Monetary policy acts on the economy primarily through its effects on investment spending. But the nature of investment has evolved over time: “Intangible assets”—such as intellectual property or software—play an increasingly important role in the modern economy. In this Chicago Fed Letter, we study the implications of this change for the transmission of monetary policy. We show that investment in intangible assets is less sensitive to interest rates than investment in tangible assets. This suggests that the secular shift toward intangibles has reduced the responsiveness of aggregate economic activity to changes in the short-term interest rate set by the Federal Reserve—by about one-quarter according to our simple calculations.

What do we mean by intangible investment? To start, investment is defined as the accumulation of assets that can be used for future production or consumption. Historically, investment was primarily geared toward physical, or tangible, assets—such as houses, cars, or plants and equipment. Increasingly, however, economies are relying on a stock of intangible assets, such as patents or computer programs and applications, but also general know-how and business processes, human capital, and networks of relationships with customers or suppliers. Businesses expend considerable resources to accumulate these assets, and derive a large share of their value from them.1

Measuring tangible and intangible investment

In the past, many of the resources spent on intangible assets were not considered an investment; instead, they were treated as an intermediate input in national accounting and thus not included in the measurement of gross domestic product (GDP) or its components, which only capture expenditures on final goods and services. Similarly, resources spent on intangibles were treated as an expense, rather than an investment, in private sector accounting. More recently, there has been an effort to recognize and measure these assets, and some intangible investments have been incorporated in the measurement of the national economy by the U.S. Bureau of Economic Analysis (BEA) as part of the National Income and Product Accounts of the United States (NIPAs).2 We will rely on these data.

We rearrange the usual national income accounting identity into three categories: 1) “total investment” (TI), defined as the sum of business fixed investment (BFI), residential investment (RI), and consumer durables (D); 2) private consumption, defined as the sum of nondurable (ND) and services (S) consumption; and 3) a residual, which consists of government spending (G), net exports (NX), and changes in business inventories (CBI).3 This rearrangement allows us to have a single measure that encompasses all forms of investment measured in the NIPAs, regardless of whether it is conducted by households or by businesses. Overall, total spending on final goods (GDP) is as follows:

$1){\quad}Y=\underbrace{BFI+RI+D}_{\text{Total investment (}TI\text{)}}+\underbrace{ND+S}_{\text{Consumption}}+\underbrace{G+NX+CBI}_{\text{Residual}}.$

The second step in our measurement is to define tangible and intangible investment. As discussed previously, intangible investment involves many activities—for instance, marketing to attract new customers and retain old ones. The BEA, however, currently only measures some of them. In order to stay consistent with the standard NIPA data, we define intangibles as the sum of two categories: “intellectual property products” (IPP)—which consists of research and development (R&D), software, and entertainment and artistic products—and investment in information processing equipment, i.e., high-tech equipment (HT). The first category (intellectual property products) is a relatively recent addition to the NIPAs, as it was introduced by the BEA in 2013. It is part of an ongoing effort to extend the scope of measured business investment precisely to capture intangibles. Although strictly speaking not an intangible, high-tech equipment is included because this type of capital is highly complementary to intellectual property products (e.g., software is not useful without a computer).4

Tangible investment consists of residential investment (RI) and nonresidential structures (NRS), equipment other than high-tech equipment (NHT), and consumer durables (D). The tangible category thus covers a wide range of physical assets, including housing, plants, offices, health care facilities, shopping malls, warehouses, heavy machinery, airplanes, cars, and furniture.

Our decomposition of total investment satisfies the following:

$2){\quad}TI=\underbrace{HT+IPP}_{\text{Intangibles}}+\underbrace{NHT+NRS+RI+D}_{\text{Tangibles}}.$

To reconcile equations 1 and 2, note that business fixed investment is defined as BFI = HT + NHT + NRS + IPP.

