As I think about our progress promoting the Federal Reserve’s dual goals of maximum employment and stable prices, I believe that last year we arrived at the appropriate stance for monetary policy. Communication is an important component of monetary policy, and the Fed’s communications evolved significantly in 2012. Most importantly, we clarified how our policy decisions are conditional on making adequate progress toward maximum employment and stable prices by making future policy decisions depend on economic conditions, not calendar time. I strongly supported this decision, as I have advocated since 2011 that the most appropriate federal funds rate forward guidance would feature this type of economic conditionality. I am confident that this course of action will instill confidence in the public that monetary policy will continue to be accommodative until economic conditions improve substantially. This report offers a short chronology, starting on page 4, of our policy communications as the year progressed and explains why I feel that the actions we took in 2012 were important ones.

In addition, this report features an extensive essay on another important issue: how our regulatory responsibilities continue to evolve, all with the ultimate goal of promoting financial stability. A detailed essay on this topic begins on page 8.

Managing any type of change requires the commitment of a very dedicated, talented and flexible group of staff members, and I am happy to say we have that at the Chicago Fed. As always, we also appreciate the contributions of our directors, whose guidance and counsel is invaluable to the success of our operations, as is their first-hand knowledge of regional business conditions.

Of note are the following members of the Chicago board who completed their service in 2012: Ann Murtlow, president and chief executive officer of AM Consulting LLC in Indianapolis, Indiana; Bill Foote, retired chairman of Chicago-based USG Corporation, who was chairman of the Chicago board for three years; and Steve Goodenow, chairman and chief executive officer of Bank Midwest in Spirit Lake, Iowa. I would also like to thank Detroit branch director Brian Walker, president and chief executive officer of Herman Miller, Inc. in Zeeland, Michigan, who also completed his service in 2012.

In conclusion, I hope you find this annual report useful and informative as we continue our efforts to return the U.S. economy to a level of performance that is solid and sustainable. We appreciate the opportunity to serve you.

Charles L. Evans

President and Chief Executive Officer

April 1, 2013

The U.S. economy continued to recover slowly in 2012. Real gross domestic product (GDP) grew a disappointing 1.7 percent over the course of the year, slightly below the pace in 2011. While the recovery continues to face headwinds emanating from both here and abroad, most professional forecasters expect growth to pick up this year. The median of the Federal Open Market Committee’s (FOMC) projections from its March 2013 meeting is for growth to reach about 2.5 percent in 2013.

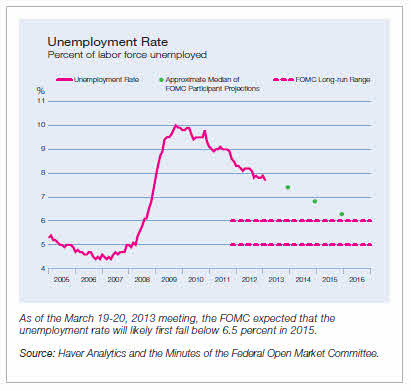

Over the course of last year and into early 2013, the unemployment rate fell by slightly less than 1 percentage point. While it remains well above the FOMC’s view of its long-run range, the Committee in March projected that growth in the economy will be sufficient to bring the unemployment rate a bit below 7 percent by the end of next year. However, it is still expected to be some time further before the unemployment rate declines to a level consistent with the employment side of our dual mandate.

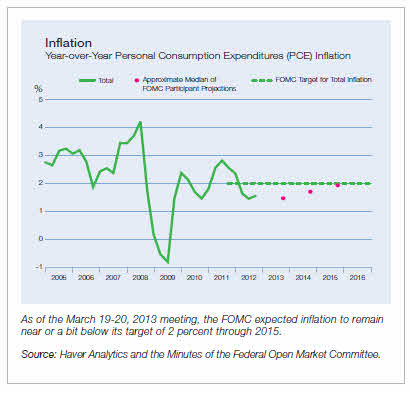

Looking at the price stability side of our mandate, the FOMC continues to expect inflation to remain near or a bit below its target of 2 percent through 2015. The Personal Consumption Expenditures (PCE) price index ended the fourth quarter of 2012 1.6 percent higher than in the fourth quarter of 2011. Excluding volatile food and energy prices, core PCE inflation was up 1.5 percent over the same period.

