Chicago’s Exchanges Look to the Future

Last week, the Chicago Board of Trade (CBOT) became a publicly traded company. On the first day after offering its stock, its share price ended the day above $80, well above forecasts of a $45-50 value per share.

The CBOT development was one of many suggesting that the prospects of Chicago area’s futures exchanges have improved in recent years. But to what extent is the turnaround sustainable, and will this growth and success continue for one of Chicago’s hallmark industries?

Chicago’s importance as a financial center is defined by its exchanges and associated dealers and brokers. The Chicago exchanges can claim close to two-thirds of the volume of exchange-traded contracts in the U.S. A major assessment of the exchanges’ importance to the Chicago economy has not been conducted since 1997. (See Civic Committee of The Commercial Club of Chicago‘s Report by the Risk Management Center, “Study of Financial Markets & Financial Services in Chicago,” 1997.) That study reported that 150,000 Chicago-area jobs could be attributed to the exchanges, and $35 billion in funds were on deposit at local banks to support Chicago’s exchange products. Many other linkages to Chicago’s economy, such as the needs of large local companies to balance their financial risks and risk exchanges’ ties with other financial and legal services firms and universities, were articulated in that report.

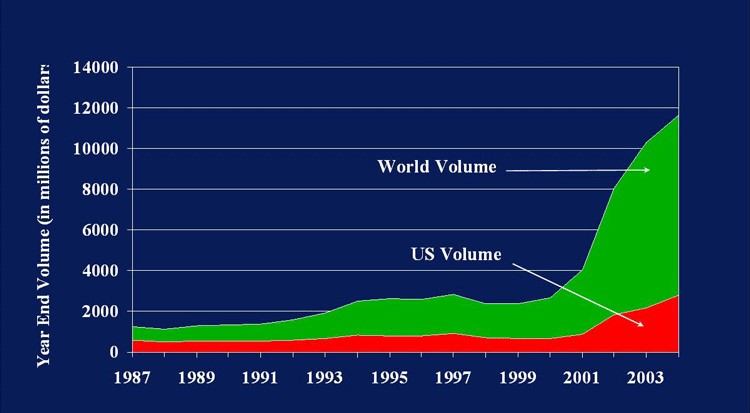

Chicago’s exchanges had long dominated global trading activity in futures and derivatives. But throughout the 1990s, the Chicago exchange community lost global market share. The figure below shows the growth in volumes of futures and options contracts traded on exchanges from 1987 to 2004. Trading volume at U.S. exchanges languished in the mid-1990s, even while growing rapidly throughout the rest of the world.

1. Annual futures and options volumes (net of options on individual equities) 1987-2004

In the 1990s, competing exchanges in Europe and Asia made strong gains in market share. Electronic or computerized exchange facilitated overseas market locations partly by offering trading activity during hours when Chicago floor trading was not active. Ultimately, electronic trading also offered cost advantages for some existing products, while preserving important liquidity, clearing, and price-discovery properties as well. Overseas competitors adapted to and innovated electronic or computer-generated trading more successfully, and therefore captured markets that the Chicago exchanges might otherwise have claimed.

The Chicago exchanges also innovated and implemented systems of electronic trading, but their strong prior commitment to the open outcry or pit trading method of trading and price discovery perhaps impeded their success. So too, globalization of capital markets enhanced the demand for futures products overseas, along with a desire to trade around the clock. And so, electronic trading and the competitors who used it effectively were more successful in capturing growth in global demand.

But in recent years, Chicago’s two major exchanges, the Chicago Mercantile Exchange (CME) and the CBOT (CBOT), have rebounded strongly. Not only are contract volumes up markedly, but both exchanges have gained market share on their global competitors over the past two years. The CME reorganized from a mutual or member ownership structure to incorporation and public ownership, with an IPO in late 2002. Since that time, product and market expansion, enhanced services, and cost savings and price reductions on trades have boosted the CME’s market shares and sales. As of mid-October, the CME share price had increased ninefold since its IPO.

