U.S. auto exports on the rise

For the past 11 years, sales of light vehicles have consistently been above 15 million units per year, representing an unusually strong run for this industry. Toward the end of 2007, the U.S. market for motor vehicles started to slow down. As the price for gasoline kept rising, recently reaching $4 a gallon, not only did vehicle sales continue to fall, but consumers rather quickly adjusted the mix of vehicles they bought, abandoning full-size trucks and large sport utility vehicles (SUVs) in favor of fuel-efficient cars and crossover utility vehicles (CUVs, or utility vehicles built on passenger car platforms).

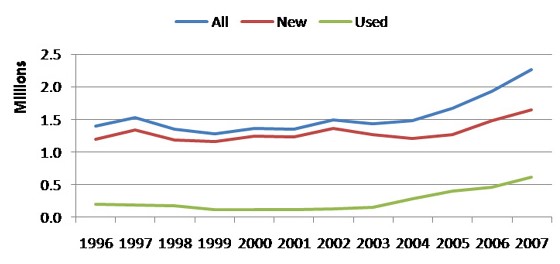

However, amid the ongoing turmoil in the auto sector, there has been a bright spot that often gets overlooked. Exports of light vehicles have increased by 52% since 2002, with exports of new vehicles up 21% and exports of used vehicles up almost fourfold (see figure below).

Figure 1. U.S. exports of light vehicles

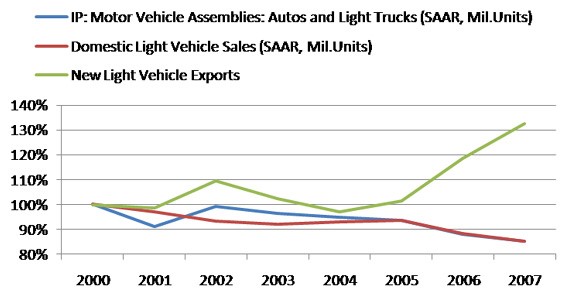

The figure below illustrates how exports of new light vehicles—that is, cars and light trucks, such as minivans and utility vehicles—have substantially outpaced domestic production as well as sales over the last eight years. As a result of this noticeable increase, last year’s exports of newly produced light vehicles represented 16% of U.S. light vehicle production, up from 11% as recently as 2002.

Figure 2. "Light vehicle exports, domestic production, and sales

What’s behind this rather substantial increase in exports? We first analyze in some detail where vehicle exports are going.

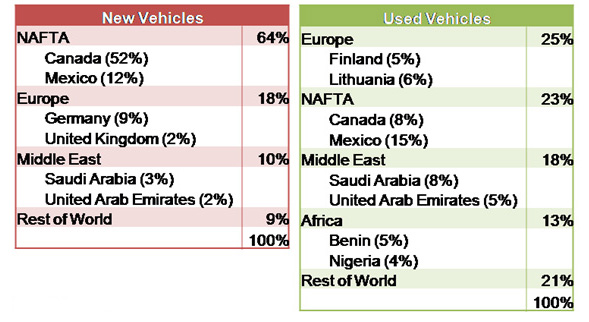

Data available from the U.S. International Trade Commission (USITC) identifies the destination country for exported vehicles. In 2007, new vehicles, representing just over 70% of all vehicle exports, were being shipped primarily to the two North American Free Trade Agreement (NAFTA) partners: Canada received just over half of all new U.S. light vehicle exports, and Mexico took in 12% of U.S. exports (see table below). The strong linkages among the NAFTA countries reflect the fact that the production footprint of each of the multi-plant carmakers is highly integrated across the U.S., Mexico, and Canada. Many vehicle models are being produced at only one assembly plant within North America. It is therefore standard practice to serve the entire North American market from that one location, resulting in cross-border shipments. In fact, analysts often refer to a single North American motor vehicle industry (in terms of production and sales). Other destination regions for U.S.-made vehicles rank far behind North America: In 2007 Europe received 18% of all new vehicle exports from the U.S., and the Middle East came in third with 10%.