The Economy

Growth in household spending was again modest in 2012. Households continued to be challenged by a debt overhang and large losses of wealth that were incurred during the financial crisis. Spending on nondurables and services was soft throughout the year. In contrast, purchases of durable goods, spurred by increases in light vehicle sales, were more robust and the housing market strengthened.

The labor market, though still tepid, showed signs of improvement. Additions to nonfarm payrolls averaged 183,000 new jobs per month in 2012, slightly higher than the pace in 2011, for a total of 2.2 million new jobs. Likewise, initial claims for unemployment insurance reached their lowest levels since early 2008, and the unemployment rate declined to 7.7 percent by February 2013.

Growth in business investment slowed in 2012. Business spending on new equipment and software decelerated, perhaps as firms grew cautious given the uncertainty surrounding the future course of fiscal policy. Although the immediate threats from the end-of-the-year fiscal cliff were avoided, there still are many issues to resolve regarding the course of government spending and tax policy.

Demand from abroad also weakened last year, as our trading partners confronted their own economic and financial difficulties. The Eurozone entered into a recession, and the most recent forecasts look for only modest growth during 2013 as a whole. In Asia, growth in China appears to be gaining momentum after slowing down somewhat last year, but analysts are not forecasting a return to the heady double-digit growth rates China experienced a few years ago.

Cost pressures were again moderate and wage growth modest in 2012. Unit labor costs in the nonfarm business sector ended the fourth quarter of 2012 at a level 2.1 percent higher than in the fourth quarter of 2011, a modest increase from the 1.3 percent increase over the same period during the prior year.

Financial conditions continued to improve. Low interest rates have helped many households and businesses pare debt burdens and restructure their balance sheets. This has particularly been true for businesses with access to the bond market, and so today many firms have plenty of cash on hand and are well-positioned to ramp up activity when more and more customers begin to show up at their door.

Monetary Policy

Though much progress has been made, our country’s continued recovery hinges critically on maintaining the current highly accommodative stance for monetary policy. One aspect of that accommodation is the Federal Reserve’s open-ended large-scale asset purchase program. Each month, the Federal Reserve is buying $85 billion of mortgage-backed securities and long-term Treasury securities. Another tool is the exceptionally low level of the federal funds rate and the Federal Reserve’s forward guidance about the federal funds rate — that is, our commitment to leave the rate at essentially zero until adequate progress is made toward economic recovery.

After its December 2012 meeting, the FOMC gave a clear statement of the economic conditions under which it expects that it would begin to remove its policy accommodation. Specifically, the Committee stated that the federal funds rate will remain within its current range at least as long as the unemployment rate remains above 6.5 percent, medium-term inflation is projected to be no more than 2.5 percent, and longer-term inflation expectations continue to be well anchored. Moreover, when it does become time to begin to remove policy accommodation, the Committee intends to take a balanced approach consistent with its dual mandate.

When making their projections in March 2013, fourteen out of nineteen FOMC participants did not expect policy firming to commence before 2015. By the end of 2015, a majority of participants expected the funds rate to remain at or below 1 percent, and only one expected the rate to be in the 4.0 to 4.5 percent range judged to be appropriate by the Committee in the longer run.

*This essay reflects information available as of March 28, 2013.

Effective Communication Matters

The goal of monetary policy is to foster financial conditions that support both full employment and price stability. Effective communication is an important element of the process. Clear articulation of our goals and actions helps reduce financial and economic uncertainty and facilitates better informed decision-making by households and businesses. In the current economic environment, effective communication plays an additional role. We have already brought our primary policy tool, the federal funds (fed funds) rate, down to its lower bound of zero. We simply cannot reduce the funds rate any further to provide additional support to the economic recovery. However, as explained below, clear guidance about our commitment to keep rates low in the future can provide such added policy accommodation and, hopefully, quicken our return to full employment within the context of price stability.

January – Statement of Principles and Projections for the Appropriate Path for Policy

The year began with the Federal Open Market Committee (FOMC) providing the public with a statement of the principles guiding its conduct of monetary policy. This is the first such statement the FOMC has made. It clarified the Committee’s thinking in three key areas:

- First, the FOMC explicitly set a longer-run goal for inflation of 2 percent, measured by the annual change in the price index for Personal Consumption Expenditures. In providing this yardstick, the Federal Reserve is better able to anchor longer-term inflation expectations, which are an important determinant of actual future inflation.