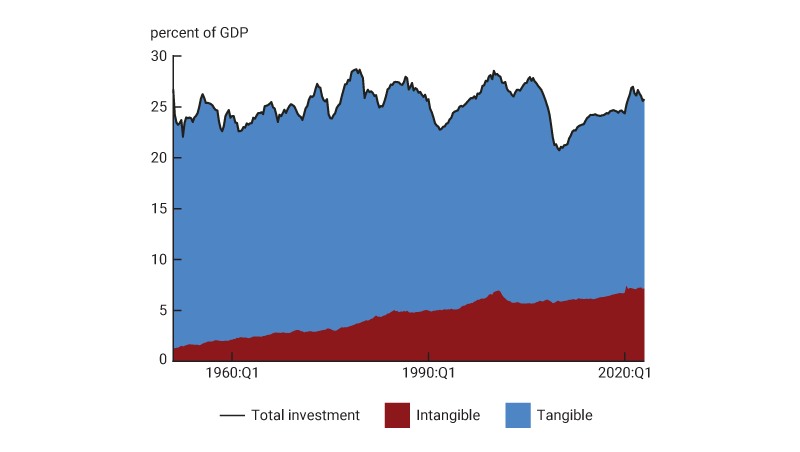

Although there are cyclical fluctuations, the level of total investment (TI) as a share of GDP has been relatively stable since the 1950s, averaging about 25%. In contrast, the composition of investment has changed markedly. Figure 1 depicts total investment as a share of GDP, as well as the breakdown between intangible and tangible investment, illustrating a striking shift in the composition of investment across the two categories. In the 1950s, intangibles accounted for only about 7% of total investment, and tangibles for 93%. Today, intangibles make up about 27% of the investment flow, and tangibles 73%. The decline of tangible investment is primarily driven by residential investment (housing) and non-high-tech equipment. The rise of intangibles was initially due to both intellectual property products and high-tech equipment, but is now entirely driven by the former.

1. Tangible and intangible investment shares of GDP

Source: Authors’ calculations based on data from the U.S. Bureau of Economic Analysis from Haver Analytics.

Heterogeneous interest rate sensitivities

We now measure interest rate sensitivities for different components of GDP, which we also refer to as “sectors.” Estimating interest rate sensitivities is not straightforward: Simply noting that some sectors contract more when interest rates rise may be misleading because interest rates might be endogenous—i.e., they may be moving in response to some other factor that is also directly affecting investment. For instance, the Federal Reserve sets short-term interest rates to achieve its dual mandate goals of maximum employment and low and stable inflation, so higher interest rates can simply reflect that economic activity is strong and that the Federal Reserve believes higher interest rates are needed to prevent higher inflation. To solve the “identification problem,” we follow Romer and Romer (2004), who construct a series of monetary policy “shocks,” i.e., changes in interest rates that are not driven by economic activity or inflation and, hence, are possibly independent of other factors driving investment.5 An example would be a period when the Federal Reserve decided that it was valuable to reduce inflation regardless of current economic conditions.6

With this shock series in hand, we follow Romer and Romer (2004) and more specifically McKay and Wieland (2021) and estimate the responses of each sector to changes in interest rates using linear regressions (“local projections”) of the form:

$3)\quad{{y}_{t+h}}={{\unicode{x03B1} }_{h}}+\sum\limits_{m=0}^{M}{{{\unicode{x03B2} }_{h,m}}R{{R}_{t-m}}}+\sum\limits_{l=1}^{L}{{{\unicode{x03B3} }_{h,l}}{{y}_{t-l}}+{{\unicode{x03B4} }_{h}}t+{{\unicode{x03B5} }_{t+h}},}$

where h = 0 ...16 denotes the horizon (in quarters) at which we estimate the response; yt = log Yt (the log of) each outcome variable (e.g., tangible or intangible investment); RRt the Romer–Romer monetary policy shocks; t a time trend; ${{\unicode{x03B5} }_{t}}$ an error term; and ${{\unicode{x03B1} }_{h}},\,{{\unicode{x03B2} }_{h,m}},\,{{\unicode{x03B3} }_{h,l}},$ and ${{\unicode{x03B4} }_{h}}$ the corresponding regression coefficients.7

