Manufacturing’s role in the Midwest future?

Across the Midwest, perhaps no economic development issue looms as large as the diminishing role of manufacturing. The Midwest’s once rapid population growth and lofty standard of living largely evolved from the industrialization that took place over the past 150 years. Yet, in recent years, job levels in manufacturing have declined. And as a share of overall payroll employment in the region, manufacturing has fallen from 29% in 1969 to 12% in 2007.

Additional debate has broken out because of dramatic declines in specific industries, such as the automotive industry, which is concentrated in Michigan and scattered throughout many parts of the region. In the face of such stark declines, the question arises as to whether the region must look beyond manufacturing and toward new industries. As the U.S. economy evolves toward advanced services, should the Midwest be following suit at an accelerated pace? And if so, how should the region go about it? For example, should the region’s policy focus on improving the quality of life features to attract highly skilled workers for business services and related industries? Or should the region cultivate new technology and entrepreneurial behavior in an effort to grow new industries?

Arguably, policymakers in the region should pursue all such avenues toward redevelopment and reinvention that are within the bounds of reason and with careful cost–benefit consideration. But there are also reasons to believe that traditional manufacturing can continue to play an important role in the Midwest economy. Significant opportunities remain for manufacturing enterprises that are both extant and emerging here.

In disparaging manufacturing’s prospects, an analogy to production agriculture can sometimes be misleading. In terms of long term productivity gains, some observers are only partly correct in drawing close parallels between the U.S. production agriculture sector and manufacturing. Rapid productivity growth in each sector has pushed down prices of products and lessened attendant labor demands. The world over, rising national income per capita has gone hand in hand with declining shares of a nation’s employment in agriculture, followed by declines in manufacturing. Eventually, such trends lead to a wealthy economy steeped in services. In the typical experience for a developed nation, the share of national employment in production agriculture drops because of startling labor saving productivity on the farm, coupled with unresponsive household demand for raw food products as incomes climb. In the U.S., for example, as our standard of living has progressed, agricultural labor as a share of the work force has declined from 41% around year 1900 to only 2% today.

Some of these same processes are also at work in the manufacturing sector. And so, some analysts reason that manufacturing jobs will similarly disappear; that is, eventually, only a slim manufacturing presence will remain across the nation as whole, leaving us an economically diminished Midwest region.

However, in contrast to agriculture, manufacturing continues to give rise to a significant share of income among the most developed countries in the world. This occurs in spite of the trends toward generating more services production in developed countries and offshoring manufacturing to low-cost countries. Manufacturing’s continuing importance to developed countries’ economies can be seen clearly in an exhibit within the Federal Reserve Bank of Dallas’ 2007 annual report. The report’s exhibit 8 observes nations both by the percentage of their workforce engaged in manufacturing and agriculture and by their average per capita income. Manufacturing resembles agriculture to only a modest extent with respect to these measures. As a nation’s income rises, the share of the workforce engaged in manufacturing does tend to decline; the same applies to agriculture. However, whereas the share of employment in agriculture drops off precipitously as countries grow wealthier, the share of employment in manufacturing declines only modestly and gradually. For even the wealthiest nations, such as the U.S., manufacturing remains a large and vibrant sector.

Manufacturing’s continued strength has much to do with the fact that manufacturing companies need to be knowledge-intensive and highly creative to develop new products. Strong productivity tends to reduce the amount of low-skilled labor required for manufactured goods, and intense global competition for such labor drives down the prices of manufactured goods. That said, as a counterweight manufacturing companies continue to come up with new products. These include consumer products, such as improved electronic appliances, pharmaceuticals, and packaged/processed foods, as well as tools for businesses, such as more advanced computing equipment, mining/construction machinery, and telecommunications.

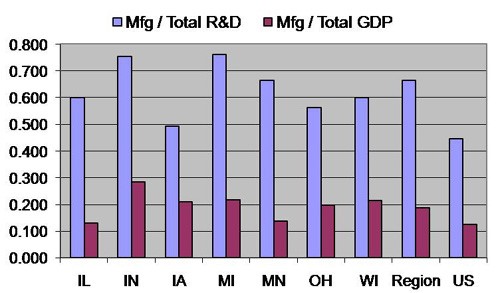

Some inkling of manufacturing’s high level of knowledge intensity can be seen from figures reported annually on research and development (R&D) of manufacturing companies. Manufacturing companies account for $123 billion of the nation’s $278 billion spent on R&D in year 2003—a 45% national share (see blue bars in chart below). This compares to a 13% share of manufacturing sector output in overall gross domestic product, or GDP (red bars below).