- Second, the statement notes that the maximum level of employment is determined by a number of factors that can fluctuate over time and are outside the direct control of monetary policy. Therefore, the FOMC does not set a specific employment target. Rather, the Committee’s assessments about maximum employment are informed by a wide range of labor market indicators and are necessarily subject to uncertainty. A long-run benchmark can be gleaned from participants’ long-run unemployment projections in the FOMC’s quarterly Summary of Economic Projections (SEP). The central tendency of these most recent unemployment forecasts was 5.2 percent to 6.0 percent.

- Third, the statement clarifies that if the FOMC judges that the policy prescriptions necessary to meet its two goals are not complementary, then it will take a balanced approach when setting policy. In doing so, the Committee will consider both the magnitude of deviations from each goal and the anticipated time horizons over which employment and inflation are expected to return to levels consistent with Fed objectives.

In another January communications development, FOMC participants’ assessments of the appropriate future path for the target federal funds rate were added to the SEP. These additions complement the projections of inflation, output, and unemployment already included in the SEP. Given current conditions, the projected policy paths provide important information about the likely timing and magnitude of future changes in the fed funds rate.

September – Open-Ended Large-Scale Asset Purchase Program

At its September meeting, the FOMC added a new directive to purchase agency mortgage-backed securities (MBS) at a pace of $40 billion per month. Rather than stipulating a total dollar amount to be spent over a specific period, as had been the case with earlier programs, this time the FOMC made a significant policy change and tied the duration of the purchases and possible changes to the program to the achievement of a substantial improvement in labor market conditions within the context of price stability.1 This economic conditionality was an important addition, as it signaled our commitment to provide further monetary accommodation if we did not see adequate progress toward our policy goals.

In addition, in its discussion of the fed funds rate, the September FOMC statement noted that the Committee “expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the economic recovery strengthens.” Many modern macroeconomic models suggest that such a long-term commitment to accommodation — beyond what would be typical during an economic recovery — is warranted following a period with rates stuck at the zero lower bound. The delay in raising rates makes up for the time when they were constrained from going negative. In other words, the average path for rates will be closer to being right over time.

December – Economic Conditionality and the Fed Funds Rate

In December 2012, the FOMC enhanced its forward guidance about future monetary policy actions by moving from using a calendar date to using more specific economic conditions to describe when it would consider beginning to remove policy accommodation.2 Namely, the Committee’s statement after the December meeting indicated that the fed funds rate will stay within its current range at least as long as the unemployment rate remains above 6-1/2 percent, medium-term inflation is projected to be no more than 2-1/2 percent, and long-term inflation expectations continue to be well anchored. Moreover, the Committee stated that when it does begin to remove policy accommodation, it will take a balanced approach that is consistent with its longer-run goals of maximum employment and 2 percent inflation.

By tying the timing of the fed funds rate lift-off to specific economic conditions, the FOMC clarified that its policy decisions are conditional on whether we are making adequate progress toward our dual mandate goals. Such progress is measured by economic conditions, not calendar time. Indeed, because it is impossible to anticipate all potential developments affecting the outlook, the Committee cannot commit firmly to a date when those economic conditions will be achieved. Furthermore, the particular thresholds that were chosen more accurately convey the Committee’s intent to keep rates near zero even after the recovery is firmly entrenched. And the inflation threshold does not mean we are abandoning our commitment to a 2 percent inflation target. Rather, the slightly higher threshold simply captures how the committee’s symmetrical view of our long-run goal allows for inflation at times to run modestly above 2 percent.

Conclusion

With a clearer understanding of the Fed’s thinking surrounding policy actions, the public can be more confident that the Federal Reserve will provide the monetary accommodation necessary to close the large resource gaps that currently exist in our economy. Additionally, the public can be certain that we will not wait too long to tighten monetary policy if inflation becomes a substantial concern. The steps taken over the past year represent important improvements in communicating both this resolve and the actions the committee would take in order to achieve its dual mandate goals.

1These MBS purchases were in addition to the existing Maturity Extension Program (MEP), in which the Federal Reserve was selling $45 billion per month of short-term Treasury securities and in their place buying $45 billion of long-term Treasury securities. In December 2012 the Committee decided that when the MEP was completed at the end of the year, it would be replaced with $45 billion per month of outright purchases of longer-term Treasury securities, which would continue under the same conditions as the new MBS program.