We estimate equation 3 using quarterly data over the period 1969:Q1 through 2007:Q4, with M = L = 16; and figures 2–4 depict, for various categories of spending yt, the coefficients $\left\{ {{\unicode{x03B2} }_{h,0}} \right\}_{h=0}^{H},$ which trace out the so-called impulse response function (IRF). We normalize the impulse response so that the shock studied corresponds to a 100 basis point increase in the real one-year U.S. Treasury rate, which is a common measure of the stance of monetary policy.

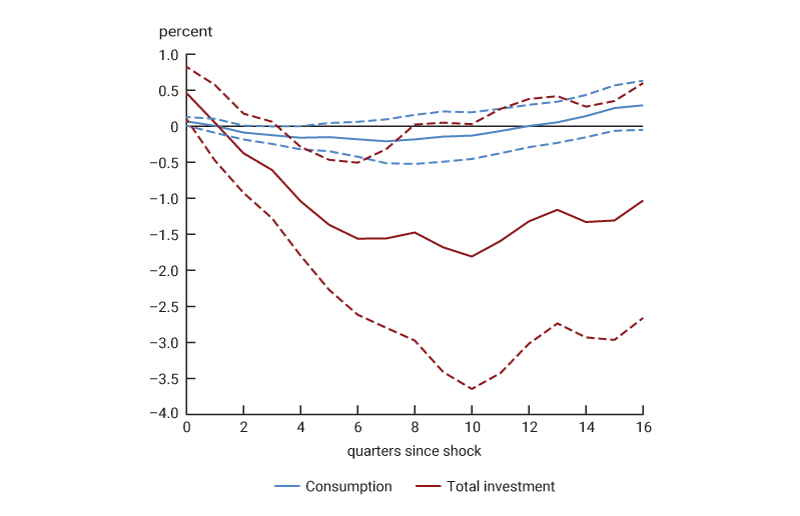

Figure 2 depicts the responses of consumption and total investment to a tightening of monetary policy (that increases the real one-year rate by 100 basis points). The figure shows that investment is much more responsive to a change in monetary policy than consumption: While both sectors decline in response to higher interest rates, investment falls over 1.5% (to its nadir), with consumption decreasing less than 0.2%. To put the results another way, the investment sector accounts for the bulk of the impact of monetary policy on economic activity.

2. Impulse responses of consumption and total investment to a monetary policy shock

Sources: Authors’ calculations based on data from Wieland and Yang (2020) and the U.S. Bureau of Economic Analysis from Haver Analytics.

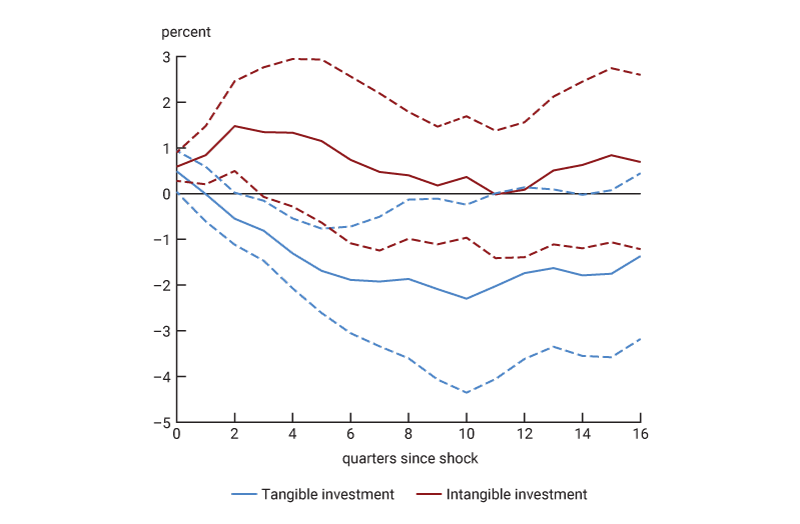

Next, figure 3 depicts the responses of tangible and intangible investment to the same tightening of monetary policy. Strikingly, tangible investment is entirely responsible for the negative total investment response. If anything, intangible investment reacts with the opposite sign, though the magnitude of the effect is substantially smaller than for tangible investment and is very short-lived (e.g., the response is statistically significant for only two quarters).8

