Growth and Great Lakes Cities

For half a century or more, the industrial belt of the Great Lakes and Midwest has lagged counterpart regions in much of the South and West. Large midwestern metropolitan areas arguably offer the best prospects for relief from this historical pattern. The reasons are rooted in a fundamental restructuring of the global economy that favors cities. In underdeveloped countries, rapid urbanization and the emergence of large cities have gone hand in hand with economic growth and progress. And in developed countries on all continents, two factors have lifted growth opportunities for large cities. Foremost, technological gains in transmission of information have intensified the productivity of cities because of their role as meeting places. Face-to-face communication complements digital information flows. As business people can more easily transmit and receive information via electronic devices, their time has been freed so that they can engage more intensely and broadly in in-person dialog and social interaction. In other words, carrying one’s office in the palm of one’s hand allows one to leave the physical office to better explore opportunities and ideas. Cities tend to maximize these encounters in person. Enhanced and cheaper air travel lends a helping hand.

A second factor, the opening of global trade and capital markets, has increased the possible scale and opportunities for large cities. Cities tend to function best in managing and administering far-flung markets. More open and intensive global trade has tended to broaden the reach and scale by which successful cities can perform such functions in finance, advertising, research and development, law, and company management. For this reason, some analysts believe that they can identify the emergence of “global cities” that have succeeded in such opportunities.

To date, large cities of the Great Lakes have not fully benefitted from these “new economy” trends. Migration to regions with warmer climates has slowed these cities’ work force and population growth—a trend also reflected throughout the remainder of the region. But more fundamentally, many if not most of the region’s large urban economies were built not on the service industries that benefit from the ongoing global changes, but rather on the manufacture of goods and associated freight transportation. These cities’ transition to services and knowledge-based economies has proven difficult because manufacturing-oriented places must overcome and replace larger portions of their economic base. Manufacturing-oriented income in the region has withered because of global competition, falling real prices for manufactured goods, and technical advances that have allowed goods to be produced with less labor. To these obstacles, technical changes in the production processes themselves may be added: Such changes have made the more-densely populated parts of large cities especially difficult places in which to manufacture, compared with those far suburban and rural places, where land is cheap and the transportation of materials is more convenient. The growth-retarding effect from manufacturing on U.S. metropolitan areas over the 1960–90 period has been documented in a statistical study by Edward Glaeser.