2In December 2008, when it first lowered the federal funds rate to zero, the FOMC’s policy statement indicated that “the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.” In March 2009, “for an extended period” replaced “for some time” in the policy statement. In August 2011, the statement began indicating a calendar date through which the Committee expected an exceptionally low level of the fed funds rate likely would be warranted. Subsequently, as the economic outlook and policy positions evolved, so did the calendar date in the statement.

The Federal Reserve Bank of Chicago is committed to operating in a socially responsible manner. Staff members carried out a wide variety of activities in 2012 that promoted environmentalism, volunteerism, economic and financial education, community and economic development, regional economic outreach, employee diversity and inclusion, and supplier diversity.

Formulating Monetary Policy

- Participated in meetings of the Federal Open Market Committee, the group headed by Chairman Ben Bernanke that makes national policy decisions.

Conducting Economic Research

- Provided high-caliber research on many vital topics and provided outstanding analysis concerning national and regional economic policy, labor markets, the insurance and payments industries, and the impact of contagion risk on sovereign bond yields.

- Studied state and local government policies, including research on the sector’s behavior during cyclical swings.

- Published a series of working papers on the risks of high-speed trading and its impact on the financial markets.

Supervising and Regulating Banks

- Banking conditions continued to improve throughout the District; however, the department experienced a 6% increase in supervisory events as problem banks continued to work through their existing issues.

- Responded to heightened supervisory requirements and implemented additional supervision programs as required by the Dodd-Frank Act while exceeding all mandates and timeliness expectations for conducting exams and delivering accurate supervisory reports.

- Gained oversight responsibility for three of the eight designated systemically important Financial Market Utilities (FMUs), partnering with Central Bank Services and the Financial Markets Group to identify policy, procedural, and legal issues for providing access to accounts, services, and emergency credit to these FMUs.

- Provided leadership of System efforts around Large Bank supervision, wholesale credit, stress testing, incentive compensation and IT examinations.

Providing Central Bank Services

- Provided leadership on a high-priority System project to develop a methodology for calculating the additional haircut on discount-window collateral pledged by troubled depository institutions.

Fostering Good Customer Relations and Support

- Met critical objectives, exceeded FedLine revenue targets, and led the communication efforts to inform stakeholders of the new Federal Reserve Financial Services strategic direction.

- Hosted the 2012 Chicago Payments Symposium, which introduced the new strategic direction to the payments industry.

Fostering Community Development and Studying Policy

- Studied community and economic development issues including trends impacting low- to moderate-income communities.

- Analyzed the availability of financial services in Detroit and how changes in the location of financial service providers affect the availability of credit and banking services for Detroit’s small businesses.

- Convened small business owners, lenders, and service providers to discuss potential solutions to financing problems.

Carrying Out Currency Responsibilities

- Met all performance targets while maintaining a strong control environment.

- Provided uninterrupted currency services during the NATO Summit held in Chicago.

Promoting Diversity and Inclusion

- Sustained emphasis on diversity and inclusion initiatives, continuing to provide key leadership to national diversity recruitment and national diversity supplier programs.

- Conducted diversity and inclusion training for all people leaders in the organization.

- Continued to attract a strong pool of diverse and highly skilled candidates, support professional growth and development for staff, and expand the District’s succession management strategies with a focus on diversity-related issues.

Fostering Partnerships

- Sustained a successful track-record of partnering with others throughout the System, leading and participating on numerous System-level committees, projects, and workgroups.

Creating a Healthy Work Environment

- Received certification for Leadership in Energy and Environmental Design for Existing Buildings (LEED-EB) Silver.

- Opened a new Wellness Center for employees.

Other

- Completed construction of new Business Continuity Office emergency relocation site, which became fully functional in November.

- Continued to coordinate and grow Money Smart Week, with more than 3,000 free financial education classes offered in more than 35 states. Classes are hosted by partner organizations including financial institutions, universities, government agencies, community groups and libraries.

The work of the Federal Reserve Bank of Chicago’s Supervision and Regulation Department (S&R) has expanded sharply in the wake of the financial crisis. S&R is supervising new companies, participating in new activities to focus on financial stability, and collaborating with others in new ways in order to take on these roles in today’s financial services market.

The Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 (DFA) to a large extent shapes modern-day supervision and many of these new functions within S&R. In addition to expanding the role of the Federal Reserve System in supervision, this expansive piece of legislation also reinforced many of the System’s existing responsibilities. S&R oversees one of the System’s largest and most diverse collections of financial institutions. More than 1,000 banking organizations — ranging from hundreds of rural, community banks to large financial institutions with consolidated total assets exceeding $350 billion — are headquartered in the Seventh District. Together, these organizations represent a vibrant cross-section of the nation’s economy and banking system that continues to provide valuable insights and perspectives.

“It is impossible to know with certainty which risks will challenge the financial system in the future,” says Cathy Lemieux, executive vice president and the head of S&R. “However, if firms have ways to measure and monitor the risks they take, as well as sufficient capital to withstand stressful conditions, then we will have a banking system able to provide businesses and consumers with the credit necessary for a vibrant economy.”

The Federal Reserve Bank of Chicago has strategically trained and hired employees in S&R to take on new roles in supervision. The following articles highlight not only the new activities within S&R, but also the skills of staff involved directly in these efforts. Our people are an important element of this work as we strive for fair and equal access to credit within a financial system that meets the needs of the communities where its participants do business.

Supervising New Companies

Savings and Loan Holding Companies

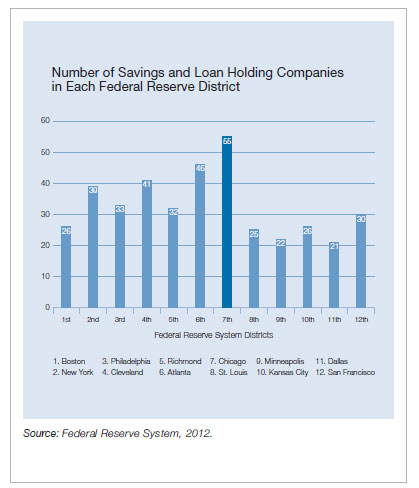

The Chicago Fed’s new role in supervising holding companies that own savings and loan associations (S&Ls) is an example of the way our work has meaningfully evolved in the span of just a few years. Since 2011, DFA has required the System to supervise Savings and Loan Holding Companies (SLHCs) whose holdings include S&Ls, also known as thrifts. At first blush, this new responsibility may not seem radically different than some of our existing roles in supervising banks. However, supervising modern-day SLHCs is a more complex job than it might initially appear.

Today’s SLHC industry is highly relevant to the 7th District’s economy. Big companies in industries that include manufacturers and insurers – two key sectors in the Chicago Fed’s geographic footprint – have come to own and use S&Ls in highly specialized ways. An S&L owned by an equipment manufacturer, for example, may finance customer purchases; an insurance company, by contrast, may use its S&L to offer more products to customers. As a supervisor, the Chicago Fed has to understand how each institution’s business activities, including those performed at both the holding company and throughout non-bank subsidiaries, impact the overall financial health of the parent company.

The Chicago Fed’s own supervisory assignments reflect the SLHC industry’s diversity. The 7th District’s portfolio encompasses 55 unique SLHCs that range in size from $65 million to $130 billion in total assets, as of December 31, 2012. This portfolio is the Federal Reserve System’s largest and includes household corporate names like farm equipment maker Deere & Company, grocer Hy-Vee Inc., and State Farm Mutual Automobile Insurance Co.

The team overseeing SLHCs has individuals with diverse backgrounds, including working in the thrift industry, insurance industry, and data management. The staff also emphasizes strong communication skills to help these companies understand the policies that apply to them, some of which are new.

“One of the most important aspects of our responsibilities is working with holding companies that own savings and loans to understand the new rules and how they apply,” says Gustavo Lira, a manager in the Chicago Fed’s Regional Thrift Group. “To do that, it’s imperative we understand the unique characteristics and risk profile of each company.”

As new jobs require new skill sets, these roles also provide opportunities for efficiencies in execution. SLHC examination team members are among the many at the Chicago Fed that are finding creative ways to lower costs and increase efficiencies, including performing more examination work without traveling to the supervised company. Meeting in person with management and conducting onsite examinations remain important elements of S&R’s work. But thanks to advancements in technology, efforts to do more work remotely have delivered a number of benefits within the last year. Fewer hours on the road mean lower costs, less regulatory burden on examined institutions, and more time for examiners to work on assignments.

