The 2023 Economy: Not Your Grandpa’s Monetary Policy Moment

Introduction

When I finished school many years ago, I headed to Chicago. My grandfather called me with advice. Grandpa Jack lived on a ranch outside Abilene, Texas, had served in World War II, and was one of those Greatest Generation wise men. He told me, “This is your first job, and you’ll need to save money. So let me tell you something very important: Never. Buy. Stocks.”

I paused, was Grandpa Jack an efficient markets guy? I asked, “No individual stocks?”

“No,” he said, “don’t buy any stocks. Your grandmother and I had friends who bought stocks. They lost everything when the market crashed.”

He was talking about the Great Depression. This one historical event scarred his thinking for 65-plus years and, evidently, led him to miss out on a few thousand percent cumulative return.

Grandpa Jack’s life experience made him a font of wisdom about many things—and his background in meteorology during World War II meant he could give a stunningly accurate forecast just by looking at the clouds—but, clearly, in personal finance not every historical lesson is helpful for every moment. Today, I will argue the same may be true for monetary policy.

History has taught us that bringing down high inflation without causing a major recession is an extraordinarily rare and difficult task. Indeed, there is what I will call a “traditionalist view” that says the substantial resource slack generated by a deep recession is necessary to reduce strong inflationary pressures—and that delaying taking this bitter medicine risks unhinging inflation expectations, making the job even more difficult. The U.S. inflation experience in the 1970s and ’80s is the one most etched in our minds, but other economies around the world have similar stories to tell.

This traditionalist view tempts us into looking at current growth and labor market conditions as the primary predictors of whether inflation is returning to target. This morning I will argue that this view misses key features of our recent inflationary experience and that, in today’s environment, believing too strongly in the inevitability of a large trade-off between inflation and unemployment comes with the serious risk of a near-term policy error.

Before continuing, let me bring some relief to my colleagues by giving the usual disclaimer: The views I am expressing are my own and not necessarily those of my colleagues on the Federal Open Market Committee (FOMC) or in the Federal Reserve System.

The traditionalist view

As I noted, bringing inflation down several percentage points in a reasonable period of time without suffering a severe recession and painfully high unemployment is historically quite rare. Many commentators have that historical perspective in mind when arguing that returning U.S. inflation to the Fed’s 2 percent target will be painful.

