In this Chicago Fed Insights article, we unveil version 2.0 of our Chicago Fed Advance Retail Trade Summary (CARTS) and provide a preview of what it signals for retail spending during the 2023 holiday season in the United States.

The Chicago Fed Advance Retail Trade Summary debuted in mid-2021. A summary measure of multiple high-frequency indicators for consumer spending (including payment card transactions, retail foot traffic, gas sales, and consumer sentiment), CARTS grew out of pandemic-era research that aimed to improve on the timeliness and reliability of traditional measures of retail spending in the U.S. To achieve this end, it introduced a new weekly index that was benchmarked to the U.S. Census Bureau’s measure of retail & food services sales excluding motor vehicles & parts (ex. auto), allowing for a direct comparison with the latest Monthly Retail Trade Survey (MRTS) and a nowcast of the next release of the Advance Monthly Retail Trade Survey (MARTS).

CARTS 1.0 came to an end in early 2022, when production was suspended after the loss of data from several data providers. In this Chicago Fed Insights article, we unveil the new and improved CARTS 2.0 and use it to preview retail spending for the 2023 holiday season.

CARTS 2.0

We expand upon the base provided by CARTS 1.0 to include a broader set of alternative consumer spending indicators. The eight weekly times series1 included in CARTS 2.0 are each seasonally adjusted2—and, in some cases, merged or transformed with other data sources—to provide a complete history extending from January 2018 through the present.3

In addition to the payment card data CARTS originally used from the firms Consumer Edge and Facteus, we now include the card data that the U.S. Bureau of Economic Analysis (BEA) publishes and similar data from SafeGraph. Replacing the retail foot traffic data formerly from SafeGraph is a new series constructed instead from data provided by SafeGraph’s partner Advan. Finally, to better cover the space of noncard transactions, we introduce into CARTS 2.0 a new data source from the company Numerator that tracks U.S. retail spending from detailed receipt-level data. Finally, we add our previously included weekly measures of consumer sentiment from Morning Consult and gasoline sales from the U.S. Energy Information Administration (EIA).

