Foreign Direct Investment in the Midwest

Recently, companies from China have begun to explore direct investments in the Midwest and elsewhere around the world. Direct investment differs from portfolio investment, such as investment in U.S. Treasuries, in that direct investors have an equity interest that allows them to have some hand in the operation of the enterprise and its assets. Though direct investment from China is miniscule so far, past experiences with other emerging nations, such as Japan, suggest that the growth prospects may be large. Beginning in the 1980s, Japanese companies began to heavily invest in the Midwest, especially in automotive assembly and parts operations. Many of these ventures brought new capital and new ideas to the region’s economy, thereby easing the region’s adjustment to competitive decline and import competition. Such investments continue today as in the case of Toyota, which is scouring the nation—including Michigan—in siting a planned engine production facility. Can investors and partners from China and other emerging countries play a similar role in the Midwest in the years ahead?

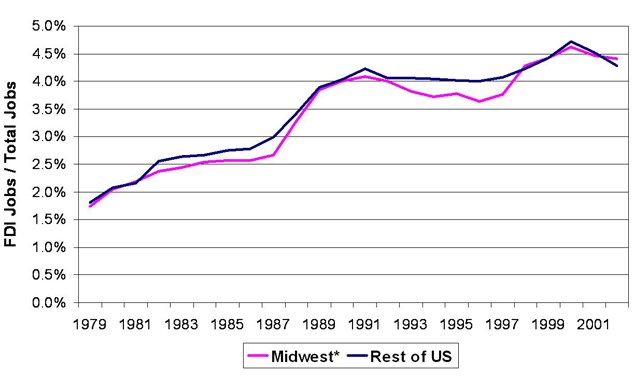

Part of the globalization phenomenon has occurred through the integration of capital markets, including direct ownership of companies by overseas parents. Data from the U.S. Bureau of Economic Analysis records foreign direct investment (FDI) transactions, along with characteristics by location of foreign-owned companies and their affiliated establishments in the United States. As a result, FDI in the U.S. may be either an acquisition of existing operations or a new investment, such as the building of a new manufacturing plant. The figure below displays wage and salary employment of FDI affiliates as a share of total employment in both the Midwest and in the rest of the U.S. It is telling us that this share has doubled in both the Midwest and the U.S. over the past 25 years.

Figure 1. FDI employment as a percentage of total wage and salary employment

Source: Bureau of Economy Analysis

By this measure, the Midwest has kept pace with the U.S. In one respect, this is surprising since the Midwest is far way from the coastal economies, where one might think that access to and linkage with global companies would be more intensive. On the other hand, most FDI takes place in the manufacturing sector, which is more concentrated in the Midwest relative to the rest of the U.S.

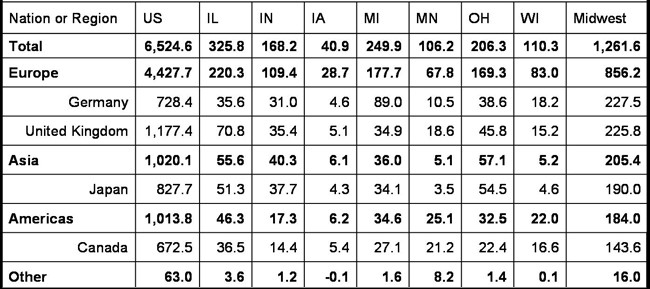

From which countries does our FDI originate? Inbound FDI has been taking place for a long, long time, back to our country’s founding when you stop to think about it. For this reason, it may not be surprising that most of our FDI is today domiciled in Europe (table below). As of 2000, Europe made up two-thirds of FDI employment at foreign-affiliated establishments in the Midwest, with over one-half of these domiciled in Germany or in the United Kingdom. The remaining one-third of FDI employment is equally split between Asia and the Americas. Almost all of the Americas’ FDI originates with Canadian companies, while almost all of Asia’s FDI originates with Japanese companies.

