The following publication has been lightly reedited for spelling, grammar, and style to provide better searchability and an improved reading experience. No substantive changes impacting the data, analysis, or conclusions have been made. A PDF of the originally published version is available here.

The sizable inflows of capital to the U.S. from abroad in recent years have raised concerns about the potential impact on the U.S. economy if the tide were to turn. This article argues that the rapid accumulation of U.S. net foreign debt is tied to permanent rather than temporary changes in the relative return on U.S. assets, so in the absence of any other shocks to the global economy, a capital outflow is unlikely.

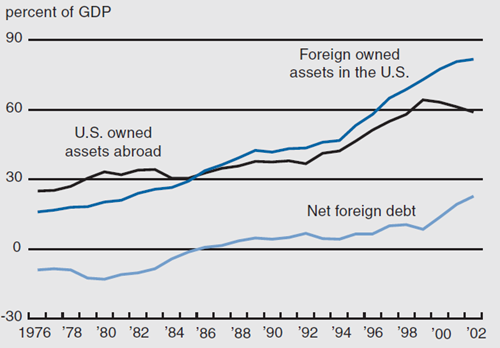

In 1994 the U.S. held claims on foreigners worth $3 trillion, while foreigners were holding $3.3 trillion in claims on the U.S., leaving the U.S. with a net foreign debt position of around $311 billion or 4.4% of 1994 gross domestic product (GDP). Over the next ten years the U.S. accumulated a string of record nominal current account deficits, which raised the level of U.S. net foreign debt to $2.4 trillion or 23% of 2002 GDP (see figure 1). This rapid inflow of capital from abroad has prompted policymakers and the financial press to speculate that these flows are tied to a temporary improvement in the expected return on U.S. assets and to express serious concern about the economic consequences of a similarly rapid outflow of capital from the U.S. if these favorable conditions should dissipate.1 This Chicago Fed Letter retraces the evolution of the U.S.’s net foreign debt position and its various components over the last ten years.

I argue that the rapid accumulation of U.S. net foreign debt was tied to permanent rather than temporary changes in the relative return on U.S. assets, so in the absence of any other shocks to the global economy, a capital outflow is unlikely.

What causes the level of net foreign debt to change?

A useful starting point in any discussion of foreign debt is a review of basic national accounting concepts. There are two key relationships. The first is the basic national accounting identity familiar to all economics undergrads, which states that the sum of consumption, investment, government spending, and exports less imports equals gross domestic product. The second is less familiar and can best be described as the national flow budget constraint. This relationship restricts the sum of all expenditures (consumption, investment, government spending, and the change in net foreign assets) to be no greater than the sum of all income (gross domestic product plus net foreign income). Net foreign income is the difference between wages, rent, and interest paid by foreigners for use of U.S. human, physical, or financial capital and the wages, rent, and interest paid by the U.S. to foreigners for use of their human, physical, and financial capital, while net foreign assets are the difference between the U.S.’s foreign assets and its foreign liabilities. If the value of net foreign assets is negative (i.e., liabilities exceed assets), we refer to the U.S. as a net debtor. Combining the national accounting identity and national flow budget constraint, it follows that the sum of the trade balance (exports less imports) and the income account balance (net foreign income) equals the change in net foreign assets. The sum of the trade balance and income balance determines the balance of the current account, so a current account surplus leads to an accumulation of foreign assets, while a current account deficit leads to a rundown of foreign assets or an accumulation of net foreign debt.

U.S. international transactions over the last ten years

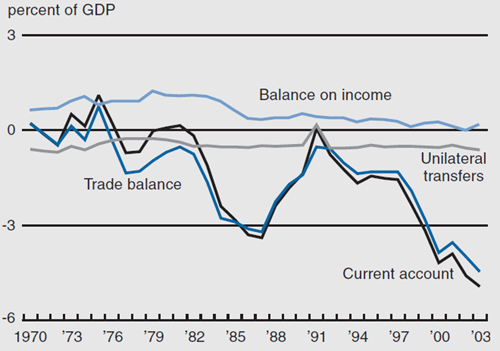

As figure 2 shows, the U.S. has been running a trade deficit for about the last 30 years, indicating that Americans spent more on foreign goods (imports) than foreigners spent on U.S. goods (exports) over this period. In contrast, the U.S. has recorded a surplus, albeit diminishing, on its income account over the entire sample period. The U.S. has been a net debtor for the last 20 years, so a surplus on the income account indicates that not only has income received from abroad been higher than income paid to foreigners, but also that the rate of return on U.S. assets held abroad has been considerably higher than the rate of return foreigners have earned on their assets held in the U.S. (In fact, the return differential has been high enough to cause the U.S. to pay effectively a zero or negative rate of interest on its net foreign debt).

