Many American cities, especially those in the Upper Midwest,1 are facing an impending financial problem hiding beneath their streets: Aging water service lines made of lead are running into houses and apartment buildings. New state and federal laws encouraging or mandating more rapid replacement of lead service lines (LSLs) rarely include sufficient funding to accomplish the work. Cities will likely have to pay for a significant chunk of costs that experts have told us may total between $45 billion and $100 billion nationwide.2

These new laws are intended to reduce exposure to lead—a potent neurotoxin that even at low levels can do significant and irreversible harm to children’s intellectual and physical development. The presence of these lines profoundly raises the risk of lead exposure because when these pipes corrode, lead enters the water flowing through them into homes.3

Neighborhoods where most people have low incomes and communities with majority Black or Latino residents have disproportionately high concentrations of lead service lines. Lead-exposure crises in these places have drawn more attention to the problems stemming from the presence of LSLs. The most thoroughly chronicled crisis occurred in Flint, Michigan, where a change in the city water source led to corrosion in LSLs and the release of the devastating metal into household drinking water.4

The new laws encouraging LSL replacement are aimed at reducing the risk of lead exposure and avoiding similar public health disasters. The magnitude of the problem is large: There are an estimated 6 to 12 million LSLs nationwide, including more than 380,000 in Chicago.5 The ultimate number of pipe replacements needed is still uncertain as many water systems work to identify the location and number of LSLs in their communities. Most water systems are currently making slow progress—with only hundreds or low thousands of pipe replacements completed and with tens or hundreds of thousands yet to be done. By forcing water systems to develop a proactive strategy, these laws encourage longer-term thinking backed by innovative approaches to funding and financing.

To help communities tackle the problem of LSL replacement, staff at the Federal Reserve Bank of Chicago began in 2022 the Lead Service Line Replacement project—an initiative that has leveraged our expertise in public policy, finance, and community economic development under the Federal Reserve’s broader mission to foster a strong and inclusive economy and promote an efficient financial system. By producing articles, conducting interviews, and highlighting examples of lead service line replacement efforts, we joined with a diverse set of stakeholders to better understand the economic and financial challenges of rapid lead pipe replacement across different communities and explore tactics that might be used to overcome them.6

In early November 2022, the Chicago Fed hosted a convening of several dozen experts—including municipal water system officials, philanthropists, and innovative leaders who work in public finance or with private capital markets. To create a trusted environment for addressing this complex problem, the meeting was held under the Chatham House Rule. As a result, participants were urged to use and share the information exchanged, but not disclose the identity of its provider.

Through a series of full-room panel discussions and targeted breakout sessions intended to provoke deeper conversation, the participants at the convening discussed promising opportunities to finance LSL replacement, as well as some related challenges and questions.

We first summarize some of the potential funding and financing strategies brought to light at the convening.

Unprecedented amounts of low-cost federal funding sources are available to pay for LSL replacement. Large amounts of new and relatively low-cost funding for LSL replacement have become available through efforts to repair the nation’s infrastructure and Covid-19 amelioration programs. The Bipartisan Infrastructure Law (Infrastructure Investment and Jobs Act),7 which was passed in November 2021, provides Drinking Water State Revolving Funds (SRFs) with $15 billion dedicated to lead service line replacement.8 Water systems must apply for this money, which the SRF distributes as grants or low-interest loans. In addition, water systems can apply to other agencies for other federal grants and loans9—for instance, they can apply to the U.S. Environmental Protection Agency (EPA) for a Water Infrastructure Finance and Innovation Act (WIFIA) loan.10 WIFIA loans are low-interest-rate loans that provide flexible financial terms and can be combined with various funding sources. A third source of funding that attendees discussed is the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program, which delivers $350 billion in grants to state, local, and tribal governments to support their responses to and recoveries from the Covid-19 pandemic.11 SLFRF rules allow governments to spend this money on many different eligible uses, which include replacing LSLs.12 These rules also state that governments must obligate their SLFRF funds to an eligible use by December 31, 2024 and spend the money by December 31, 2026.