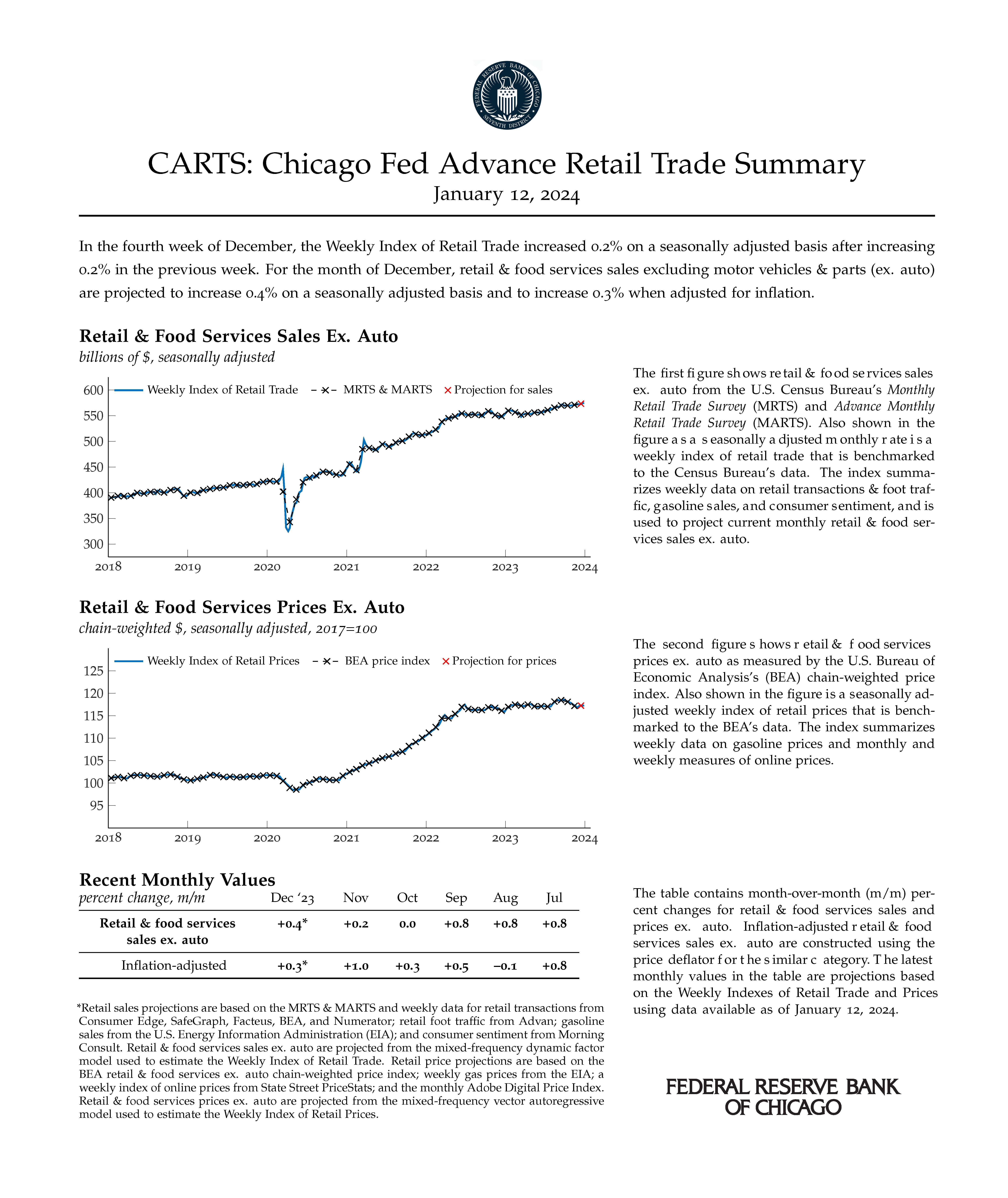

The key feature of CARTS is its ability to combine these eight weekly data series with the U.S. Census Bureau’s monthly data on retail & food services sales ex. auto in a time-consistent fashion. The result is a Weekly Index of Retail Trade that is designed to match, when aggregated to a monthly frequency, the available Census Bureau data, and to provide an initial estimate of these data ahead of each month’s release from the Census Bureau.

The Census Bureau data are measured in nominal terms, meaning that they are not adjusted for changes over time in the prices of retail goods and services. To account for this fact and arrive at a measure of real consumer spending, CARTS also contains a weekly estimate of the price deflator used by the BEA to convert retail sales into an inflation-adjusted spending measure. This Weekly Index of Retail Prices is constructed much like its sales counterpart, matching, when aggregated, the BEA’s monthly chain-weighted price index whenever it is observed and providing an early estimate of it ahead of each new release.

Informing our weekly estimate of retail prices are measures of online prices from State Street PriceStats (weekly) and Adobe (monthly) and weekly gas prices from the EIA. The addition of the Adobe Digital Price Index and EIA gasoline prices to the CARTS 2.0 model used to estimate the Weekly Index of Retail Prices helps to provide a timelier indication of changes in retail prices and, as a result, a more reliable measure of inflation-adjusted retail sales in CARTS.

Latest results

Beginning in February 2024, the Federal Reserve Bank of Chicago will resume providing the Chicago Fed Advance Retail Trade Summary twice a month: 1) a day ahead of the U.S. Census Bureau’s MARTS release summarizing data through the end of the prior month and 2) at the end of each month summarizing data available through mid-month. A preliminary release schedule is available online. As we work to continue to improve our technical infrastructure for CARTS, additional release dates may be added.

As a preview of what information will be provided once CARTS is relaunched, we summarize below the CARTS 2.0 preliminary results for December 2023.

Notes

1 We use a regularized weekly calendar that runs from days 1–7, 8–14, 15–21, and 22 to the end of each month. The varying number of days in the fourth week of each month is then corrected for during seasonal adjustment.

2 Our seasonal adjustment procedure incorporates the U.S. Census Bureau’s monthly seasonal factors and allows as well for seasonal variation at the weekly frequency driven by retail holidays in the U.S. and other seasonal factors. All of this takes place jointly in the R programming language using the Prophet package developed by Facebook’s data scientists.

3 For instance, we use the history of nonstore payment card transactions from the company Womply that was part of CARTS 1.0 to backfill and obtain an initial level for nonstore credit & debit card transactions from the U.S. Bureau of Economic Analysis (BEA).