Detroit and Chicago: Real Property Value Comparisons

Both Chicago and Detroit have become poster children for city government financial stress in recent years. Chicago’s city and school district alike have been running structural deficits, meaning that the government has been covering its normal operating expenditures by issuing or over-extending debt and running down its assets. Both Chicago’s municipal government and school district face large shortfalls in required contributions for the future pensions of current and retired employees. Both have raised local property taxes as partial steps toward balancing their budgets. In the case of Detroit, the city has only just emerged from Chapter 9 bankruptcy while its school district teeters on insolvency under state-mandated “emergency manager” operation.

Are these places comparable in terms of their outlooks and situation? The value of real property in each place offers one fascinating indicator of the resources available to their local governments, as well as a look into how private homeowners and commercial property owners perceive the general prospects of Detroit and Chicago.

Why examine real property values? In some sense, real estate and improvements are long-lived assets that are largely fixed in place. In the market for these properties, buyers and sellers must assess and incorporate the government fiscal liabilities and service benefits – present and future – attached to these properties in the prices at which they buy and sell. High (and rising) property values may indicate that home owners and commercial property owners expect that the prospects for value in these locations are good and that they will continue to improve. And from the local government’s perspective, high values indicate that there may be room for further imposition of local taxes to fund government services, if need be.

Nuts and bolts

The estimation of the value of real property—land and improvements– in a locality is far from an exact science. The actual sales prices of property can be thought of as one reflection of an individual parcel’s value. However, as we saw during the financial crisis last decade, sales transaction prices can be very volatile, and sometimes speculative. More practically, parcels of property do not turn over frequently, so that transactions prices of all property parcels are not observed in any one year. In practice, then, local public officials often rely on various estimation methods in assessing the value of property for taxation purposes, most of which involve using a sample of information from similar properties that were sold during a year. From the recorded sales price and a property’s particular features such as size, location, age, and configuration, the property assessment office infers the value of each property and, ultimately, the total value of property against which taxes are levied.1 These taxable values are often termed assessed values or sometimes equalized assessed values and often represent some fixed percentage of market or true value.2

In the charts, we draw on such data from the local and state governments of Detroit, Chicago, and Illinois to estimate the market or true value of real property in both Detroit and in Chicago.3 For Detroit, figures on total assessed property value are published in the city’s Comprehensive Annual Financial Report (CAFR). By law, assessed value must amount to one-half of true value in Michigan. And so, to arrive at our estimates of full value, we simply double the assessed value. We believe that this yields a far upper bound on the value of residential property in Detroit because there is much evidence that, following the steep plunge in Detroit’s property market over the last decade, assessments were not reduced to accord with actual market value in a timely fashion.4

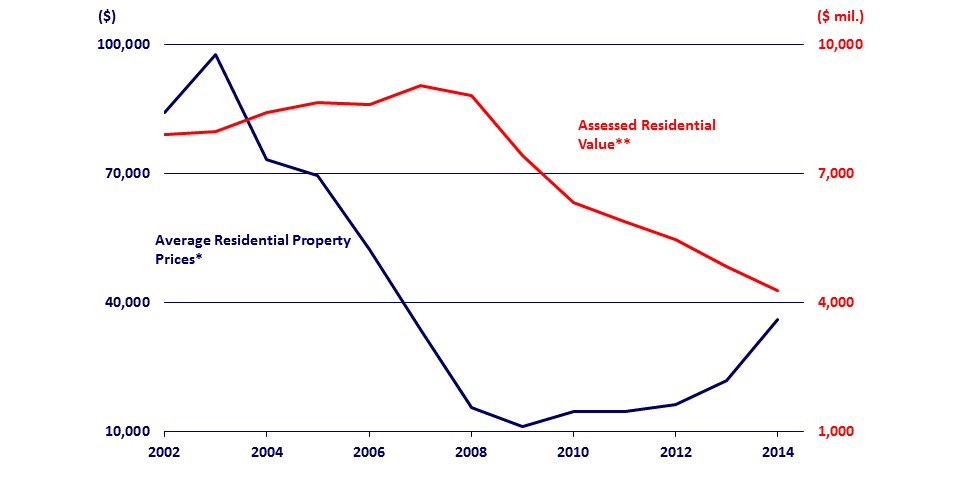

Drawing on prices of homes that recorded sales, the following chart shows that average home prices began to fall in 2004, while assessed value did not begin to fall until 2009.