1. Manufacturing as percentage of total R&D and total GDP

Midwestern manufacturing companies have a strong orientation toward knowledge-intensive manufacturing. The region’s manufacturing companies account for 66% of the region’s R&D versus 19% of the region’s total output.

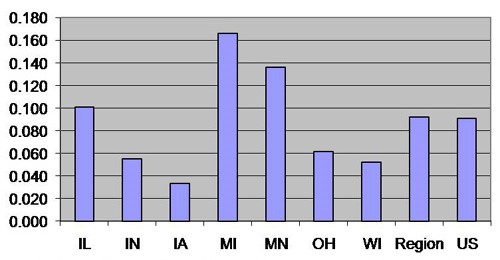

That the manufacturing R&D share of the Midwest economy exceeds that of the nation can be explained by the larger role of manufacturing companies in our region. Moreover, it may surprise some to learn that Midwest manufacturing is no less “high tech” than the national average as well. The sector’s “R&D intensity” also contributes to the dominant role of manufacturing R&D in the region. In both the region and in the nation, R&D spending makes up about nine cents of every dollar of inputs spent by manufacturing companies (per chart below).

2. Manufacturing R&D intensity

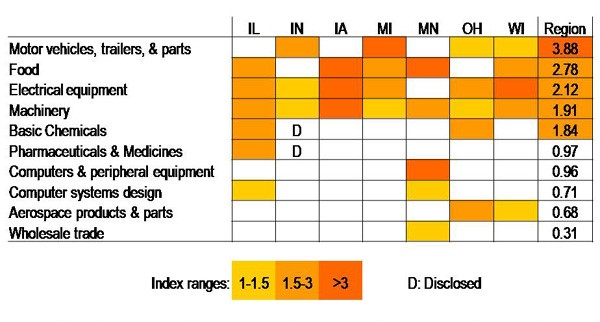

The bulk of the Midwest’s industrial R&D takes place within the region’s hallmark sectors—automotive, food products, electrical equipment, machinery, and chemicals. By our estimates, these sectors make up 42% of the region’s $42 billion of industrial R&D reported for 2003. The chart below characterizes the concentration of R&D by industry sector in the Midwest. Highly concentrated R&D expenditures are denoted by deeper shades. These concentrations are constructed for a state, for example, as an index of R&D taking place in a particular sector relative to the state’s national share of total output. For instance, the state of Michigan scores a deep shade in “Motor vehicles, trailers & parts” because its share of the nation’s R&D in this sector far exceeds the state’s share of overall GDP. Indeed, company activity in motor vehicle R&D in Michigan registered $10.7billion—a national share representing a concentration over 17 times the state’s share of overall economic output in 2003.

3. R&D concentration 2003

Other Midwest states can also be seen to be domiciles of R&D in particular industries. The final column above displays R&D concentrations (as an index number) for the entire seven-state region. In addition to intensive R&D activity in the region’s hallmark industries, the region also scores highly in pharmaceuticals, computer equipment and its design, and aerospace.

And so, if a high degree of ongoing R&D intensity is any indication, manufacturing will continue to play a strong role in U.S. production. Despite its current challenges in automotive production, the Midwest is no exception in this regard. To be sure, the region’s overall population and work force growth have lagged those of the nation. In some part, this reflects the region’s greater concentration in manufacturing—a sector that has experienced outsized impacts from labor-saving productivity and, to some degree, offshoring of activity. Nonetheless, there remains a sizable future to be built by the region’s manufacturing companies.

One public policy effort to further the strength of the manufacturing sector in the region has been initiated as the Great Lakes Manufacturing Council. This coalition will meet this summer “to discuss the image of the Great Lakes region, innovation in manufacturing, the work force and skills needed for manufacturing today and tomorrow as well as the borders and logistics requirements to effectively move goods and services in today’s global economy.” I hope to see many gather at the meeting to discuss (and act) on these issues further.

Note: Thanks for assistance from Graham McKee.