The automotive industry has embarked on a major transition from manufacturing gasoline-powered vehicles to producing electric vehicles (EVs). This transition is impacting nearly every aspect of the industry, ranging from vehicle design and development all the way to vehicle fueling and repair. What does the transition to EVs portend for the production footprint of light vehicles (i.e., cars and light trucks) across North America through the end of this decade? In this Chicago Fed Insights article, we summarize our recently published research that addresses this question.

Most light vehicle assembly plants within North America—comprising the United States, Canada, and Mexico—are currently located in an area known as “auto alley.” This geographic corridor of automotive manufacturing is located chiefly within the United States between the Great Lakes and the Gulf of Mexico, with an extension at its northern end into southwestern Ontario, Canada.1 It became the principal location for auto production beginning in the 1980s in order to minimize the cost of distribution of assembled vehicles to consumers throughout the United States.2 Most gas-powered engines are also manufactured in auto alley in order to facilitate their shipment to assembly plants. A second cluster of assembly and engine production is found in central Mexico. As the motor vehicle industry transitions to electric vehicles in the coming years, will vehicle assembly and battery operations be attracted to new locations?

How have we addressed our main research question?

To answer the question of whether the transition to electric vehicles is likely to alter the automotive manufacturing footprint across North America, we analyze forecasts of light vehicle production obtained from S&P Global Mobility, a provider of such data. Most importantly for our research, S&P Global Mobility identifies the specific factories from which each assembly plant is expected to obtain the propulsion systems (i.e., gas engines, batteries, or a combination of them) to be installed in the vehicles being assembled. As a result, we are able to identify precise linkages expected between the future geography of light vehicle assembly and the production of different propulsion systems.

S&P Global Mobility updates its forecasts each month on many elements of motor vehicle production. For our research, we focus on the specific locations of all light vehicle assembly operations and of all engine and battery plants existing in North America as of 2023 and forecasted through 2029.

What we find

Light vehicles with a number of different types of propulsion systems are expected to be assembled in North America in the years ahead:

- Internal combustion engine (ICE) vehicles, powered exclusively by a gasoline (or diesel) engine;

- Hybrid electric vehicles (HEVs), powered primarily by a gasoline engine and by a small battery that may propel them in some circumstances, such as when starting up from a complete stop;

- Plug-in hybrid electric vehicles (PHEVs), powered by both an electric motor connected to a battery and an internal combustion engine;

- Battery electric vehicles (BEVs), powered exclusively by an electric battery; and

- Fuel cell electric vehicles (FCEVs), powered by converting hydrogen stored in a tank to electricity.

In our analysis we focus on just four of the five types of light vehicles differentiated by their propulsion systems: ICE vehicles, HEVs, PHEVs, and BEVs. We exclude FCEVs because their production is anticipated to increase from nothing in 2023 to only about 14,000 units in 2029, accounting for less than 0.1% of North America’s total light vehicle production then.

S&P Global Mobility forecasts a dramatic shift in the mix of light vehicle types (with different propulsion systems) produced by the end of the decade. In 2023, 12.0 million ICE vehicles were assembled in North America, 2.1 million HEVs, 0.4 million PHEVs, and 1.1 million BEVs. ICE production is forecasted to decline by 6.9 million vehicles between 2023 and 2029, whereas the production of the other three vehicle types is expected to increase over that span: HEVs by 1.3 million, PHEVs by 0.2 million, and BEVs by 6.2 million.