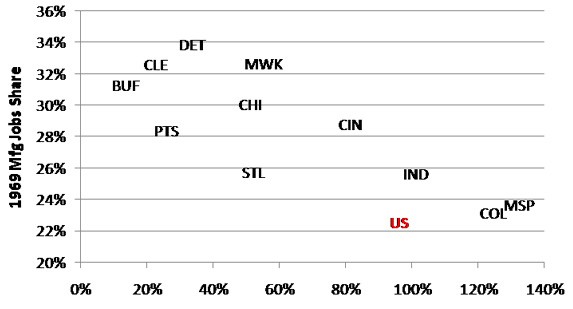

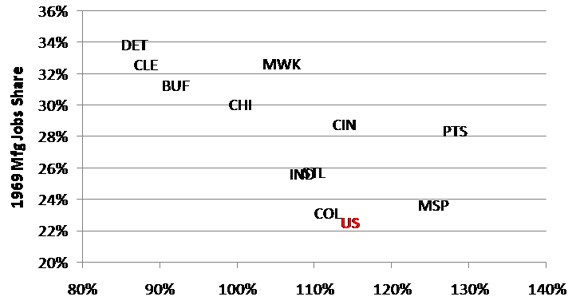

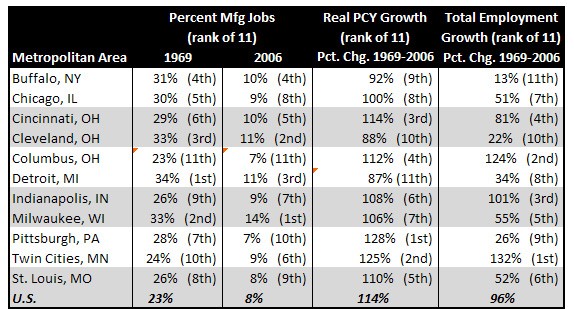

Have the relative growth rates of midwestern metro areas coincided with the degree of their original manufacturing orientation? The charts below display employment concentration in manufacturing for the eleven largest metropolitan areas in the industrial belt on the vertical axis. The horizontal axis displays each metropolitan area’s total job growth on the first chart and real per capita income growth on the second chart. The inverse correlation of economic well-being with initial manufacturing concentration is quite evident. A simple correlation between job growth from 1969 through 2006 and the manufacturing orientation in 1969 is a strongly negative 0.8. Similarly, the correlation between manufacturing and per capita income growth is -0.7.

Figure 1. Total employment growth (1969-2006)

Figure 2. Real PCY growth (1969-2006)

What might be some other reasons behind varying performance of these metropolitan areas? For one, even within the manufacturing sector, industry mix (and related performance) varies markedly. For example, the Twin Cities’ manufacturing base included emerging medical instruments and computer equipment during this time period, while Detroit hosted sagging domestic auto production.

Other observers wonder about the role that the metro core or central city has played in its relative growth and development. Due to marked suburbanization within metropolitan areas, and fixed central city boundaries, some cities such as Cleveland and St. Louis became relatively small islands of population; today, the city population accounts respectively for only 20.9% and 12.5% of these two metropolitan areas. As such, cities such as these were left largely alone to provide public services to low-income populations—and to do so with a rapidly diminishing tax base. Accordingly, some researchers speculate whether growth and development suffered as a result of this trend—not only in the city but in the entire metropolitan area. In contrast, central city Columbus and Indianapolis began with a broader geography and richer tax base with which to provide public services and development-oriented infrastructure.

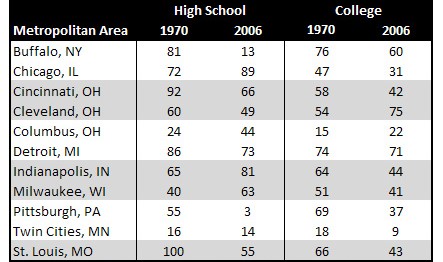

While Midwest cities have many challenges to overcome, there are also assets on which to build. As widely shown and increasingly recognized, the most important overall determinant of regional growth performance has been the educational attainment of its population and work force. This is not surprising given the structural changes that have taken place in the emerging economy—changes which place a greater emphasis on information exchange and the development of creative ideas. For Midwest metro areas, and as discussed by Timothy Dunne in a recent Economic Commentary, educational attainment may be more important than for other regions. To succeed in overcoming the shocks that rocked their industrial bases, educational attainment in Midwest metro areas may have been most helpful in adaptation and re-invention. Tim Dunne displays charts similar to those above which indicate a weaker correlation between educational attainment and growth in warm weather metro areas as compared to cold weather climes. In considering educational attainment of the populations, the table below displays the ranks of Great Lakes metropolitan areas among 118 metropolitan areas in 1970 and 2006. The two local leaders in 1970 college attainment, Columbus, Ohio, and the Twin Cities also experienced the fastest employment growth. While Pittsburgh ranked low in college attainment in 1970, its gains in this metric since then have been the most rapid. Perhaps not accidentally, Pittsburgh’s growth in per capita income also outpaced other cities in the region.

Table 1. MSA rank

Source: IPUMS

As for policy, while the region’s goods-producing industry mix has left behind a legacy of a slow-growing industrial base, the region also boasts top-notch colleges and universities. With regard to elementary and secondary education, the region maintains a healthy income base with which to support its schools. Similar to most other parts of the country, the region’s educational challenges are to have its students to perform much better, especially in central cities and lower-income communities.

Note: Vanessa Haleco-Meyer contributed to this weblog.

Supplemental Information:

Source: BEA