Municipal debt markets are large enough to finance LSL replacement funding gaps. Attendees heard that because most of the Coronavirus State and Local Fiscal Recovery Funds money will likely not be used to replace lead service lines and other available federal grants and loans are not sufficient to cover nationwide costs, many water systems are likely to face unfunded mandates to replace all LSLs. Private capital markets—primarily the $4 trillion municipal bond market—have the capacity to finance even the largest funding gaps. So far, municipal water systems have left the municipal bond market largely untapped for replacing LSLs. According to experts at the convening, municipal bond investors consider bonds financing major water system infrastructure improvements an attractive investment because these bonds generally have low default rates and offer market rates of return. However, water systems may face two potential hurdles to successfully using this type of financing. One hurdle is creditworthiness: Water systems need to have sufficiently high credit ratings from a major ratings agency to attract private capital investment at low rates. A second hurdle is size: Water systems looking to tap this market will need to borrow large amounts of money—at least tens of millions of dollars. An additional caveat is that recent increases in interest rates have increased the cost of borrowing substantially.

There is potential for banks to receive consideration under the Community Reinvestment Act when they help finance LSL replacement in low- and moderate-income (LMI) communities.13 The Community Reinvestment Act (CRA) of 1977 is one of the seminal pieces of legislation to address systemic inequities in access to credit for LMI communities.14 Under the CRA, banks may be evaluated for their community development activities, including lending, in the LMI communities they serve. In 2020, banks reported over $169 billion in community development lending.15 Attendees at the event discussed the potential for bank lending to help pay for LSL replacement—including bank investments in municipal bonds, state revolving fund bonds, and even personal loans—to be treated as a community development activity. Attendees also discussed the potential for banks to receive CRA consideration for funding workforce training that supports LSL replacement. By offering residents in LMI communities a chance to learn plumbing, this job training would allow a neighborhood to build up its vocational capacity while reducing its risk of lead exposure. Attendees agreed that Community Development Financial Institutions (CDFIs) have the potential to play an important intermediary role between banks and communities by identifying lending opportunities and delivering funding.16 Proposed updates to the CRA regulations released in May 2022,17 treat water infrastructure investments that meet certain criteria as a community development activity and, as such, eligible for CRA credit.18 This means that banks, CDFIs, and communities may find it worthwhile to discuss the potential role of the CRA in helping fund LSL replacement and related workforce training in LMI communities.

LSL replacement is an environmental, social, and governance (ESG) investment, which can attract a new set of investors to finance this type of water system infrastructure improvement. Significant dollars are flowing now into investment vehicles that consider not just financial factors but also ESG impacts. Attendees heard that investments in LSL replacement are a type of ESG investment, given that removing a health hazard like lead pipes from the home has both environmental and social benefits. Water systems looking to attract ESG investors to finance LSL replacement were advised to use traditional investment disclosure materials to “tell their story.” That is, water systems were encouraged to let investors know specifically that the investment will remove lead pipes in disadvantaged communities and lead to better outcomes for children.

Outcomes-based financing and social-impact investing are innovative approaches to finance water infrastructure and other investments that achieve environmental and social goals. Attendees heard that building outcomes-based financing strategies for LSL replacement involves a process that identifies outcomes that complement LSL replacement or can occur alongside it and can be monetized. This monetization, which can include reduced borrowing costs or resulting funding streams, is then used to help pay for LSL replacement. One example discussed where an outcome helped reduce borrowing costs was Buffalo, New York, where the Buffalo Sewer Authority issued environmental impact bonds to finance sewage infrastructure improvements.19 The lower borrowing costs are available when and if the sewer authority accelerates green infrastructure investments that are expected to decrease the volume of stormwater in the sewer system, which would in turn reduce sewer overflows and associated environmental damage.20 Another example discussed where outcomes were monetized was the Soil and Water Outcomes Fund, which pays money to farmers who adopt conservation practices on their farmland that sequester carbon and improve water quality.21 The fund makes money by contracting with beneficiaries who pay the fund when periodic measurements show farmers’ practices achieved those sequestration and improvement goals. This is an example of stacking outcomes—in this case, more carbon sequestration and higher water quality—to increase the amount of available financing. Attendees discussed potential opportunities for bringing in partners—from health care, insurance, technology, and other industries—that might be willing to pay to use the hole in the ground created to replace an LSL—for instance, to plant trees shown to improve air quality and reduce medical costs associated with childhood asthma. Philanthropies can play a key role by providing predevelopment grants that fund the months-long process to identify monetizable outcomes and by using their social-impact funds to finance the identified actions that help accomplish LSL replacement (like tree planting in the example).

