The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

Many authorities at home and abroad questioned Italy’s ability to meet the strict criteria to join the European Monetary Union. The author looks at the interaction between fiscal policy and monetary policy in Italy between 1992, when it exited the European Exchange Rate Mechanism, and 1998, when an official announcement was made that it would join the union.

It is widely recognized that all episodes of high inflation across the world were accompanied by rapid money creation on the part of a central bank. At the same time, most of these episodes occurred in countries that faced serious fiscal imbalances.1 The central banks of these countries caved in to the needs of the fiscal authorities, because of either political or institutional constraints.

In this Chicago Fed Letter, I look at the interaction between fiscal policy and monetary policy in a somewhat different case, one in which the central bank consistently experienced a high degree of independence and no fiscal crisis occurred: namely, Italy between September 1992, when it exited the European Exchange Rate Mechanism (ERM), and May 1998, when an official announcement was made that it would join the European Monetary Union (EMU).2 While Italy’s central bank was not actually forced to run (and did not run) the printing press to bankroll public deficits, I argue that movements in the exchange rates and, to some extent, inflation were dominated by the people’s expectations about what could have happened. These expectations were driven mainly by fiscal news. During the run-up to the European Monetary Union, uncertainty about Italy’s ability to join exacerbated the swings in expectations, which made the Italian experience a somewhat extreme but particularly informative case.

Fiscal and monetary conditions in Italy after the ERM crisis

While Italy experienced moderately high rates of inflation throughout the 1970s and the early 1980s (peaking at around 21% in 1980), by 1992 inflation had been stable at around 5% for many years. The Bank of Italy had gradually become more and more independent from the executive branch over the previous decade. This trend toward greater institutional independence started with the widely acclaimed “divorce” in 1981, whereby the bank was no longer forced to act as a residual claimant of unsold Italian Treasury debt securities. Aside from gaining more institutional independence, the Bank of Italy also enjoyed a large degree of popularity and respect from the public—a further benefit of disinflation that reinforced its ability to run an effective monetary policy.

Throughout the disinflation period, independence from the executive branch was accompanied by tighter involvement in the European Exchange Rate Mechanism. Central banks participating in the ERM committed to keep their currencies within a narrow band. While the band was periodically readjusted, participation in the quasi-fixed exchange rate regime limited the freedom of the central bank, and it was an important element for the Bank of Italy in regaining credibility for pursuing price stability in the eyes of the public and the financial markets. The Italian commitment to the ERM was suspended in September 1992, following unprecedented speculative attacks. This suspension was triggered in part by domestic weaknesses and in part by larger international considerations. On the domestic front, the ability to sustain a strong exchange rate was challenged by the same fiscal concerns about the ability to manage debt that would play such an important role in the subsequent years. From a broader perspective, the ERM was particularly fragile in the wake of German reunification: The British pound abandoned the system at the same time as the Italian lira, and the following year the trading bands for most currencies were widened sixfold. Leaving the ERM implied that, for the first time, the Bank of Italy would have the responsibility of conducting a truly independent monetary policy, free from both internal and external constraints.

The disinflation of the 1980s was not matched by equal progress in public finances. On the contrary, higher real interest rates and the ceasing of seigniorage revenues3 led to increasing deficits. Government debt in 1992 stood at over 100% of gross domestic product (GDP) and continued to grow rapidly, with interest payments imposing an ever-increasing burden on the budget. Even the very large fiscal adjustment (almost 6% of GDP) approved after the shocking exit from the ERM only managed to slow the growth rate of debt in relationship to output.

Fiscal uncertainty and monetary policy

The solution to the Italian fiscal imbalance could come from one of three sources (or a combination of them):

• An increase in taxes and/or a decrease in spending,

• A spurt of inflation, and

• Outright repudiation (or a capital levy).4

To gauge the extent of inflation and default risk, one can see that yields on Italian ten-year government bonds in the last quarter of 1992 averaged 13.85%, almost 9% above inflation. Several studies have looked at decomposing this risk into the risk of devaluation/inflation and outright credit default.5 These studies found that the pure credit risk of Italian sovereign debt was small, but not insignificant, suggesting that financial markets viewed reversion to high inflation (or a capital levy across a broad spectrum of financial assets) as a more likely outcome than repudiation. More than simply providing seigniorage revenues, inflation would act as an implicit default on existing government debt, since most of it was denominated in domestic currency and was not indexed to prices. The effectiveness of inflation was somewhat limited by the short average maturity of debt.6

The precarious state of Italian finances posed two challenges for monetary policy.

