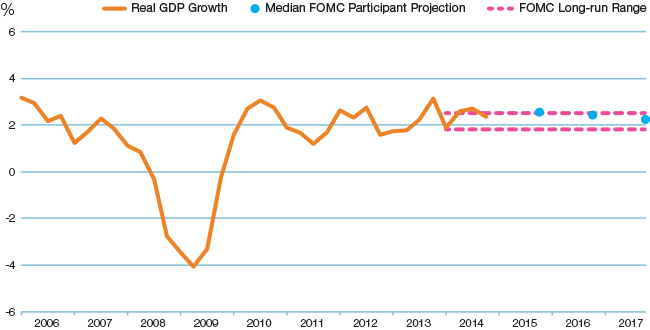

Economic Growth

Year-over-Year Real Gross Domestic Product Growth

Data current as of April 15, 2015. Sources: Data from the Bureau of Economic Analysis and the Board of Governors of the Federal Reserve System, accessed via Haver Analytics.

Economic Growth

The year began with a decline in real gross domestic product (GDP) that proved to be transitory. Growth was then very strong in the second and third quarters and moderated in the fourth quarter. In sum, from the fourth quarter of 2013 to the fourth quarter of 2014, real GDP increased 2.4 percent. Looking ahead, the Federal Open Market Committee's (FOMC) projections from March 2015 anticipate that over the next two years economic growth will remain slightly above most participants’ views of the long-run trend rate of growth in GDP.

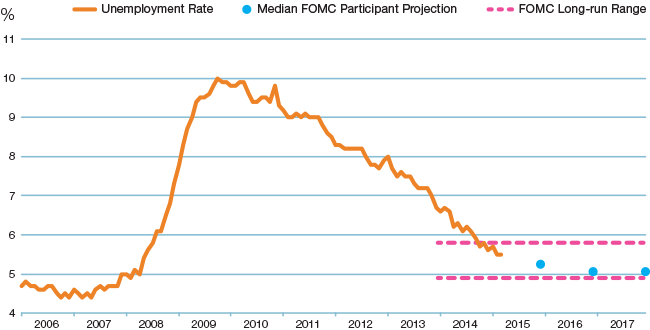

Labor Markets

Percent of Labor Force Unemployed

Data current as of April 15, 2015. Sources: Data from the Bureau of Labor Statistics and the Board of Governors of the Federal Reserve System, accessed via Haver Analytics.

Labor Markets

With the economy expanding, gains in payroll employment averaged 260,000 per month in 2014, and the unemployment rate fell by more than a percentage point to 5.5 percent in March 2015. This progress brought the FOMC much closer to achieving the full employment side of its mandate, with participants in March 2015 projecting a range of 4.9 percent to 5.8 percent for the natural rate of unemployment. It should be noted though that some measures of labor market slack remain elevated relative to the unemployment rate.

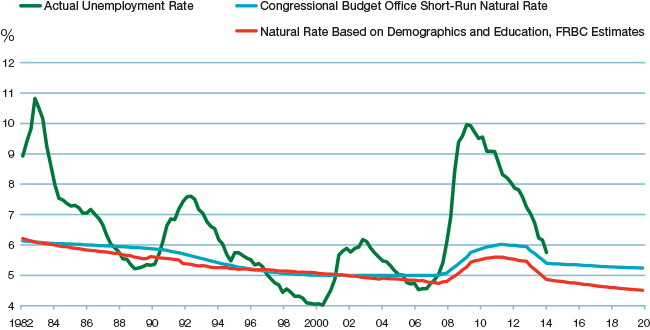

Unemployment Research

Actual Unemployment Rate and Natural Rates

Data current as of April 15, 2015. Sources: Bureau of Labor Statistics and Congressional Budget Office, accessed via Haver Analytics and authors’ calculations from the Current Population Survey.

Unemployment Research

The unemployment rate measures the number of unemployed people actively searching for work as a percent of the number of people in the labor force. Estimates of the level of unemployment that is consistent with maximum employment are uncertain and can evolve over time. New research from the Chicago Fed indicates that compositional changes in the labor force — such as the growing number of younger workers — may have reduced the natural rate of unemployment by up to 0.6 percentage points since 2000 to a current level of roughly 5.0 percent.

