China and Midwest Biotech

Many Midwest businesses are scrambling to adapt to the rise of China’s economy in world trade and financial markets. Import competition is especially keen. Some Midwest automotive parts suppliers are watching with concern as China has climbed to the number four exporter to the U.S. behind Japan, Mexico, and Canada (CFL).

How can U.S. businesses successfully adapt to the expansion of the dynamic Chinese economy with its low labor costs and less stringent environmental regulations? One way is to shift some operations overseas, investing in China for export back to the states and/or for sales to the growing Chinese market. So far, China has grown at a spectacular rate by inviting foreign companies to set up shop there. While many U.S. multinationals such as GM, Tenneco, and Motorola have done so, so have smaller producers such as Wahl Clipper (hair grooming products) out of Sterling, Illinois, and Atlantic Tool and Die Co. of Strongsville, Ohio.

Another avenue to survival and adaptation is to partner with Chinese companies on investment inside the U.S. So far, foreign direct investment (FDI) by Chinese companies in the U.S. has been miniscule. A few prominent examples of late may make Chinese FDI seem larger than it is, such as Legend’s purchase of IBM’s personal computer business and CNOOC’s failed attempt to purchase Unocal (petroleum). Over time, it is natural to expect that as Chinese companies grow and mature, they will sometimes find it advantageous to invest overseas. Likewise, foreign investment flows into the U.S. can mean new technologies and new portals to global markets for U.S. products, which often keep American workers productive and well-compensated.

This week I am speaking about biotech in the Midwest to the Midwest China Association. The MWCA’s mission is to attract inbound Chinese investment into the greater Midwest. They do so by educating the Chinese business community about the benefits of the Midwest, as well as educating our region about overseas opportunities. The MWCA sees Midwest biotech as one of the future cornerstones of the Midwest economy and aims to gather a portfolio of information that can be used to characterize and market the region to potential Chinese investors and partners.

Where can the MWCA and foreign investors learn about biotech activity and opportunities in the Midwest? Currently, there is no Midwest biotech association that compiles information and markets the region’s industry assets. However, journalist and seasoned industry veteran Michael S. Rosen is a virtual encyclopedia of information on the Midwest biotech business scene. And for a more active way of gathering information, the nation’s premier biotech meeting, BIO2006, will be held in Chicago this coming April. Due to its nearby location and Illinois sponsorship, Midwest states will be heavily represented.

As we learned at the December Chicago Technology Forum, past “BIO” meetings have galvanized the host regions, if not spurring them to significant cooperative efforts and partnerships, then at least delivering a more comprehensive and cohesive image and understanding of biotech activity and opportunities in the host region. Past meeting have been held in Philadelphia (2005), San Francisco (2004), Washington, DC (2003), Toronto (2002), San Diego (2001), and Seattle (1999).

How will I characterize the Midwest biotech landscape when I speak to the MWCA? For one, the Midwest is long on research and short on commercialization (CFL). A familiar refrain among biotech wannabe locales across the U.S. is their inability to attract venture capital investment flow and to originate startup companies, which is also true of most locales in the Midwest. However, less common among U.S. biotech wannabe locations are the host of potential assets for commercialization that can be found here in the Midwest.

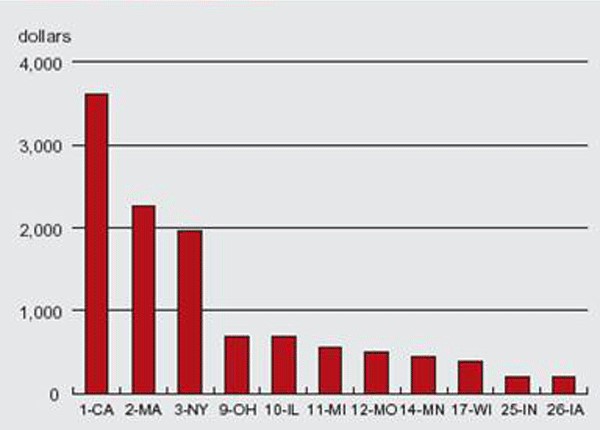

Our region’s universities and federal labs boast prodigious R&D funding and activity (see figure below). One prominent ranking of world universities’ science capacity reports that the states of Iowa, Minnesota, Missouri, Wisconsin, Illinois, Indiana, Michigan, and Ohio are the domicile of 7 of the top 50 and 12 of the top 100 institutions. Overall academic R&D funding in Midwest states tends to be above the U.S. average, with Ohio, Illinois, Michigan, Missouri, and Minnesota ranking 9th, 10th, 11th, 12th, and 14th nationally in 2004. Licensing revenue from the region’s universities amounted to $197 million for FY2003, with 47 new startup companies created, many of which are biotech in orientation. A young organization, the Midwest Research Universities Network (MRUN), is a collaboration that promises to raise the number of startups emerging from the regions universities and labs.

Figure 1. NIH state funding, 2004

Source: National Institutes of Health.

Table 1. World universities’ science capacity

The Midwest also hosts large pharmaceutical companies, including Abbott and Baxter in Chicago, Eli Lilly in Indiana, and large Pfizer facilities in Michigan. So far, although large pharma companies have become the prime buyers of basic research from biotech nationwide, local linkages between these companies and biotech have not always developed.

A “diversity” of biotech arenas also characterizes the Midwest. Aside from pharmaceuticals, companies that design and manufacture medical devices are found here. Minneapolis hosts Medtronic, Inc.; Milwaukee hosts GE Medical Systems (high-end imaging); Indianapolis has Guidant; the area around Warsaw, Indiana hosts the prosthesis industry; and the Chicago area is home to Baxter and Hospira.

Attendees of BIO2006 will also learn about the Midwest’s agricultural biotech sector. Ethanol plants are being built or expanding in the corn belt, and high-end research to more efficiently derive energy products from agricultural feedstocks is taking place at the region’s universities and biotech companies. Seed and chemical companies such as Pioneer Hi-Bred and Monsanto are continuing to produce stronger strains and new varieties of crops, as are smaller companies such as Chromatin Inc. in Illinois.

Will biotech become a cornerstone of the Midwest economy? While the outlook is promising, there are no guarantees. Despite all that the Midwest has going for it, some studies indicate that biotech activity is becoming more concentrated in just a few places rather than dispersing (link). So too, Midwest assets are noticeably dispersed and spatially separated across the region, making collaboration more difficult than within some existing biotech centers.

Still, it is a little more likely that the Midwest will realize its tech commercialization ambitions so long as organizations like the MWCA are working to connect Midwest biotech opportunities with potential investors and partners.