1. Detroit average residential property prices (sales) and total residential assessed value

* Paul Traub's calculations courtesy of Detroit Real Estate Association and RealComp II, LTD, and

** City of Detroit CAFR

For Chicago, a prominent local government “watchdog” and research foundation has long been using state and city data on recorded property sales by class of property to estimate full market values.5 The accuracy of these data is believed to be reasonable, though far from exact.6

What do we see?

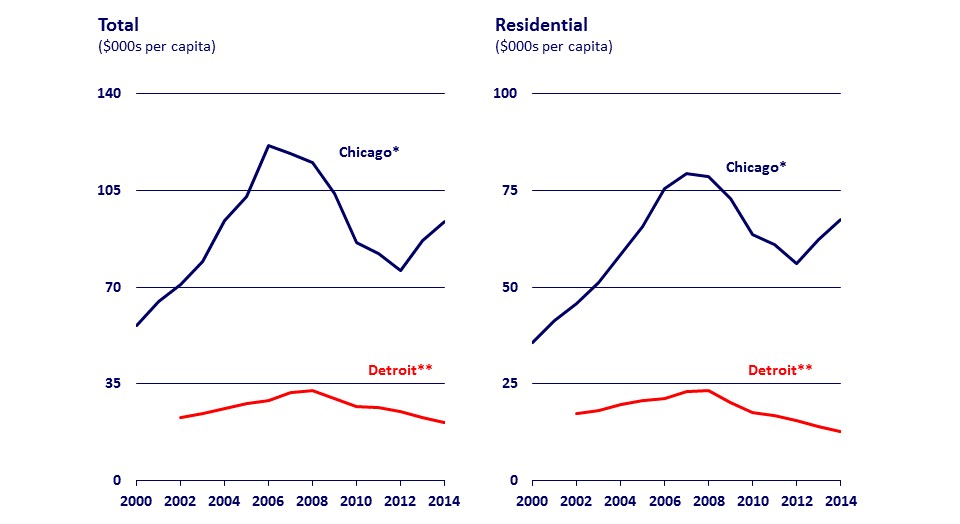

Due to lags in data availability, the estimates below are representative through calendar year 2014. The charts display total property value across all types, as well as the largest category in both Chicago and Detroit, that being residential property.

As shown here, Chicago real property value rose dramatically during the early part of last decade before dropping off just as dramatically. Detroit’s property values remained flat. However, Detroit’s apparent stability belies the fact that assessed values of residential properties have not been allowed to fall off in tandem with actual market transactions price there. As measured by volume of sales, the market for residential real estate in the city of Detroit became almost nonexistent during this period.7 Few homes were sold using conventional financing; almost all of them sold for cash. By some estimates, prices of homes sold fell by many multiples during this time, though they have since been heading back up in parts of the city.

Even using generous measures, and with rising home prices in some neighborhoods, residential property value overall in Detroit have continued to drift lower in recent years. In contrast, following the steep decline, Chicago property values have begun to recover for both residential and commercial (not shown) property.

Most telling, at over $80,000 per resident, the value of overall taxable real property in Chicago remained markedly higher than that of Detroit as of 2014. By even our generous measure, Detroit’s property values were only about $25,000 per resident.

