The Federal Reserve's Dual Mandate

Note

The Federal Open Market Committee announced substantial revisions to its policy framework in its updated Statement on Longer-Run Goals and Monetary Policy Strategy, dated August 27, 2020. The Committee’s previous framework can be found here and a guide to the changes can be found here.

The content on this page is for historical reference and discusses the FOMC’s dual mandate objectives and path for monetary policy under the previous framework.

What Is the Dual Mandate?

In 1977, Congress amended The Federal Reserve Act, stating the monetary policy objectives of the Federal Reserve as:

"The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates."

This is often called the "dual mandate" and guides the Fed's decision-making in conducting monetary policy. On January 25, 2012, the Federal Open Market Committee (FOMC) released the principles regarding its longer-run goals and monetary policy strategy. Read more...

What Are the Dual Mandate Projections?

Inflation and Unemployment

These charts plot the current rates of inflation and unemployment, as well as the FOMC participants’ most recent projections over the next three years and in the longer run. The dots show the median forecasts for the next three years and the dashed lines give the upper and lower ranges of the central tendency of the long-run projections.

Policy

This chart plots the federal funds rate and the rate after adjusting for the annual change in the price index for personal consumption expenditures excluding food and energy prices. Read more...

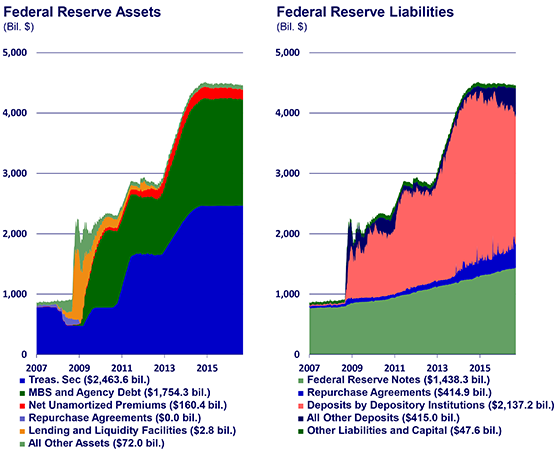

Federal Reserve Balance Sheet

During the financial crisis and in the period since the fed funds rate neared the zero lower bound, the FOMC has employed unconventional tools to improve the functioning of financial markets and to provide additional policy accommodation. Read more...

Federal Funds Rate Projections

In addition to its interest rate and balance sheet policies, the FOMC has enhanced its communications and increased transparency regarding its outlook, objectives and policy strategy. The dots represent individual policymakers’ projections of the appropriate federal funds rate target at the end of each of the next several years and in the longer run. It should be noted that these projections reflect the views of all the participants, irrespective of whether they are a voting member or not. Read more...