3. Impulse responses of tangible and intangible investment to a monetary policy shock

Sources: Authors’ calculations based on data from Wieland and Yang (2020) and the U.S. Bureau of Economic Analysis from Haver Analytics.

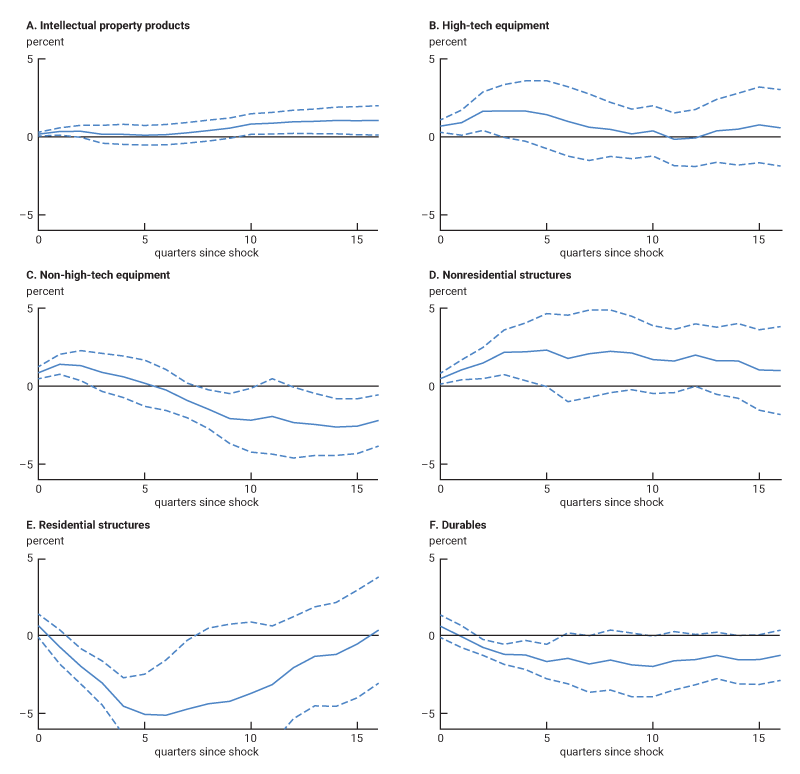

To understand which categories of investment are driving the result, we plot in figure 4 the estimated responses of the components of investment defined in equation 2 to the same monetary policy shock. For ease of comparison, all the panels in figure 4 have the same scale. Panels A and B depict the responses of the two components of intangibles: intellectual property products and high-tech equipment. The general lack of response of intellectual property products to the shock is noteworthy; the response of high-tech equipment is mildly positive for two quarters and then becomes statistically indistinguishable from zero. Panels C and D plot the responses of the two traditional investment components: equipment (excluding high-tech equipment) and nonresidential structures. The non-high-tech equipment category responds strongly negatively to the shock, but with a long lag; meanwhile, puzzingly, the nonresidential structures category responds positively.9 Finally, panels E and F show that residential structures are the component of investment that responds the most negatively (and also, the fastest) and that consumer durable spending also reacts fairly strongly negatively.

3. Impulse responses of tangible and intangible investment to a monetary policy shock

Sources: Authors’ calculations based on data from Wieland and Yang (2020) and the U.S. Bureau of Economic Analysis from Haver Analytics.