The discussion of these funding and financing opportunities also covered the challenges that when left unaddressed are likely to push up LSL replacement project costs. We next discuss some of the identified challenges.

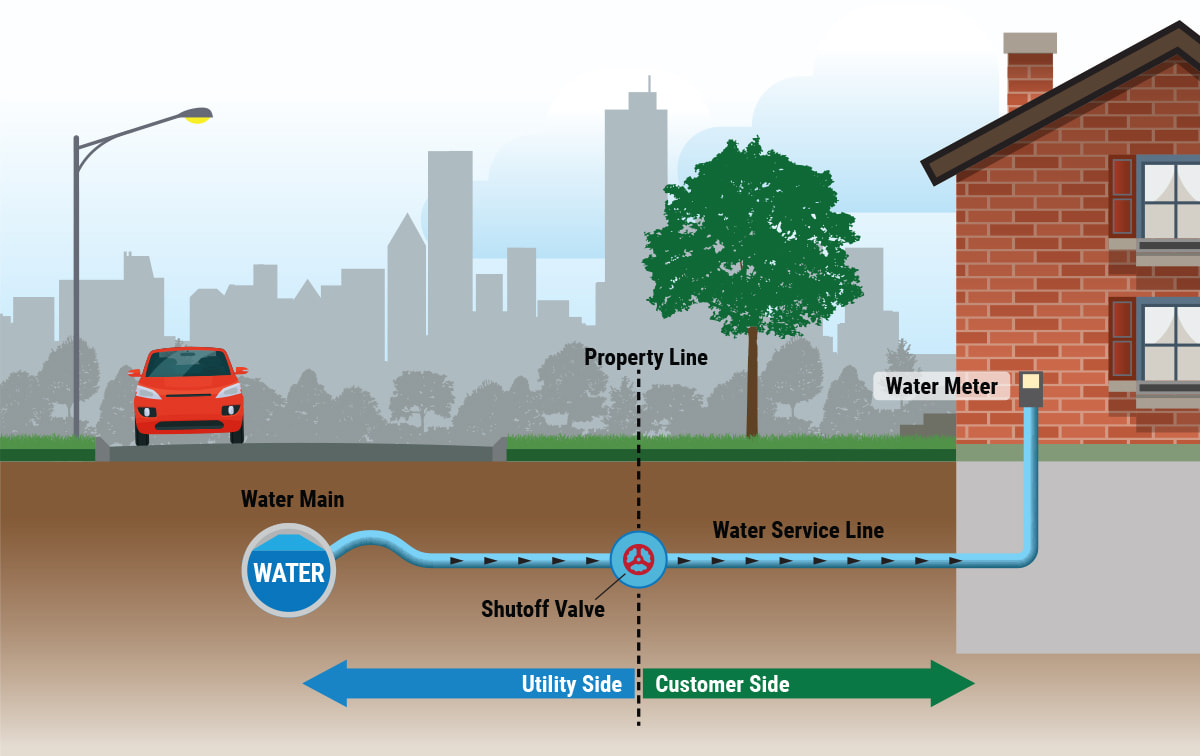

Split ownership of LSLs often creates a property-owner consent requirement that can increase per-line replacement costs. While there is a common set of activities to LSL replacements, differences in state and municipal laws affect the cost and pace of replacement. One common legal hurdle that convening participants discussed is the nearly universal public–private split in ownership of lead lines—with the water utility owning the pipe section leading from the water main to a property line and the homeowner or landlord owning the section that connects the public side to the home. Because replacing only the public side can raise lead exposure by increasing corrosion in the private-side pipe, reducing lead exposure requires replacing both pipe sections.

What is a water service line?

Split ownership generally means that water systems must get property owners to agree to replace the private line, which typically involves digging a hole and entering the home. Coordinating work to replace a whole block’s or neighborhood’s lines at the same time reduces per-line replacement costs, especially in cities with high permitting fees, but getting an entire block of property owners to consent can require a water system to engage in expensive person-to-person outreach.

