Summary

Farmland values for the Seventh Federal Reserve District rose 9 percent in the second quarter of 2023 from a year earlier. This year-over-year gain was the smallest one since the first quarter of 2021. Values for “good” agricultural land were up 3 percent in the second quarter of 2023 from the first quarter, according to survey responses from 153 District agricultural bankers. Nine percent of survey respondents forecasted higher District farmland values during the third quarter of 2023, while 5 percent forecasted lower values; the remaining 86 percent forecasted farmland values to be stable during the July through September period of this year.

Overall agricultural credit conditions for the District were better in the second quarter of 2023 than a year ago, even though farm interest rates were higher. Average nominal interest rates on farm operating, feeder cattle, and farm real estate loans moved up during the second quarter of 2023, ending at their respective highest points since the third quarter of 2007. With repayment rates for non-real-estate farm loans higher than a year ago, the portion of the District’s agricultural loan portfolio reported as having “major” or “severe” repayment problems (1.3 percent) was at its lowest level on record for a second quarter. Also, renewals and extensions of non-real-estate farm loans in the District were down from a year earlier. For the April through June period of 2023, the demand for non-real-estate farm loans was lower than a year ago, as was the level of funds available for lending by agricultural banks. For the second quarter of 2023, the District’s average loan-to-deposit ratio rose to 72.8 percent—the highest reading since the fourth quarter of 2020.

Farmland values

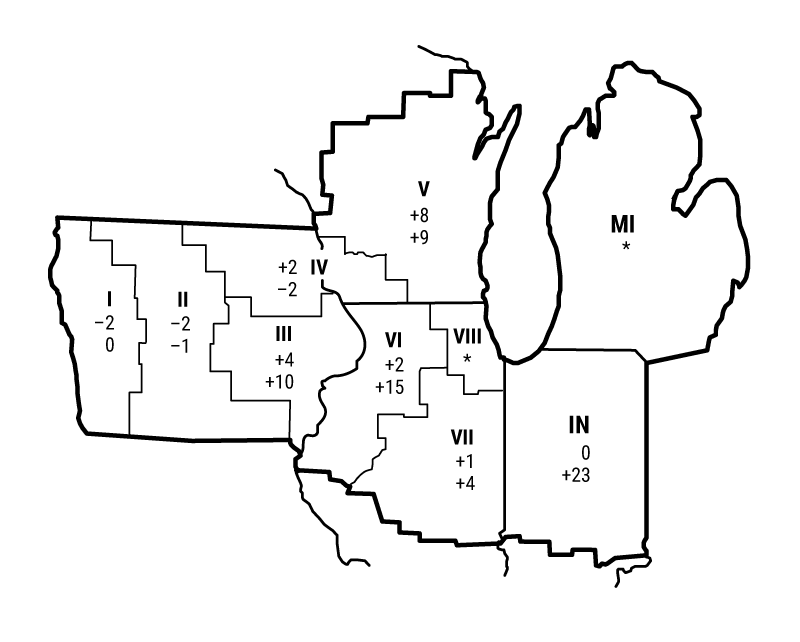

At 9 percent, the year-over-year increase in District farmland values for the second quarter of 2023 was nearly as large as that for the first quarter. However, the second quarter marked the first time that the year-over-year percent gain in District farmland values had dipped into single digits since the first quarter of 2021. Once again, Indiana exhibited the largest year-over-year increase in agricultural land values (see map and table below); Illinois, Iowa, and Wisconsin exhibited more modest year-over-year gains than Indiana, having tailed off from their stronger gains of previous recent quarters. “Good” farmland values in the District increased 3 percent in the second quarter of 2023 relative to the first quarter. One Iowa banker noted: “Low-quality land values are stronger than a year ago due to nonfarm investors. Medium-quality values are showing some weakness recently. High-quality land values are still strong.”

Percent change in dollar value of “good” farmland

|

April 1, 2023 to July 1, 2023 |

July 1, 2022 to July 1, 2023 |

|

|---|---|---|

| Illinois | +2 | +9 |

| Indiana | 0 | +23 |

| Iowa | +1 | +2 |

| Michigan | * | * |

| Wisconsin | +6 | +8 |

| Seventh District | +3 | +9 |

Top: April 1, 2023 to July 1, 2023

Bottom: July 1, 2022 to July 1, 2023

Higher farmland values seemed to reflect the strong financial conditions of the past couple of years, rather than the relatively weaker current situation. Agricultural prices were lower in June 2023 than in June 2022, yet they were still generally higher than in June 2021. The U.S. Department of Agriculture’s (USDA) June index of prices received by farmers was down 5 percent from a year ago, but up 19 percent from two years ago (see final table). Of particular relevance to the District were the June corn, soybean, hog, and milk prices, which were down 12 percent, 13 percent, 17 percent, and 33 percent from a year ago, respectively.