Estimating the change in the transmission of monetary policy

How do the changing investment shares documented in figure 1 affect the transmission of monetary policy to economic activity? The overall percentage change in total GDP for a given change in interest rates is the sum of the contributions of each sector; and a sector’s contribution is the product of the sector’s share in GDP and its individual responsiveness to a change in interest rates. If each sector had the same interest rate sensitivity, reallocation of activity across sectors would have no effect on monetary transmission. In contrast, if sectors differ in their interest rate sensitivities, as figure 3 shows is the case for intangible and tangible investment, reallocation toward sectors with low (high) rate sensitivities decreases (increases) the overall responsiveness to changes in rates.10 Using the estimated responses for each type of investment along with each type’s share of GDP, we can quantify the implications of the changing shares for the transmission of monetary policy to overall economic activity. Figure 5 reports our calculations. The first column displays the estimated impulse response of each investment category, e.g., the coefficient ${{\unicode{x03B2} }_{h,0}}$ from equation 3, at a horizon h of nine quarters, which corresponds to the peak response of GDP to the monetary shock. In panel A of figure 5, we report the 1953 and 2019 shares of each investment category in total investment and the implied contribution of each category in each period to the rate sensitivity of total investment (calculated as the first column’s value multiplied by second or fourth column’s value, depending on the year). In panel B, we report the analogous statistics for GDP.

5. Investment shares and monetary policy transmission

| 1953 | 2019 | |||||

|---|---|---|---|---|---|---|

| IRF (h = 9) (1) |

Share (2) |

Contribution (3) |

Share (4) |

Contribution (5) |

||

| A. Investment | ||||||

| Nonresidential structures | 2.13 | 0.14 | 0.30 | 0.13 | 0.28 | |

| Non-high-tech equipment | –2.08 | 0.20 | –0.42 | 0.15 | –0.31 | |

| High-tech equipment/IPP | 0.18 | 0.07 | 0.01 | 0.27 | 0.05 | |

| Residential structures/durables | –3.09 | 0.59 | –1.83 | 0.45 | –1.38 | |

| Total | – | 1.00 | –1.94 | 1.00 | –1.37 | |

| B. GDP | ||||||

| Nonresidential structures | 2.13 | 0.03 | 0.07 | 0.03 | 0.07 | |

| Non-high-tech equipment | –2.08 | 0.05 | –0.10 | 0.04 | –0.08 | |

| High-tech equipment/IPP | 0.18 | 0.02 | 0.00 | 0.07 | 0.01 | |

| Residential structures/durables | –3.09 | 0.14 | –0.44 | 0.11 | –0.34 | |

| Total | – | 0.24 | –0.46 | 0.24 | –0.33 | |

From the third column of figure 5, panel A, the total investment response in 1953 to a 100 basis point interest rate shock (in terms of the real one-year Treasury rate) was –1.94%. This negative response is entirely accounted for by the non-high-tech equipment and residential structures/durables categories. By 2019, because of shifting investment shares alone, the fifth column shows that the total implied investment response had fallen (in absolute value) to –1.37%—a decline of 0.57 percentage points, or roughly 30%. The result stems from the fact that between 1953 and 2019, the share in total investment of the two most interest-rate-sensitive categories—non-high-tech equipment and residential structures/durables—fell by about 20 percentage points, from 79% to 60% (see the second versus fourth columns), whereas the share of intangibles (high-tech equipment/intellectual property products)—which are not sensitive to interest rates—rose by essentially the same amount, from 7% to 27%. Figure 5, panel A shows that this change in the composition of investment may have dampened the investment response to monetary policy by almost 30%.

