The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Increased concern for the environment has introduced a new dimension into the risks faced by lenders. Previously, the risks were primarily default and interest rate risks. Although environmental groups claim that banks are exaggerating their potential exposure, environmental policies and recent court cases are making it increasingly necessary for the lender to also evaluate the risks in a loan arising from the borrower’s responsibilities for compliance with environmental laws and regulations.

This Chicago Fed Letter examines the nature of the risk exposure for financial institutions as a result of environmental laws and regulations. And, given the long history of industrial activity within Seventh District states—Illinois, Indiana, Iowa, Michigan, and Wisconsin—it addresses the question of whether potential environmental lending risks are greater in the District than in the U.S. on average.

Environmental legislation

Just over 20 years ago, on January 1, 1970, President Nixon signed into law the National Environmental Policy Act of 1969, which established the encouragement of environmental protection and the preservation of our natural resources as a national policy. The Act provided for an Environmental Protection Agency (EPA), the President’s Council on Environmental Quality, and an environmental impact review program. With the founding of the EPA in December 1970, the environmental movement entered a new phase.

Other major environmental legislation followed, culminating in the Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), also known as the Superfund Act, in 1980. The law was subsequently amended by the Superfund Amendments and Reauthorization Act of 1986 (SARA).1

The passage of CERCLA ended the disinterested party status of financial institutions. The intent of CERCLA was to assign the cost of cleanup of contaminated sites to the responsible parties. In addition to the parties responsible for placing the contamination in the ground, the Act assigns responsibility to successors in the chain of title, for example, the present property owner. The third parties responsible for the cleanup costs are those “associated” with the title to the contaminated property, e.g., as a mortgagee. It is in this third grouping that financial institutions have found themselves at risk.

Persons may be exempt from liability if they can establish that the contaminated property was acquired after the placement of the hazardous substance at the facility and if they are able to claim the “innocent landowner’s” defense. To do so, defendants must establish that they exercised “environmental due diligence”; i.e., at the time the facility was acquired, they did not know and had no reason to know that any hazardous substance was disposed of at the facility.

CERCLA also includes an exemption for a person who, without participating in management, holds indicia of ownership primarily to protect a security interest. Interpretation of this security interest exemption has generated uncertainty within the financial and lending communities about whether activities such as monitoring facility operations, requiring compliance activities, refinancing or undertaking loan workouts, providing financial advice, and similar actions that may affect the financial, managerial, and operational aspects of a business count as “participating in the management of a facility.” There is also concern regarding the effect of foreclosure on the security interest exemption of the lender.

Recent major court cases

Court cases have gradually been defining the responsibilities and liabilities of lenders under environmental law. In U.S. v. Mirabile,2 a bank held title to a property for four months after foreclosure, when it was sold at a sheriff’s sale. In this case the court ruled that facility monitoring and financial involvement and advice were permissible under the security interest exemption and held that the bank was exempt from cleanup liability under the security interest exemption because the foreclosure was a natural consequence of protecting a security interest. In the U.S. v. Maryland Bank & Trust Company,3 Maryland Bank also foreclosed on a property but did not resell it until four years later. The court held in this case that the extended period of time showed that the bank maintained title to protect its investment, not its security interest. As a result, Maryland Bank had to pay more than $500,000 in cleanup and court costs and was unable to recover its costs and original investment on resale.

Two recent cases introduce new uncertainty concerning the extent of involvement with a facility allowed under the security interest exemption. In U.S. v. Fleet Factors Corp.,4 Fleet Factors, a commercial factoring firm, foreclosed on its security interest in inventory and equipment, and arranged for its sale and removal. The Eleventh Circuit Court of Appeals held that a secured creditor may be liable if it participated in the financial management of a facility to a degree indicating a capacity to influence the corporation’s treatment of hazardous wastes. The court reasoned that the decision would encourage lenders to investigate the potential borrower’s environmental practices and to factor the discovered risks of CERCLA liability into the terms of the loan agreement.