Corn and soybean prices were lower than a year ago, even though an expanded drought threatened much of the nation’s primary growing region for these crops and uncertainties surrounded Ukraine’s grain exports. These factors, which could lower supplies (and push up prices), were offset by the large output of corn and soybeans in South America, along with a still sizable harvest anticipated for the Midwest despite the drought. The USDA estimated in July that 2023’s harvest of corn for grain would be a record 15.3 billion bushels (up 12 percent from 2022) and that this year’s harvest of soybeans would be 4.3 billion bushels (up 1 percent from 2022). (Notably, these July estimates were expected to be revised down somewhat when long-term trends for crop yields are updated with new data.) The USDA forecasted prices for the 2023–24 crop year of $4.80 per bushel for corn and $12.40 per bushel for soybeans. When calculated with these prices, the projected revenues from the 2023 U.S. harvests relative to revenues from the previous year’s harvests would be down 19 percent for corn and 12 percent for soybeans. Thus, expected corn and soybean revenues in 2023 should fall well short of their levels in 2022.

In addition, prices paid by farmers remained elevated following the large increases in their costs in 2022. In June 2023, overall costs for commodities and services, interest, taxes, and wage rates were up 1 percent relative to last June, based on USDA data. Notwithstanding fairly flat costs, net farm income was expected to fall because of a major loss of farm revenues in 2023. Yet an Illinois banker observed that “real estate sales remain very strong,” even with concerns about the size of the 2023 crop and rising interest rates.

Credit conditions

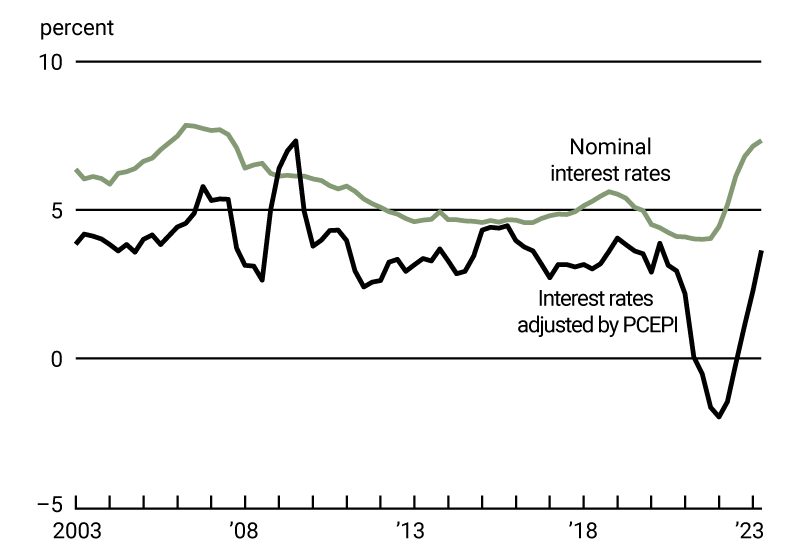

On the whole, agricultural credit conditions in the second quarter of 2023 improved from a year ago yet again, although interest rates on farm loans continued to move up. As of July 1, 2023, the District’s average nominal interest rates on new operating loans (8.24 percent), feeder cattle loans (8.19 percent), and farm real estate loans (7.33 percent) were at their highest levels since the third quarter of 2007. In real terms (after being adjusted for inflation with the Personal Consumption Expenditures Price Index), these agricultural interest rates increased rapidly during the second quarter of 2023, as inflation decreased. The average real interest rate for farm real estate loans continued to rise more sharply in the second quarter of 2023 than the average nominal interest rate—in line with the pattern that began in the third quarter of 2022 (see chart 1); the average real interest rates on farm operating and feeder cattle loans followed similar patterns. Even though the average nominal farm real estate loan rate has been well above its pre-Covid levels for over a year, the inflation-adjusted rate just surpassed its level from the start of 2020 during the third quarter of 2023.