Legal and accounting positions related to split ownership create financial challenges and equity concerns by requiring homeowners and landlords to pay upfront LSL replacement costs. Some lawyers advise their clients—cities and utilities—to take the position that they cannot use water fees paid by their customers to pay for replacement of private-side lines. Some accountants take the position that replacing a private-side line does not create an asset the water system owns, which effectively limits a water system’s ability to issue debt and use the proceeds to pay for private-side replacement. Attendees also heard that some bond counsel take the position that the interest payments made to bondholders may be subject to federal income tax when a water system issues debt to pay for private-side LSL replacement, whereas interest paid on debt issued solely to pay for public-side LSL replacement is not.

These legal and accounting positions make it more difficult or impossible for water systems to pay for private-side replacement, effectively requiring homeowners and landlords to pay a portion of the upfront replacement costs themselves. According to EPA estimates, under split ownership, average per-line costs in 2016 were $4,578 for water systems and $3,559 for property owners.22 These costs are likely much higher today and vary substantially across water systems. Convening participants expressed concern that requiring property owners to pay some upfront costs can slow the pace and increase the cost of LSL replacement in a community by delaying or preventing block-wide consent and is especially burdensome in LMI communities. It can also cause a water system to replace LSLs first in high-income communities, where residents are better able to pay the upfront costs.

Convening experts noted that these legal and accounting positions are often incorrect. In addition, the experts pointed out that these positions are sometimes held out of an abundance of caution or a sense of inertia. Behind these positions are often views that public funds or public debt cannot be used to, in essence, repair private property. They discussed how education for recalcitrant counsel and accountants—including by sharing Denver’s bond financing of LSL replacement as a case study23—can help change these positions and underlying views. Where it is less feasible to change legal positions, they recommended lobbying for laws to clarify that water systems can use their water fee revenues and issue tax-exempt bonds to pay for private-side LSL replacement.

Water systems face a messaging conundrum that may make gaining broader public support for LSL replacement more difficult. Water systems have been reassuring their users for decades that when properly treated and serviced, lead service lines deliver clean and safe drinking water. But at the same time, as new laws take effect, it is becoming important to get users to buy in—often literally with their own financial contribution toward the project—to the notion that these lines present a health risk and need to be replaced rapidly. Walking this fine line between calm and alarm becomes a messaging challenge. Solving this challenge is key to getting widespread consent from property owners to replace lines block-by-block and keep replacement costs down.

Attendees learned about an effective outreach strategy used by one water system that pays private-side replacement costs: Months ahead of any work being done, it has representatives sit with homeowners on their property in lawn chairs and explain to them why the work that’s planned is important; the water system representatives literally meet with people where they live. To replace LSLs at rental properties, where it can be especially difficult to get landlord consent, this water system accepts consent from any adult living at a property to replace the private-side line. This in-person, relationship-building approach—in contrast to a notice mailed in an official envelope or a mandate issued by a bureaucracy—has resulted in nearly universal buy-in. This emphasis on earning community trust via robust outreach has led to waiting lists of people who want to get their lines replaced.

Limited capacity of water systems and contractors can keep costs high and raise equity concerns. Attendees heard that water systems are often working in isolation to solve a complex set of challenges related to funding and financing LSL replacements and have limited capacity and few opportunities to learn from each other or from external partners with expertise in innovative funding and financing strategies. It can be daunting to find, apply for, win, and deploy low- or no-cost federal funding and mix and match those funds with private capital financing to help pay for the work they want to do.

Capacity constraints also affect a water system’s ability to conduct effective outreach at the large scale necessary to get block-wide consent, to identify and prioritize neighborhoods where the benefits of LSL replacement are expected to be largest, and to consult with legal and accounting experts to consider changing long-held positions (some of which we described previously) that can keep costs high.

Finally, limited contractor capacity also affects the ability of water systems to increase the pace of LSL replacement. Attendees heard that increasing capacity in these areas can play an important role in accelerating LSL replacement equitably and at the lowest possible cost.

Together the funding and financing opportunities discussed at the convening, when considered alongside these challenges cited, raise important questions of equity. The most common equity questions shared at the convening were as follows:

- Assuming a water system takes on bond debt to replace LSLs, how does it do so in a way that doesn’t end up raising water rates to the point of unaffordability for some residents?