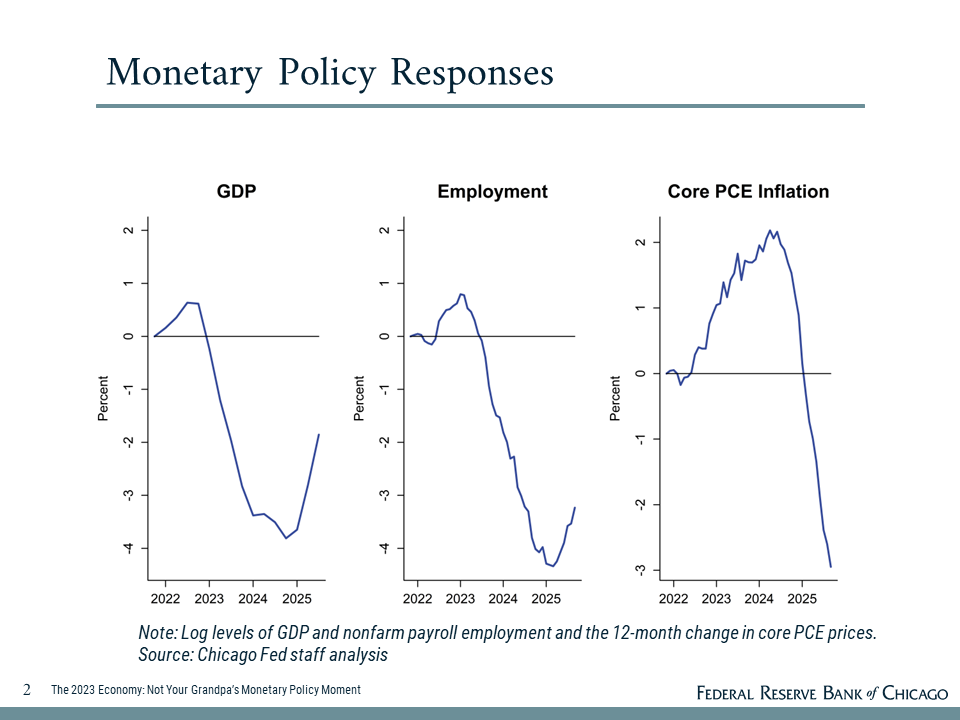

This perspective is also a statistical feature of many econometric models in the long-established literature identifying the effects of monetary policy shocks. Their results generally are consistent with a flat Phillips curve, so that a steep decline in activity is necessary to bring inflation down a lot. The research staff at the Chicago Fed recently updated a version of this analysis based on the work of Romer and Romer (2004) and using data going back to the 1960s.1

The chart shows the changes in the log levels of gross domestic product (GDP) and employment and the core PCE inflation rate2 that we would expect to see based on estimated historical relationships and Fed policy moves to date. Recall that when the Fed first increased rates in March of last year, core PCE inflation was nearly 5-1/2 percent. The historically based dynamics show inflation would not be expected to start moving down until sometime next year and it would come with a large recession and the recession would have already started prior to inflation moderating.

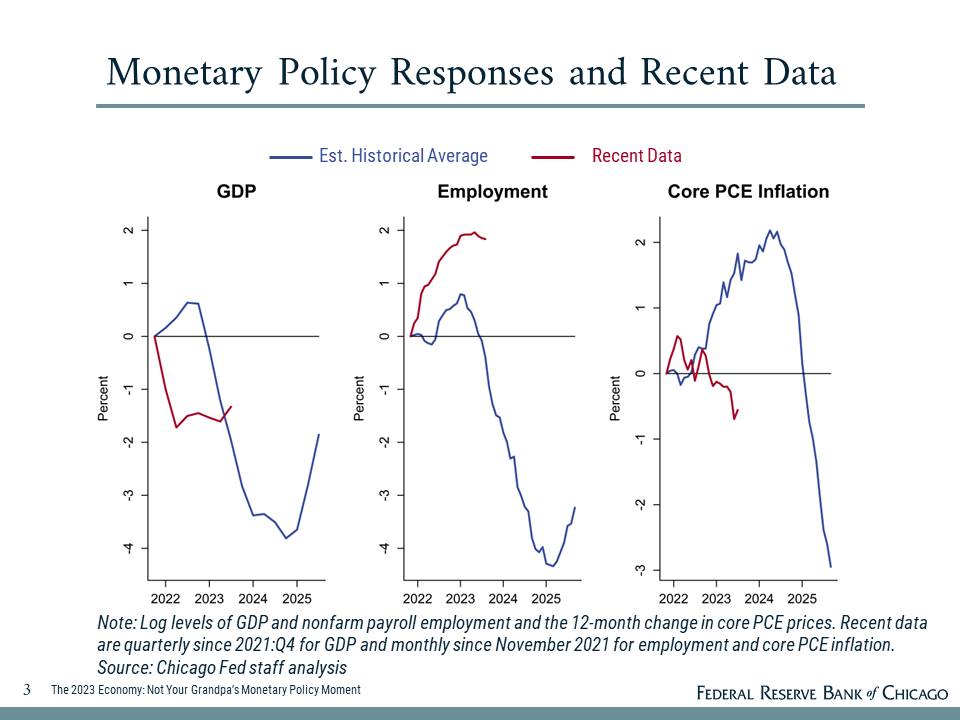

The red lines here show our actual experience so far. Notice how the real data have not followed the historical patterns at all. There are three points I want to make. First, GDP fell more quickly than the typical policy tightening effect. While the level at this moment is close to its average response, the typical pattern has further steep declines coming. Second, employment has been much stronger than expected, so it would need to weaken a lot to follow the typical relationship. Third, inflation fell much sooner than the historical average. And if past correlations were to hold, most of the reduction in inflation from monetary policy actions to date is still to come, and it would be large.