Financial Market Utilities

On July 18, 2012, the Financial Stability Oversight Council (FSOC) designated eight financial market utilities (FMUs) as systemically important under Title VIII of DFA. FMUs are multilateral systems for transferring, clearing, or settling payments, securities, or other financial transactions among financial institutions. Three designated FMUs are headquartered in the 7th District – The Chicago Mercantile Exchange Inc. (CME), ICE Clear Credit LLC, and The Options Clearing Corporation (OCC). The primary supervisory agencies for these three designated FMUs are the U.S. Commodity Futures Trading Commission (CME and ICE Clear Credit) and the Securities and Exchange Commission (SEC). S&R works with the primary supervisor for each firm through a team of individuals with experience in FMUs, including central clearing, counterparty credit, liquidity, and risk management in operations and information technology.

Focusing on Financial Stability

Given the interconnected nature of financial markets, the Chicago Fed is also taking on new activities related to carrying out DFA provisions intended to minimize the systemic imprint of financial failure.

“A focus on systemic risk has been central to reform efforts, and fittingly so,” said Federal Reserve Gov. Daniel Tarullo in a 2011 speech.1 “It was, after all, a systemic financial crisis that we experienced and that led to the Great Recession.”

Staff involvement in capital stress testing efforts, the System’s Wholesale Credit Risk Center and resolution and incentive compensation planning reflect a significant shift in the way the Chicago Fed helps meet the mission of promoting financial stability.2

A key component of the financial condition of any banking organization is capital resiliency. Capital has been a cornerstone of banking supervision for decades, and international coordination efforts in measuring capital standards have occurred since the 1980s. Perhaps one of the most defining capital moments in recent history was the launch of the Supervisory Capital Assessment Program (SCAP)3 in early 2009 to assess the strength of the 19 largest U.S. bank holding companies at the time. This first round of capital “stress tests” helped calm roiling markets by providing additional transparency and assurance as to the financial condition of the largest banking entities. Congress later made these stress tests a fixture of supervision of large financial institutions. The DFA includes a requirement for all financial institutions above $10 billion in total assets to conduct at least one such test per year.

In the stress tests of large firms, financial institutions with total assets exceeding $50 billion submit to the Federal Reserve System data tied to their balance sheets and income statements. The Fed then processes it using models that measure capital adequacy under extreme economic stress. Staff members then analyze results alongside capital plans and firm-specific internal capital stress testing efforts. In the latter part of the cycle, supervisors use the results to determine whether each institution has sufficient capital to withstand financial and economic stress, as well as adequate forwardlooking capital planning processes.

More than 100 staff members at the Chicago Fed participated in stress test efforts in 2012. Supervisors assessed whether stress testing assumptions and approaches are appropriate, including estimated loss exposures and sources of revenue. The Chicago Fed also houses a team of individuals that specializes in wholesale lending, which includes commercial real estate and corporate loan activities. This team carries out its job as part of the Wholesale Credit Risk Center, which has delegated responsibility to monitor large financial institutions’ wholesale lending activities nationwide. Wholesale Credit Risk Center personnel have experience ranging from commercial banking, statistics and data analysis to programming and modeling.

“We’ve been hiring staff from a variety of backgrounds, but they all have one characteristic in common: intellectual curiosity,” notes Nancy Beebe, an assistant vice president of the Wholesale Credit Risk Center. “We’re working in a world that’s constantly changing, so we need professionals who can keep learning and adapting.” Beebe joined the Chicago Fed after working in global banking for more than a decade.

The work of the Wholesale Credit Risk Center extends beyond assumptions surrounding capital stress testing efforts. Detailed loan information is reported to, and used by, this team to identify emerging and macro risks in wholesale lending.

“We can see things and ask questions like we never could before,” said Paul Huck, Ph.D. and assistant vice president overseeing the Chicago Fed’s Wholesale Credit Risk Center and capital analysis team.

While capital stress tests are a critical tool in identifying capital resiliency at large financial institutions, they are but one aspect of overall efforts to foster financial stability. Title I, Section 165(d) of DFA requires covered companies with assets totaling greater than $50 billion to develop plans for emergency funding and, if necessary, an orderly wind-down of operations in the event of material financial distress or failure. These plans are an effort to reduce systemic risk by rapidly resolving large firms during a crisis. A number of large firms have submitted their plans to supervisors, and some sections are available to the public. Chicago Fed staff members have participated in the review of the initial plans, while also staying in close connection with companies slated to submit initial plans in 2013.