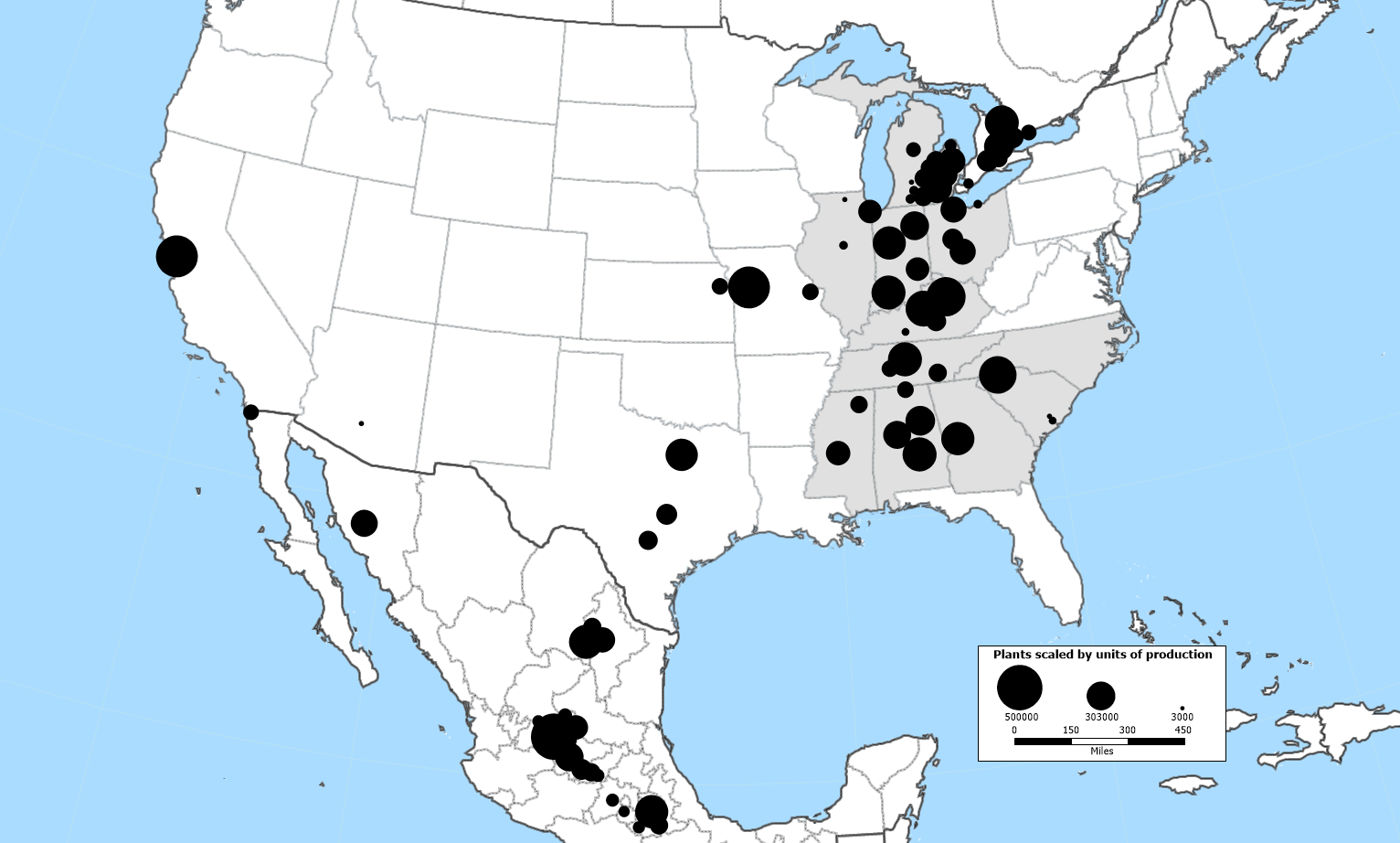

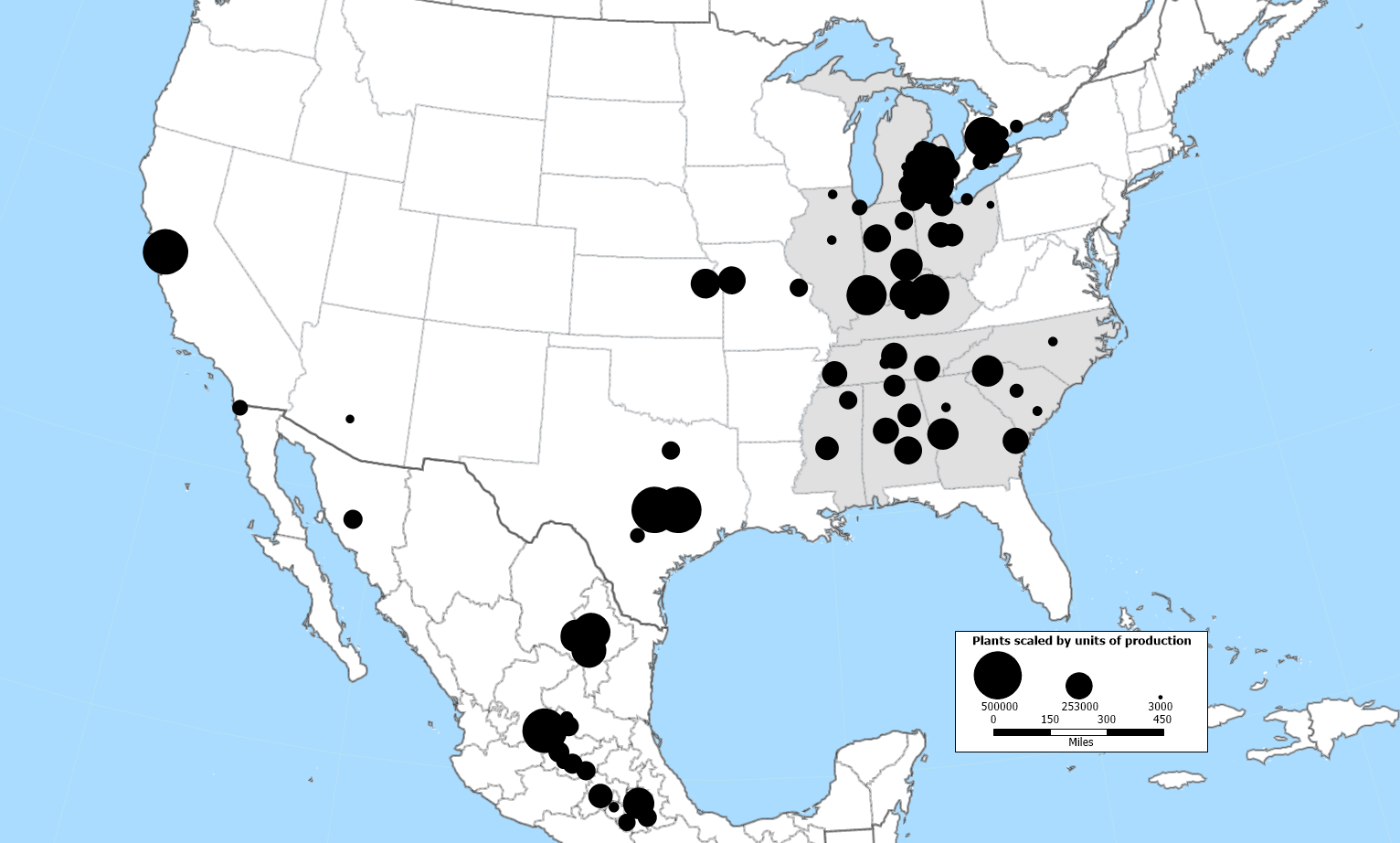

Yet despite the change in the production mix of light vehicle types, we find that the footprint of auto assembly plants in North America is expected to remain essentially unchanged (see figure 1). S&P Global Mobility forecasts that only one of the 74 light vehicle assembly plants in operation within North America in 2023 will close before 2029. Seven new ones are anticipated to open by 2029. Six of the seven new plants are expected to open in auto alley within the United States, and one is expected to open in Mexico. The one plant forecasted to be closed between 2023 and 2029 is in Mexico.

1. Locations of light vehicle assembly plants in North America, by production volume, 2023 and 2029

A. 2023

B. 2029

Sources: Authors’ adaptation of data from S&P Global Mobility as of January 2024 (for 2023 data) and as of December 2023 (for 2029 data) and Maptitude.

Instead of closing existing light vehicle assembly plants and building new ones, most automakers are responding to changes in the mix of vehicle types by reconfiguring existing assembly plants so that they’re able to produce vehicles that use a greater variety of propulsion systems. For example, the number of assembly plants building vehicles with three or all four of the propulsion systems we studied is anticipated to more than double from 12 in 2023 to 25 in 2029. In this way, many assembly plants will provide auto manufacturers with flexibility to accommodate fluctuations in consumer demand for various vehicle types.

At the same time as flexibility grows in this manner, the number of assembly plants producing light vehicles with only one type of propulsion system will switch in favor of electric vehicles. In 2023, 30 of the 74 light vehicle assembly plants in operation in North America produced only ICE vehicles and eight produced only BEVs. By 2029 those numbers are expected to be different: only nine of the 80 light vehicle assembly plants in operation within the region then are anticipated to produce only ICE vehicles, while 23 are anticipated to produce only BEVs (one is anticipated to produce only HEVs).

