Midwest payroll job growth—Turning but weak

Sample-based estimates of payroll employment are among the most prominent and timely indicators of regional economic performance. Recent trends in reported payroll data indicate lagging economic performance in the Seventh Federal Reserve District, which comprises all of Iowa and major parts of Illinois, Indiana, Michigan, and Wisconsin. Payroll job growth over the past year varies among these states, with losses in Michigan pulling down the District’s job growth average.

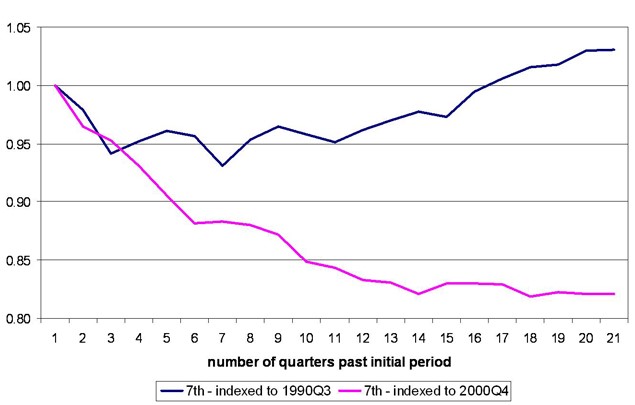

The District’s payroll job performance during the period following the 1990 national recession compared much more favorably to that of recent times. Have the region’s fortunes temporarily turned for the worse? Or is this lagging performance an indication of a structural worsening in the region’s growth path?

Payroll job estimates for December 2005 were released by the Bureau of Labor Statistics on January 24, 2006. While these figures seemingly complete the calendar year 2005, they have not been finalized yet. When the January figures are released (every March), monthly data are revised back for the previous 18 months. Because current data are based on reports from a sample of establishments, the data are later revised or benchmarked to a so-called universe of establishments that report their employment covered by the Unemployment Insurance tax system. The revisions can sometimes be significant and we will examine them during the week of March 6.

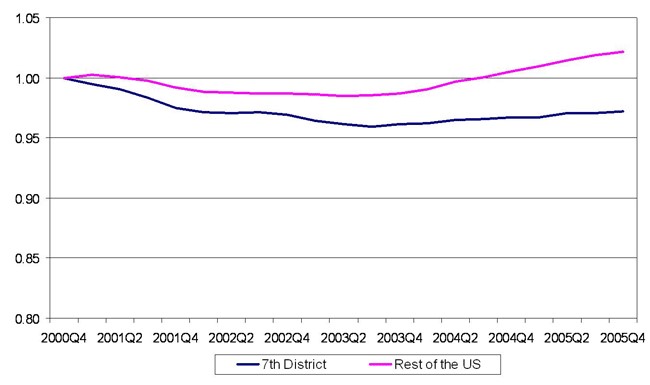

Over the past year, this preliminary data suggest that payroll job growth is trending up in all District states except Michigan. However, job growth continues to lag the nation in all District states except Iowa.

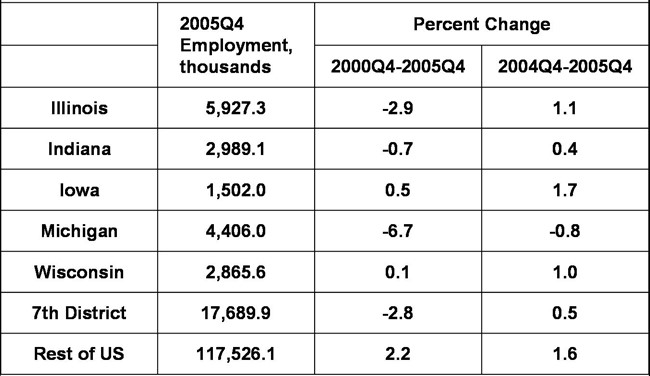

Looking back over the past five years to one quarter prior to the onset of the last national recession, there have also been steep job losses. The table below indicates that Michigan’s monthly average payroll jobs declined 6.7% from the fourth quarter of 2000 (prior to the onset of the national recession) to the fourth quarter of 2005. Reviewing payroll jobs data over this same five-year period for other Distict states and the rest of the nation, we can see that there was a 2.8% loss in jobs for the average of all five District states and a 2.2% gain for the remainder of the U.S.

