Auto Parts Issues & Conference

A conference discussion on the issues facing automotive companies, workers, and communities will be held on April 18–19, 2006, in Detroit, at the Chicago Fed’s new branch building. The conference will center on the auto supplier industry. Suppliers employ three times as many workers as assembly operations, but as an industry, it is little known to most of us. However, as assembly operations are changing owners and shifting geographically, the responsive behavior of auto suppliers will have important implications and impacts for many Midwest workers and communities.

One of the conference organizers, Thomas Klier of the Chicago Fed, has been studying the behavior and geography of the North American automotive industry for over a decade. During that time, never have the questions and uncertainty about the industry’s future footprint in the Midwest been as portent for the region’s economy as today. The traditional assembly companies (the Big Three) and their (more-sizable) suppliers have been pulling in production from the coastal United States to the Midwest. At the same time, the Big Three and suppliers have seen their market share shifting southward from the Midwest to transplant assembly companies and their suppliers. This leaves the upper Midwest with an ever-greater concentration of the most vulnerable segment of the North American automotive industry.

Thomas offers the following analysis of the shifting geography of Big Three and transplant assembly operations to put this matter into perspective.

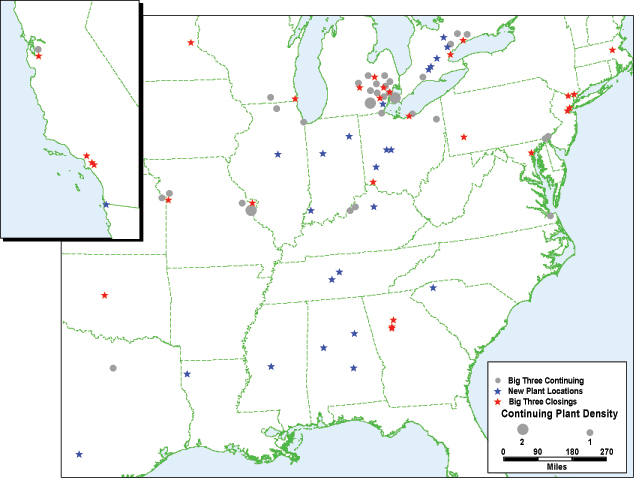

Figure 1. Assembly plant locations

The U.S. auto industry’s footprint has been changing for a considerable time. Since the early 1980s the domestic auto producers have been losing market share to transplant producers setting up plants in the U.S. and Canada as well as a growing number of imported cars. Subsequently the Big Three closed most of their coastal and southern plants (red stars in the map) and pulled back to their traditional Midwest home.

The transplant assembly facilities opened since 1980 have been sited in the interior of the country, primarily in a north–south corridor formed by interstate highways 65 and 75, between the Great Lakes and the Gulf of Mexico. Since 1990, many of the new assembly plants have been located in the Deep South, centering on Alabama and Mississippi. That trend continued with last week’s announcement by Kia, a Korean automaker that is part of Hyundai Automotive Group, to build a new assembly plant in southwestern Georgia.

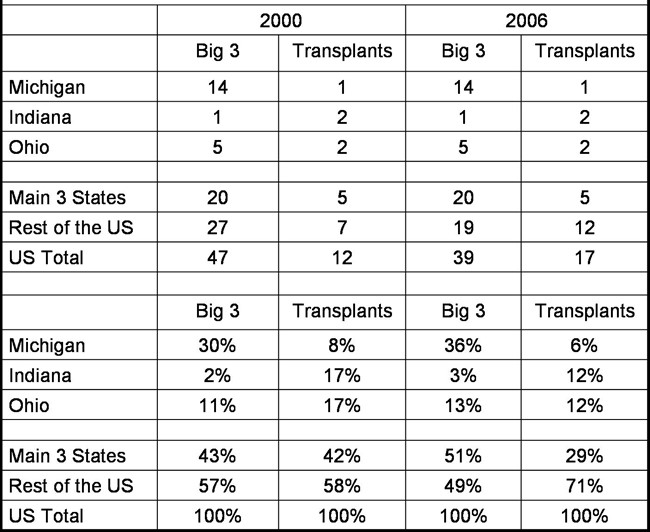

Table 1 highlights these geographic shifts with data for the last 6 years. A unit of observation is an assembly line (a measure of the output of an assembly plant, as assembly facilities can have multiple lines). Since 2000, the Big Three closed 8 assembly lines in the U.S. During the same time the so-called transplants, carmakers which are headquartered outside of North America, opened five assembly lines. None of these were sited in the three traditional auto industry states of Michigan, Indiana, and Ohio.

Table 1. Regional distribution of assembly lines

The Big Three restructuring summarized in table 1 includes two major capacity cutbacks by Ford (including the announcement from January of this year), GM’s announcement from November of last year, and Chrysler’s restructuring from several years ago.

The combined effect of these on the footprint of the Big Three assembly operations is a significant increase of their concentration in the core auto states (the share of Big Three assembly lines located in Michigan, Indiana, and Ohio will increase from 43% in 2006 to 51% by the time the recently announced restructurings will have been put into place) at a time when the domestic carmakers are substantially trimming output and capacity.

The April 18-19 conference in Detroit will discuss these trends in much more depth. More importantly, many of the nation’s experts will address questions that are key to the Midwest’s economic future:

- What are the indications and plans for a turnaround of the Big Three assembly companies?

- How important are Big Three losses with respect to the region’s automotive parts industry, and in what ways?

- How are auto parts companies restructuring to put themselves on a firmer footing going forward?

- What role will changing labor-management relations and working conditions play in the re-configured auto parts industry?