• Expectations of future conditions are an essential determinant of interest rates, exchange rates, and eventually the overall price level. The control that the central bank could exert over all these variables was limited, since fiscal news challenged the belief that the central bank would be able to retain its political and institutional independence in the long run.7 Figure 1 displays interest rates on one- and ten-year government debt, along with the official discount rate set by the Bank of Italy; this figure clearly suggests that movements in the official rate followed, rather than led, the trend in interest rates on government securities.

1. Interest rates in Italy, 1992–98

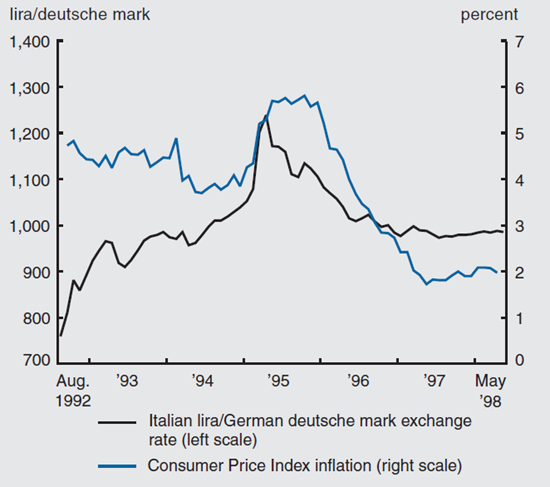

Figure 2 displays the exchange rate of the lira against the deutsche mark (the dominant currency in Europe at the time) and inflation. During the period, Italy experienced extreme swings in its exchange rate, which the Bank of Italy had very limited ability to control. As an example, some of the largest daily swings occurred between March 15 and March 22, 1995, and coincided with parliamentary votes over a supplementary budget resolution and debates over pension reform. The inflation response to currency swings was significant, albeit surprisingly muted, compared with the magnitude of devaluations and revaluations; this is most likely due to the fact that a fiscal adjustment and a consequent revaluation of the lira took place before the large depreciation of 1994–95 had passed through into prices.

2. Exchange rate and inflation in Italy, 1992–98

- Monetary authorities mostly adopt a short-term rate as their policy instrument. It is usually taken for granted that this rate is risk free and that movements in the rate (net of inflation) reflect looser or tighter credit conditions. As already noted, the return on Italian Treasury securities reflected a small, but significant and time-varying, credit risk: This made it harder to disentangle changes in interest rates stemming from the perceived probability of default (or capital levy) from changes purely reflecting credit tightness.

A resolution

Eventually, uncertainty was resolved in favor of a fiscal adjustment, and no default occurred. The success of this maneuver, which took place in 1996, once again bears witness to the power of fiscal (rather than monetary) policy in determining interest rates and inflation over this period. Throughout 1996, it became increasingly clear that a strict adherence to the limit of a 3% deficit-to-GDP ratio in 1997 would be required of countries to be admitted to the European Monetary Union. This limit and the huge stock of debt put Italy squarely into a region of multiple equilibria, where the expectations of financial markets would become self-fulfilling. If the public or the markets expected Italy to join the EMU, the resulting drop in interest rates would bring enormous relief to public finances and put the 3% within easy reach. If instead the public or the markets perceived Italy would remain out of the union, the persistent inflationary risk would keep interest rates at very high levels and would make it all but impossible to bring the deficit down to the required threshold. This situation was very clear to the government.8 To steer markets toward favorable expectations, public officials throughout 1996 increasingly stressed a commitment to the fiscal discipline needed to enter the EMU, and in the fall of 1996, a carefully crafted fiscal package of spending cuts and tax increases (including a one-time income tax surcharge explicitly labeled “euro tax”) was approved. The size of the fiscal adjustment of 1996 was much smaller than the one that was approved in the wake of the 1992 crisis, but it was just enough (by skill or luck) to tip the markets into believing that Italy would be able to join the EMU. Figure 1 shows the resulting slide in interest rates that ensured that the 3% threshold would be reached.