This traditional approach leaves us with a puzzle. Core inflation began moving down in 2023—not mid-2024. And it did so while the job market was still strong—not after it had already weakened substantially. For the traditionalist, the answer is that it must be noise: Just wait; the real economy will get much worse.

It’s possible. But another answer is that something very different is going on: Either nonmonetary shocks are heavily influencing the economy or the nature of the monetary policy environment we are working in today is different. I believe both of these factors are at play. If so, we need to be extra careful about indexing policy to this traditional view of what the incoming data on output and the labor market mean for the inflation outlook.

Sources of inflation

Let’s start with the sources of inflation. Recall that inflation began to soar in 2021 even as the unemployment rate exceeded 6 percent and GDP was well below previous estimates of potential output. Such elevated slack should have lowered inflation, not raised it. Also, inflation surged all over the world, including in places with different fiscal responses, also suggesting something else was at work.3

In my view, the most important factors were Covid-related. There were well documented negative supply chain shocks and unusual shifts in the composition of demand. Adding to supply side difficulties, Covid reduced labor supply as labor force participation—especially for women and those nearing retirement—dropped and immigration collapsed.

There are analysts who don’t agree with the predominantly-supply-shocks view of inflation. They observe that supply chain disruptions and severe labor dislocations typically impact isolated sectors and, therefore, show up as a few relative price changes rather than a widespread increase in prices across the board.

It’s worth reexamining the evidence on our actual experience, though. I think a lot of the evidence points to the supply disruption channel. Chad Syverson’s (2023) contribution to this year’s Jackson Hole conference showed substantial differences in inflation across a wide range of industries, with the biggest price increases associated with the smallest increases in quantity, fully consistent with the role of supply shocks as an important driver of overall inflation.

Research with a more macroeconomic focus also finds a large role for supply shocks, such as recent papers by Bernanke and Blanchard (2023) and Liu and Nguyen (2023). Our Chicago Fed dynamic stochastic general equilibrium (DSGE) model ascribes a large portion of the run-up in inflation to supply shocks as well.4

Fortunately, the negative supply shocks and demand distortions have been unwinding steadily, which have been important factors in bringing inflation down over the past year or so. Most metrics indicate that supply chains have improved considerably—also corroborated by our business contacts—and that improvement is likely to continue working its way through the economy.

We have also seen increases in labor supply. The prime-age labor force participation rate is at its highest level since 2001. Perhaps because of more flexible post-Covid work arrangements, the female labor force participation rate is hitting record highs, as is the participation rate for those with disabilities. Immigration has recovered as well.

Holding to the simple historical correlations of what growth and labor market conditions mean for inflation in the face of positive supply developments is a recipe for overshooting and causing an unnecessary downturn. Tying monetary policy too closely to contemporary output and labor market readings today risks giving a decidedly wrong answer.

