Bureau of Economic Analysis

On Thursday, September 26, the Chicago Fed was pleased to host a presentation by Steve Landefeld, the Director of the Bureau of Economic Analysis (BEA), to the Chicago Area Business Economists (CABE). The BEA is the government agency responsible for producing key statistics such as gross domestic product, GDP, a measure of economic output, and the personal consumption expenditure price index (PCE), a measure of inflation. In his CABE presentation, Landefeld illustrated the importance of BEA’s statistical products to policy topics, such as changes in the U.S. distribution of household income. He also explained their role in illuminating features of the financial crisis and Great Recession. Landefeld then discussed planned cuts to existing statistical products due to budgetary pressures. Ideally, he said, these plans should be shared with users ahead of time so that they can adapt their data use accordingly.

However, the agency has also been working on some interesting new products. For example, the BEA recently released new measurements of real or price-adjusted personal income for states and metropolitan areas—Regional Price Parities (RPPs). Although the BEA has been estimating nominal income by state since the 1950s, the value of these data was limited by the fact that the price levels can vary considerably, both across states and over time. While the new products are still in the experimental stage, they have the potential to allow comparisons of personal income across both time and geography.

Up to now, the only available price indexes for household income have been the local area Consumer Price Indexes (CPI). The Bureau of Labor Statistics calculates CPI on a national level every month; estimates for major cities are released less frequently.

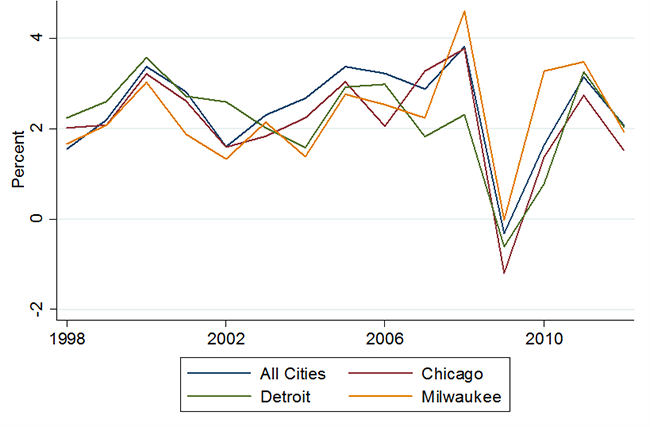

Figure 1 compares inflation measured by the CPI for the three major urban areas in the Seventh District with national CPI inflation. We see that CPI inflation does not vary much across cities, and it has closely followed the national trend in recent years.

The CPI measures changes in the price level within individual cities; it does not reflect price differences between cities at any one point in time. Additionally, these data exists for only 26 cities, so many states are entirely unrepresented.

Figure 1. CPI inflation

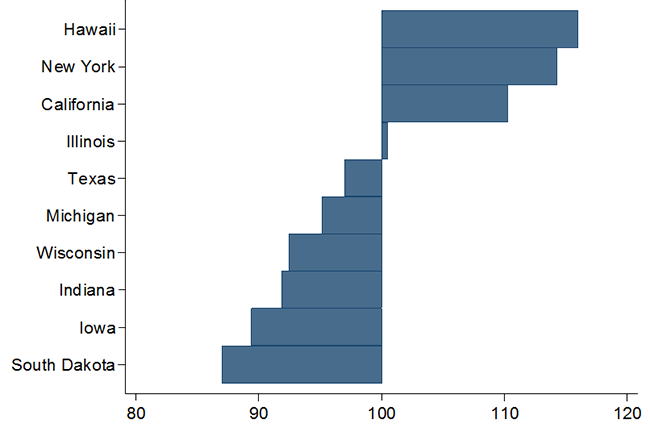

In contrast, the BEA’s new RPP data series provides estimates of the price levels that are comparable across states and time. These estimates are constructed by combining survey data from various sources, including the CPI and the PCE, and calculating an index such that national price levels in a given year are calibrated to 100. Figure 2 shows RPPs for selected states in 2011. The price level in Illinois is barely above the national average; price levels for all other states in our district are below the national average. The RPP also shows that South Dakota has the lowest cost of living in the nation and Hawaii has the highest.

Figure 2. Regional price parity in 2011

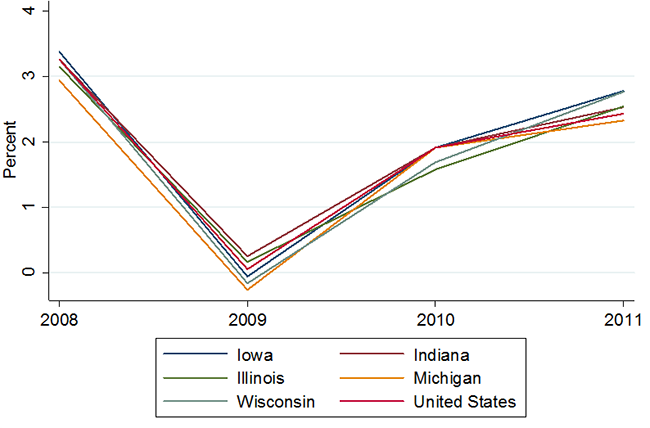

So far, the BEA has only released data in this series for 2007 to 2011. Figure 3 compares the RPP-derived price changes related to household income for Seventh District states with the national average. The series are almost indistinguishable. In fact, the variance across states is substantially lower than the CPI data would suggest. While Figure 2 shows that there is a large gap in the price level across states, Figure 3 suggests that this gap is persistent and has been largely invariant over this short period.

Figure 3. RPP inflation

New products from the BEA, such as the RPPs, present exciting new opportunities for economists and other analysts to improve our understanding of regional economic trends and structure.