Congestion tolling and privately operated roads—An idea whose time has come?

As our roads become increasingly congested, tolling and privatization of highways will be increasingly important lifelines, especially for large urban economies. The idea that motorists should pay tolls when driving on congested highways has long been advocated by economists. Conceptually, the “public” part of highway transportation is limited to the necessary intervention by public authorities to strategically acquire land for transportation and assure that all have access to travel freely in pursuit of commerce and recreation. However, the individual’s use of a roadway is often “private” in that it imposes congestion costs on other drivers (and some pollution as well). That is, in the motorist’s decision to use a road, the individual driver does not consider the congestion costs imposed on other drivers, thereby leading to the overuse of limited public roadway capacity. As a remedy, congestion tolls bring these individual driving decisions back into line with the greater public good. As the degree of road use (and congestion) varies by time of day and by day of the week, so should the amount of tolls vary accordingly.

After a long hiatus, interest in congestion tolling and privately operated roads has been climbing. European and Asian cities have made innovative headway in congestion fees. Both Stockholm and the City of London have implemented motor vehicle charges for the privilege of access to their central area; so has Singapore. Most recently, New York City has proposed to charge auto motorists $8 for the privilege of driving around Manhattan during peak traffic hours, with higher fees for those driving trucks.

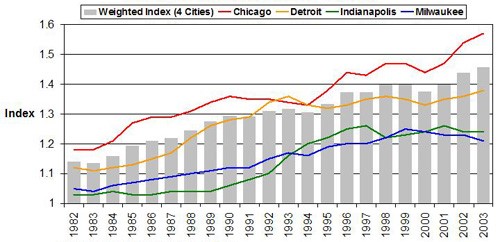

Such actions are largely being spurred by rising congestion—which did not materialize overnight. The Texas Transportation Institute (TTI) creates a “travel time index” that indicates the relative change in travel time from peak traffic to free-flow traffic. In a TTI report, Chicago in 1982 had a travel time index of about 1.2, meaning that given a 40-minute commute during a free-flow period, a person driving during peak hours would drive about 48 minutes (20% longer than it “should” take). This had climbed to 57 percent longer by 2003. In four major cities of the Seventh District, the added time to a commute during peak hours has increased from 14% in 1982 to 46% in 2003.

Figure 1. Travel time index

Prior to the recent spate of toll programs, some highway authorities experimented with non-price-rationing measures such as “high occupancy vehicle” (HOV) lanes. To curtail congestion, HOV lanes set aside and dedicated freeway lanes to those vehicles, including cars and buses that have multiple occupants. Unfortunately, the results were sometimes disappointing in relieving congestion because HOV lanes merely attracted vehicles that already contained multiple occupants, without prompting a significant number of single-passenger motorists to carpool. So, too, the dedicated HOV lanes, while often uncongested, tended to push even greater congestion onto unrestricted lanes of the highway.

In response, the so-called “high occupancy toll” or HOT lanes have sometimes been called into action. HOT lanes are essentially HOV lanes that allow single-occupancy vehicles to motor in them—but for a price.

What has brought us to this state of affairs? Under the best of circumstances, motorists prefer to drive when and where they choose at no charge. But Americans’ penchant for driving has far outrun our financial ability to build roads. Lifestyle changes have tremendously raised the miles traveled in cars by U.S. households. Rising household incomes have lifted the desires for ever larger houses and lots, which are, in turn, often satisfied by homes located quite far from work sites. In addition, owing to the desire for residential privacy, homes are often built on dead-end or nonthrough streets, which has aggravated traffic on the major arterial roads surrounding residential communities.

Also, the rising trend of two-earner households makes it difficult for both earners to simultaneously live near their workplaces. More generally, there are extensive logistics (and driving miles) for today’s American family to coordinate their many trips for work, shopping, education, and recreation. By one estimate (DOT), highway travel miles climbed 23.4% from 1995 to 2005 in comparison to a population increase of 11.4%. To accommodate such rising traffic, road expansion has climbed by only 2.6% over the same period.

