How should we gauge manufacturing’s importance?

Manufacturing jobs and income are shrinking as a share of the national economy as well as the Midwest economy. Some representatives of manufacturers raise this fact in alarm, worrying that the shrinkage leaves the nation unable to support its needs and wants. But at the same time, some manufacturing advocates sometimes claim that the sector’s is mis-measured and undercounted. Meanwhile, economists mostly applaud diminishing manufacturing jobs as a harbinger of continued enhancements to productivity and standards of living for the average household, pointing instead to rising real output of manufactured goods available at ever-lower prices. How, then, should we think about and measure the economic importance of manufacturing?

To use an agricultural metaphor, manufacturing is no small potatoes for many Midwest communities. In the Seventh District states of Illinois, Indiana, Iowa, Michigan, and Wisconsin, personal income directly coming from manufacturing activity, on average, is more than 50 percent more concentrated than in the nation as a whole. Much of this personal income reflects wage and salary income attendant to jobs in the sector, as shown below. What’s more, such income and jobs are augmented by services related to manufacturing, such as transportation and warehousing, as well as white-collar business services that are purchased locally by manufacturing operations. All of this, of course, means jobs and income to Midwest residents, firms, and households.

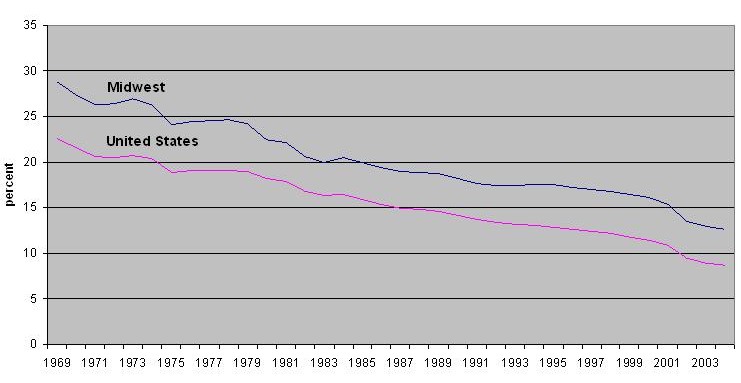

1. Manufacturing share of total employment

It is no small concern to manufacturing workers and communities, then, that income and jobs derived from manufacturing have been shrinking as a share of the economy. However, along with other economists, Senior Business Economist Bill Strauss of the Chicago Fed has pointedly illustrated that what is troubling to those who are discomfited is the very same phenomenon that brings about rapidly rising standards of living across a broad spectrum of households. The perpetual innovation and advances in productivity by manufacturers, accompanied by sharp competition among manufacturing firms, have delivered, on average, cheaper, more customized, more durable, and higher quality manufactured goods to households.

Government statisticians at the U.S. Bureau of Economic Analysis (BEA) calculate prices for manufactured goods purchased in the U.S., and they also do so for a standardized unit of a “real good” including autos, frozen foods, appliances, etc. Qualitative advancements in such manufactured goods are folded into counts of “real goods output,” meaning the total amount—both quantity and quality—of what we buy with our household income.

Over time, such measures show that real output growth by manufacturers in the U.S. and Midwest economies has kept pace with output or total gross domestic product (GDP) growth. Accordingly, if we measure real output produced by the manufacturing sector as a share of the overall economy, the manufacturing share would be virtually constant rather than declining. This is in apparent contradiction to the falling share of income and jobs derived from manufacturing activity.

Yet, in this there is really no paradox when we take into account the fact that the prices of manufacturing goods have fallen even while output has risen. That is, households and businesses are buying a greater “real” quantity of goods, but they are spending less on them overall because falling prices have more than offset the growing quantities being purchased. As illustrated and discussed in the 2004 Economic Report of the President, household and business purchases of manufactured goods have swelled in response to bargain prices, but not enough to sustain the manufacturing sector’s share of total revenue (and income).

A much lesser reason for manufacturing’s falling share is that a greater portion of domestic goods are produced abroad. As the Report illustrates, if the U.S. trade deficit had been hypothetically held to zero while U.S. manufacturing productivity were allowed to improve at its historic rate from 1970 to 2000, the U.S. proportion of employment in manufacturing would be only 14 percent in year 2000 rather than its actual 13 percent. Accordingly, rising productivity in domestic manufacturing accounts for the lion’s share of the decline in manufacturing share of employment from 25 percent in 1970. And yes, even that part of the shift from manufacturing to services related to the rise in imports has helped to buoy U.S. living standards because some goods can be produced abroad more cheaply, thereby allowing U.S. workers to instead produce greater services for domestic consumption.

Manufacturing representatives sometimes claim that manufacturing is not shrinking as share of current economic activity or at least that the shrinkage is being greatly overstated. Rather, the sector is being undercounted because some functions previously performed by manufacturing companies have now been outsourced to service companies. A consistent accounting of manufacturing activity would show it to be more sizable.

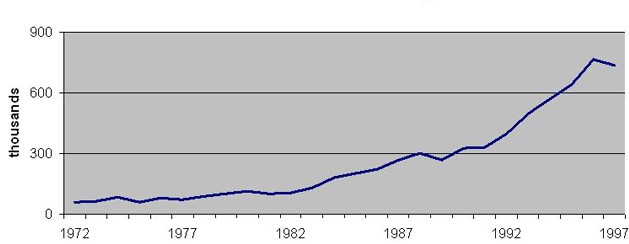

This latter assertion is partly true and but it does little to alter the long-term reality that the proportion of income and jobs derived from the manufacturing sector has fallen dramatically over many years. For one, it is true that U.S. manufacturers are increasingly relying on temporary workers rather than on their own employees. In official tallies, these temp workers are attributed to the services sector rather than to manufacturing. Yet, while their numbers expanded by roughly one-half million in the U.S. during the 1990s, according to a study by Estavao and Lach, they still made up only 5 percent of the manufacturing work force.

