Financial Services Employment Growth in Chicago

Financial and insurance activities have historically concentrated in cities. In large part, this location tendency follows from the deep and broad information that is needed in allocating capital to those endeavors of highest return. Owing to their intense human interaction, large cities are advantaged in gathering and processing information about potential investments, and in matching specialized financial market participants on both sides of financial transactions.

Although it might seem otherwise, the heightened ease of global trade and communication in recent years has done nothing to break loose the urban advantage in financial services. To be sure, technological advances in information technology have lowered the costs of transmitting information over long distances, thereby allowing some financial functions to disperse to less urban areas. For example, routinized activities such as the processing of insurance claims and billing invoices can now be more cheaply carried out in small U.S. cities or even overseas. However, to the contrary, the complexity of financial transactions has grown considerably, putting a high premium on the advantages of urban location as the domicile for many higher order financial transactions and for highly skilled financial workers and entrepreneurs.

As the fourth largest metropolitan area in the world, measured by total annual output, the Chicago area harbors some hopes for a strong and growing financial services sector. Chicago has long served as a significant regional financial capital for the Midwest, especially in banking and insurance. So too, its risk management exchanges and member firms have evolved these particular specialties into industries of global reach and employment. Accordingly, while Chicago’s economic roles in manufacturing and other activities have waned, Chicago’s stature in financial services remains highly important in supporting the region’s economy. For 2005, financial and insurance payroll jobs amounted to 246,000 in the metropolitan area, comprising 5.8 percent of the total job base.

The current industry classification system (NAICS) breaks down financial services into three parts: Credit intermediation (NAICS 522), Securities and Commodities Contract Brokerages & Other Financial Services (NAICS 523), and Insurance Carriers and Other Activities (NAICS 524). “Credit intermediation” includes commercial banking along with credit card issuing, consumer lending, sales financing and mortgage lending. NAICS 523 includes not only stocks, bonds, commodities brokerage and exchanges, but also investment banking, portfolio management, and investment advice.

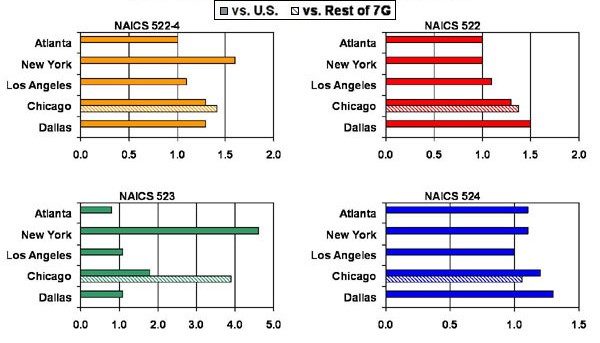

Using payroll employment by industry as a measure, the graph below displays the relative concentration of large U.S. cities in these industries versus the overall U.S. economy. An index value of one indicates parity with the U.S. in the industry’s job concentration; a value exceeding one indicates that the city’s employment concentration exceeds the U.S. For example, a value of two indicates that a particular industry concentrates twice as much employment in the city as compared to the U.S.

Generally, Chicago and other large metropolitan areas are seen to concentrate more highly than the U.S. across major financial industries. The Chicago area’s payroll employment index registers a value of 1.33 for 2006, indicating a concentration over the entire 522-524 sectors that is 33 percent more concentrated than the U.S. (This concentration was approximately the same as back as 1990).

The Chicago area’s sharpest employment concentration lies in the NAICS 523 sector, securities and commodities brokerage etc. with an index value of 1.96. In large part, this derives from the city’s world-prominent risk exchanges and their member firms. In addition, however, concentrated sub-sectors also include investment banking, portfolio management, and investment advice.

In addition to these activities, Chicago’s economy also concentrates employment in insurance related sectors (NAICS 524, an index value of 1.15) and credit intermediation (NAICS 522, an index value of 1.30).

1. Metropolitan area concentration index

Despite some ups and downs, Chicago’s financial sector employment has contributed to the city’s growth. As elsewhere in the U.S., the wave of banking deregulation led to profound consolidation during the 1990s. During the era, the Chicago area experienced employment declines in NAICS 522 concurrent with waves of bank acquisitions, mergers, and attendant consolidation. Since then, Chicago area employment in credit intermediation businesses has grown. For one reason, in a recent study, Tara Rice and Erin Davis document the proliferation of commercial bank branches in the Chicago region. Previously, severe legislative restrictions on the branching of banks in Illinois resulted in an underserved population.

Similar performance experiences befell Chicago’s risk exchange community during the late 1990s and early years of this decade. Prior to their recent structural re-organization and successful adaptation to electronic trading, Chicago’s risk exchanges stagnated as emerging exchanges around the world gathered market share from them. Since then, Chicago’s risk exchange and risk management community is once again expanding, including firm spinoffs into emerging business lines and technologies. One recent study entitled “Exploring Entrepreneurship: The Chicago Futures Trading Industry” documents the spawning of local economic ventures centered around “technologies developed to enhance the buy-side of trading as well as post-trading management and technologies that cope with the increasing volume of market data that is being generated through electronic trading.”

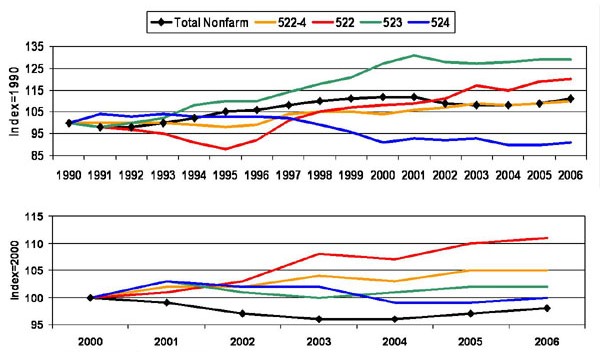

Through such upheavals, the graph below shows that finance-insurance employment growth has kept pace with overall job growth in the Chicago metropolitan area over the longer term. Employment in the insurance arena has declined 10 percent since 1990. However, these losses were made up for by growth in both remaining financial sectors. In particular, job growth in the securities and commodities sectors expanded by 30 percent since 1990, an increase of about 10,000 jobs.

In more recent times–since year 2000, all three finance and insurance sectors are helping to pull along the Chicago area’s labor market. On an annualized basis, in 2006 Chicago’s total payroll job levels across all sectors, financial and otherwise, remained 2-3 percent below the peak year 2000. Yet, financial and insurance sector payroll employment jobs has risen 5 percent over the period.

2. Chicago metropolitan area payroll jobs

How important is this financial service performance to the Chicago regional economy? In some measure, Chicago’s financial industries serve the surrounding Midwest region and its industries which would suggest some drag on Chicago’s financial sector activity. Yet, despite slow growth of the broader Midwest, Chicago’s financial and insurance sectors continue to expand payroll. Such growth bears watching. Averaged across all sectors, payroll jobs in the NAICS 522-524 sectors carry an average annual payroll that is 75 percent above the region’s average annual payroll per job, clocking in at more than $81,000 per payroll job in 2005.