- How can cities and towns ensure that LSLs are being replaced in homes across the economic spectrum, not just in homes that can afford the work?

- With LSL replacement potentially bringing more investment into disadvantaged neighborhoods than they’ve seen in decades, can that work be treated as part of a broader approach that funds, say, home improvements and helps overcome mistrust of local government, which in some cases had been built up over decades?

- How well can communities use data to help prioritize replacing lead water pipes where they pose the highest health risks to vulnerable populations like young children?

- With federal grant funding limited, which communities should receive such aid, and which should be expected to take on debt to pay for LSL replacement?

Notes

1 Lead Pipes Are Widespread and Used in Every State | NRDC.

2 For a cost estimate between $28 billion and $47 billion, see What would it cost to replace all the nation’s lead water pipes? (brookings.edu). Costs would exceed $100 billion at the high end of U.S. Environmental Protection Agency’s (U.S. EPA) estimates for both the number of lead service lines and average costs of replacement, see Strategies to achieve full lead service line replacement (October 9, 2019) (epa.gov). These U.S. EPA cost estimates reflect 2016 prices for goods and services; use of 2022 prices are also likely to result in cost estimates at the higher end of the range. For example, prices for copper – commonly used to replace lead for water pipes – increased by over 80% between January 2016 and January 2022, see U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Special Indexes: Copper and Copper Products [WPUSI019011], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WPUSI019011, December 17, 2022.

3 Mary Jean Brown and Stephen Margolis, 2012, “Lead in drinking water and human blood lead levels in the United States,” Morbidity and Mortality Weekly Report, Centers for Disease Control and Prevention, Vol. 61, supplement (August 10, 2012).

4 Flint, MI: Water crisis spurs new focus and funding - Federal Reserve Bank of Chicago (chicagofed.org).

5 Getting the Lead Out: New Opportunities and Challenges to Scale Up Lead Service Line Replacement - Federal Reserve Bank of Chicago (chicagofed.org).

6 Lead Service Line Replacement: About - Federal Reserve Bank of Chicago (chicagofed.org).

7 Text - H.R.3684 - 117th Congress (2021-2022): Infrastructure Investment and Jobs Act | Congress.gov | Library of Congress.

8 Bipartisan Infrastructure Law: A Historic Investment in Water Fact Sheet (epa.gov).

9 Funding for Lead Service Line Replacement | US EPA.

10 Water Infrastructure Finance and Innovation Act (WIFIA) | US EPA.

11 Coronavirus State and Local Fiscal Recovery Funds | U.S. Department of the Treasury.

12 SLFRF-Final-Rule-Overview.pdf (treasury.gov).

13 The U.S. Census Bureau defines LMI communities as those having income levels lower than 80 percent of the area median income. For further details, see Ben Horowitz, 2018, “Defining ‘low- and moderate-income’ and ‘assessment area,’” Federal Reserve Bank of Minneapolis, March 8.

14 Federal Reserve Board - Community Reinvestment Act (CRA).

15 Findings from Analysis of Nationwide Summary Statistics for 2020 Community Reinvestment Act Data Fact Sheet (https://www.ffiec.gov/hmcrpr/cra_fs21.htm).

16 What Are CDFIs? CDFI Fund U.S. Department of the Treasury.

17 Community Reinvestment Act Proposed Rulemaking, Federal Register, Vol. 87, No. 107, pp. 33884–34066 (June 3, 2022).

18 CRA Modernization and Community Development: Banking Agencies Seek Feedback by August 5 - Federal Reserve Bank of Chicago (chicagofed.org).

19 Bond Buyer, Vol. 393, No. 35535, pp. 1, 4 (June 29, 2021).

20 Buffalo Sewer Authority Sewer System Environmental Impact Revenue Bonds Series 2021, Official Statement, June 3, 2021 (msrb.org).

21 Soil and Water Outcomes Fund (theoutcomesfund.com).

22 Economic Analysis Appendices for the Final Lead and Copper Rule Revisions, January 14, 2021, EPA-HQ-OW-2017-0300-1768 (see appendix A, exhibit A-3). Cost estimates are in 2016 dollars, reflecting costs observed between 2016 and 2020.

23 City and County of Denver Water Revenue Bonds Series 2022A, Official Statement, September 27, 2022 (msrb.org).