According to a decision by the Ninth Circuit Court of Appeals, In re Bergsoe Metal Corp.,5 however, the mere capacity or unexercised right to control facility operations is insufficient to void the security exemption. The Court stated that “there must be some actual management of the facility before a secured creditor will fall outside the exception.”

New risks in lending

Prior to the passage of the environmental legislation during the last two decades, in particular, CERCLA, a financial institution’s risk associated with lending was generally considered to consist of default risk and market or interest rate risk.

Compliance with environmental legislation in general represents an addition to default risk to the lender because of the requirements imposed on the borrower. In reviewing the default risk, the lender must also now consider the borrower’s current and potential costs of compliance with environmental laws and regulations. Thus, the lender must be assured that the borrower has exercised “environmental due diligence” and is protected by the “innocent landowner defense” in the acquisition of property which may or may not be used as collateral for the loan. The lender must also be reasonably certain that the borrower is aware of any environmental laws and regulations that might be expected to affect business operations.

The new dimension to the risks faced by a lender is that a financial institution may become liable for the costs of cleanup of contaminated property owned by a borrower and therefore may incur environmental cleanup costs that exceed the total amount of the loan. In addition, it may prove difficult to sell the property because of contamination.

Financial institutions may well be reluctant to assume the additional risk associated with lending to businesses where contamination may be present or may occur. As a result, the reduction in the availability of credit may hinder the success of these businesses and their ability to contribute to the cleanup of the environment.

Proposed clarifications of lender liability

In response to the uncertainty surrounding lender liability and its possible effects on the availability of credit, the EPA recently proposed for comment a rule to interpret the “security interest exemption” to CERCLA liability of both privately owned financial institutions and governmental loan guarantors or lending entities.6 It describes a range of permissible activities that may be undertaken by a private or governmental lending institution in the course of protecting its security interest in a facility, without being considered to be participating in the facility’s management and thereby voiding the exemption. To clarify the Fleet Factors decision, it states that participation in management means actual participation, not just the ability or capacity to participate. The proposed regulations also provide a safe harbor allowing the lender either to foreclose on the property or to take a deed in lieu of foreclosure. No time limit is specified for the sale of the property, but the lender is required within 12 months of foreclosure to list the property with a broker and to advertise the property for sale, at least monthly. Finally, the proposed rule encourages, but does not require, the customary or common practice for holders of security interests to undertake or require environmental inspections to minimize the risk that their loans will be secured by contaminated property. Such inspections are considered to be consistent with the security interest exemption; i.e., they do not count as participating in the management of the facility.

Bills were introduced in March 1991 in both the House and the Senate that were designed to clarify lenders’ liability under current environmental laws. The House bill incorporates for the most part the provisions of the rule proposed by the EPA. The Senate bill amends the Federal Deposit Insurance Act to cap the liability of insured depository institutions and other mortgage lenders under federal statutes that impose strict liability for the release of hazardous materials, provided that the institution or company involved did not cause or contribute to the contamination. If a cleanup is conducted, the liability of the institution is limited to the actual benefit it receives, up to the fair market value of the property. The bill also states that management participation must be actual. It is too early to tell whether either of these bills will be passed.

The EPA proposal has received a mixed review. Bankers and others in the lending community have indicated that they still want the level of certainty that only congressional legislation would bring. Lenders fear that courts will not use an EPA rule to block private lawsuits brought by other interested parties against lenders. Environmental groups, on the other hand, claim that the banking industry’s contention that it is facing enormous potential liability from hazardous waste sites is exaggerated. Environmentalists oppose new legislation and assert that the threat of lenders’ liability encourages lenders to investigate whether a company has a toxic-waste problem before agreeing to lend to it. According to environmental groups, this is beneficial because it makes companies more vigilant about obeying environmental laws.