Many observers recognize that improved community land use planning could help curtail our appetite for driving. For example, allowing developers to build high-density apartment-type residences around existing commuter rail stations would allow at least one of a household’s commuters to keep a car parked during the workday commute. So, too, stronger community planning efforts to assure that households of modest means can find affordable housing could help curtail the need for very long commutes. In the Chicago area, for example, policy think tanks such as Chicago Metropolis 2020 and the Metropolitan Planning Council spearhead efforts and programs that promote such community planning. Still, however sensible such planning may be, there has been very little of it implemented in many U.S. cities to date, and so, the increased commuting has often overtaken existing roadway capacity.

In past decades, state governments have often tried to keep pace with rising demands for driving and for far-flung housing by building more roads, including freeways. Several forces are now conspiring to slow such construction, especially tight fiscal conditions. The primary source of highway grant assistance to states, the Federal Highway Trust Fund, is replenished from the federal tax on gasoline. But the tax of 18.4 cents per gallon has not been raised since 1993 so that while revenues do rise somewhat along with vehicle miles traveled, they do not keep pace with rising gasoline prices and higher milage automobiles. Meanwhile, the revenue resources of state governments have also been besieged. Many state gasoline taxes are themselves imposed on a stagnant “cents per gallon” basis, and the voting public strongly resists the raising of gasoline taxes—especially as motor fuel prices have put increased pressure on household budgets over the past three years.

This leaves state government officials in a quandary, since the costs for competing public services, especially health care, education, and prisons, are concurrently squeezing state budgetary funds. State and local governments are hard pressed to even maintain existing highways, let alone fund expansions to curtail growing traffic congestion.

In addition to charging tolls, elected officials are also responding by increasingly turning to the private sector to assume responsibilities that include the financing, planning, marketing, construction, operation, and pricing of roads and bridges. Many combinations and arrangements of these functions are being attempted, from simple outsourcing of management and toll collection of highways to the all encompassing long-term leasing of highways as a publicly regulated private business entity.

Increased congestion and financial stress are not the only reasons behind the privatization and tolling of transportation infrastructure. New and improved technologies for payment of highway tolls have recently come to the fore. In contrast to the driver of yesteryear who had no option but to deal with the delay-plagued coin and cash toll booths, today’s driver can often make payment with little or no slowing down. Toll payments can be made online by transponders carried within vehicles or offline by remiote reading of license plates.

Seventh District initiatives lie at the recent epicenter of these movements in the U.S. In particular, the City of Chicago entered into a 99-year lease to a private consortium in 2005, turning over operational responsibility for and revenue returns from an 8-mile stretch of toll highway called the Chicago Skyway. By many accounts, the City benefited greatly from this transaction, while the public interest of drivers was also well served by enhanced operational efficiencies. The City of Chicago used income from the deal to retire existing debt on the Skyway infrastructure, and with the remaining revenue, it also set up a trust fund and purchased a sizable annuity that will help finance the city’s general operating funds well into the future. The driving public now enjoys rapid roadway maintenance and toll collection and eased congestion, albeit with prospective increases in toll fees.

Following Chicago’s lead, the Indiana Finance Authority leased its east–west toll turnpike for $3.8 billion in 2006. In large part, Indiana will use the proceeds to fund and maintain highway infrastructure throughout the state.

Meanwhile, in an effort to reduce rush-hour congestion around the Chicago area, the Illinois Tollway Authority introduced differential time-of-day pricing for only trucks in 2005. This program also doubled tolls for drivers in autos who choose to pay by cash at toll booths rather than by electronic transponder as they drive through rapidly. Revenues from these schemes are being used for repairs and expansion of the tollway system; they are also being used for the capital costs of new and reconfigured “open road” (or no-stop) toll collection system, which enables vehicles to pay tolls while traveling at highway speeds.

As the Illinois Toll Authority and other examples show, privatization and tolling of roads are separable actions. But in some ways they reinforce one another. Turning one’s operations over to private companies may provide one way to overcome the public’s resistance to congestion pricing, especially in contrast to government authorities who may be encumbered or distracted by non-transportation responsibilities or political constraints (i.e., the lack of political will to appropriately price use of the asset). Privatization potentially may also allow the operational authority to change pricing regimes and payment technologies more quickly in response to changing roadway conditions. Also, cost efficiencies and service quality are presumably improved when private agencies are watching the bottom line, though this has not always proved to be the case.

