Treasury Market Resilience

Remarks presented virtually by Sam Schulhofer-Wohl, senior vice president and director of financial policy and outreach, Federal Reserve Bank of Chicago, on October 25, 2021, before the Global Markets Advisory Committee of the U.S. Commodity Futures Trading Commission (CFTC).

Thank you, Chair Karna, and thank you to Commissioner Stump and Ms. Goldsmith for the kind invitation to speak with you today.

My name is Sam Schulhofer-Wohl, and I am senior vice president and director of financial policy and outreach at the Federal Reserve Bank of Chicago. I oversee our research and policy analysis on financial markets, especially derivatives, as well as our community development and public affairs programs. I’ve been asked to speak about recent dislocations in the Treasury market and the path forward for improving market resilience.

As always, the views I express are mine and not necessarily those of the Chicago Fed or the Federal Reserve System.1 Also, because there is a Federal Open Market Committee meeting next week, our communications blackout rules limit the topics I can discuss.2 I will not be commenting on current or prospective economic and financial conditions or current or prospective uses of the Federal Reserve’s policies and tools. No inference should be drawn from my silence on these matters. I also will not be able to answer questions today, but I very much value dialogue and would welcome the opportunity to engage with you further outside the blackout period.

With those disclaimers out of the way, let me turn to Treasury market resilience. The Treasury market serves many vital purposes: It is a source of financing for the government, it provides safe and liquid assets for savers and investors, it establishes a risk-free yield curve, and more. Both the financial system and the American people benefit from the market’s considerable strength. It is, as this audience knows, the deepest and most liquid market in the world. Nevertheless, there have been some significant dislocations in recent years, and we can try to learn from these events to make the market more robust.

I’ll discuss two events: the March 2020 pandemic stresses and the September 2019 repo market pressures. Each event was unique, but there are some common threads, and I want to highlight one in particular that might shed some light on resilience. That common thread is the behavior of supply and demand for liquidity.

In March 2020, as the Covid-19 pandemic spread, people around the world faced an extraordinary threat to their lives, health, and livelihoods. Actions taken to control the spread of the virus led to extreme disruptions of economic activity. Financial markets reacted with severe volatility. After an initial period of typical flight-to-safety inflows into Treasury securities, these highly uncertain circumstances caused broad-based and rapid sales of Treasuries, especially seasoned securities with longer maturities.3 Overall, there appear to have been three distinct sources of these sales. First, in the face of economic and financial stress, many market participants sold their most liquid noncash assets—frequently Treasury securities—to obtain cash and cash-like assets such as Treasury bills. These sellers included mutual funds meeting redemptions, foreign central banks considering currency interventions, and traders covering margin calls, among others.4 Second, some market participants were motivated to unwind positions when the volatile environment changed the economics of certain trades. For example, Treasury cash-futures basis positions became riskier and more costly amid uncertainty about funding availability, the risk of large variation margin calls, and higher initial margin requirements intended to protect central counterparties against the increased market risks.5 Third, precautionary concerns amplified the initial rush of sales. For example, as it became clear that the sales were challenging market functioning, some Treasury holders appeared to sell not because they needed cash immediately, but in order to guard against the risk that market functioning would deteriorate further.6

Someone who wants to sell Treasuries needs to find a buyer, typically through an intermediary who provides market liquidity. So the broad-based desire to sell Treasuries was, effectively, a dramatic increase in the demand for intermediation. On the whole, intermediaries such as dealers and principal trading firms greatly increased their activity to meet this demand, as reflected in the large increases in trading volumes in the Treasury market in March 2020. However, there were limits to intermediaries’ capacity. These limits appear to have reflected in large part the interaction of the extreme market volatility and uncertainty with intermediaries’ risk appetites and business strategies and, in some cases, the influence of regulations on these.7 In this context, bid–ask spreads and other measures of liquidity, such as the price impact of trades, reached the worst levels since the Global Financial Crisis.8 The market stress resolved only after the Federal Reserve purchased Treasury securities on an unprecedented scale and following additional forceful actions by the Federal Reserve, Treasury Department, and Congress to support smooth market functioning and to aid the economy.9

You can think of measures like the bid–ask spread as indicators of the price of market liquidity. If the bid–ask spread is wider, intermediaries can make more money by taking both sides of the market, and it costs end-users more to get in and out of positions.

So, to sum up, in March 2020 in the Treasury market, the demand for intermediation went up, the supply of intermediation went up, and the price of intermediation went way up. As an economist, I think of the rising price as providing powerful incentives. The bid–ask spreads and other measures show that there was a lot of money to be made by intermediating—and a big cost to trading as an end-user. And yet, despite these powerful incentives, the supply and demand for market liquidity did not respond enough to avoid market stress. Perhaps that simply reminds us just how large the pandemic shock was.