Table 1. FDI by employment 2000 (in thousands)

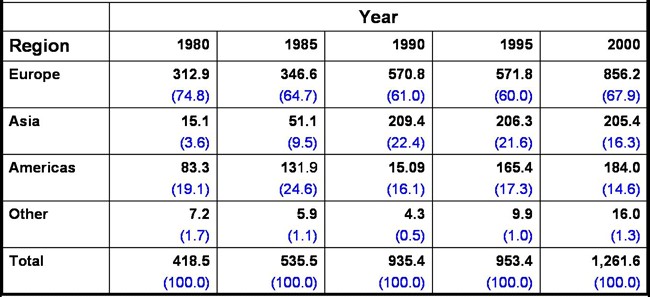

Over time, Japan’s FDI has been replacing Europe’s and Canada’s in the Midwest (table below). From 1980 to 2000, FDI employment at Japanese affiliates grew from 14,000 to 190,000 in number, thereby boosting Japan’s share of the region’s FDI from 3.4% to 15%. With this growth, Japan’s FDI displaced Canada’s for the number three spot behind those of Germany and the United Kingdom.

Table 2. Midwest* FDI employment, in thousands, and share of total

Source: Bureau of Economy Analysis

By now, the origin and legacy of Japanese FDI in the Midwest is well known. Japanese automotive assembly and parts plants in the U.S., such as Denso, Honda, and Toyota, demonstrated that their successful production and distribution technologies were not derived from location or cost advantages abroad. Rather, their affiliates’ success proved that the quality and cost efficiencies of their products could be duplicated in the U.S. This lesson was not lost on other manufacturers in the U.S. or worldwide. Japanese methods were copied and often improved across many industries. For many companies based outside of Japan, successful imitation and adaptation, along with investment from Japanese companies themselves, eased the transition to global competition and helped revive local production activity.

The map below displays the location and number of foreign-affiliated automotive parts plants in the eastern United States. Clearly, the Midwest has held its own in attracting these plants, which in turn suggests that the Midwest continues to be a desirable location for manufacturing production.

Figure 2. Foreign supplier density

Can inbound FDI from China serve the same purpose as FDI from Japan? To date, Chinese inbound FDI has been miniscule. As of the most recent tally, only 4,000 payroll workers in the entire U.S. were employees of Chinese affiliates versus almost 6 million from FDI affiliates from all nations combined.

So, too, the source of China’s emergence as a global producer differs greatly from those of Japanese and many European manufacturing companies. Although China is rapidly evolving its economy to integrate more sophisticated technology (link), China’s initial strength is as the low-cost producer for the world, not as the innovator. Unlike Japan, China’s rapid rise owes much to its openness to a huge influx of FDI into China by other Asian nations and the U.S. in search of low cost production there. Accordingly, Chinese companies’ interest in Midwest locales will probably be less focussed on production. Rather, these firms will more likely be interested in activities such as local product research and design for distribution to U.S. markets, with most of the production remaining in low-cost China.

A recent story by journalist Michael Oneal documented one such instance, that of Chinese affiliate Wanxiang, which is headquartered in Elgin, Illinois. Wanxiang’s originator is reported to be scouring the Midwest for troubled manufacturing operations, including auto parts suppliers, to acquire or with which to partner. One such partnership has resulted in Wanxiang taking an equity interest in Rockford Powertrain Inc., a supplier of heavy-duty driveline components to U.S. off-road equipment makers. Thanks partly to the partnership, the operation is now on a sounder financial footing. However, as part of its restructuring, its nonassembly production has been outsourced to China, while the U.S. operation concentrates on design, engineering, customer relations, assembly, and distribution. Overall employment has declined so far, especially in production, although the company is looking to grow.

What are we to make of China’s initial (and thus far miniscule) FDI overtures in the Midwest? First, China’s character as low-cost producer rather than as innovator likely means that the volume of China’s overseas FDI interest will be limited, at least for a while. Second, much like all potential FDI opportunities, partnering with Chinese companies on operations in the U.S. can sometimes be a successful strategy for domestic companies in preserving or expanding jobs and income. However, in China’s instance, the resulting production employment prospects in the Midwest are not likely to be as expansive as they have been from FDI partnerships with Japanese and European companies.

If Midwest manufacturing companies are to succeed, they will need to find their own best pathways. In some instances, success will be achieved by partnering with foreign companies on U.S. soil; in others, it will mean investing abroad to serve emerging market opportunities (link). Above all, innovation will be key to the success of their organizational structure, management, process technology, distribution, and new products.