Countering Downward Bias in Inflation

GIC and Banco de México

February 27, 2020

Mexico City, Mexico

Charles L. Evans

President and CEO

Federal Reserve Bank of Chicago

Key Messages

- Effective Lower Bound (ELB) risk leads to downward bias in inflation

- When ELB drives down π < π* for an extended period, need to follow with some period of π > π* in order to establish E[π] consistent with symmetric target

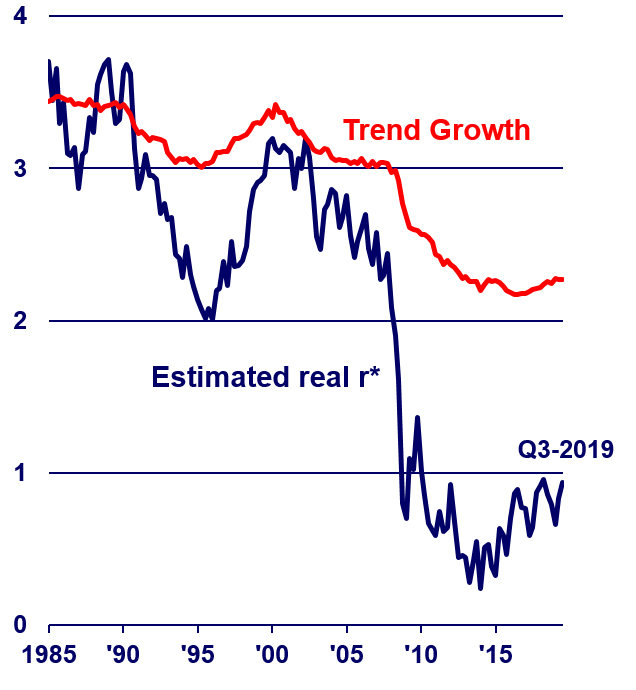

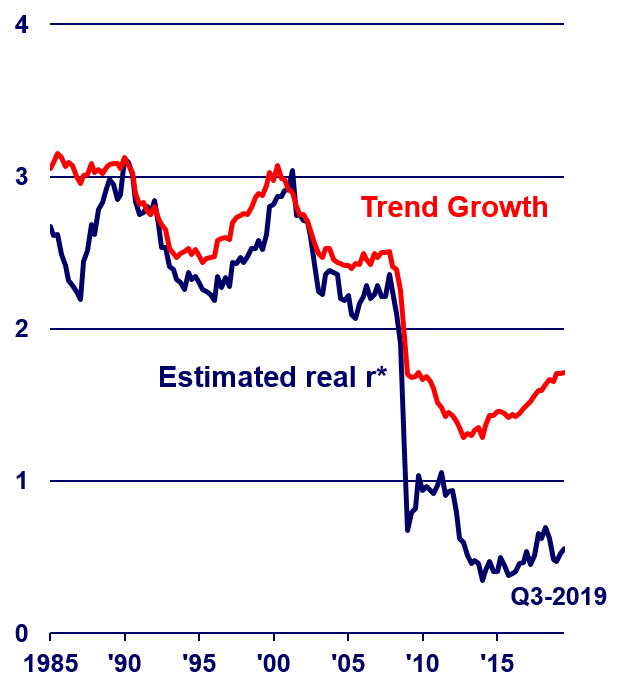

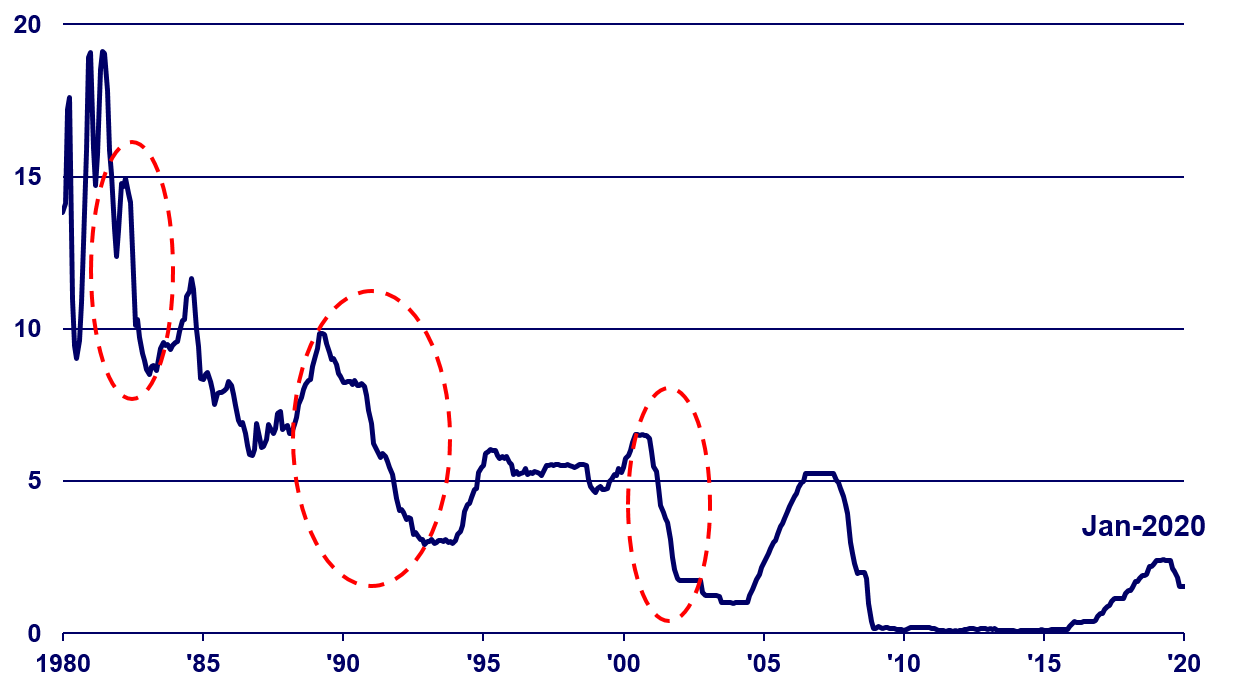

Low Trend Growth and Low Neutral Interest Rates (r*)

US (percent)

Advanced Economies (percent)