The Bank is also working to address the incentives that contribute to firms taking on imprudent risks. A multi-disciplinary Federal Reserve effort is focused on identifying and remedying inappropriate incentive compensation arrangements that fail to deter the taking of long-term risks to achieve short-term profits. Chicago Fed staff has been actively engaged in this effort by working with local institutions, leading several important initiatives and providing leadership to the national implementation project.

Said Lemieux, “Not only do we need to identify risks taken by supervised institutions; we also need to better understand the behaviors that incent such risk-taking activities.”

Collaborating in New and Expanded Ways

The growing roles and activities within S&R provide new opportunities for employees to communicate and collaborate with others, both within and outside of the Chicago Fed. S&R’s partnerships extend across the Federal Reserve System and also include other supervisory agencies. This ongoing collaboration also involves outreach to the banking industry. Members of S&R actively lead and participate in System committees that strive for consistent supervision across various market sectors, including community, regional and large financial institutions. Lemieux is currently chair of the System’s Large Banking Organization Management Group, which meets regularly to discuss and establish processes to ensure consistent supervisory assessment of risks across holding companies ranging in size from $50 billion to $400 billion in total assets.

Collaborating with New Partners

The financial crisis demonstrated that financial stability relies in part on close cooperation and coordination among relevant supervisory agencies. As such S&R has developed close collaborative relationships with the Securities and Exchange Commission and the U.S. Commodity Futures Trading Commission in monitoring designated FMUs in the Seventh District. Also, Chicago Fed staff works with others in the System on the FMU Supervision Committee, an inter-disciplinary committee that includes lawyers, economists, supervisors and policy analysts who discuss risk and share perspectives.

During the financial crisis, anecdotal and statistical information indicated consumers were vulnerable to unfair lending practices, including some that led to the housing market crisis. In response, DFA renewed supervisors’ focus on maintaining a banking system that provides fair and equal access to credit and generally meets the needs of communities. The System is responsible for examining the consumer practices of banks under $10 billion, while assisting the newly created Consumer Financial Protection Bureau (CFPB) in monitoring compliance of larger institutions. In these roles, the Chicago Fed has responsibility for the second-largest portfolio of state member banks among the System’s 12 Districts.

The consumer compliance team at the Chicago Fed has expanded its skills and expertise in order to capably carry out its newly shaped role.

“The world won’t stop while we adjust to our new responsibilities,” says Gretchen Cappiello, manager in the consumer compliance area of S&R. “We have a number of examiners who are new to the Chicago Fed. Getting them up to speed quickly has included extensive education, field training, coaching and mentoring.”

The full examiner commissioning training process typically takes employees about three years to complete. During the training period, examiner trainees collect valuable on-the-job experience by assisting commissioned staff in exams and other supervisory work.

The advent of the CFPB through DFA is a clear example of the critical need for supervisors to work together closely. The CFPB is charged with protecting consumers through regulation of financial services and products. Although the CFPB is an independent bureau, Congress requires the Federal Reserve to support its work in a number of ways. As one example, S&R staff have helped the Federal Reserve System meet requirements to offer perspective to the CFPB as the bureau proposes and issues new consumer protection rules. The perspectives of S&R continue to be shaped by the 7th District’s large presence of community banks, whose business models typically vary substantially from those of larger banking institutions.

New Outreach Efforts

Community banks play a critical role in extending credit across the 7th District. The System continues to make distinct efforts to tailor supervisory guidance and in some cases regulations to account for the differences between community banks and large financial institutions. Community banks, for example, are specifically excluded from enhanced prudential standards outlined in DFA, such as capital stress testing, which applies to larger organizations.

The Chicago Fed is keenly interested in understanding how its actions, as well as new rules from the Board of Governors and other supervisors, affect institutions and their various business activities. Staff members routinely gather input through a range of local forums that also help build awareness of industry issues and regulatory changes, as well as foster the sharing of best practices. For example, the Annual Community Bankers Symposium, which is attended by senior banking industry representatives, is held in the fourth quarter every year at the Chicago Fed’s headquarters. The System recently launched a website entitled Community Banking Connections, which is designed specifically for smaller banks and offers access to the most up-to-date regulatory information and education. S&R also participates periodically in Ask the Fed sessions, a series of teleconference calls to facilitate discussion among supervisors and bankers about top banking issues.