My discussion in the last section glossed over another element in the national flow budget constraint, which is net official transfers. These transactions also enter the current account. A negative value indicates higher official transfers from the U.S government to foreign governments than from foreign governments to the U.S. government. With the exception of 1991, the U.S. has typically recorded a transfer deficit.2 Over the last 30 years, the income account surplus has been completely offset by official transfer deficits, so the U.S. has recorded current account deficits that closely follow the path of its trade deficits.

Figure 2 reveals that from 1994 to 1997, the U.S. trade and current account deficit held steady at around 1.5% of GDP. After that they jumped by just over 1% of GDP per year to their current level of just under 5% of GDP. These changes are echoed by the acceleration in the level of U.S. indebtedness as a percentage of gross domestic output over the 1990s in figure 1; the net debt level rose from 4.4% percent of GDP in 1994 to 23% of GDP in 2002, with the bulk of that change occurring after 1997.3

1. U.S. international investment position

2. U.S. current account

Should we be concerned about this path?

The persistent and widening U.S. current account deficit to GDP ratios over the last ten years, combined with a diminishing income balance and a rapidly rising net debt to GDP ratio have led many commentators to ask whether these paths are sustainable. Some have argued, based on research studies such as Freund (2000), that a reversal in the U.S. current account balance (capital outflow) is necessary to move U.S. net foreign debt to a sustainable level. However, there are a number of drawbacks to this line of research. The ideal approach would be to estimate a structural model of the global economy that identifies both the sources of economic disturbance and the responses to these disturbances. The sustainability of the current path of the U.S.’s external accounts could be analyzed by simulating this model under plausible assumptions about the sources of economic disturbance that have affected the U.S. and global economy over the last ten years. If the simulations generate a reversal in the U.S. current account balance, then the current levels of debt are not sustainable. Freund’s analysis, in contrast, estimates the average path of the current account of countries that have had persistent current account deficits (i.e., a deficit over 2% of GDP for four or five years). This approach generates a typical response to an unknown disturbance. Based on such incomplete analysis, it is impossible to say what the likely trajectory of the U.S. current account is to a particular source of economic disturbance. Knowing the response to a particular disturbance is important to the current debate, because 1) most of the candidate shocks affecting the U.S. economy over the last ten years appear to be permanent shocks (e.g., level of U.S. productivity), 2) theoretical models suggest that the effects of permanent and temporary shocks on the U.S. economy are likely to have different implications for the U.S. current account, and 3) Freund argues that her estimated responses are largely a function of temporary business cycle shocks.

It is beyond the scope of this article to estimate and simulate a structural econometric model of the world economy to assess the sustainability of U.S. foreign debt. I take the next best alternative, which is to simulate a computable general equilibrium model of the global economy calibrated to represent the U.S. and two other regions—a composite of all other industrial countries and a composite of all developing countries. The objective of households and firms in all countries/regions of the model is to maximize their well-being and profits, so the simulated paths of U.S. and foreign net foreign debt reflect the optimal decisions of all agents. I simulate the model under a range of plausible assumptions about the sources of economic disturbance that have affected the U.S. economy over the last ten years.4 Deciding on the candidate shocks was relatively easy since pessimistic and optimistic commentators to a large extent agree on the events that have shaped the U.S. net debt position since 1994: a persistent increase in the growth rate of U.S. productivity, the Asian financial crisis of 1997, and the growth of bilateral trade liberalization agreements between the U.S. and its various trading partners.

Productivity

Most analysts agree that the U.S. has experienced at least a temporary increase in its productivity growth rate of about 1 percentage point from the second half of the 1990s through to the present.5 So how did this temporary increase have a permanent impact on the economy? By producing a permanent change in the level of productivity. The temporary increase in the productivity growth rate has raised the level of U.S. productivity by about 7% since the mid-1990s. My benchmark simulation assumes that there was a onetime increase in the level of U.S. productivity of 1%. I find that a permanent 1% shock to the level of productivity permanently raises the debt to GDP ratio by a little over 5% of GDP (reaching this level about ten years after the shock), with roughly half of the adjustment occurring after two years. Based on these results, a permanent increase in the level of U.S. productivity of 7% could easily account for the 20 percentage point change in the U.S. debt to GDP ratio since mid-1994.

Asian financial crisis

The U.S. current account deficit to GDP ratio jumped from 1.5% in 1997 to 2.3% in 1998, which had led many commentators to speculate that the worsening U.S. current account deficit was driven, in part, by capital flows from Asia in the wake of the Asian financial crisis.6 This argument assumes that the uncertainty surrounding the Asian economies during the crisis raised the risk-adjusted return on assets held in the U.S. If this was a permanent shock to the risk-adjusted return of U.S. assets, then this capital will remain in the U.S. On the other hand, if the shock was temporary, then a resolution of the uncertainty surrounding Asian economies would cause an outflow of capital from the U.S.