2. THS jobs in manufacturing

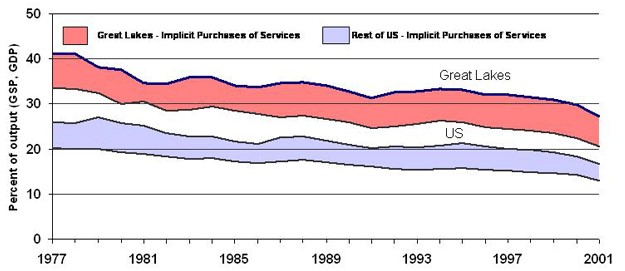

The outsourcing of functions by manufacturing companies is perhaps more important in mismeasuring manufacturing activity. Greater specialization of business functions, including accounting, marketing, payroll, information technology (IT), human resource management, research and development (R&D), strategic management, and public relations, has taken place such that most businesses—not only manufacturing— have come to outsource an increasing share of such activities. The snapshot below is drawn from data from U.S. Input-Output tables that are estimated by the BEA. In particular, manufacturing companies are shown below to be purchasing increasing amounts of business services in relation to each dollar of their own output since 1982. Not all of this service growth derives from outsourcing from manufacturing companies. Manufacturers are also using more services to deliver goods than in the past. In other words, the knowledge content of final goods delivered to households and businesse is higher than before. For example, pharmaceutical production may require an increasing amount of both R&D and testing services purchased by pharmaceutical companies, as well as legal, advertising and public relations services.

3. Select services: Direct requirement coefficient

I have constructed a rough accounting of total purchased services by U.S. manufacturing companies from 1958 onward. The construction subtracts the BEA’s measure of manufacturing from the U.S. Census Bureau’s measure of value added in manufacturing. Since the U.S. Census’s value added includes services purchased by manufacturing companies, the difference provides an estimate of purchased services. For the U.S., I find that in the late 1950s, manufacturing companies purchased approximately 16 cents of services for every one dollar of their own output. This had climbed to 30 cents in recent years.

The figure below illustrates the generous and comprehensive measure of “manufacturing activity” for both the U.S. and for the Great Lakes region from 1977 to 2001. The color additions represent purchased services, which are shown to considerably inflate the share of manufacturing in total economic activity—be it GDP or its state equivalent, gross state product (GSP). However, regardless of the inclusion of purchased services, manufacturing activity is shown to be steadily declining as share of output.

4. Manufacturing in the Great Lakes region and the U.S.

To return to the agricultural metaphor, is it appropriate to think of U.S. manufacturing as we do production agriculture? The parallels are often drawn. Production agriculture employed close to one-half of the U.S. workforce prior to the dawn of the twentieth century. Subsequently, tremendous gains in productivity provided magnificent improvements to the American diet while shrinking the size of the sector to 3 percent of the work force. In broad perspective, the remainder of the work force have now been freed to deliver to us a great array of services and goods, even as we eat better.

Although the parallel to manfacturing is instructive in some ways, not all observers would be satisfied in relegating manufacturing to the backwaters of economic history along with agriculture. For one, some argue that the sector continues to be the chief engine of innovation in overall U.S. productivity and innovation growth. While the manufacturing sector has diminished in size, it continues to be responsible for a greatly outsized share of the nation’s R&D. As of 2001, manufacturing funded 44 percent of the nation’s R&D, or $199 billion. This amounts to an innovative intensity that is roughly four times the size of the sector’s own activity.

Moreover, it is also argued that the much of the payoff or “economic returns” to this innovation accrues outside of the manufacturing sector to a great extent. That is, there are large spillover benefits to R&D performed by manufacturers. In particular, as service firms providing health or personal services or business services learn to use new and innovative capital equipment such as IT equipment, medical equipment, or pharmaceuticals, their own productivity continues to grow or accelerate.

In the end, how should we measure manufacturing’s importance to the U.S. economy? The answer is, of course, “in many ways.” For manufacturing communities and workers, it will be helpful to track the diminishing (sometimes growing) shares of manufacturing jobs and income in the economy. Communities will sometimes need to consider how to best transition to new economic base sectors; workers will sometimes need to transition toward new or enhanced occupational skills or even to different locales.

In continuing to track productivity or “real” output growth of manufacturing, nations and regions will gain a better understanding of the sources of national growth and living standards. In this, there are several important public policy arenas. Which particular public policies with respect to public investment in fundamental scientific research and technical education give rise to productivity innovations? What regulatory environment is most fertile with respect to the protection of intellectual property, promotion of competition among global firms, and the flow of workers and their ideas across international borders? How much should we be investing in public infrastructure of importance to manufacturing such as roadways, ports, and air cargo airports? How much and in what ways do open global markets for investments, services, and manufactured goods lift our standards of living?

If we get such questions right, the size of manufacturing of the manufacturing sector will be just right. That is because, in market economies such as ours, both service and goods-producing firms compete, adjust, evolve, and innovate and, in the process, they provide households with the services that they desire. Whether those services emanate from manufactured goods or whether they are provided directly to households by service workers is not at issue.