Anchored inflation expectations

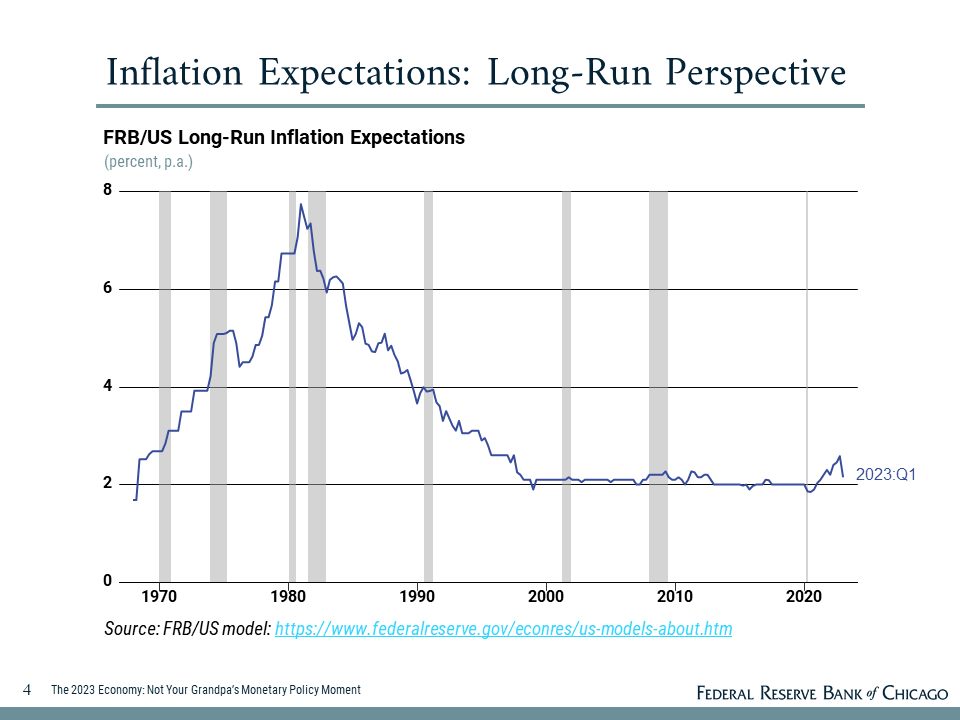

The second reason I think the traditionalist perspective on the current underlying economic environment may miss the mark is the role of central bank credibility in keeping inflation expectations anchored now versus in past periods of high inflation.

Regardless of what causes inflation, if high inflation rates get rolled into expectations of future inflation, it makes the job of reducing inflation that much harder. This is what happened in the 1970s: As inflationary psychology took hold, breaking it became extremely costly. It took much more aggressive tightening because inflation expectations had ratcheted up over time.

If economic agents make wage and price setting decisions that are consistent with their expectations, then inflation expectations become a strong attractor for actual inflation itself. Long-run inflation expectations that are anchored at our inflation target become an important force returning inflation to target with less economic pain than was needed in the past.

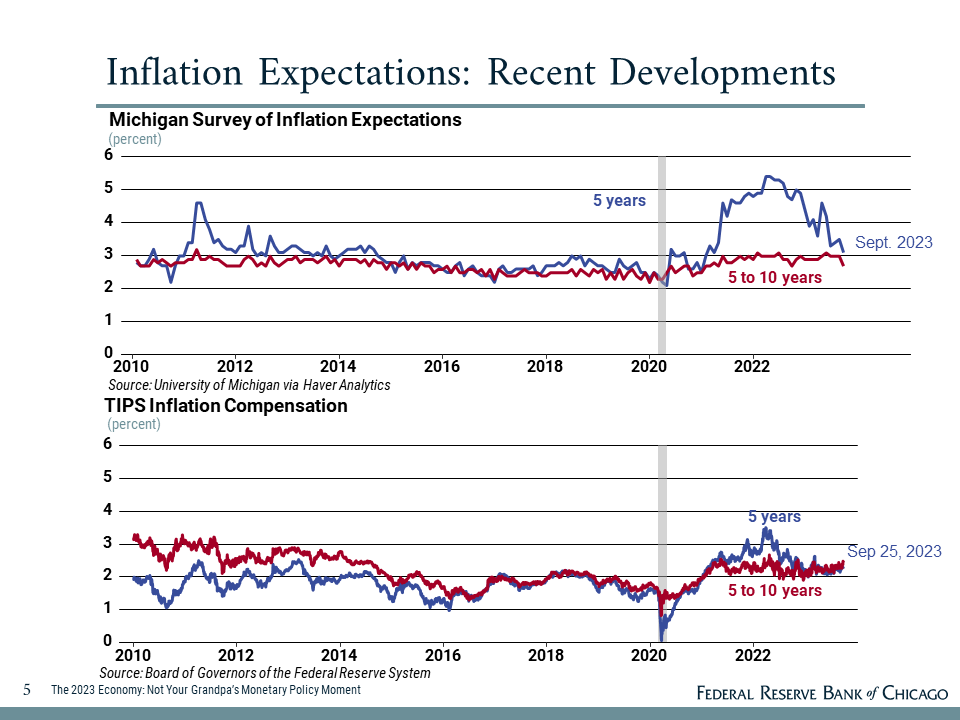

And as can be seen by these graphs, today long-run inflation expectations indeed appear to be well anchored. There are different ways to measure inflation expectations. The top panel shows a survey-based measure, and the bottom panel is a market-based measure. Both tell a similar story: Longer-run inflation expectations, shown in red, have not moved much during this entire inflationary episode.