Uncertainty does not play a role in my stylized global model. However, we can use it to sort out whether perceived changes in the relative returns from investing in the U.S. versus Asia were permanent by simulating the model under a temporary and a permanent shock to developing region productivity. According to my model, the observed changes in U.S.–Asian relative goods prices, trade flows, and capital flows over the last six years are consistent with a permanent negative shock to the relative return from investing in Asia. This suggests that in the absence of other global shocks, capital that flowed to the U.S. in response to the Asian crisis will remain here. Furthermore, my simulations imply that a negative 1% shock to the level of Asian productivity results in a permanent rise of the U.S. net debt to GDP ratio of 0.5%, which suggests this may have been a quantitatively important source of change in the U.S. net debt to GDP ratio.

Trade liberalization

In 1998 the U.S. Congress established a bipartisan commission, the U.S. Trade Deficit Review Commission (USTDRC), to look into the perceived trade deficit problem. One of the questions posed by the commission was the role that trade liberalization played in the persistent U.S. trade deficit. I examined this question using the same stylized model described above. I approached it from a few different angles. First, much of the U.S.’s efforts to liberalize trade in the 1990s involved far-reaching agreements with developing countries, so I simulated the model under the assumption that the U.S. and developing region liberalized their bilateral trade. Trade liberalization is similar to a permanent shock to the productivity of both countries, so it is not surprising to find that bilateral liberalization leads to an increase in the net foreign debt of both liberalizing parties in comparison to the rest of the world.

Second, I examined whether there was anything unique about liberalizing trade with a developing country (that is, with a relatively more labor-intensive producer), by simulating the model under the assumption that the U.S. and the industrial region liberalized their trade. According to my calibrated model, the U.S. economy’s response to trade liberalization is the same whether the trade partner is a developing country or an industrial country. Finally, much of the world has been engaged in multiregion and bilateral agreements, so I simulated the model under the assumption that the industrial and developing regions liberalized their bilateral trade. As expected, the indebtedness of these regions rose, while the level of U.S. net foreign debt fell. In light of these findings, the answer to the USTDRC question is that trade liberalization has likely been a source of capital inflows to the U.S, but given the trend toward liberalization in the rest of the world, these capital inflows have probably been offset by outflows from the U.S. to other liberalizing regions.

Conclusion

Several commentators have voiced concern that the current U.S. net foreign debt position is unsustainable and that the adjustment to a sustainable debt level may involve a painful reversal of the current account that would lead to lower levels of GDP, consumption, and investment. This article questions these pessimistic predictions by showing that the current path of U.S. net foreign debt is consistent with simulated responses to widely agreed upon permanent increases in relative productivity of the U.S. economy. In light of this, I argue that in the absence of an unanticipated shock to the global economy, the current path of U.S. net debt is sustainable.

Notes

1 See C. Mann, 2002, “Perspectives on the U.S. current account deficit and sustainability,” Journal of Economic Perspectives, Vol. 16, No. 3, pp. 131–152; International Monetary Fund, 2002, “Essays on trade and finance,” in World Economic Outlook, September, chapter 2, pp. 65–107; C. Freund, 2000, “Current account adjustments in industrial countries,” Board of Governors of the Federal Reserve System, International Finance, discussion paper, No. 692; The Economist, 2003, “The price profligacy,” September 18; and U.S. Trade Deficit Review Commission, 2000, Final Report, November 14, at www.ustdrc.gov.

2 The surplus in 1991 came about because of net transfer payments to the U.S. associated with the war in the Persian Gulf.

3 The change in the level of U.S. net foreign debt does not equal the sum of accumulated current account deficits over this period due to valuation adjustments coming from fluctuations in nominal exchange rates and foreign stock price movements. See Cedric Tille, 2003, “The impact of exchange rate movements on U.S. foreign debt,” Current Issues in Economics and Finance, Federal Reserve Bank of New York, for more details.

4 The model used here is a variant of the well-known and widely studied dynamic two-country, one-sector, open-economy model. See D. Backus, P. Kehoe, and F. Kydland, 1995, “International business cycles, theory, and evidence,” in Frontiers of Business Cycle Research, T. Cooley (ed.), Princeton, NJ: Princeton University Press, pp. 331–357, for details. I deviate from this basic two-region/-country model of industrial regions/countries by introducing a third region, which is calibrated to capture salient features of developing countries and by allowing countries to trade bonds. The most important differences between the developing and industrial regions are that labor is used more intensively in the production of the developing region good and the developing region is about two-thirds the size of an industrial region. The simulation results are presented for illustrative purposes and should not be interpreted as forecasts of the quantities and prices.

5 See note 1.

6 See J. Hervey and M. Kouparitsas, 2000, “Should we be concerned about the current account?” Chicago Fed Letter, Federal Reserve Bank of Chicago, April, for details.