Similarly, figure 5, panel B shows that changing investment shares reduced the interest rate sensitivity of GDP—by about 0.13 percentage points between 1953 and 2019, from –0.46% to –0.33%. (Note that the compositional effects on GDP are approximately equal to the effects on investment, scaled by the investment share of GDP, which was 24% in both of these years.) The results imply that the rise of intangible investment may have dampened the impact of monetary policy on overall economic activity by 27%—in other words, about one-quarter.11

Conclusion

We have shown that the rising importance of intangibles may have dampened the responsiveness of economic activity to changes in interest rates—by as much as one-quarter according to our estimates. This result does not necessarily imply that the Federal Reserve has less ability to affect output than in the past; rather, it implies that the impact of a given rate change may be smaller than in the past, so larger changes in interest rates may be required to affect output by the same amount as before. One important assumption to keep in mind is that the interest rate sensitivities of tangible and intangible investment have stayed constant over time. To the extent that these sensitivities are time-varying as well, the impact of reallocation from tangible to intangible investment could be either heightened or diminished.

But we have left open one question: Why do intangible investment and tangible investment differ in their responsiveness to changes in interest rates? There are at least two plausible explanations.12 First, the expected lifetime of intangibles is typically shorter than that of tangible capital; i.e., intangibles tend to depreciate faster—for example, the depreciation rate on intellectual property is a little over 20%, compared to just over 2% for residential structures.13 This makes the cost of investing in intangibles less sensitive to interest rates, since their payoffs are not as backloaded. Second, intangible investment appears to be financed differently than tangible investment: Intangibles are financed primarily using internal funds or equity, rather than through debt, likely reflecting, at least in part, the fact that tangible capital is easier to pledge as collateral for new loans. This would naturally make tangible investment more sensitive to financial conditions in debt markets.

Notes

1 For some recent discussions on the role of intangibles, see, e.g., Corrado et al. (2022), Crouzet et al. (2022), and Bronnenberg, Dubé, and Syverson (2022)—all in the Summer 2022 issue of the Journal of Economic Perspectives—and Haskel and Westlake (2018).

2 For some work on the measurement of intangibles, see Corrado, Haltiwanger, and Sichel (2005), Corrado, Hulten, and Sichel (2009), and Lev (2001).

3 Note that we categorize consumer durables as a form of investment, although the BEA does not.

4 It would be interesting to expand our analysis to other forms of intangibles not yet incorporated by the BEA into the NIPAs; see, for instance, Morlacco and Zeke (2021), who study expenditures on advertising.

5 More specifically, the Romer and Romer (2004) shock series measures the deviations of the policy interest rate from a “rule”—i.e., it extracts movements in the (target) federal funds rate that are unrelated to changes in Federal Reserve internal (Tealbook/Greenbook) forecasts of future economic conditions and inflation and to the lagged federal funds rate.

6 There are of course other methodologies to estimate the effects of monetary policy or, more broadly, the interest rate sensitivity of each sector. We use the Romer and Romer (2004) series, which was updated by Wieland and Yang (2020), because it allows us to use a sample that aligns in time with the secular increase in intangible capital we study. In unreported results, we obtained similar findings using shocks identified via vector autoregression (VAR) with timing restrictions as in Christiano, Eichenbaum, and Evans (1999).

7 In general, a regression model is a statistical method that estimates the strength of relationships between variables. A regression coefficient represents the expected change in the dependent variable for a one-unit change in the independent variable (while holding constant any other independent variables).

8 Our results are consistent with the study of Döttling and Ratnovski (2023), which uses microdata on firm investment rather than macroeconomic data.

9 Several explanations have been advanced for the erratic behavior of nonresidential structures. First, the length of the process to plan and implement such large-scale projects may induce a long lag. Second, there is natural substitution in the production of residential and nonresidential structures: Construction inputs (both workers and materials) can switch between producing one or the other. Hence, as residential investment declines, the construction industry might find it appealing to build nonresidential structures instead.

10 Of course, these calculations assume that the interest rate sensitivity of each sector is not itself changing. One possibility is that intangibles have become more sensitive to changes in interest rates. Investigating whether this is the case would necessitate long enough time-series data to robustly estimate time-varying impulse response functions.