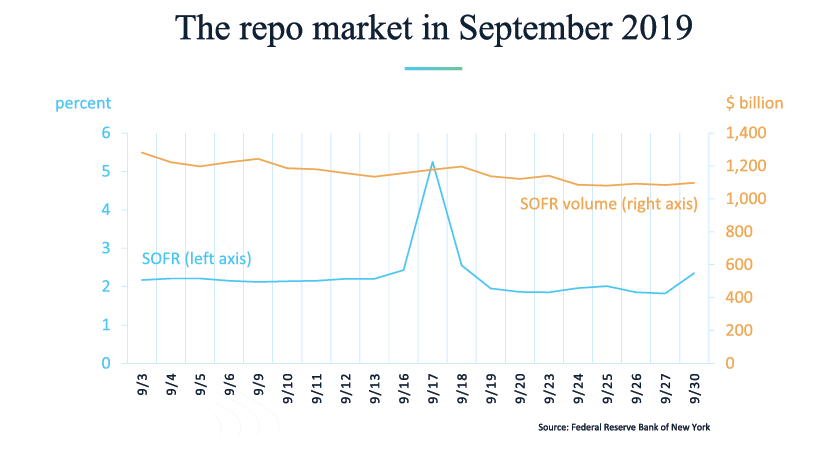

Now let’s turn to September 2019. On the 16th of that month, a quarterly tax payment date and the settlement of a Treasury auction drained funds from the financial system even as the auction settlement increased some institutions’ need for funds. Earlier in the month, repo rates had been trading a bit below 2 and a quarter percent, but on the morning of the 17th, rates spiked as high as 9 percent on some trades, and the Secured Overnight Financing Rate, or SOFR, settled at 5 and a quarter percent, up 282 basis points from the day before. Rate pressures spilled over to other money markets, such as federal funds, and subsided only after the Federal Reserve carried out large-scale repo operations.10

A repo interest rate like SOFR is the price of funding liquidity—the ability to use an asset as collateral.11 I want to show you a familiar but still remarkable graph of this price. This graph shows SOFR as well as the volume of transactions used to compute it—basically, all overnight, general collateral triparty and centrally cleared bilateral Treasury repos. You can see the spike in rates on September 17th. And if you look really closely at the volumes on the 17th, you can see—well, you can see that nothing much happened. The supply and demand for funding liquidity were not particularly responsive to the price of funding liquidity. And so the price—the interest rate—had to rise enormously for the market to clear.

Now, these dynamics are pretty different from what we saw in March 2020. The shock in September 2019 wasn’t nearly so large. Rather, a major factor appears to have been that, even though the overnight repo market reprices every day, it was difficult for participants to significantly change their activities from one day to the next.12 Borrowers needed to fund their assets and couldn’t quickly exit positions at a reasonable price; at least in the short run, it made sense to pay very high repo rates to get funding. Lenders, meanwhile, often relied on relationships with particular borrowers, and trading desks operated within limits based on an institution’s overall strategy for deploying its balance sheet—so it was difficult to rapidly ramp up lending when rates were spiking.

But even though the dynamics in September 2019 and March 2020 are different, there still is the common thread that, at times, supply and demand for liquidity haven’t adjusted enough to keep the price of liquidity from soaring. We can think about some potential improvements in light of that pattern. As mentioned, I cannot speak today about current and prospective Federal Reserve policies and tools. I will instead note three other areas that researchers, market participants, or agencies have discussed publicly.13 All of these, in my view, may affect the responsiveness of liquidity supply and demand in the Treasury market.

First, there have been calls to improve the collection and increase the public dissemination of market data. Treasury futures, as an exchange-traded and fully centrally cleared market, are subject to extensive data collection and reporting, but there are gaps in data for the cash and repo markets. For example, in the repo market, we have extensive data on the triparty and cleared bilateral segments, but the official sector has not collected systematic data on uncleared bilateral repo transactions since a pilot project in 2015.14 Improvements in data collection and transparency could make the market more resilient and elastic in a couple of ways. For the official sector, more complete and timely data may enable more nimble responses when stress emerges as well as allow for better design of policies ex ante. For the private sector, appropriate data transparency may remove uncertainty and support more responsive trading, though the potential for transparency to interfere with liquidity provision must also be considered.

Second, there have been calls to consider expansion of central clearing in the Treasury market. Treasury futures are centrally cleared, but not all repos and cash transactions are. As long experience in cleared markets has demonstrated—and as research by my colleagues in the Chicago Fed’s Financial Markets Group has found—central clearing in general has two major benefits: improved risk management and multilateral netting.15 Both of these, again speaking generally, have the potential to support more responsive trading dynamics by making intermediation safer and, in some circumstances, less balance sheet intensive. However, much depends on the institutional details of a particular market, and the precise effects of broader clearing in the Treasury cash and repo markets merit careful study. Moreover, central clearing concentrates risk at the central counterparty, so continued strong risk management, regulation, and supervision would be crucial. I’m looking forward to today’s second panel, which I understand will delve into central clearing of Treasuries in more detail.

Finally, there have been suggestions to reconsider how Treasury trading venues are regulated. For example, the Securities and Exchange Commission (SEC) has proposed extending Regulations ATS and SCI to alternative trading systems for government securities.16 These regulations provide investor protections and safeguards for the reliability of electronic and automated systems in other markets.17 Extending this oversight to Treasury alternative trading systems could help to support access to and reliability of these heavily used trading venues.