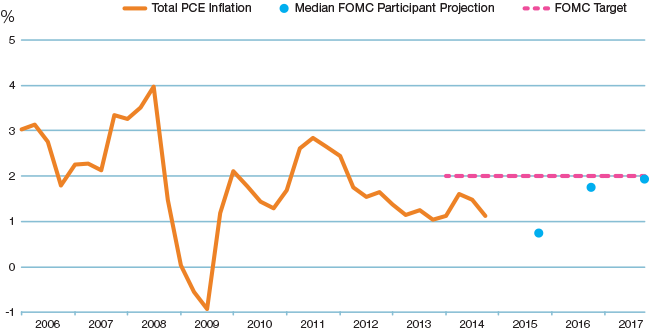

Inflation

Year-over-Year Personal Consumption Expenditures (PCE) Inflation

Data current as of April 15, 2015. Sources: Data from the Bureau of Economic Analysis and the Board of Governors of the Federal Reserve System, accessed via Haver Analytics.

Inflation

Inflation in 2014 remained below the two percent target the FOMC views as consistent with the Federal Reserve's mandate to achieve price stability. After briefly rising in the first half of 2014, inflation moved lower in the second half of the year due to declining energy prices, ending 2014 at 1.1%. Core inflation – which does not include the volatile food and energy components – also moved down during the year and was 1.4 percent in the fourth quarter of 2014. The FOMC expects that inflation will begin to move up toward its target over the next two years as the labor market improves further and the transitory effects of energy price declines and other factors dissipate.

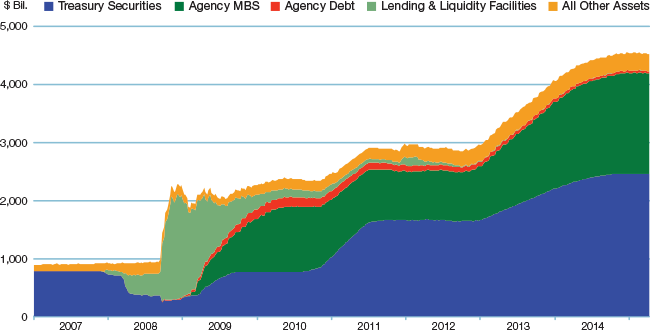

Balance Sheet

Federal Reserve Asset Categories

Data current as of April 15, 2015. Sources: Data from the Board of Governors of the Federal Reserve System, accessed via Haver Analytics.

Balance Sheet

Responding to continued economic growth in 2014, the FOMC steadily reduced the pace of asset purchases. At the conclusion of the purchase program in late 2014, the Federal Reserve held $4.5 trillion in assets, an increase of $1.7 trillion from the beginning of the most recent asset purchase program in September 2012.

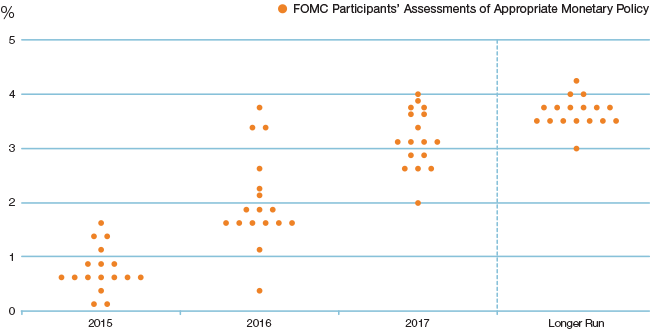

Federal Funds Rate

Target Federal Funds Rate at Year-End

Data current as of April 15, 2015. Sources: Data from the Board of Governors of the Federal Reserve System, accessed via Haver Analytics.

Federal Funds Rate

The federal funds rate has been at a near-zero level since 2008. With the economy expected to expand at a somewhat above-trend rate in the next few years, the funds rate should move back up toward what has historically been considered normal. A majority of FOMC participants expect that it will be appropriate to increase the rate sometime in 2015. However, a diversity of views exists as to the rate’s appropriate level in 2015 and beyond, as the timing and pace of future rate increases will depend on the evolution of economic and financial conditions.