The idea that anchored inflation expectations can pull down inflation without as much economic damage as has happened in the past (when expectations lost their anchor) is another important reason to downweight the traditionalist view right now. Of course, this anchoring didn’t come out of thin air; it hinges on a belief in the inflation-fighting credibility of the Fed. In turn, appropriate monetary policy actions and communications aimed at hitting our inflation target reinforce credibility, anchor inflation expectations, and support the effectiveness of monetary policy.

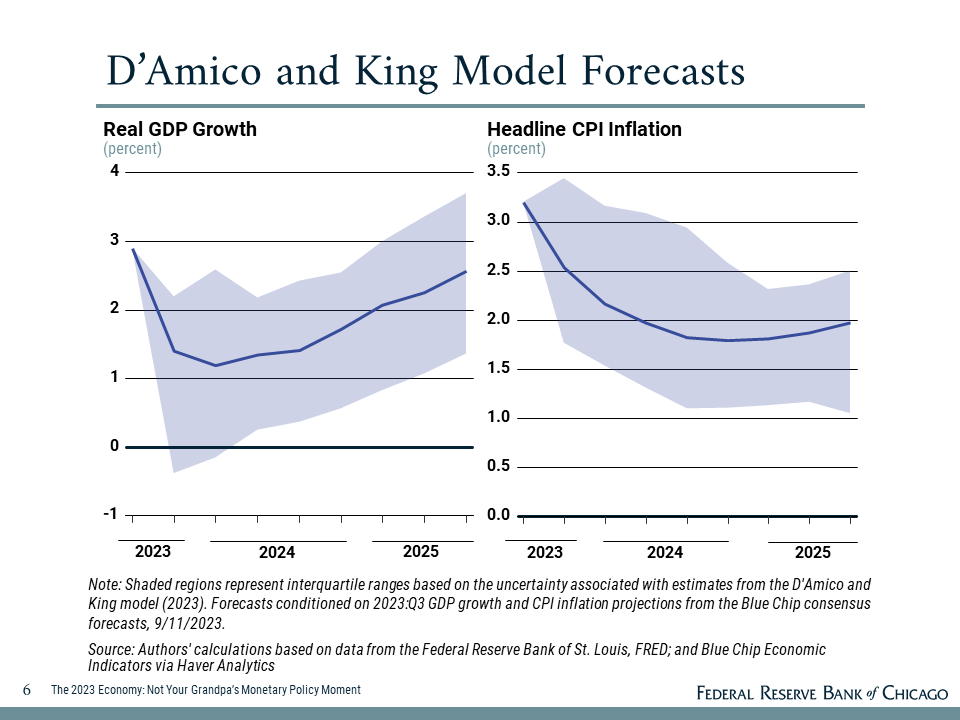

There is a lot of research studying this channel. One example is a model developed by two Chicago Fed economists, Stefania D’Amico and Tom King.5 Standard models—such as vector autoregressions (VARs) that capture the traditionalist view I talked about earlier—generally have no independent role for forward-looking behavior. They only pick up whatever is captured by the average dynamics estimated in the model.

Stefania and Tom’s model explicitly accounts for measures of private sector expectations of activity, inflation, and interest rates, allowing them to identify shocks to both the current policy rate and the expected path going forward. The model estimates that throughout this tightening cycle the public has formed expectations for tighter policy well in advance of actual changes in the policy rate.