Embracing the Future

The Chicago Fed and its S&R staff continue to execute both new and existing functions in order to help promote financial stability and the fair and equal treatment of consumers. Now and in the future, staff members will look for ways to efficiently implement additional provisions of DFA, while strategically developing the skills and abilities of staff.

Lemieux notes, “It takes a well-trained and flexible staff to stay abreast of risk issues across an increasing array of financial institutions.”

The Reserve Banks continue to operate in a dynamic payment environment. New technology advances are triggering innovations in the payments system. Driving these advances are end-users’ and payment providers’ need to find faster and more efficient payment solutions.

To ensure that Reserve Banks keep pace with industry changes and to support the evolution of the payment system, the Financial Services Policy Committee (FSPC) — which is the oversight and governing body of Federal Reserve Financial Services (FRFS) — recently refreshed the FRFS strategic direction to address the current and future environment. Traditionally, the Reserve Banks have fostered the integrity, efficiency and accessibility of the U.S. payments system by focusing on the needs of depository institutions that serve various end-users. The refreshed direction calls for expanded efforts to better understand and support the industry’s goal of delivering improvements to end-users and financial institutions. The Reserve Banks will collaborate with financial institutions to pursue opportunities to enhance the speed, safety, cost effectiveness, and ease of use of payments — from initiation to completion.

To raise awareness of the renewed strategic direction, the Chicago Fed hosted a Payments Symposium in 2012 bringing industry leaders together to discuss ways collaboration could be most productive in making payments faster, safer and more efficient.

Sandra Pianalto, chair of the FSPC and president and CEO of the Federal Reserve Bank of Cleveland, announced that the Federal Reserve has been actively engaged in adjusting its planning, product development and resources to address innovation in the marketplace, within the context of its unchanging financial services mission of integrity, efficiency, and accessibility. She emphasized the need for industry collaboration and noted that, “…a payment system built around competition and collaboration will best serve the needs of different users, including banks, consumers, businesses, and government. Our strategy calls for more engagement with both traditional providers such as the banking industry — and with new market participants and innovators.”

The Payments Symposium attracted more than 150 senior leaders representing all sectors of the payments industry — including financial institutions, industry associations, consulting firms, processors, vendors, networks, merchants and regulators. More than 30 of these experts participated as speakers. This served as an opportunity for payments professionals to educate one another on a variety of issues that affect the payments marketplace today. Of particular interest at the symposium, participants and panelists proposed a number of ideas that, collectively, could help foster the creation of a roadmap to unify the fragmented payments industry and ultimately improve the payment system. In the near term, this could include:

- Fostering safe, easily accessible and efficient directories of transaction account information that can be used in an interoperable fashion and that leverage current payments infrastructure to benefit end-users.

- Fostering faster payments that improve the availability of funds and improving error resolution and providing additional transaction-level information to payers and payees.

In the longer term, participants suggested:

- Forming a national payments strategy or framework, with broad industry involvement and support.

- Developing incentives for different parties involved in payment transactions (e.g., consumers, merchants, and payment service providers) to continue to improve security practices and ensure the integrity of the overall system.

- Investing in generating and implementing new standards (e.g., authentication, etc.) that account for the industry’s fast pace of change.

The annual Payments Symposium is an excellent example of how our Reserve Bank is taking on a leadership role within the Federal Reserve System and the banking industry to advance, in a substantive way, the discussion about the future of payments. This forum helped industry participants gain insight into new payment services and changes within the payments infrastructure. This level of engagement is the first step to bring forward improvements to the payments system. As the U.S. payments landscape continues to evolve, the Reserve Banks are committed to working with the industry, and the Chicago Fed will play a key role in fostering diverse and inclusive industry relationships in support of the renewed direction.

Contributing to the development of this essay were Kirstin Wells, assistant vice president, Financial Market Group; Mike Hoppe, vice president, Customer Relations and Support Office (CRSO); Brian Mantel, vice president, CRSO; and Johanna Perez, strategic analyst, CRSO.