Contaminated sites in the Seventh District

Some indication of the exposure to environmental risks in the Seventh District is provided in CERCLIS, the CERCLA Information System. CERCLIS is the EPA’s comprehensive database and management system containing the official inventory of CERCLA sites. Sites that the EPA believes pose environmental threats significant enough to warrant detailed evaluation for possible remedial action under Superfund are placed on the National Priorities List (NPL). About 4% of the CERCLIS sites evaluated are placed on the NPL.

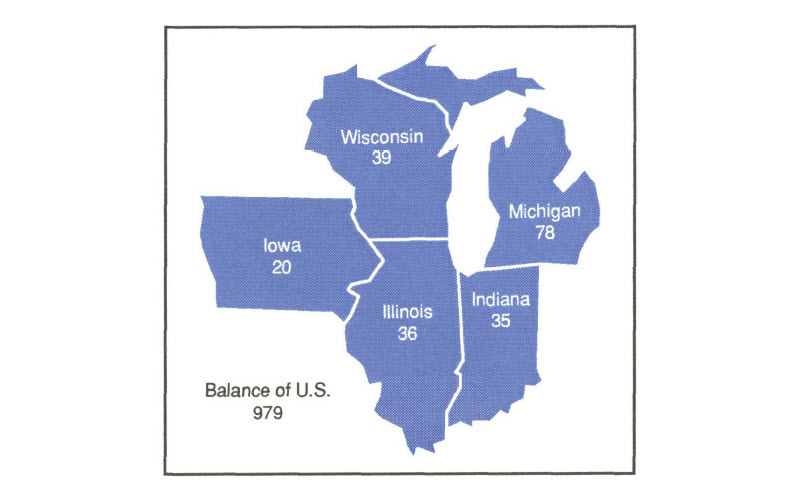

Currently about 5,200 sites in Seventh District states are listed on CERCLIS. Of this number, 53% are designated as requiring no further action. Of the 2,473 remaining, 208 are on the NPL. This represents 18% of the total 1,187 NPL sites in the U.S. As shown in figure 1, the number of NPL sites in the individual states ranges from 78 in Michigan to 20 in Iowa. The remaining 2,265 sites may require cleanup but are not considered serious enough to be currently eligible for the Superfund list.

1. NPL sites

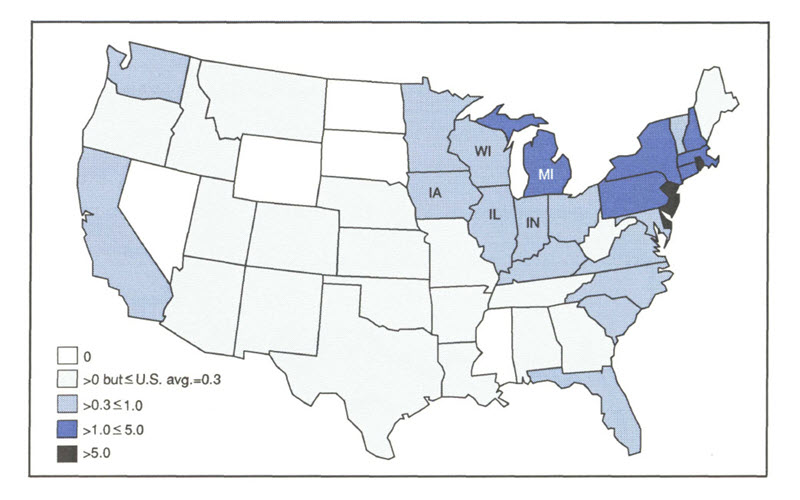

As an indication of the extent of the risk of contaminated sites in individual states, the number of NPL sites per 1,000 square miles of land area is shown in figure 2. Except for Michigan, the NPL ratio for each of the Seventh District states is moderately above the national average of 0.3. In Michigan there are 1.4 NPL sites per 1,000 square miles. The number of other sites on CERCLIS (not eligible for NPL) per 1,000 square miles is below the U.S. average of 4.4 in Wisconsin and Iowa and moderately above in Michigan, Illinois, and Indiana.