The resolution of the fiscal uncertainty was accompanied by a large recovery in the foreign value of the Italian lira and by a drop of inflation to levels that Italy had not experienced since the 1960s.

Conclusion

Thomas J. Sargent and Neil Wallace9 remarked that a truly independent monetary policy is impossible if fiscal deficits create expectations of future government interference in monetary affairs. Italy between 1992 and 1998 offers a clear example of Sargent and Wallace’s “unpleasant monetarist arithmetic.” More recently, the “fiscal theory of the price level” has argued that there are conditions under which the evolution of prices is primarily dictated by the need to match the real value of debt to the primary surpluses that the fiscal authorities are willing or able to deliver,10 with monetary policy playing a minor role at best. In other work,11 I have argued that the fiscal strategies that lead to the fiscal theory of the price level are more natural in an environment where the government is running primary surpluses for the foreseeable future, a condition that highly indebted Italy faced at the time. In the almost daily reaction of exchange rates to fiscal news, it is tempting to see the fiscal theory at work. At the same time, fiscal policy was so important because of its repercussions for Italy’s likelihood of joining the EMU or staying out of it; this created a very unusual direct link from fiscal policy to monetary policy outcomes.

Notes

1 A discussion of several historical episodes is contained in Thomas J. Sargent, 1993, Rational Expectations and Inflation, 2nd ed., New York: Harper Collins.

2 In 1998, it was announced that the countries initially joining the EMU would be Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain.

3 Seigniorage revenues measure the amount of interest that the government saves by issuing money (a liability that carries no interest) rather than interest-bearing government debt. When inflation (and thus nominal interest rates) were high in the 1970s, the interest savings from issuing money rather than debt were significant; these dried up when inflation abated in the 1980s.

4 The government did pass some small capital levies on businesses and bank deposits in 1992, though it carefully avoided hitting government bonds.

5 See Alberto Alesina, Mark De Broeck, Alessandro Prati, and Guido Tabellini, 1992, “Default risk on government debt in OECD countries,” Economic Policy, Vol. 7, No. 15, October, pp. 427–463; and Kamhon Kan, 1998, “Credit spreads on government bonds,” Applied Financial Economics, Vol. 8, No. 3, June, pp. 301–313.

6 In computing effective maturity, it is important to account for the significant amount of variable rate bonds that Italy issued. For the years from 1960 to 1989, such a computation is reported in Alessandro Missale and Olivier Jean Blanchard, 1994, “The debt burden and debt maturity,” American Economic Review, Vol. 84, No.1, March, pp. 309–319. By the end of the period, effective maturity had dropped to about one year.

7 In the event of a government debt crisis, the banks’ exposure to the Italian Treasury would have had severe consequences on Italy’s banking sector. This would have spurred the central bank to accommodate more inflation even without direct pressure from the Italian Treasury.

8 A very important role in shaping the government’s economic policy in 1996 was played by Carlo Azeglio Ciampi (Treasury minister) and Lamberto Dini (foreign minister), who held the top two offices at the Bank of Italy between 1979 and 1993. It can thus be argued that inflation was finally conquered by the Bank of Italy’s taking over the government.

9 Thomas J. Sargent and Neil Wallace, 1981, “Some unpleasant monetarist arithmetic,” Quarterly Review, Federal Reserve Bank of Minneapolis, Vol. 5, Fall, pp.15–31.

10 Michael Woodford, 1994, “Monetary policy and price level determinacy in a cash-in-advance economy,” Economic Theory, Vol. 4, No. 3, pp. 345–380; Christopher A. Sims, 1994, “A simple model for study of the determination of the price level and the interaction of monetary and fiscal policy,” Economic Theory, Vol. 4, No. 3, pp.381–399; and, for the case of exchange rates, see William Dupor, 2000, “Exchange rates and the fiscal theory of the price level,” Journal of Monetary Economics, Vol. 45, No. 3, June, pp. 613–630.

11 Marco Bassetto, 2002, “A game-theoretic view of the fiscal theory of the price level,” Econometrica, Vol. 70, No. 6, November, pp. 2167–2195.