

Lately, the Chicago business press has lamented the region’s loss of large company headquarters—for example, those of Amoco, Arthur Andersen, Borg-Warner, Quaker, Searle, and Zenith. The chart below numerically depicts the source of this local concern: The Chicago area is down 19 headquarters over the period from 1975 to 2005 as measured by Fortune magazine’s list of the largest nonfinancial companies. Has Chicago lost its vitality for building large companies and hosting their headquarters?

Figure 1. Fortune 500 companies count: 1975 and 2005

Taking a broader perspective, it appears that Chicago has held its own as a domicile for corporate headquarters. It consistently ranks second place among large metropolitan areas that host headquarters; only New York exceeds it. Looking farther afield, one can see that headquarters offices of the largest companies have spread out to other metropolises that have come into their own as business centers. A recent conference examined shifts in headquarters site decisions and motivation. Cities such as Houston, Atlanta, and San Francisco have developed a large scope of business support services, such as legal, accounting, and management consulting, that attract headquarters. All have large hub airports which are desirable in sending out and bringing in headquarters execs and their business associates.

In some ways, then, Chicago’s relative loss of headquarters reflects the filling in and development of the remainder of the U.S. rather than Chicago’s decline. To put it another way, why would we expect Chicago and New York to maintain the lion’s share of headquarters while the remainder of the U.S. economy grew more rapidly?

A different look reveals that Chicago’s headquarters companies have grown at a healthy rate—one that reflects a mature but healthy business service center. The following tables list the Chicago region’s top 50 companies from 1979 to 2005, again measured by Fortune magazine’s accounting of total company revenues. The companies’ revenues are quoted in comparable dollars, equivalent to spending power for gross domestic product (GDP) in 2005.

Table 1. Chicago region’s top 50 companies, 1975 and 2005

In examining individual companies among these rankings, we can see that, on average, the annual revenues of the top 50 companies in 2005 exceed those of the equivalently ranked companies in1979. In fact, the sum of the top 25 companies’ revenues in 2005 exceeded that of their counterparts’ in 1979 by 89 percent. For the top 50 companies, the revenue total of 2005 companies exceeded that of 1979 companies by 78 percent. Over this time period, the overall U.S. economy grew by 115 percent. Accordingly, in the context of the faster regional growth taking place in the Sun Belt and the West since 1979, Chicago has enjoyed healthy, though modestly lagging, success as the domicile of many of America’s largest and fast-growing companies.

In explaining Chicago’s continued role as a headquarters city, we can see that many large companies have survived and prospered from the 1979 list. These companies include Brunswick, Caterpillar, Deere, Kraft, Sears, United Airlines (UAL), and USG (United States Gypsum). Still others—such as Walgreen’s, Abbott, McDonalds, Archer Daniels Midland, and Illinois Tool Works—have survived and even experienced outsized growth. Walgreen’s revenues are up over 13 times since 1979. Illinois Tool Works Inc. ranked 17th in 2005, with $11.7 billion in revenue, although the company had not made the top 50 list of 1979.

Other companies have chosen Chicago as their headquarters’ domicile from outright relocations, during mergers, or through spinoffs. Boeing is the most notable relocation, choosing Chicago in 2000 over competitors Dallas and Denver. OfficeMax Inc. is another relocation to Chicago (from Boise, Idaho). Smurfit-Stone chose Chicago during its merger, and medical equipment maker Hospira Inc. was a recent spinoff of Abbott.

Other promising companies with headquarters in the Chicago region, such as Hewitt Inc., a human resource management company, have grown up here and have since emerged as public companies. Equity Office Properties Trust is another home-grown company with headquarters in the area, as is CDW, a computing equipment leasing company.

A comparison of the top 50 lists also reflects the shifting industry orientation of the Midwest away from manufacturing to services. In 1979, 33 of the top 50 companies could be classified as manufacturing versus 26 in 2005.

The Chicago region correctly stands up and takes notice at the loss of a large company headquarters. Hosting companies’ headquarters is an important specialization of Chicago’s economy. Over the long term, Chicago’s headquarters’ performance is a cause for interested concern though perhaps not for alarm.