While existing light vehicle assembly plants are being reconfigured to accommodate BEV production, the same is not the case with engine plants. Instead, batteries for BEVs are being produced in new factories. In principle, these new factories could be located outside of auto alley, but in actuality we find that the newly constructed and announced battery plants are—like existing engine plants—clustering in auto alley. Batteries are being manufactured in auto alley for the same reason as engines are: to facilitate their shipment to assembly plants.

North America’s light vehicle production footprint is also forecasted to remain remarkably stable in part because relatively few engine plants are anticipated to close in the next few years. Although ICE vehicle production is forecasted to decline by 57% between 2023 and 2029, the number of engine factories is expected to decline by only five, from 34 to 29, and their mean output is expected to decline by only 24%. The reason for the more modest decline in engine production compared with ICE vehicle production is that the production volume of HEVs (one of two vehicle types with hybrid propulsion systems) is projected to rise 61% between 2023 and 2029.

Summary

We find that despite the upheaval in the motor vehicle industry due to the transition from gasoline-powered to electric-powered vehicles, the future production footprint of light vehicles in North America is anticipated to remain remarkably similar to the current one.

For a more detailed analysis of what we’ve discussed here, see our recent research published in Economic Perspectives.

Notes

1 Thomas H. Klier and James M. Rubenstein, 2022, “North America’s rapidly growing electric vehicle market: Implications for the geography of automotive production,” Economic Perspectives, Federal Reserve Bank of Chicago, No. 5. Crossref

2 James M. Rubenstein, 1992, The Changing US Auto Industry: A Geographical Analysis, London and New York: Routledge.