Yet the significant increase in new vehicle exports during the last few years followed a noticeably different geographic pattern: Between 2002 and 2007, exports to the NAFTA countries actually fell by 5%. In contrast, Europe received 52% of the net increase of 287 thousand in new vehicle exports over that period; the Middle East accounts for about 40%, likely reflecting spending from increased oil revenues. Incidentally, exports of used vehicles were much more dispersed than those of new vehicles, with each major region of the world receiving at least 10% in 2007 (see table below).

Table 1. 2007 composition of U.S. exports — by region and major countries

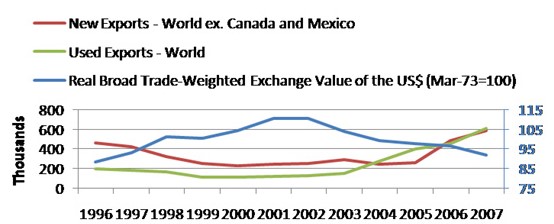

At first glance export growth seems related to the exchange rate value of the U.S. Dollar (see figure below). (Note that the exports of new light vehicles from the U.S. to Canada and Mexico are excluded from this graph.) Subsequent to the dollar’s recent peak in 2002, exports of both new and used vehicles accelerated. However, more is afoot than currency fluctuations. This is evident because exports began to rise a couple of years prior to the dollar’s 2002 peak. By the same token, the strong increase in new vehicle exports took place during the last two years, well after the dollar started to decline.

Figure 3. U.S. exports of light vehicles vs. trade weighted U.S. dollar

A better understanding may be found in the global nature of production employed by today’s automakers, many of whom have chosen to produce on U.S. soil. During the 1980s all the major Japanese carmakers opened their first production facilities in the U.S. The German carmakers BMW (Bayerische Motoren Werke AG) and Mercedes-Benz followed during the 1990s, and the Korean carmakers Hyundai and Kia entered during the first decade of the twenty-first century. Yet setting up production operations in the U.S. (or for that matter another country) for a foreign carmaker is neither done quickly nor reversed easily. In fact, the recent response of U.S. exports of light vehicles to currency fluctuations might well reflect the new reality of global production linkages common among today’s international carmakers. Indeed, exports of vehicles from the U.S. include production by many carmakers of different nationalities (unfortunately data on exports at that level of detail are not available). For example, both BMW and Mercedes now operate an assembly facility in the United States. Some of their models are exclusively produced in the U.S. from where they are shipped around the world. BMW recently announced a further expansion of its South Carolina plant, designed to increase its capacity by 50% by 2012. Both Honda and Toyota produce vehicles in North America. Yet the two companies’ production operations are linked not only within North America but also within their respective global operations. And so, rather than reduce production of certain models because of weakening U.S. demand, Honda recently increased exports of U.S.-produced models to Russia. Similarly, Toyota exports its Avalon sedan from the U.S. to the Middle East.

Volkswagen (VW), the largest German carmaker, decided in mid-July to locate a new assembly plant in Chattanooga, Tennessee, returning as a producer to this country after making cars in Westmoreland, Pennsylvania, over the period 1978–1988. Part of the company’s rationale is to increase the proportion of vehicles as well as parts produced in the U.S. dollar region so as to provide a natural hedge for its European base. Once the new factory is in operation, VW plans on exporting more than 125,000 North American-produced vehicles to Europe.

Finally, among the Detroit Three, Chrysler LLC is the most concentrated in North America, and it has been growing its exports overseas. Last year the company exported around 10% of its North American production to countries other than Canada and Mexico.

And so the recent increase in U.S. exports of light vehicles most likely reflects changes to the production system of international carmakers as well as changes in the value of the U.S. dollar. Because of their globally linked production operations many carmakers within North America can now readily shift production to serve overseas markets as demand conditions warrant. That aspect of the global auto industry could act as a buffer to a slowdown in a market like the U.S., which is home to production operations of many international carmakers.

This blog has been reposted as of July 29, 2008, reflecting domestic rather than total exports.