Housing Construction Developments

The nationwide falloff in residential investment activity is unfolding along various channels and to varying degrees across U.S. regions. Falling residential activity is being felt in consumer spending, manufacturing production (e.g. construction equipment, appliances, and materials), the financial sector (e.g. mortgage and development financing), real estate (sales) and, of course, in home building itself. In home building activity, slow-growing regions such as those in the Midwest may be somewhat advantaged. That is because construction activity does not comprise as large a share of total regional employment in comparison to fast-growing regions. And so, a proportionate decline in home building activity does not tend to slow the region’s overall economy as greatly.

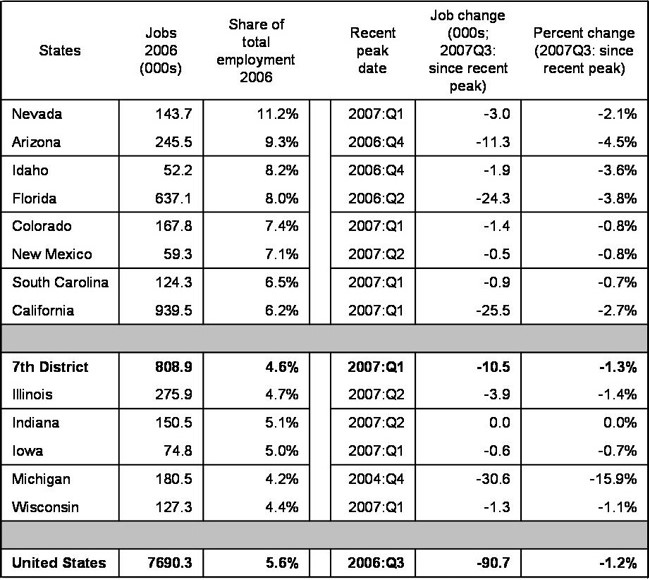

The table below reports payroll employment for the overall construction sector in major U.S. regions and in the Seventh District. States in the West and in the South such as Nevada, Arizona, California, and Florida report construction employment as comprising 6–11 percent of the state’s total employment for the year 2006 (see column 3). In contrast, the District’s construction industry makes up 4-5 percent of total payroll jobs—a share which lies below the national average of 5.6 percent.

Table 1. Construction employment (seasonally adjusted)

Source: Haver Analytics/BLS

The upshot of these differences is that a falloff in construction activity can be expected to be felt more keenly in those regions whose work forces are more concentrated in home building. At least this is true if construction activity declines are proportionate across regions. And if the rate of decline in construction activity were more rapid in regions outside of the Midwest, this would additionally contribute to some favorable convergence toward the Midwest pace of economic activity. By some reports, speculative home buying activity had been running very hot in many coastal states in recent years.