This results in more front-loaded effects on output and inflation than traditional analyses show, and although the confidence intervals are large, the forecasts from the model shown here have inflation reaching target soon, with only a modest slowing in GDP growth—what I have called the “golden path.” And these outcomes are achieved without further policy tightening.

Now, some people don’t like the specific assumptions of any particular model. So fine. Forget the models. If you think expectations matter, just go look at them. Today, market participants largely expect the Fed to raise rates only a bit more and then hold them there for a while. And their economic forecasts generally see inflation getting down to target without a major recession, pretty much in line with the “golden path.” And as long as they expect that, it makes the outcome easier to achieve.

On a side note, the importance of inflation expectations and Fed credibility is why I think recent proposals to change the inflation target to something higher are quite risky. To do so now would undermine the power of expectations to bring actual inflation down. No matter what level the target, no matter what measure of inflation, the whole benefit of announcing a target comes from people expecting that you will do what it takes to achieve it. Raising the target when inflation is above the target would undermine the credibility of the Fed’s commitment to any inflation target and impairs the very mechanism of how it is supposed to help. It’s a recipe for ratcheting up inflation expectations just like we saw in the old days.

Risks

The unwinding of supply shocks, the composition of demand returning to more stable patterns, and Fed credibility are central to why I think it might be possible today to reduce inflation while avoiding a deep recession. These factors also argue against putting too much weight on the idea that strong labor market and growth conditions will necessarily stall out the disinflationary process. Doing so risks policy overshooting and unnecessarily derailing the expansion.

Of course, the golden path is not guaranteed. External shocks pose risks to the outlook. Earlier, less challenging soft landings such as in 1990 and 2001 were derailed by such shocks. Today we are faced with oil price hikes, the slowdown in China, the possibility of an expanded and prolonged auto strike, and the potential for a disruptive government shutdown. Each of these shocks could have important effects on the economy—either directly or indirectly through consumer and business confidence or through financial markets.

What to pay attention to?

So, if I am arguing that at this moment real-side economic conditions are not the primary thing telling us how soon we will get to target inflation, what should an empirically minded data dog pay closest attention to over the next few quarters? I will give you my big four.

One, watch the composition of price dynamics. I and others have remarked on this before, so let me be brief. Core inflation getting back to 2 percent must come from a combination of falling inflation for goods, housing,6 and nonhousing services. Before Covid, core inflation was actually running steadily somewhat below 2 percent. Over that time goods prices were falling about 1 percent, housing prices were rising about 3 percent, and inflation for services excluding housing was close to 2.5 percent. So, scale those up a few tenths and you have an idea of where we need to be heading.

Looking at recent three-month annualized changes, we already got core Consumer Price Index (CPI) inflation down to 2.4 percent; we’ll update that for core PCE tomorrow, but we have made excellent progress and wouldn’t be far from target if we can sustain it. Much of that improvement came from goods inflation getting back down to about –1 percent as before Covid. Housing inflation has fallen noticeably in recent months, and more is expected given the leading data on new-tenant market rents. Nonhousing services inflation is still near 4 percent, and given the persistence of inflation here, only small and gradual improvements can be expected for this piece. All this means that over the next few quarters the key to further progress will be what happens to housing inflation. Continued progress would bode well, but there is a risk that recent increases in home prices could spill over to market rents and stall the improvement here. So, this is a critical risk to monitor.

Two, watch productivity growth. Here there has been a little good news that affects the prospects for both growth and real wages. Productivity data are notoriously noisy, but it appears as if we could be settling in at a trend rate not far from what it was pre-pandemic, instead of the lower rate we were running in 2022 and early ’23. If so, the pace of long-run nominal output or wage growth consistent with our 2 percent inflation target would not be as low as some have feared.

Three, don’t obsess over the near-term path for real wages. Many have expressed concern that a tight labor market with wages rising faster than prices would result in a wage–price spiral. Some have gone further and implicitly argued that the Fed’s stopping rule should be tied to getting wage growth down to a level consistent with 2 percent inflation.

