Detroit Renter Housing Analysis Challenges of Income and Affordability

Amid new efforts to preserve and expand Detroit’s affordable housing stock, policymakers and community development practitioners should continue to note the unique demographic and economic trends underlying the city’s rental housing challenges. A recent analysis of Detroit’s rental housing trends by the Community Development and Policy Studies (CDPS) division of the Federal Reserve Bank of Chicago compares the city’s rental housing market to some of its peers in the region. This analysis also shows that very low-income households with high housing cost burdens comprise the majority of the city’s renters, and suggests mixed evidence on whether household financial health is improving based on credit score data. These trends have important implications for programs and policies to improve the supply of affordable housing for Detroit’s low- and moderate-income communities.

In the city of Detroit, 66.1 percent of renter households experience high housing cost burden, meaning they spend at least 30 percent of their income on gross rent. A high housing cost burden can stretch a household’s budget for other necessities like food, transportation, and health care, and can make it challenging to save for the future.

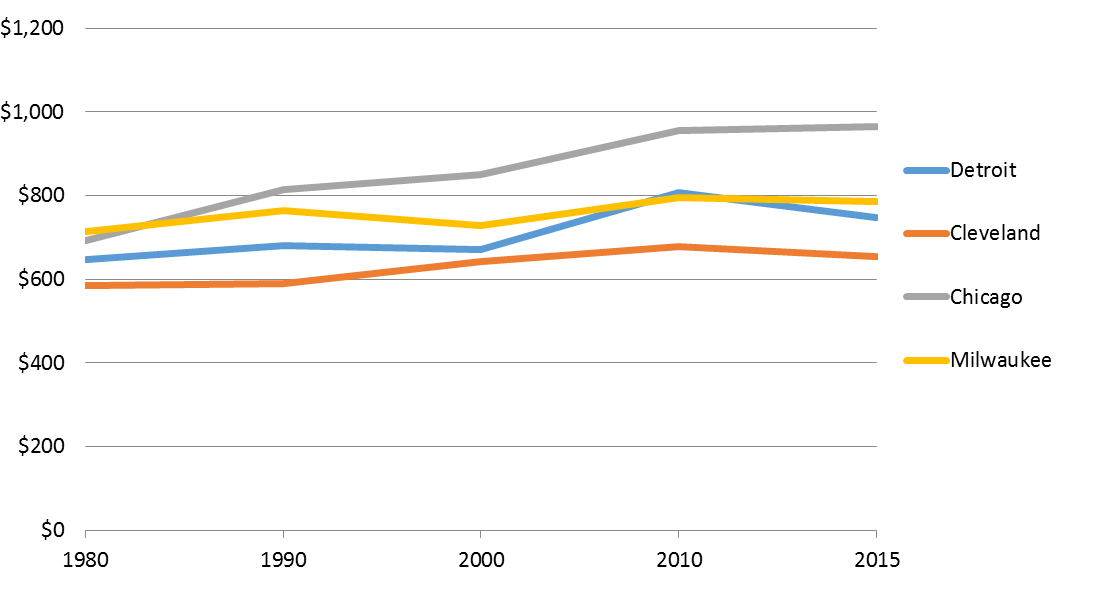

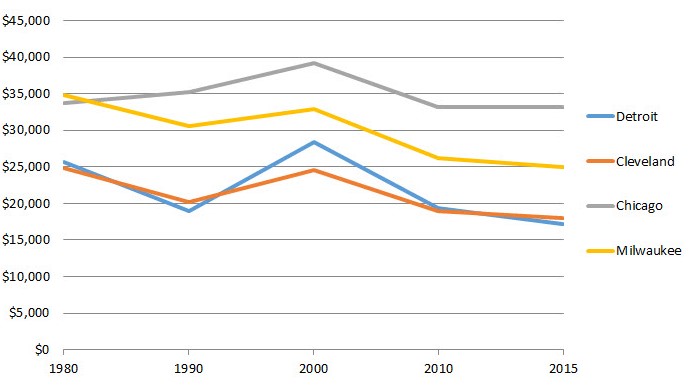

Perhaps not surprising, due to the city’s large population loss, Detroit’s rental cost burden has been driven primarily by declining renter household income rather than mounting rental costs, compared to some other large cities in the region. Adjusted for inflation, median gross rent in Detroit increased by 15.4 percent from 1980 to 2015, a similar rate to Cleveland (11.8 percent) and Milwaukee (10.1 percent), and far less than Chicago (39.2 percent) (Chart 1). Detroit’s median renter household income, however, declined more steeply over this period than its peers, and is lower than all of them as of 2015, at just $17,239 (Chart 2). As a result, Detroit’s rate of housing cost burden is remarkably high: 66.1 percent of rental household pay 30 percent or more of their income towards rent, and 42.6 percent pay at least 50 percent or more of their income towards rent. The problem affects all ages, with over 60 percent of both working-age and senior households facing high rates of rent burden.