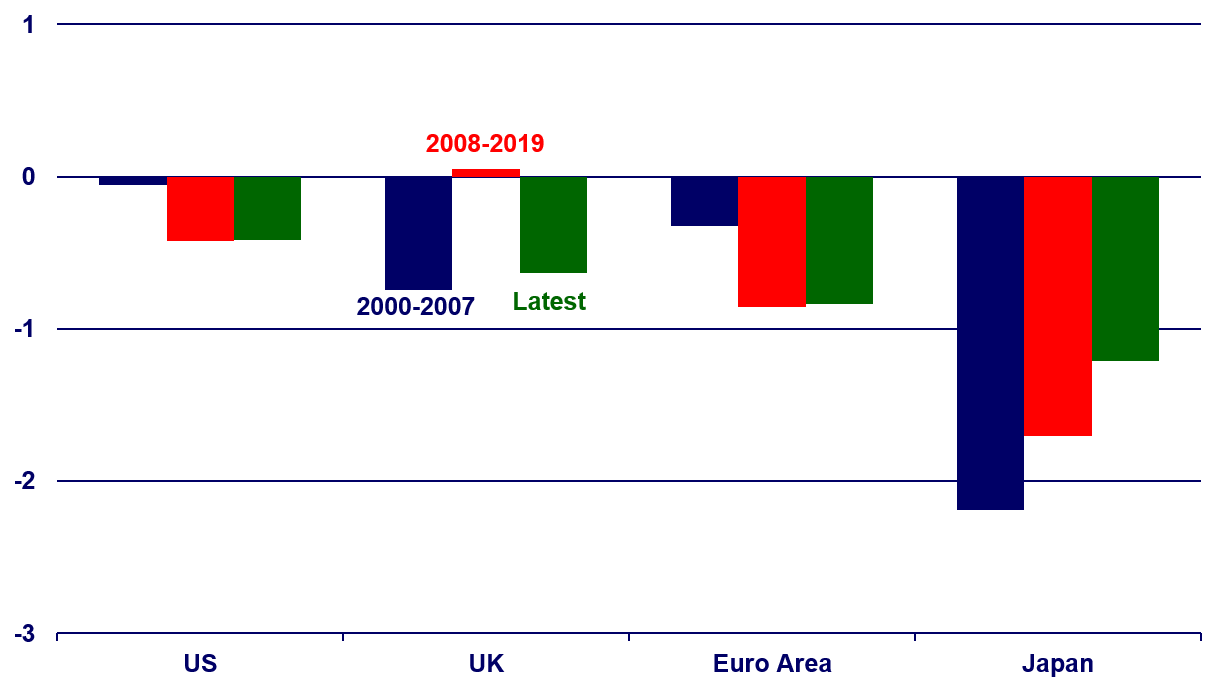

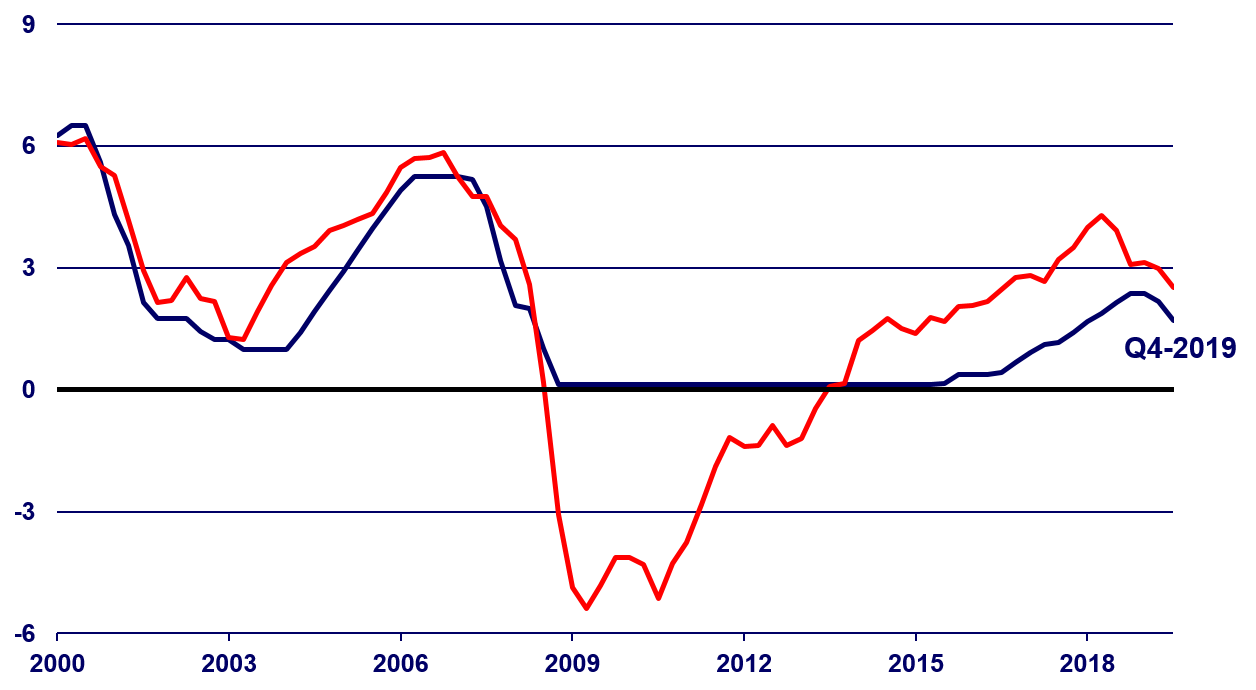

Undershooting Inflation Goals

Deviation from Central Bank Inflation Target

Conventional Monetary Policy Easing During Past Recessions

Federal Funds Rate (percent)

| Average easing during recessions | 500 bps |

| Current fed funds rate range | 150-175 bps |

| Long-run neutral rate | 250 bps |

Fed Funds Rate and a Traditional Benchmark

Federal Funds Target Rate (percent)