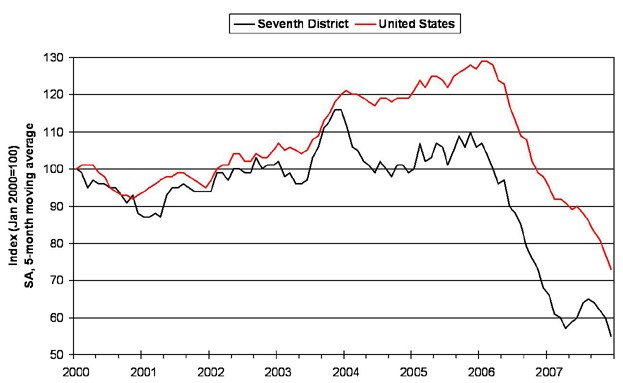

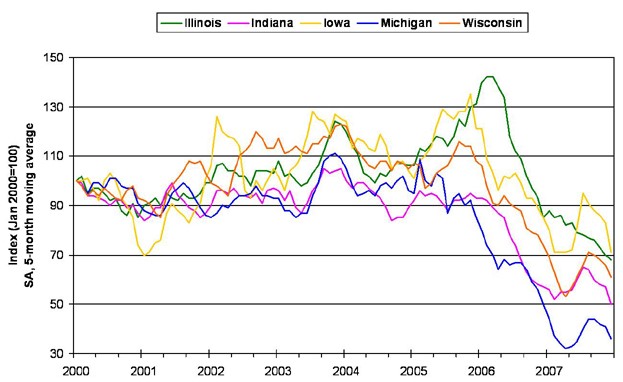

Data trends also indicate that the pace of recent declines in Seventh District home building activity have been on par with the U.S. Constructed square feet of residences from the McGraw-Hill Construction Dodge reports currently indicate that home-building has in fact been declining about the same as the remainder of the U.S. Since January 2006, the pace of home building has averaged declines of 25 percent year-over-year on a monthly basis in the Seventh District versus 26 percent in the overall U.S. over the same time period. Similarly, the pace of housing starts in the graphs below indicates that Seventh District declines have largely paralleled the U.S. since 2006, though the U.S. level of activity had climbed to a higher peak over the decade. Accordingly, though the construction sector covers more than residential activity alone, steeper-than-average job declines reported in the table above (column 6) are consistent with greater drops in home-building activity in the top construction-job states.

Figure 1. Housing starts — Seventh District and United States

Figure 2. Housing starts — Seventh District states

On the flip side, however, in many parts of the Midwest lagging general economic growth has tended to limit home buying and associated construction activity. In particular, Michigan’s construction employment peaked long ago during the fourth quarter of 2004 (see table above, column 4) and has fallen by 16 percent since then. So, too, housing starts (above) have fallen more steeply in Michigan versus both the U.S. and other District states.

But aside from Michigan’s woes, the pace of national construction employment growth (decline) has been converging (on average) with that of the Seventh District over the 2006-2007 period. The chart below illustrates the year-over-year pace of construction employment growth in the Seventh District versus the nation.

Figure 3. BLS construction employment (total U.S. and Seventh District)

This convergence cannot be attributed to home building activity alone because construction employment includes the nonresidential sector as well. As measured by jobs, residential building and construction make up 43 percent of the total. However, available data on commercial construction activity also indicates a pace of growth in the Seventh District that is roughly coincident with that of the nation. Consequently, the fact that the Midwest economy has a lesser share of total jobs devoted to new housing construction is likely contributing in some small measure to convergence of District employment growth with the nation’s.

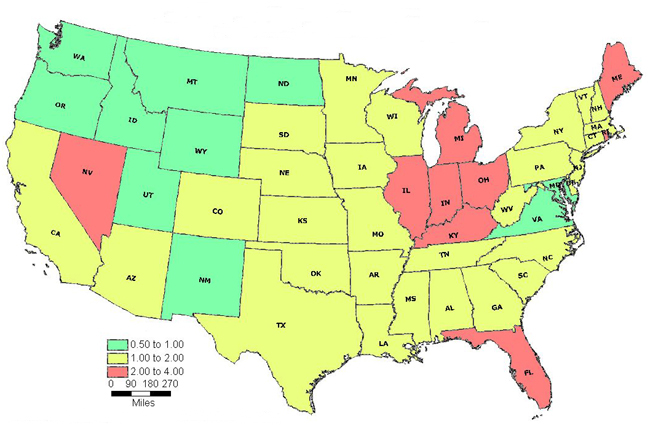

To be sure, this convergence of construction employment will not spare Midwest households from financial loss and dislocation associated with a slowing national economy. As economist Leslie McGranahan demonstrates in a recent analysis, local economic conditions are one of the primary determinants of home foreclosure in addition to a state’s foreclosure procedures and the degree of subprime and FHA borrowing. Accordingly, because automotive industry structuring has been weighing heavily on the Midwest economy, home foreclosure rates in Seventh District states are now running ahead of national averages (see figure below). An expected slowing of national economic growth during the first half of 2008 will continue to pressure many Midwestern homeowners who are stretching to meet their mortgage obligations.

Figure 4. Mortgage foreclosure inventory rate 2007Q3 (number of foreclosures/number of mortgages)

Note: Emily Engel and Vanessa Haleco-Meyer assisted this blog.