1. Quarterly average interest rates on Seventh District farm real estate loans

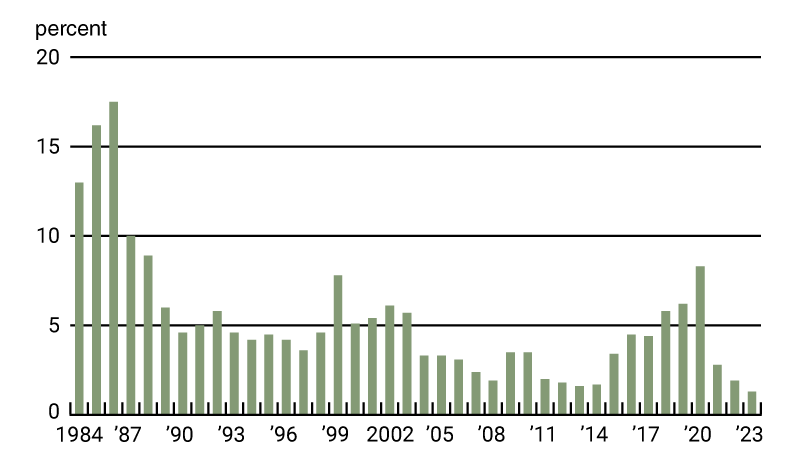

Repayment rates for non-real-estate farm loans continued to improve, but just barely: The index of loan repayment rates was 105 for the second quarter of 2023, with 12 percent of responding bankers noting higher rates of loan repayment than a year ago and 7 percent noting lower rates. The current streak of 11 quarters with year-over-year improvements in loan repayment rates was the second longest in the index’s history. The share of farm loans with “major” or “severe” repayment problems in the District’s agricultural loan portfolio (as measured in the second quarter of every year) was 1.3 percent—which represented the lowest such reading ever (see chart 2). In addition, renewals and extensions of non-real-estate farm loans during the April through June period of 2023 were lower than during the same period of a year earlier, as 5 percent of survey respondents reported more of them and 9 percent reported fewer.

2. Percentage of Seventh District farm loan portfolio with “major” or “severe” repayment problems

In the second quarter of 2023, demand for non-real-estate farm loans was down from a year ago for the 12th quarter in a row. With 19 percent of survey respondents observing demand for non-real-estate farm loans above the level of a year ago and 42 percent observing demand below that of a year ago, the index of loan demand was 77 for the second quarter of 2023. Over the first half of 2023, District banks originated fewer farm operating and real estate loans than normal (likewise for life insurance companies), according to responding bankers. In contrast, over the first six months of 2023, merchants, dealers, and other input suppliers reportedly lent more funds to the agricultural sector than normal (lending by the Farm Credit System was about normal). With 12 percent of survey respondents noting their banks had more funds available to lend than a year ago and 29 percent noting they had less, the index of funds availability fell to 83 for the second quarter of 2023 (the lowest reading since the third quarter of 2018). This index reading could reflect lower levels of deposits at District banks in the past year, as reported by 48 percent of the responding bankers (31 percent reported higher levels of deposits). As lower deposits seemed to have greater weight than softer lending, the District’s average loan-to-deposit ratio for the second quarter of 2023 was up to 72.8 percent (7 percentage points below the average level desired by the responding bankers). Also, the amount of collateral required by banks across the District was slightly higher than a year ago.

Credit conditions at Seventh District agricultural banks

| Interest rates on farm loans | |||||||

| Loan demand | Funds availability | Loan repayment rates | Average loan-to-deposit ratio | Operating loansa | Feeder cattlea | Real estatea | |

|---|---|---|---|---|---|---|---|

| (index)b | (index)b | (index)b | (percent) | (percent) | (percent) | (percent) | |

| 2022 | |||||||

| Jan–Mar | 83 | 148 | 159 | 65.0 | 4.64 | 4.74 | 4.44 |

| Apr–June | 82 | 129 | 133 | 67.0 | 5.42 | 5.53 | 5.17 |

| July–Sept | 91 | 96 | 121 | 68.2 | 6.52 | 6.58 | 6.13 |

| Oct–Dec | 82 | 102 | 131 | 70.6 | 7.50 | 7.54 | 6.80 |

| 2023 | |||||||

| Jan–Mar | 78 | 102 | 123 | 70.3 | 7.97 | 7.93 | 7.14 |

| Apr–June | 77 | 83 | 105 | 72.8 | 8.24 | 8.19 | 7.33 |

b Bankers responded to each item by indicating whether conditions in the current quarter were higher or lower than (or the same as) in the year-earlier quarter. The index numbers are computed by subtracting the percentage of bankers who responded “lower” from the percentage who responded “higher” and adding 100.