Still, the issues inherent in privatization schemes are contentious with respect to both purported operational efficiencies and sound fiscal management by governments. In awarding operational and pricing autonomy to private companies, it is not always clear whether the public interest is less than optimally served in favor of the profitability of the private operator. In particular, monopoly-type pricing by a private operator may be worse than publicly directed underpricing of congested facilities. Similarly, the data collected from the publicly rather than privately operated system may be more readily available for systemic public land use and transportation planning across entire metropolitan areas. For these reasons, as they enter into such partnership arrangements, elected officials must carefully craft contract terms and then follow up by monitoring the private companies during the terms of the contract.

Other concerns center on the behavior and actions of governments when they first enter into such agreements. Upfront revenue windfalls from the leasing of public infrastructure may cloud the judgment of governments and elected officials. Without proper disclosure and oversight of government by the public, the sale and leasing of transportation infrastructure to private buyers may pander to the near-sighted proclivities of elected officials. To plug current budget holes, or to plump up current spending for self-motivated reasons, public officials may unwisely commit large revenue streams immediately received from the sale or lease, while concurrently widening future budget deficits by eliminating public revenue streams. As always, the voting public and their representative think tanks must be on guard to oversee the terms of public–private partnership arrangements.

Elected officials must also represent and protect the public’s interests in matters of fairness and equity. Lower-income households are those who will be disproportionately burdened to pay for the use of less-congested roadways. In many ex-urban and suburban places, lower-income households must travel long distances to access their workplaces. Equity concerns are often compelling, since these workplace commutes are often lengthened by land use restrictions undertaken in high-income communities that limit the availability of affordable housing near work sites.

In response to equity concerns, some states and localities are adding capacity and subsidies to public transportation—both light rail and buses. When funding is short, as it usually is, governments often earmark part of highway toll revenues to such dedicated purposes.

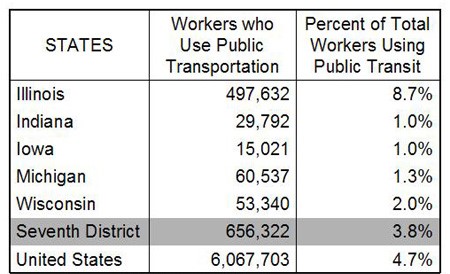

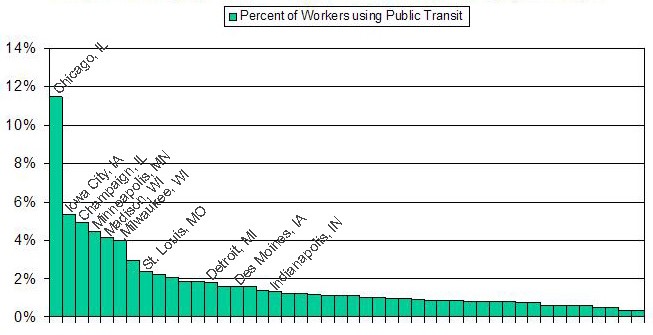

However, for many households, public transportation is not an option. According to the 2000 U.S. Census, only 4.7 percent of workers currently use public transportation. The table below shows average usage of public transportation for Seventh District states. Public transportation is, of course, more viable in densely populated places, including large cities such as Chicago. Since large cities also coincide with highway congestion and tolling practices, the use of tolls to fund public transportation subsidies will work better there.

Table 1. Average usage of public transportation for Seventh District states

Figure 2. Public transportation usage in midwest metropolitan areas

The use of congestion pricing, privatization, and new payments technologies remain in their infancy. Yet, because of the ever-increasing demand for driving, accompanied by little highway expansion and poor land use planning, heavy congestion will soon be a reality in many communities. For this reason, the Federal Reserve Bank will hold a one-day workshop this June to understand how pricing schemes, public–private partnerships, and emerging payment mechanisms can be used to address congestion and efficiency in commuter networks.