We need to be especially careful about that type of argument. Over long periods of time, wages (adjusted for productivity) and prices grow in tandem. In the shorter term, however, wages generally are stickier than prices. This tends to make unit labor costs a lagging indicator of inflation.7 This doesn’t mean that wages are unimportant. They are a major input cost to most industries. But it does mean we shouldn’t be using short-term wage growth to predict inflation; indexing our monetary policy decisions to it at a moment of transition like this would almost certainly mean overshooting.

And four, keep your eye on inflation expectations. As I noted earlier, their role is central to our effort. Expectations currently show a benign view of the economy and the road back to stable target inflation. The fact that they do makes the job that much more achievable. But if the influence of improved supply conditions wanes too quickly or other factors impinge on the disinflationary process, rising inflationary expectations could be one of the early signals that policy needs to adjust.

Conclusion

At the end of the day, we will get inflation back to our target, whatever that takes. Inflation still needs to come down. But we also can’t lose sight of the fact that the Fed has the chance to achieve something quite rare in the history of central banks—to defeat inflation without tanking the economy. If we succeed, the golden path will be studied for years. If we fail, it will also be studied for years. But let’s aim to succeed.

And like with my grandpa’s investment tips, let’s be prepared to recognize when historical lessons might not work that well for today’s environment. No, at this moment, it feels like the Fed might do better following Grandpa Jack’s West Texas ranch advice instead: “Work ’til it’s dark and pray for rain.”

Thank you.

Notes

1 For additional information on the Chicago Fed research staff’s recent update of this analysis, please contact Mark Peters.

2 The Fed’s preferred inflation gauge is the annual change in the Price Index for Personal Consumption Expenditures (PCE). Core inflation strips out the volatile food and energy sectors and is a better indicator of underlying inflation trends than is total inflation.

3 Hobijn et al. (2023).

4 Campbell et al. (2023).

5 D’Amico and King (2023).

6 Housing includes tenants’ and owners’ equivalent rent.

7 The U.S. Bureau of Labor Statistics calculates unit labor costs as the ratio of hourly compensation to labor productivity. Increases in compensation that are accompanied by rising productivity do not necessarily add to production costs. See Barlevy and Hu (2023).

References

Barley, Gadi, and Luojia Hu, 2023, “Unit labor costs and inflation in the non-housing service sector,” Chicago Fed Letter, Federal Reserve Bank of Chicago, March, No. 477. Crossref

Blanchard, Olivier J., and Ben S. Bernanke, 2023, “What caused the US pandemic-era inflation?,” National Bureau of Economic Research, working paper, No. 31417, June. Crossref

Campbell, Jeffrey R., Filippo Ferroni, Jonas D. M. Fisher, and Leonardo Melosi, 2023, “The Chicago Fed DSGE model: Version 2,” Federal Reserve Bank of Chicago, working paper, No. 2023-36, September. Crossref

D’Amico, Stefania, and Thomas B. King, 2023, “Past and future effects of the recent monetary policy tightening,” Chicago Fed Letter, Federal Reserve Bank of Chicago, No. 483, September. Crossref

Hobijn, Bart, Russell A. Miles, James Royal, and Jing Zhang, 2023, “The recent steepening of Phillips curves,” Chicago Fed Letter, Federal Reserve Bank of Chicago, No. 475, January. Crossref

Liu, Zheng, and Thuy Lan Nguyen, 2023, “Global supply chain pressures and U.S. inflation,” FRBSF Economic Letter, Federal Reserve Bank of San Francisco, No. 2023-14, June 20, available online.

Romer, Christina D., and David H. Romer, 2004, “A new measure of monetary shocks: Derivation and implications,” American Economic Review, Vol. 94, No. 4, September, pp. 1055–1084. Crossref

Syverson, Chad, 2023, “Structural shifts in the global economy: Structural constraints on growth,” remarks at the Federal Reserve Bank of Kansas City’s Jackson Hole Economic Policy Symposium: Structural Shifts in the Global Economy, Jackson Hole, WY, August 25, available online.