How did the Chicago exchanges turn it all around and what are their prospects? The answers are central to the future of the Chicago area’s economy. On October, 13, 2005, I participated on a panel convened by Bob DeYoung of the Chicago Fed at the Financial Management Association meetings. At the session, I noted that the exchanges’ success in recent years seems to parallel an unprecedented explosion of exchange-traded contracts worldwide. For example (as shown in the chart above), the volume of contracts expanded five times from 1999 to 2004. Much of this growth can be attributed to the continued deepening of capital markets and expanded funds flows as markets and firms continue to extend their global reach, along with heightened global uncertainty and economic upheaval. Have Chicago’s exchanges merely been riding the crest of the rising market, which would ultimately make it vulnerable to a worldwide slowing of exchange-traded contract growth?

The fact that Chicago’s exchange community has been gaining market share in recent years somewhat belies that interpretation. Furthermore, Kim Taylor, managing director & president, MERC Clearing House, showed that the CBOT’s market share among the four major global exchanges had risen from 19% in the second quarter of 2005 to 22% in the same quarter of 2006; the CME’s share rose from 27% to 33%. Taylor offered an alternative interpretation of the global growth of exchange-traded contracts. She argued that, far from riding the wave, the Chicago exchanges were partly responsible for the expanded demand for exchange-traded contracts worldwide through their own product and training innovations—especially at the CME. These efforts include expanded overseas trading capabilities in Europe and Asia, the consolidation of clearing operations for both of Chicago’s largest exchanges in 2003, enhanced electronic trading platforms, and new products. Bryan Durken, executive vice president and COO, CBOT, further explained that the CBOT’s success was hard won by “listening closely to the needs of their customers and acting quickly and creatively.”

But what was the source of the recent inspirations? Chicago’s exchanges had suffered through some rough periods when their traditional “membership” mode of organization, coupled with deep-seated cross-town rivalry, seemed to impede their transition toward computerized trading and other innovations. Chicago’s dominance was challenged to such an extent that Eurex US, an arm of a major European exchange, won approval to operate in Chicago in an attempt to topple CBOT’s market dominance of U.S. Treasury futures contracts. This attempt ultimately failed. And both the CME and the CBOT are now publicly traded companies, with the third major Chicago exchange, the Chicago Board Options Exchange, also moving toward de-mutualization.

In talking about Chicago’s recent success and its prospects, I also offered the idea of an “economic cluster” at the session. Economists such as Gerald Carlino describe the spatial concentration of some industries as being highly productive and often a formidable barrier to competition from market challengers. In this instance, over the course of its long and successful life, Chicago’s risk exchange community developed local assets like a deep pool of talent and supportive service firms, including local banks that understand their businesses, legal/consulting firms with specialized knowledge to service them, and local universities that produce new workers and new product ideas from finance professors. Might such a clustering of firms and assets have carried Chicago’s exchanges through a period when they were otherwise hobbled by their own outdated organizational structures?

Mike Cahill, CEO of The Options Clearing Corporation, noted that the specialized workers and other local personnel have been critical in maintaining Chicago’s exchanges. In particular, in areas such as contract product innovation, there is no question that Chicago’s historical role continues to provide the exchanges with striking advantages. However, Cahill also explained that Chicago’s strength and local assets have been weakened by technological changes that have lessened the need for “back office” activities to be located near the trading floor. Such operations have begun to move closer to far-away customers or where processing costs are cheaper. And as data manipulation and trading systems become more technical in nature, clearing operations and back office support are drawn to the technical workforce and technology firms of other regions.

Bob DeYoung asked whether the exchanges’ access to credit had been diminished with the loss of several major banks from Chicago. All of the industry panelists agreed that the loss of some major banks in Chicago had weakened the “cluster” of mutually dependent relationships among the exchanges, brokers, dealers, and banking community. It is not the case that the existing Chicago area lenders are not savvy and responsive partners. However, the choice spectrum of lenders is somewhat diminished, and with it some of the former willingness to fund and finance the small start-up companies.

The risk exchanges are a bright spot for Chicago and the Midwest even as many of its other industries are not sharing this luster. Local public policy is not a dominant force in determining the success of a local cluster such as this. Yet, it seems to me that it is worthwhile for us to understand our local industry clusters so that we continue to support—as appropriate—their supporting industries, their work force requirements, and their public service needs.