Seventh District Cities: Their Business & Professional Services Sectors

Large Midwest cities, especially Chicago, are highly attentive to the opportunities that accompany globalization. Many large cities, such as London, Los Angeles, Paris, Hong Kong, and New York, are benefiting from heightened globalization. This is because big cities operate on a global scale, especially with respect to business and professional services such as international export, finance, law, business meetings and travel, entertainment and tourism, accounting, advertising, public relations, R&D, and management consulting. Accordingly, large Midwest cities would like to extend the global reach of their business and professional services as a way to revitalize their economies.

What is the industry base and recent performance of business and professional services for large Midwest cities? Let’s look at the varying depth and breath of these sectors in each of the largest cities in the Seventh District states of Illinois, Indiana, Iowa, Michigan, and Wisconsin.

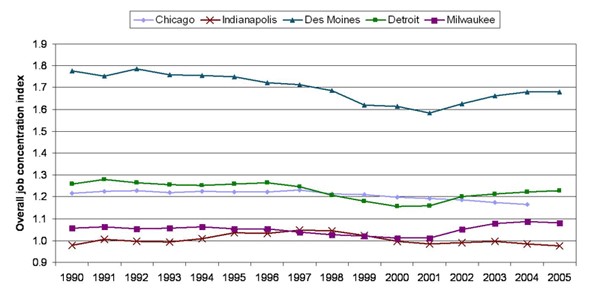

A common yardstick for these sectors combines various business and professional service industries into a single “professional services” index, including information and communications (NAICS 51), finance and insurance (52), business and professional services (54), and the management of companies (55). The index further indicates a city’s concentration of business and professional services as compared to the overall U.S. economy. The index is constructed as a ratio of the business and professional services’ share of employment in a particular Midwest city to the same share for the nation. For example, and index value of 1.52 for a particular city would indicate that its concentration of professional services employment exceeds the overall nation by 52 percent.

Such indexes are shown below for each of the largest metropolitan areas in the Seventh District states of Iowa (Des Moines), Wisconsin (Milwaukee), Illinois (Chicago), Indiana (Indianapolis), and Michigan (Detroit).

1. Services* concentration indices for major cities in the Seventh District

We might expect that large urban economies would be concentrated in these services because such sectors are highly specialized in nature and can only be supported by the large and varied market and work force that big cities offer. In this respect, we see that the relative concentration of these service industries among the five cities does (roughly) correlate with population size. The larger metropolitan areas of Chicago and Detroit are more concentrated in professional services than the less populous metropolitan areas of Indianapolis and Milwaukee. As an exception, however, Des Moines, with a population less 600,000 (the Chicago area is 15 to 16 times more populous), leads the five metropolitan areas with a service concentration that is 70% to –80% higher than the overall U.S.

The relative size and contribution of individual service industries among Midwest cities is varied. For example, the figure below displays many of the particular business and professional service industries in the Des Moines area, both their relative concentration (horizontal axis) and their absolute levels of employment (vertical axis). Des Moines’ extremely high concentration of insurance carriers (4.8 times the nation) contributes greatly to its high overall concentration.

2. Industry by concentration and size — Des Moines, IA

Similar charts for the remaining metropolitan areas can be found on our Midwest Economy web site. The Chicago area economy is strong in advertising and management consulting services. Detroit is a leader in engineering and testing labs. Milwaukee is highly concentrated in the establishments that manage and administer companies.

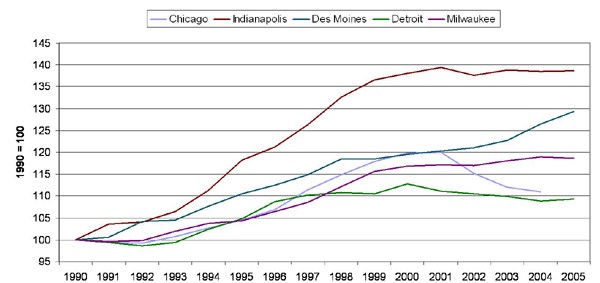

Though Indianapolis’ population and work force ranks third largest of the five metropolitan areas, its overall business and professional service concentration ranks last. However, Indianapolis is catching up in this regard. Since 1990, employment in this broad sector has climbed by almost 40%, which is double the pace (or more) of Chicago, Detroit, and Milwaukee.

3. Services* index for major cities in the Seventh District

Indianapolis is diversifying into service sectors. At the same time, many of the rural areas and smaller cities surrounding Indianapolis are becoming more concentrated in manufacturing—a sector that is not generally generating as many additional local jobs and income of late. The overall effect is that Indianapolis is having an easier time of it than many of its neighboring communities.