There are, of course, many other possibilities for enhancing the resilience of the Treasury market. Additionally, while I’ve highlighted the role of supply and demand for liquidity in some recent events, this is a large and complicated market with many drivers. The lens I’ve offered is certainly not the only one that could be used to consider how the market might be strengthened. But I hope this perspective is helpful to you, and I look forward to further discussion.

Thank you.

Notes

1 I thank my colleagues in the Federal Reserve System for valuable comments and suggestions.

2 See Federal Open Market Committee, 2017, “FOMC policy on external communications of Federal Reserve System staff,” report, Washington, DC, as amended effective January 31, available online.

3 See Board of Governors of the Federal Reserve System, 2020, Financial Stability Report, November, available online.

4 See, for example, Lael Brainard, 2021, “Some preliminary financial stability lessons from the COVID-19 shock,” speech at the 2021 Annual Washington Conference, Institute of International Bankers, via webcast, March 1, available online, and Lorie K. Logan, 2020a, “Treasury market liquidity and early lessons from the pandemic shock,” remarks at the Brookings-Chicago Booth Task Force on Financial Stability meeting, via videoconference, October 23, available online.

5 See Daniel Barth and Jay Kahn, 2020, “Basis trades and Treasury market illiquidity,” Office of Financial Research, brief, No. 20-01, July 16, available online.

6 See Lorie K. Logan, 2020b, “The Federal Reserve’s market functioning purchases: From supporting to sustaining,” remarks at the Securities Industry and Financial Markets Association (SIFMA) webinar, July 15, available online.

7 See Financial Stability Oversight Council, 2021, 2020 Annual Report, Washington, DC, available online, and Logan (2020a).

8 See Michael Fleming and Francisco Ruela, 2020, “Treasury market liquidity during the COVID-19 crisis,” Liberty Street Economics, Federal Reserve Bank of New York, blog, April 17, available online.

9 See Lorie K. Logan, 2020c, “The Federal Reserve’s recent actions to support the flow of credit to households and businesses,” remarks before the Foreign Exchange Committee, Federal Reserve Bank of New York, April 14, available online.

10 See Sam Schulhofer-Wohl, 2019, “Understanding recent fluctuations in short-term interest rates,” Chicago Fed Letter, Federal Reserve Bank of Chicago, No. 423. Crossref

11 See Markus K. Brunnermeier and Lasse Heje Pedersen, 2009, “Market liquidity and funding liquidity,” Review of Financial Studies, Vol. 22, No. 6, June, pp. 2201–2238. Crossref

12 See, for example, Sriya Anbil, Alyssa Anderson, and Zeynep Senyuz, 2020, “What happened in money markets in September 2019?,” FEDS Notes, Board of Governors of the Federal Reserve System, February 27, Crossref, and Sriya Anbil, Alyssa Anderson, and Zeynep Senyuz, 2021, “Are repo markets fragile? Evidence from September 2019,” Finance and Economics Discussion Series, Board of Governors of the Federal Reserve Reserve System, No. 2021-028, April, Crossref.

13 See, for example, Nellie Liang and Pat Parkinson, 2020, “Enhancing liquidity of the U.S. Treasury market under stress,” Brookings Institution, Hutchins Center on Fiscal and Monetary Policy, working paper, No. 72, December 16, available online; Brian Smith, 2021, “Remarks at the Federal Reserve Bank of New York’s Annual Primary Dealer Meeting,” U.S. Department of the Treasury, press release, Washington, DC, April 8, available online; Task Force on Financial Stability, 2021, Report of the Task Force on Financial Stability, Washington, DC: Brookings Institution, June, available online; and Group of Thirty Working Group on Treasury Market Liquidity, 2021, “U.S. Treasury markets: Steps toward increased resilience,” Washington, DC, July, available online.

14 See Viktoria Baklanova, Cecilia Caglio, Marco Cipriani, and Adam Copeland, 2016, “The U.S. bilateral repo market: Lessons from a new survey,” Office of Financial Research, brief, No. 16-01, January 13, available online.

15 See Ed Nosal and Robert Steigerwald, 2010, “What is clearing and why is it important?,” Federal Reserve Bank of Chicago, Chicago Fed Letter, No. 278, September, available online, and Robert S. Steigerwald, 2013, “Central counterparty clearing,” in Understanding Derivatives: Markets and Infrastructure, Federal Reserve Bank of Chicago, chapter 2, available online.

16 See Securities and Exchange Commission, 2020, “Regulation ATS for ATSs that trade U.S. Government securities, NMS stock, and other securities; Regulation SCI for ATSs that trade U.S. Treasury securities and agency securities; and electronic corporate bond and municipal securities markets,” Federal Register, Vol. 85, No. 251, December 31, pp. 87106–87253, available online.

17 Regulation ATS, 17 CFR §242.300–304, provides for SEC oversight of alternative trading systems (ATSs) and establishes investor protections related to confidentiality and access. Regulation SCI (Systems Compliance and Integrity), 17 CFR §242.1000–1007, establishes requirements for the operational resilience of electronic or automated systems that support the securities markets.