2. NPL sites per 1,000 square miles

Conclusion

Environmental laws and regulations and recent court cases have introduced additional uncertainty and a new dimension to risk for financial institutions in lending. The apparent attempt to encourage lenders to require borrowers to comply with environmental laws and cleanup of industrial properties has introduced additional costs for the lender.

Uncertainties as to the environmental liabilities associated with lending need to be clarified. Both the financial and environmental communities will benefit if the risks can be quantified with a reasonable amount of certainty. If this is not possible, then we risk a reduction in the availability of credit to any industry, area, or borrower that presents a possible liability because of contaminated property.

MMI-Midwest Manufacturing Index: Current expansion

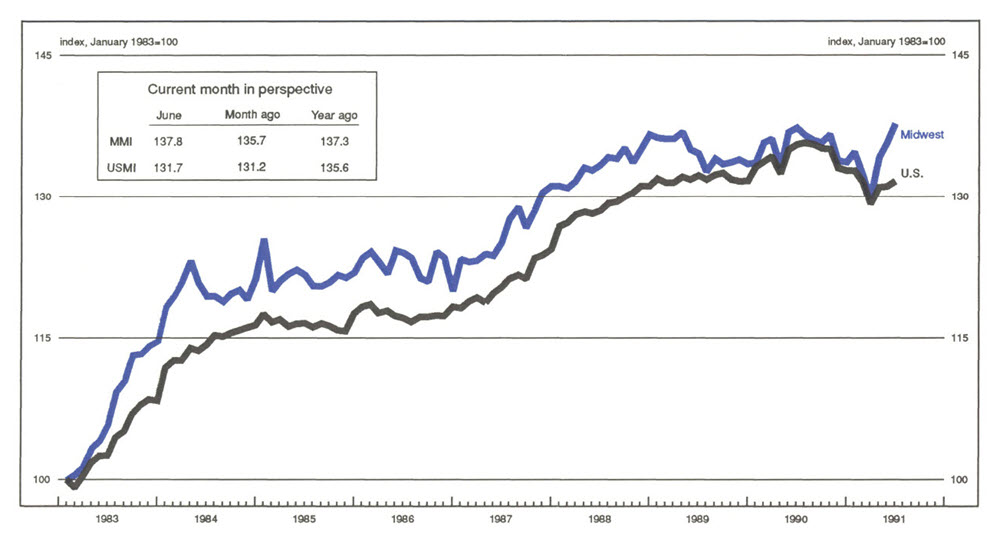

Manufacturing activity in the Midwest continued its upward advance in June, restoring the MMI to its pre-recession level. The gains were widespread, with two-thirds of the industries up from the previous month. Transportation equipment and fabricated metals continued to be major contributors to the June expansion, while primary metals remained weak.

While the Midwest has followed a similar pattern to that of the nation, the region’s recovery to date has been robust. For the third consecutive month, the MMI has markedly outperformed the USMI (1.5% versus 0.4%, respectively, in June and 6.2% versus 1.9% since the March trough). With auto production expected to improve in the third quarter, the MMI should continue to rise.

Notes

1 42 U.S.C.A., §§9601-9657, Public Law 96-510 (Dec. l1, 1980); Public Law 99-499 (Oct. 17, 1986).

2 15 Environmental Law Reporter 20922 (E.D. Pa. 1985).

3 632 F.Supp. 573 (D.Md. 1986).

4 901 F.2d 1550 (11th Cir. 1990), cert. denied, 111 S.Ct. 752 (1991).

5 910 F.2d 668 (9th Cir. 1990). The Ninth Circuit claims to agree with the Eleventh Circuit decision in a footnote, “As did the Eleventh Circuit in Fleet Factors, we hold that a creditor must, as a threshold matter, exercise actual management authority before it can be held liable for action or inaction which results in the discharge of hazardous wastes. Merely having the power to get involved in management, but failing to exercise it, is not enough.”

6 FR 28797 (June 24, 1991).