2. Estimated market values: All cities

** Source: City of Detroit CAFR and Authors' calculations

Discussion

It would appear that, as measured by real estate values, Chicago’s economy and prospects remain much stronger than Detroit’s. And from a local government perspective, Chicago’s taxable resources with which to pay down liabilities and fund public services appear to be much larger. Of course, there are myriad political and institutional factors at play that render such a simple assessment of wealth inadequate to characterize the fiscal capacity of these cities. In both places, for example, property wealth is concentrated in a subset of places such as near the downtown areas and along the waterfronts. Accordingly, it may be difficult to tap available property wealth selectively because existing statute largely requires that tax rates be applied uniformly. And voters and their representatives may be reluctant to allow tax hikes at all. Similarly, there may be different levels of sensitivity to taxation in these two places and among different constituencies. For example, the imposition of new and higher taxation may cause economic activity and investment to decline more sharply in one place as opposed to another.

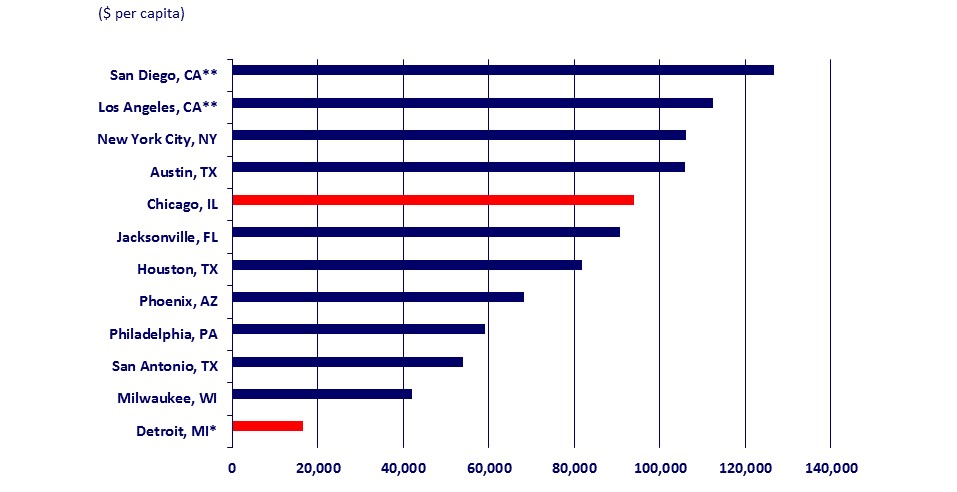

More broadly, we might ask whether property wealth is a good indicator of potential resources that local governments may draw on to fund services. A look at more U.S. cities may be helpful. The next chart undertakes the same exercise for the most populous cities. Here we see that Chicago continues to look fairly robust by this measure, though less so than the cities of San Diego, Los Angeles, Austin, and New York City.

3. Estimated real estate values

* Authors' calculations

** Subject to Proposition 13, which limits the growth rate of future assessments to 2 percent until property is sold.

Footnotes

1 Assessed value of property for taxation purposes is often a fixed percentage of market value across all property parcels, or else it is a fixed percentage across all parcels of a certain type or class such as residential, commercial or industrial. In turn, estimates of full value of all property can be made by taking sample average ratios of “assessed value/sales price” and applying these ratios to all parcels’ assessed values.

2 Equalized assessed values refers to the practice of further adjusting the totalities of assessed value of property across jurisdictions so that each locale’s assessed valuation represents the same or “equalized” value in relation to (percent) sales price or true value.

3 The city of Detroit also taxes tangible personal property of commercial enterprises such as computing equipment and furniture; Chicago does not.

4 Using sales price and assessed values for a sample of 8,650 residential parcels in 2010, Hodge et al find an average assessment to sales price ratio of 11.47, which suggests an average over assessment or property values many times over. See Timothy R. Hodge, Daniel P. McMillen, Gary Sands, and Mark Skidmore, 2016, “Assessment Inequity in a Declining Housing Market: The Case of Detroit,” Real Estate Economics.

6 Discrepancies arise because only sample values of real estate transactions are available in any one year. In addition, full value projections derive from the median value of property in each class. However, the median property value may not represent the entire distribution of property values.