Midwest housing activity

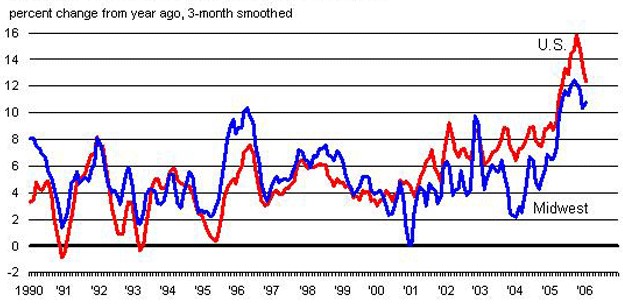

The Midwest Builders Show and Conference met recently in Chicago. Home builders and home owners alike are quite attentive to the slowing home markets in the Midwest and in the United States. During the past 4 to 5 years of low or falling mortgage rates, home appreciation in most markets has been very strong, as has home building. Because Midwest population and income growth have been lagging the nation, home appreciation and new home construction in most parts of the region have not kept pace with the national average. The chart below documents the relative appreciation rates for median-priced homes in the Seventh District states of Illinois, Indiana, Iowa, Michigan, and Wisconsin.

1. Existing single family home median sale price

The benefit of lagging Midwest residential real estate is that, if national home activity and appreciation levels off or declines, the impact on Midwest communities and households will not likely be as severe as in places where such real estate has become inflated by speculative purchases. Strong housing markets have driven more of the employment growth in these regions so that a general cooling in housing construction may bring a modest convergence in employment growth rates. Re-building areas such as parts of Florida, Mississippi and New Orleans are excepted, of course.

Speculative activity aside, there is little doubt that a region’s fundamental economic growth also determines residential building activity and appreciation. The charts below examine recent residential appreciation and building (i.e., permits for building) in large metropolitan areas of the Midwest. Both of these measures are plotted on the horizontal axis versus a growth index on the vertical axis. The growth index is an equally weighted sum of population growth (annual year over year) and employment (fourth quarter year over year) from 2004 to 2005.

Job and population growth in Minneapolis-St. Paul and Chicago have led home appreciation; lagging economic growth in Detroit and Cleveland has done little for their respective residential markets.

2. Appreciation, 2004-2005, percent change

3. Total permits, 2004-2005, percent change

Residential activity and appreciation are determined by more issues than simple demand. For example, high population growth has led to rapid home building in Des Moines, yet home appreciation there has been meager. Land availability and ease or restrictiveness of development can influence the supply of housing and its price. Home-building materials prices and construction labor costs may also be bid up to differing degrees across metropolitan areas.

Most metropolitan areas in the Midwest are little constrained by land availability in comparison to other regions of the country where geographic impediments such as mountains, government land, or oceans constrain development, or where communities themselves are more strongly authorized and motivated to restrict development.