1. Median gross rent

Note: Rents are adjusted for inflation to 2015 dollars.

2. Median renter household income

Note: Rents are adjusted for inflation to 2015 dollars.

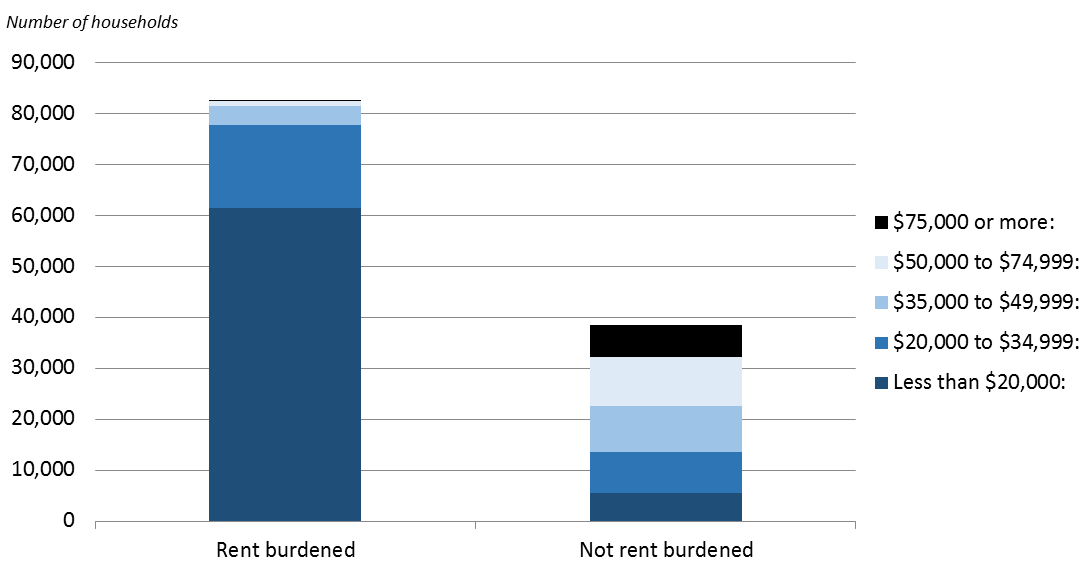

While it is not surprising that low-income renters are most affected by rental affordability challenges, the extent of this population’s needs in Detroit is noteworthy. Of the over 80,000 rental households in Detroit experience high cost burden, 74.5 percent have an income of less than $20,000 per year. Of this group, 7,400 households reported zero or negative income in 2015. Actions to ensure access to quality affordable housing must go alongside policies to spur economic opportunities for these households.

3. Detroit rental households by income and rent-burden

Note: Rent burden is defined by spending at least 30 percent of household income on gross rent.

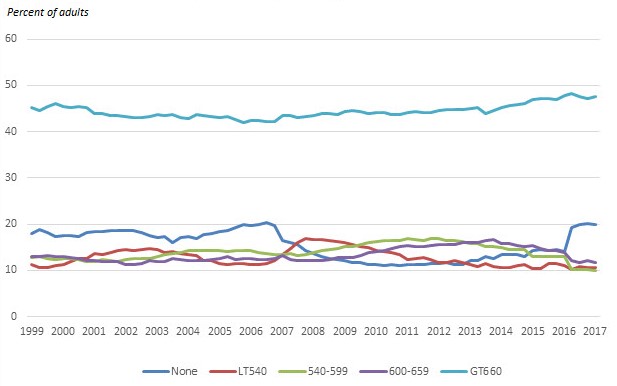

Finally, the CDPS analysis examined consumer credit conditions in Detroit for signs of changes in households’ financial health. Risk Scores, a measure of creditworthiness akin to a credit score in the Federal Reserve Bank of New York Consumer Credit Panel data from Equifax, painted a mixed picture in this regard. While the share of individuals with a strong Risk Score of 660 or greater has increased in recent years, the share with no Risk Score also grew. This suggests that while more households are gaining stronger financial footing and the ability to potentially qualify for a mortgage, another growing group of households has very limited access to mainstream financial products, and may struggle qualifying for rental housing or employment opportunities because of weak credit (Chart 4).

4. Equifax risk scores in Wayne County, Michigan

Taken together, this analysis shows the degree of need among Detroit’s low-income renters for affordable quality housing. CDPS will continue to partner with policymakers and practitioners in Detroit and across the Seventh District to identify and promote strategies to address these needs.

Taz George is a research analyst in the Community Development and Policy Studies Division at the Federal Reserve Bank of Chicago. Sara Cooper was the CDPS summer 2017 intern.