Taylor Rule (1999):

r(t) = r*(t) + π(t) + 0.5[ π(t) – π* ] + 2[ uLR(t) – u(t) ]

Source: Board of Governors of the Federal Reserve System from Haver Analytics

Offsetting ELB Downward Inflation Bias

- Heightened risk of ELB

- Downward bias in inflation

- Risk of E[π] < π*

- To offset bias, likely need π > π* for some period of time so that:

- E[π] is firmly anchored at π*

- π = π* in the medium term

- Embrace approaches aimed at these bias-adjusting outcomes

Outcome-Based Approaches

- Overarching aim: achieve dual mandate goals

- To do so, monetary policy must commit to:

- Provide extraordinary policy accommodation during and after ELB episodes

- Prescriptions from simple rules (e.g., Taylor) are inadequate

- Generate periods of π > π* to offset ELB downward inflation bias

- Recognize π > π* is required more than in non-ELB world

- Convey to public that periods of π > π* essential to achieve dual mandate over long haul

- The outcome of E[π] = π* is key

- Provide extraordinary policy accommodation during and after ELB episodes

- A number of ways to operationalize this

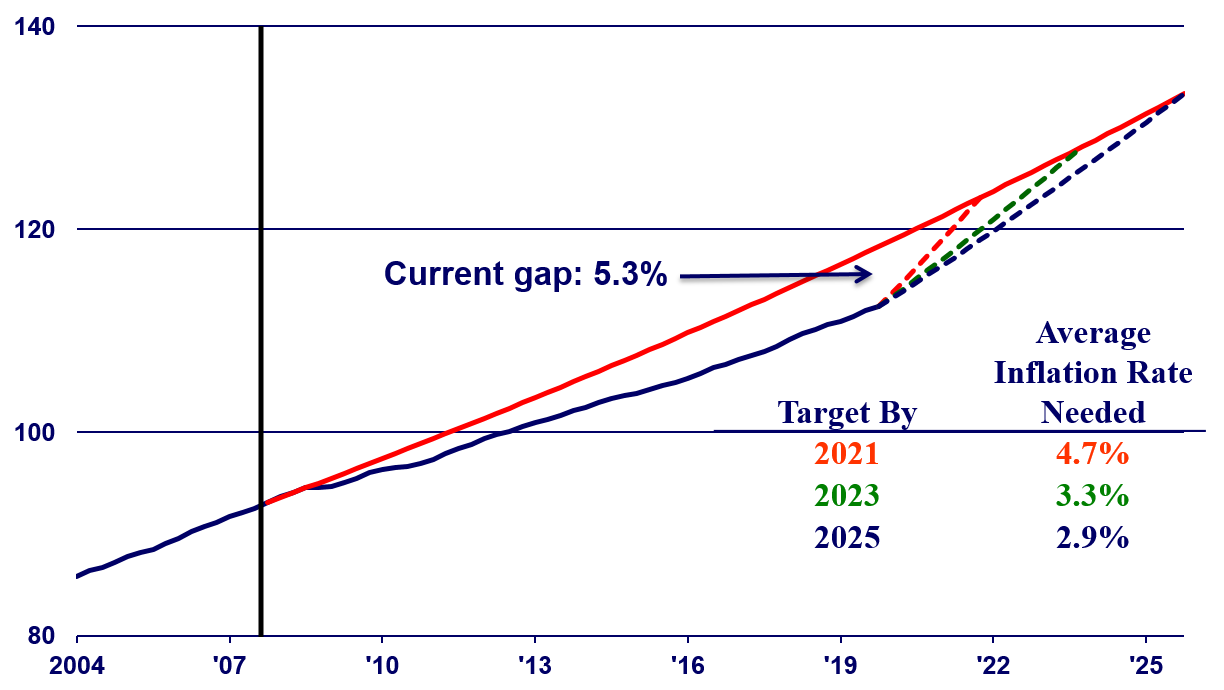

Example: State-Contingent Price Level Targeting

Core PCE Price Index

Example: Asymmetric Policy Response

- Respond more aggressively when inflation below target than when inflation above target: Bianchi, Melosi, Rottner (2020)

- Adjust the standard Taylor Rule

r(t) = r*(t) + π(t) + λ[ π(t) – π* ] + 2[ uLR(t) – u(t) ]

- If π(t) < π*, larger λ

- If π(t) > π*, smaller λ

Evans’s view: Inflation objectives that have a point target, such as 2 percent, are easier to communicate than objectives defined by an inflation range. As I discuss next, using a range requires even more attention to asymmetry.