11 To calculate this value, we use the values in figure 5 and the shares and impulse responses of the consumption and residual categories defined in equation 1 to derive the total response of GDP to the monetary shock of –0.49% in 1953. (Note that this value of –0.49% is quite close to the GDP response obtained by summing the responses of investment categories, i.e., –0.46%, reported in the third column of figure 5, panel B—which reflects that consumption and the residual, on net, contribute little to the response of GDP.) The percentage fall in GDP sensitivity due to the rise in intangibles is then $\frac{-0.13}{-0.49}=0.27.$

12 See also related work by Crouzet and Eberly (2019), Caggese and Pérez-Orive (2022), and Döttling and Ratnovski (2023).

13 Authors’ calculations based on data from table 1.3 and table 1.1 of the Fixed Asset Accounts Tables of the BEA.

References

Bronnenberg, Bart J., Jean-Pierre Dubé, and Chad Syverson, 2022, “Marketing investment and intangible brand capital,” Journal of Economic Perspectives, Vol. 36, No. 3, Summer, pp. 53–74. Crossref

Caggese, Andrea, and Ander Pérez-Orive, 2022, “How stimulative are low real interest rates for intangible capital?,” European Economic Review, Vol. 142, February, article 103987. Crossref

Christiano, Lawrence J., Martin Eichenbaum, and Charles L. Evans, 1999, “Monetary policy shocks: What have we learned and to what end?,” in Handbook of Macroeconomics, John B. Taylor and Michael Woodford (eds.), Vol. 1A, Amsterdam: Elsevier / North-Holland, pp. 65–148.

Corrado, Carol, John Haltiwanger, and Daniel Sichel (eds.), 2005, Measuring Capital in the New Economy, National Bureau of Economic Research Studies in Income and Wealth, Vol. 65, Chicago: University of Chicago Press.

Corrado, Carol, Jonathan Haskel, Cecilia Jona-Lasinio, and Massimiliano Iommi, 2022, “Intangible capital and modern economies,” Journal of Economic Perspectives, Vol. 36, No. 3, Summer, pp. 3–28. Crossref

Corrado, Carol, Charles Hulten, and Daniel Sichel, 2009, “Intangible capital and U.S. economic growth,” Review of Income and Wealth, Vol. 55, No. 3, September, pp. 661–685. Crossref

Crouzet, Nicolas, and Janice C. Eberly, 2019, “Understanding weak capital investment: The role of market concentration and intangibles,” in Changing Market Structures and Implications for Monetary Policy, proceedings of the 2018 Jackson Hole Economic Policy Symposium, Federal Reserve Bank of Kansas City, pp. 87–149, available online.

Crouzet, Nicolas, Janice C. Eberly, Andrea L. Eisfeldt, and Dimitris Papanikolaou, 2022, “The economics of intangible capital,” Journal of Economic Perspectives, Vol. 36, No. 3, Summer, pp. 29–52. Crossref

Döttling, Robin, and Lev Ratnovski, 2023, “Monetary policy and intangible investment,” Journal of Monetary Economics, Vol. 134, March, pp. 53–72. Crossref

Haskel, Jonathan, and Stian Westlake, 2018, Capitalism Without Capital: The Rise of the Intangible Economy, Princeton, NJ: Princeton University Press.

Lev, Baruch, 2001, Intangibles: Management, Measurement, and Reporting, Washington, DC: Brookings Institution Press.

McKay, Alisdair, and Johannes F. Wieland, 2021, “Lumpy durable consumption demand and the limited ammunition of monetary policy,” Econometrica, Vol. 89, No. 6, November, pp. 2717–2749. Crossref

Morlacco, Monica, and David Zeke, 2021, “Monetary policy, customer capital, and market power,” Journal of Monetary Economics, Vol. 121, July, pp. 116–134. Crossref

Romer, Christina D., and David H. Romer, 2004, “A new measure of monetary shocks: Derivation and implications,” American Economic Review, Vol. 94, No. 4, September, pp. 1055–1084. Crossref

Wieland, Johannes F., and Mu-Jeung Yang, 2020, “Financial dampening,” Journal of Money, Credit and Banking, Vol. 52, No. 1, February, pp. 79–113. Crossref