Midwest Economy

Hello midwesterners and those interested in the Midwest’s economic growth and development. My name is Bill Testa, and this is an introduction to my Midwest Economy Blog.

In this blog, I will offer some current information on the Midwest economy, as well as analysis of important public policy issues and even an occasional prediction or two. In this effort, I will be looking for those of you who share my keen interest in the Midwest economy to contribute not only your attention and readership, but also your thoughts and information. Those of you who do respond, as well as those who only listen, will help us all to enrich our understanding and knowledge of this region. And as time passes, we will also have an extensive compilation of information and experts to draw on as the Midwest encounters new issues and economic challenges.

Unlike some economists who sponsor blogs, I am neither a Nobel prize winner nor a renowned media personality. However, I have been following and analyzing the Midwest economy for over 25 years, most recently as the director of Regional Programs in the Chicago Fed’s Economic Research Department. The most burning questions that keep me up at night include: Why do some regions grow faster than others? What are the prospects for the Midwest and other regions? What can we do to influence our economic destiny? What roles, if any, do state-local governments and public-private partnerships play, or should they play, in the growth and development process?

At the Chicago Fed, my interest in the Midwest economy is shared by a talented and varied group of economists. Some of them—such as Rick Mattoon, Thomas Klier, Yukako Ono, and Mike Munley—are part of my Regional Team, while some are in other areas of our Research Department, including our Chief Business Economist, Bill Strauss, and our agricultural/rural specialist, Dave Oppedahl.

And if you are a true Midwest economy buff—as I am—you will find your way here—to our newly launched Midwest Economy web page. This new page features content galore, including our own vast archive of published analysis organized by subject area. You can also access regional data to create your own analysis; or link to other related web sites. Also, the site features our many past conferences, along with the presentations of renowned experts on the Midwest economy, state-local finance, economic growth, and a host of special topics concerning economic growth and development.

“Ag Bio” Conference at the Chicago Fed

Last week, Dave Oppedahl, our agriculture and rural specialist, held a conference at the Bank addressing agricultural biotechnology and rural development prospects in the Midwest. The best-known of these technologies are so-called bio-fuels, such as ethanol (which is largely refined from corn in the U.S., but it is largely refined from sugar cane in other countries like Brazil), and GMOs or genetically modified organisms, such as pest-resistant and herbicide resistent grains. Dave’s chief interest in these technologies and their prospects are how they will affect the well being of Midwest agriculture and rural communities.

New biotech products linked to agriculture are but one of several avenues by which rural counties hope to revive their fortunes and sustain their populations. Historically, family incomes in rural counties were supported by agriculture, mining, and forestry—especially agriculture. The U.S. Bureau of Economic Analysis compiles figures on the shares of personal income that derive from various industry sectors, and they estimate that as recently as 1969, 935 “rural” or nonmetropolitan counties counted on agriculture for 20% or more of personal income. By 1999, the number had fallen to only 235.

The problem has not been so much a failure of sagging production, or vulnerability to foreign producers, as it has been rising productivity itself. Improved strains of agriculture and better/more mechanized farming methods have increased yields astronomically. Since 1947, U.S. real farm product is up over 3.5 times. But despite rising real product, prices for farm products have fallen steeply, because the demand for raw agricultural products has not kept pace with rising production and productivity. In 1950, corn in the U.S. cost five times its price today as measured by inflation-adjusted dollars. Falling prices (along with labor-saving productivity) have come to mean meager farm earnings and jobs in most nonmetropolitan counties. In 1870, over 50% of the U.S. work force could be found in agriculture, but this had dwindled to 13% by 1947, and to 2% today.

In our Seventh Federal Reserve District states of Iowa, Illinois, Michigan, Wisconsin, and Indiana, farm earnings comprised 13% of personal income in 1969, but had fallen to only 2.8% by 2002. Of course, such productivity gains, along with urbanization of population, have also created the world’s highest standard of living for the average American.

But in generating income and jobs, many rural communities have not found a sufficient replacement for agriculture. (Though some, of course, have become suburbanized by nearby metropolitan area expansion, while others have redeveloped toward service industries and manufacturing). Consequently, the decline of agriculture-related income in nonmetropolitan areas has often been accompanied by lagging population growth or even outright declines. In the U.S., nonmetropolitan population grew at around one-half the pace of metropolitan counties from 1969. With falling population, many rural towns have been challenged to sustain essential services such as health care, schools, and retail. And in relation to metropolitan standards of living, rural personal incomes have fallen. Per capita income in nonmetropolitan counties in the Seventh District, for example, declined from 85% of the nation’s average in 1969 to 80% in 2002.

