Logistics and the Midwest

Transportation of goods and materials seems to be as important as ever in the U.S. economy. Rising personal income in the U.S. begets greater demand for goods, and these goods must be transported from their place of production to the places where households consume them. In addition, as global trade has expanded, goods are purchased and transported from afar to an ever greater extent. Meanwhile, the physical production processes in manufacturing now have longer supply chains of parts and inputted materials around the world, which help take advantage of the differences in labor costs and skills in different countries, further magnifying transportation demands.

Such transportation activities have long been more important to the Midwest economy. The movement of materials, parts, products, and finished goods is as much a part of its commerce as farming and manufacturing. But the nominal values of farming and manufacturing are diminishing in the region as a share of the Midwest economy. Can the same be said of goods transportation and logistics?

Upon initial consideration, we might think so. However, the aforementioned trends in global trade and transportation may also tend to heighten transportation demands in (and across) the Midwest region. So, too, many Midwest manufacturers have adopted so-called just-in-time (JIT) production technologies in manufacturing. JIT production methods put a premium on low inventories everywhere along the supply chain. And to accomplish these low inventories, JIT production methods make heightened use of the transportation of parts and materials.

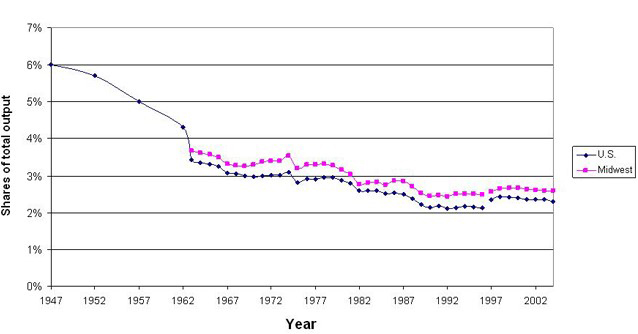

The figure below displays transportation and warehousing output as a share of Midwest total output and as a share of U.S. total output (figures quoted are in nominal dollars and exclude personal air transportation). True to form, the Midwest has been an intensive user of transportation and warehousing services. A closer look at the transportation subsectors reveals that rail, air freight, trucking, and warehousing are more concentrated here than in the overall U.S. Pipelines and seaports are less represented.

1. Transportation and warehousing share of total industry output: U.S. and Midwest

2. Transportation and warehousing sector share of total output: 2004

It is somewhat surprising that the nominal share of output devoted to goods transportation has declined over time in both the region and the nation since 1947. This means that either fewer transportation services are being demanded or that productivity gains are delivering greater actual or “real” transportation services, but doing so at a lower price.

The latter wins hands down. An examination by the U.S. Bureau of Economic Analysis shows that real output growth in warehousing and transportation lagged badly from 1947 to 1987, averaging a growth rate 2.3 percent per year over this forty-year span. This is well below the growth of overall output, which was 3.6 percent per year.

However, in the more recent period from 1987 to 2000, real output in the sector did outpace overall economic growth, 4.6 percent versus 3.3 percent.

Two general phenomena explain the more recent resurgence in real output growth in transportation and warehousing. The more recent period has experienced rapid growth in global trade. Since 1987, for example, the sum of goods exports and imports in the U.S. economy has grown from 14 percent to 21 percent, as measured against total gross domestic product (GDP).

Since 1987, however, this surge in demand for transportation services has only held the sector’s nominal share of GDP in place. That is because productivity gains, coupled with competition, have held down costs and prices for transportation services. A survey article in this week’s Economist, describes the productivity gains taking place in logistics sector, “Like information on the internet, goods are moving around the world with ever greater efficiency.” As a result, from 1987 to 2000, average prices in the sector rose at only one-third the pace of the overall average price rise of GDP.

What are the origins of the sector’s productivity gains? Technological improvements in logistics communication, as well as the intermodal shipment of goods in standardized containers, have allowed transportation services to be produced with fewer inputs of real resources. Competition among service providers, partly owing to deregulation, has also spurred technological gains while holding down prices near to the costs of production.

Is the Midwest developing a sharper specialization in transportation and warehousing? The chart below looks at the ratio of the shares of transportation and warehousing output from 1963 to 2004 for both the region and the nation. Over the past 15 years, the Midwest’s share is widening its relative concentration in the production of goods transportation and warehousing. It may be the case that the central location of the Midwest, coupled with its established transportation infrastructure and its logistics know-how, are buffering the region’s economy with growth in transportation services.

3. Concentration index: Midwest vs. U.S. (100% = parity with U.S.)