Note: Historical data on Seventh District agricultural credit conditions are available online.

Looking forward

A majority of survey respondents were of the view that District farmland was overvalued (only a single respondent was of the view that it was undervalued). Looking ahead to the third quarter of 2023, just 9 percent of survey respondents anticipated farmland values to rise, 86 percent anticipated them to be stable, and 5 percent anticipated them to fall. According to one Michigan banker, “given the increase in interest rates and the lower commodity markets, coupled with lackluster export sales, I would expect land values to weaken.” Survey respondents expected lower volumes of farm loans in the third quarter of 2023 compared with year-earlier levels, except for operating loans. Farm operations could be increasingly in need of greater liquidity from operating loans on account of expectations of lower 2023 net farm income. As one Iowa banker put it, the “general outlook has become more guarded.”

Selected agricultural economic indicators

| Percent change from | |||||

|---|---|---|---|---|---|

| Latest period | Value | Prior period | Year ago | Two years ago | |

| Prices received by farmers (index, 2011=100) | June | 128 | 0.4 | –5 | 19 |

| Crops (index, 2011=100) | June | 121 | 0.2 | –4 | 12 |

| Corn ($ per bu.) | June | 6.49 | –0.8 | –12 | 8 |

| Hay ($ per ton) | June | 234.00 | –5.3 | 10 | 25 |

| Soybeans ($ per bu.) | June | 14.20 | –1.4 | –13 | –2 |

| Wheat ($ per bu.) | June | 7.67 | –5.0 | –20 | 23 |

| Livestock and products (index, 2011=100) | June | 135 | 1.0 | –7 | 26 |

| Barrows & gilts ($ per cwt.) | June | 66.80 | 10.0 | –17 | –21 |

| Steers & heifers ($ per cwt.) | June | 184.00 | 4.0 | 30 | 50 |

| Milk ($ per cwt.) | June | 17.90 | –7.3 | –33 | –2 |

| Eggs ($ per doz.) | June | 1.28 | 18.5 | –37 | 58 |

| Consumer prices (index, 1982–84=100) | June | 305 | 0.3 | 3 | 12 |

| Food | June | 323 | 0.1 | 6 | 17 |

| Production or stocks | |||||

| Corn stocks (mil. bu.) | June 1 | 4,106 | N.A. | –6 | 0 |

| Soybean stocks (mil. bu.) | June 1 | 796 | N.A. | –18 | 4 |

| Wheat stocks (mil. bu.) | June 1 | 580 | N.A. | –17 | –31 |

| Beef production (bil. lb.) | June | 2.33 | 1.3 | –5 | –3 |

| Pork production (bil. lb.) | June | 2.20 | –3.0 | –2 | –2 |

| Milk production (bil. lb.) | June | 18.9 | –4.9 | 0 | 0 |

| Agricultural exports ($ mil.) | May | 13,933 | –3.1 | –18 | –5 |

| Corn (mil. bu.) | May | 240 | 20.4 | –15 | –28 |

| Soybeans (mil. bu.) | May | 36 | –61.4 | –59 | –22 |

| Wheat (mil. bu.) | May | 52 | –5.9 | 4 | –41 |

| Farm machinery (units) | |||||

| Tractors, 40 HP or more | June | 9,200 | 12 | 4 | –1 |

| 40 to 100 HP | June | 6,411 | 11 | –3 | –12 |

| 100 HP or more | June | 2,789 | 14 | 25 | 34 |

| Combines | June | 673 | 38 | 10 | 34 |

Sources: Author’s calculations based on data from the U.S. Department of Agriculture, U.S. Bureau of Labor Statistics, and the Association of Equipment Manufacturers.

AGLETTER PRINT EDITION ENDING

AgLetter No. 2001 is the final release with a print edition. Subscribe to receive email notifications for new releases of the digital edition.

SAVE THE DATE

On November 28, 2023, the Federal Reserve Bank of Chicago will hold a hybrid event to explore aspects of Midwest farmland ownership and investments. Registration is available online.