What’s a rural area to do? In our part of the Midwest, two distinct avenues to re-development are most prominent—manufacturing/distribution and retirement/recreation.

What other development paths are you seeing around the Midwest? Please share your thoughts and observations with us.

Bright prospects as a haven for retirees and recreational visitors can be most commonly observed in our northern states of Michigan and Wisconsin. Places such as Walworth and Door Counties in Wisconsin, and the northwest coastline of Michigan are perhaps the best-known in this regard. The map below illustrates those nonmetropolitan counties that have experienced hikes in population since 1969 (shown in blue, declines shown in green), and the “north woods” pattern in Wisconsin and Michigan is quite evident. (A map of second homes from the 2000 Census would show much the same effect). In many such places, the choice to develop tourist or retirement centers is not without its downsides. Recreational and retirement homes, and attendant commercial activities, often change the very character of rural towns, sometimes to the consternation of its original residents. Many towns on the periphery of large and sprawling metropolitan areas also face many of the same difficult choices: How much to grow, and in what directions?

1. Population changes since 1969, by county

For other rural places, manufacturing jobs have helped them survive and allowed many farm households to earn sufficient income off the farm to sustain their rural lifestyle. In fact, manufacturing jobs have actually been growing in the nonmetropolitan counties of the Seventh District, even while they have been shrinking fast in metropolitan areas. Compared with 1969, when the concentration of manufacturing jobs in the Seventh District nonmetro areas was about the same as the U.S., these counties are now, on average, 75% more concentrated in manufacturing than the national economy overall. Apparently, in the face of cost competition from abroad and from the American South, manufacturers have found the rural Midwest desirable in terms of land and labor costs, labor quality, and access to rail and roads.

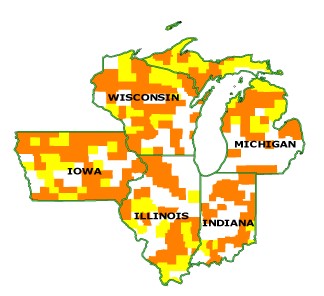

As the map below shows, manufacturing has become a staple of the economic base of nonmetro counties throughout the Seventh District states. (Orange-colored counties have a manufacturing concentration above the U.S. average). It is surprising that the preponderance of nonmetro counties in Indiana are concentrated in manufacturing. Morton Marcus, Director Emeritus of Indiana University’s Business Research Center, describes the common confusion between manufacturing and farming in Indiana this way, “For a century, the state has been considered an agricultural state when its reality has been as a manufacturing state. Hoosiers and citizens of other states refer to Indiana as part of the Corn Belt ignoring the massive steel and automotive parts industries in the state. Local economies that have depended on manufacturing for decades are still thought of as farm-serving towns. Workers, who derive the bulk of their income from factory jobs, imagine themselves as independent farmers because they own some acreage and plow or harvest after working hours at the plant of some global firm.”

2. Manufacturing concentration by county

This is not to say that life is a bed of roses in those nonmetropolitan areas that are oriented toward factories. Recent plant closings over the past five years in places such as Galesburg, Illinois (Maytag), and Thompson’s picture tube plant in Marion, Indiana, have been caused painful labor dislocations for the towns and their workers.

More troubling still, earnings per job in nonmetro counties have not kept pace with metropolitan earnings. Apparently, the search for lower costs and lower wages is responsible for some of the urban to rural shift of manufacturing jobs. Does this mean that these same jobs are those that are most vulnerable to foreign competition and labor-saving technological change? Some analysts believe that many rural manufacturing jobs are at the end of a geographic “product cycle,” meaning that well-paying jobs are spawned in urban areas, but outsourced first to U.S. nonmetropolitan areas as their technology and production methods become routinized and subject to competition from abroad. Recently, there is little evidence of a shift in favor of metropolitan areas in the Seventh District. Manufacturing employment declines since 2000 in the District’s nonmetro counties have given back most of what had been gained since 1970s, but the pace of decline has been the same as in metropolitan counties.

What about the economic development promise of so-called “ag biotech”? What has been its impact so far? And what is on the horizon? We learned a lot from Dave Oppedahl’s September 8 conference. Before I share some observations with you from that conference, think about your own impressions of this phenomenon… and tune in later this week to compare your theories and experience with the information delivered at the conference on September 8.

Later this week…

Further discussion from the Chicago Fed’s recent conference “Ag Bio and Rural Economic Development, and

The Chicago Area’s economic performance…