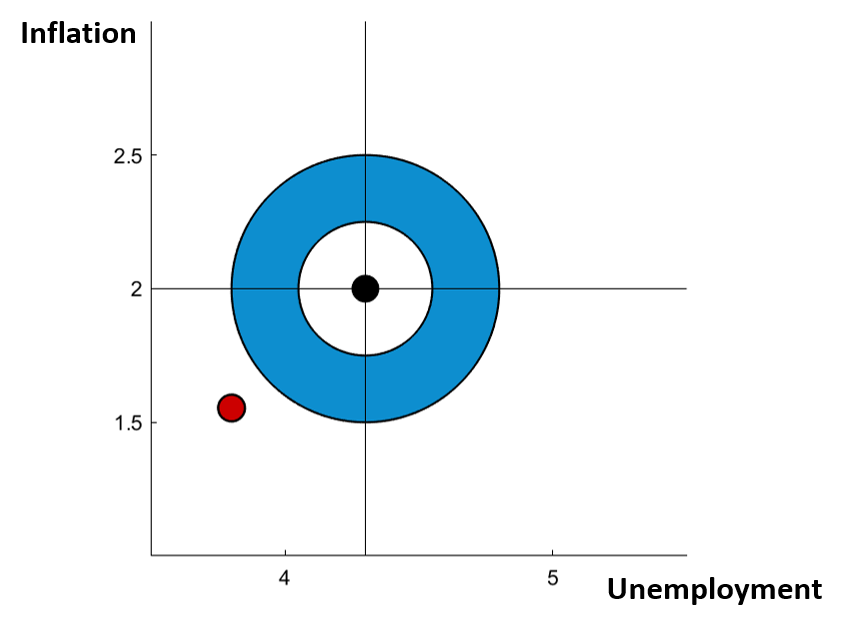

Example: Inflation Ranges [πL < π* < πU ]

- Alternative #1: Harris (2016); Mertens and Williams (2019)

- Recognize that inflation will be driven to πL when at ELB

- Aim for higher inflation πU away from ELB to average π* over time.

- Alternative #2: Bianchi, Melosi, and Rottner (2020)

- When inflation is in range, react less aggressively

- But set range asymmetrically about target

- e.g., if π* = 2%, then πL = 1.5%, πU = 2.85%

Example: Inflation Ranges [πL < π* < πU ]

- Alternative #3: Symmetric Range of Policy Indifference

- When inflation is in range, do nothing. Say we can go home—that’s good enough for government work

Example: Inflation Ranges [πL < π* < πU ]

Rejected

- Alternative #3: Symmetric Range of Policy Indifference

- When inflation is in range, do nothing. Say we can go home—that’s good enough for government work

- Won’t cure ELB downward inflation bias

Properties of Asymmetric Responses and Range Alternatives #1 & #2

- Parameters can be set so that inflation will average π* over long periods of time

- Do not require mechanical makeup for past periods of inflation away from target

Some Questions

- Can policymakers credibly commit to pursuing the policies prescribed by some of these alternatives?

- How will central banks communicate these strategies effectively?

- How will the public react to protracted periods of π > π*?

- Will long-run inflation expectations move up? By how much?

- What are the financial stability implications of the highly accommodative policies prescribed by the alternatives?

My Key Considerations

- Focus on outcome-based strategies

- In the U.S., focus on the dual mandate

- When ELB drives down π < 2%, likely need follow with period of π > 2% to get inflation expectations consistent with target

- Given ELB, any operational framework will need to use unconventional tools (e.g., QE, forward guidance)

- Effectiveness of these policies will influence the policy parameters of the alternative frameworks

- Address potential financial stability risks with regulatory and supervisory tools

- Credibility is key and essential for any operational framework