CABE event highlights measures of regional economic performance

On September 26, 2013, the Chicago Association for Business Economics (CABE) hosted a lunch meeting with Steve Landefeld, Director of the US Bureau of Economic Analysis (BEA), at the Federal Reserve Bank of Chicago. In his presentation “Lessons Learned from the Financial Crisis and the Great Recession”, Landefeld discussed the BEA’s initiative to produce measures beyond gross domestic product (GDP) that better capture the distribution of growth and monitor the sustainability of economic trends.

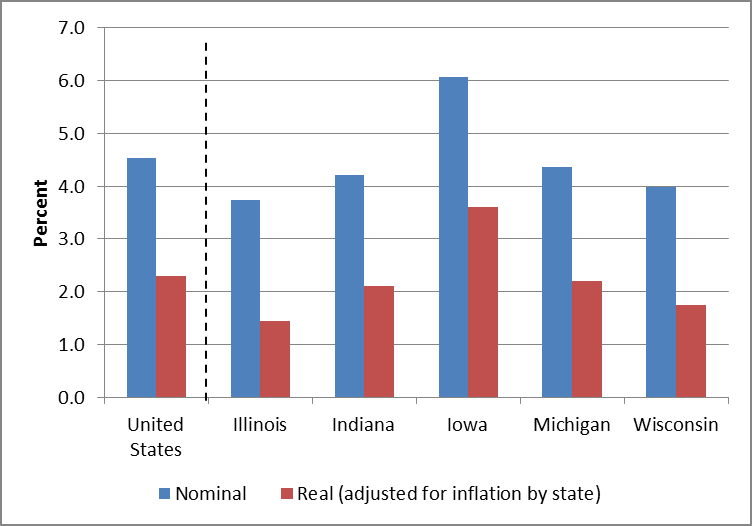

Of particular interest to readers of this blog, the BEA recently released a series that measures purchasing power across states and metropolitan areas. Adjusting for differences in regional prices allows a more direct comparison of real personal income. Landefeld presented the following figure of personal income growth across states in the seventh district, adjusted for inflation and regional prices.

1. Average annual growth in personal income, 2009-2011

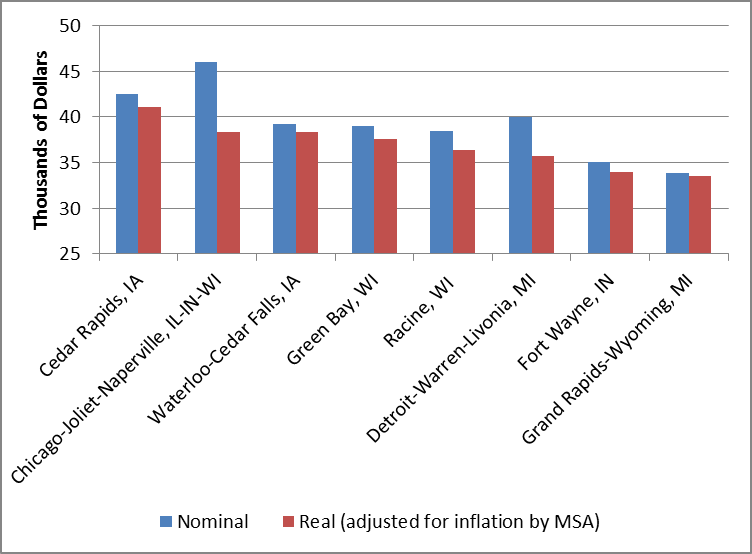

Iowa stands out for its relative strength on this measure, which is also evident among our sample of cities for the Industrial Cities Initiative (ICI). ICI is an effort by CDPS to better understand trends shaping industrial cities in the Midwest. We are currently producing in-depth profiles of 10 former manufacturing hubs: Cedar Rapids, IA; Waterloo, IA; Aurora, IL; Joliet, IL; Fort Wayne, IN; Gary, IN; Grand Rapids, MI; Pontiac, MI; Green Bay, WI; and Racine, WI. An analysis of 2011 income data for the metropolitan statistical areas (MSAs) associated with our sample cities reveals that, after adjusting for purchasing power, per capita personal income becomes greater in Cedar Rapids than Chicago, which ties with Waterloo for second place. (Note that the Chicago MSA includes Aurora, Joliet, and Gary.) The large adjustment is due to the fact that the price level in Cedar Rapids and Waterloo was only 90% of the overall national price level in 2011, whereas Chicago’s was 106%. A clearer understanding of such variation in purchasing power should improve policymakers’ interpretation of economic impacts across regions.

2. Per capita personal income by MSA for ICI cities, 2011

Landefeld also touched on cuts the BEA has made due to sequestration, which include a reduction in its detailed local area personal income statistics and the elimination of its regional input-output modeling system.

Watch for future CABE events as well as CDPS profiles from the Industrial Cities Initiative, which will shed more light on trends in Cedar Rapids, Waterloo, and the other industrial cities.

For more information on the event, please see Steve Landefeld’s presentation and Bill Testa’s Midwest Economy Blog.

Additional information can be found at the following resources:

- CABE Website

- GDP and Beyond

- Impact of Sequestration Reductions

- Economic Role of GDP

- Real Personal Income for States and Metropolitan Areas

- CDPS Industrial Cities Initiative

*Note: Data adjusted for inflation with the BEA’s national Personal Consumption Expenditures (PCE) chained price index (2005=100) and regional price parities (RPP) by state. A chained price index accounts for the fact that consumers change their basket of goods as relative prices move up or down, rather than maintain a fixed basket of goods.

**Note: Data adjusted for inflation with the BEA’s national Personal Consumption Expenditures (PCE) chained price index (2005=100) and regional price parities (RPP) by MSA.