“Clunkers for cash” sells cars, hikes fuel economy

A few weeks ago, at the Detroit Branch of the Federal Reserve Bank of Chicago, we held a workshop that discussed the significant challenges in meeting the federal government’s new fuel efficiency standards. To help meet these challenges, the President recently signed into law a “cash-for-guzzlers” bill. Funded to the tune of $1 billion dollars, this program is designed to subsidize the sales of new vehicles in exchange for scrappage of older, less fuel-efficient vehicles. If this new program succeeds, it will take some older cars and trucks off the road, marginally improving the overall fuel efficiency of vehicles on our roads. It will also have the salutary effect of boosting sales at a time of great stress for automotive producers.

This bill is part of a broad-based policy effort by the current administration to improve fuel efficiency in the motor vehicle sector. This policy effort includes other measures such as accelerating the timeline from 2020 to 2016 for meeting the tighter corporate average fuel economy (CAFE) standards. In addition, there is the Advanced Technology Vehicle Manufacturing Loan Program, administered by the U.S. Department of Energy, which will fund innovative vehicle technologies designed to reduce our dependence on oil.

Technical details of the cash-for-guzzlers program, such as how dealers are to register for the program and how the payment of incentives is to be administered, will be worked out by the U.S. Department of Transportation by July 23, the program’s expected launch date. Yet one can already comment on the broader aspects of this bill.

What incentives are available?

Under this new program, a buyer can get up to $4,500 from the federal government toward the purchase of a new car or light truck (used cars do not qualify for this incentive). The actual amount given by the government is contingent on the improvement of fuel efficiency between the “trade-in” (the vehicle to be scrapped) and the new vehicle to be purchased. That is, this amount is staggered depending on the improvement in the miles-per-gallon (mpg) rating between the old and new vehicle. The vouchers available come in the amounts of $3,500 and $4,500. A “trade-in” is eligible for the lesser amount if the mileage improves by 4 mpg for cars and 2 mpg for light trucks. In order to get the maximum amount of $4,500, the mileage has to improve by 10 mpg for cars and 4 mpg for light trucks.

How long will government incentives be available?

In its current version, the program is set to end November 1, 2009, unless the funding is depleted earlier.

Which vehicles qualify for trade in?

There is no restriction as to where the vehicle was produced. Restrictions in the bill are of two kinds: the age of the vehicle to be traded in (it cannot be older than model year 1984), as well as its fuel efficiency (its mpg rating cannot be higher than 18).

Our estimate of the potential number of trade-ins

Two factors determine the eligibility of vehicles for the scrappage program: 1) vehicle fuel efficiency1 2) today’s resale value of vehicle models.2

To approximate how many eligible post-1984 vehicles are still on the road today, we applied an estimate of vehicle scrappage rates to the number of vehicles sold in each model year.3

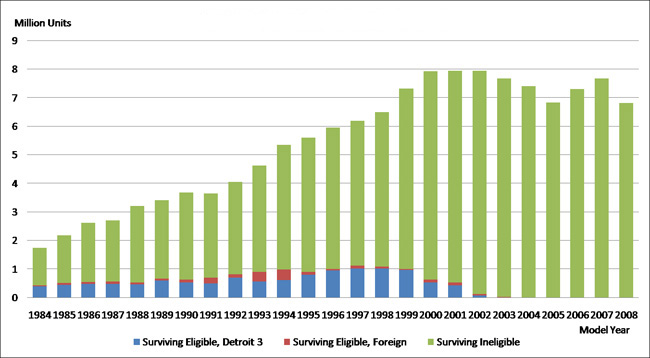

The two charts below show the level of today’s surviving vehicles by model year for both cars and light trucks. Additionally, for each model year we identify the number of vehicles eligible for the scrappage program, distinguishing vehicles produced by the Detroit Three from those made by other producers.

We find that this program covers far more light trucks than cars. Just over 16% of all surviving car sales since model year 1984 are eligible,—85% of which are Detroit Three (Chrysler, Ford, and General Motors) products. Also, 66% of all light truck sales from the same period are eligible, and 88% of these represent Detroit Three sales.

1. Surviving vehicles and eligibility: cars

2. Surviving vehicles and eligibility: light trucks

What impact on motor vehicle sales is expected?

Assuming an equal mix of fuel efficiency improvements, the average voucher handed out would be worth $4,000. The program is funded with $1 billion. That amount represents 250,000 vouchers of $4,000. To the extent these vouchers are taken up, they would increase light vehicle sales in like amount. At the seasonally adjusted annual sales rate of 9.5 million units recorded during the first five months of 2009, 250,000 additional sales would boost light vehicle sales by about 10% over the three months of this program’s existence. This estimated boost represents an upper bound as some of these trade-in transactions may have taken place anyway.

Footnotes

1 Data on fuel efficiency is available online.

2 See this link for a list of eligible car and truck models by model year.

3 Richard L. Schmoyer, 2001, unpublished study on scrappage rates, Oak Ridge National Laboratory, Oak Ridge, TN, as cited in Transportation Energy Data Book: Edition 23—2003, pp. 3-13, 3-15.