Table 1. Total nonfarm payroll jobs (NSA)

Figure 1. Seventh District payroll jobs (quarterly average)

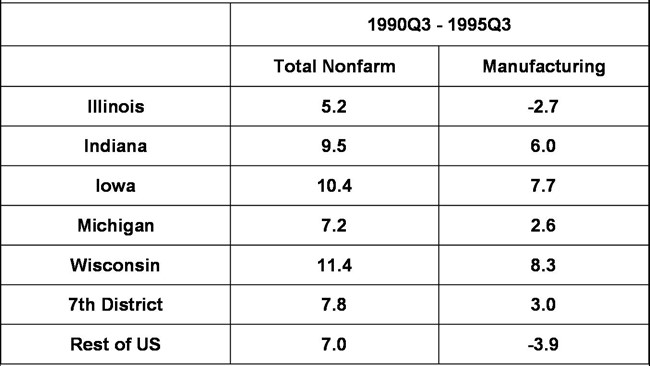

Such performance is in sharp contrast to results from the previous national recession of 1990–91 and its aftermath. During that five-year period, starting from the national peak quarter, 1990:Q3, District employment expanded by 7.8 percent versus 7.0 percent for the rest of the U.S. At that time, stronger than average payroll job growth emerged in Indiana, Iowa, Michigan, and Wisconsin.

Is the region experiencing a structural change, that is, a performance indicating deep-seated conditions that cannot be expected to reverse themselves? During the early 1990s, several transitory events and conditions were playing to advantages of the Midwest, as well as to the disadvantages of other regions. Among these were the savings and loan crisis and subsequent restructuring that affected parts of the South, the Northeast, and the West, but largely bypassed the Midwest. In addition, the build-down in national defense procurement, along with base closings, diminished income in jobs in some parts of these other regions. So, too, exports were growing and import competition was abating nationwide, following the easing of the dollar’s exchange rate during the late 1980s. In this regard, the high concentration of manufacturing in the Midwest was especially favored by a improving balance of trade.

Manufacturing employment performance generally appears to have been a key factor. In both the nation and in the Midwest, manufacturing employment remained generally buoyant during the 1990s. Since manufacturing was (and remains) so much more concentrated in the Midwest than throughout the rest of the U.S., this sector’s impacts on overall growth were magnified in Seventh District. Moreover, job expansion in District manufacturing actually surpassed the nation. The table below reveals that manufacturing jobs grew over 3% in the Seventh District from the third quarter of 1990 to the third quarter of 1995, whereas it declined by 4% in the nation over these five years.

In the more recent period, 2000–05, manufacturing jobs have declined steeply in both the Seventh District and the rest of the nation; both are experiencing manufacturing job declines at a pace of 17% to 18% during this recent five-year period.

Table 2. Percent change (NSA)

Figure 2. 7-G index of manufacturing employment

Have structural changes taken place recently in the Midwest involving manufacturing? We cannot say with certainty. Our examination of the manufacturing sector in 2004 established that manufacturing’s job share displays a long-term and sustained decline in the U.S. so that the region’s recent weakness is not necessarily a permanent turn for the worse (link).However, it is also clear that the automotive industry is undergoing some profound geographic shifts, which do not favor the Midwest (link), and that import competition also looms as a possible contributor to domestic automotive parts travails (link).

There is much that we do not know yet. Still, as the Seventh District crosses the mid-decade mark, with its lagging performance showing little sign of abatement, it is time to raise questions and to analyze the extent to which the region’s growth path has changed.