Auto Industry: Back to the Future?

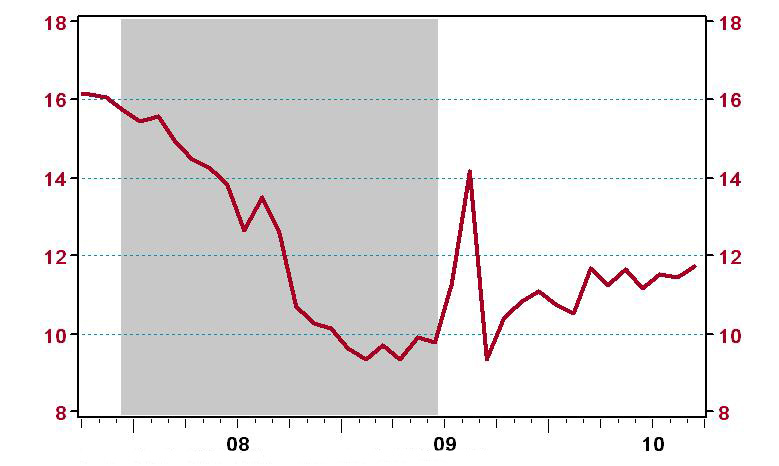

As the sales of light vehicles (cars and light trucks) continue to move up ever so slightly from a deeply depressed state (see chart 1), many wonder about the outlook for the auto industry. How long will it be before we see another year of 16 million units sold in the U.S.? We need to remind ourselves that it’s been fewer than two years since this industry experienced a dramatic slowdown. For every month during the first half of 2009, we saw sales of below 10 million units, calculated at a seasonally adjusted annual rate. For January 2009, we also noted an all-time low capacity utilization rate in the production of light vehicles of 26%. Detroit closed a dozen of its U.S. assembly plants in just two years (2008 and 2009), and thousands of workers were laid off in the industry’s supply base. Things have improved somewhat since the first half of 2009.

Steven Rattner, who was in charge of the day-to-day operations of President Obama’s auto team, recently released a book on the historic restructuring of Detroit in 2008–09.1 The book is a fast-paced account of the many dramatic events that led to a massive government intervention and resulted in an equally massive restructuring of General Motors (GM) and Chrysler between December 2008 and August 2009. It provides a timely reminder of, and an invaluable perspective on, the scope and complexity of those restructuring efforts.

While the recent restructuring of Detroit’s operations was brought on by a sharp cyclical contraction in the overall economy, it also responded to long-running trends that had been insufficiently addressed in the past.2 Detroit’s market share had peaked in the mid-1950s. Detroit’s subsequent decline was long-term and persistent, punctuated by milestone events such as the Chrysler bailout of 1979 (similarly brought on by a deep and sharp recession). Unfortunately, the hard lessons learned from the 1970s oil crises and the early 1980s recessions 3 were forgotten as soon as the real price of gasoline fell back to pre-1973 levels during the second half of the 1980s. During the late 1980s, consumers discovered minivans and sport utility vehicles (SUVs)—segments that the Detroit automakers dominated in profitable fashion at the time. Yet, as the growth in SUVs had run its course by the late 1990s, the fortunes of the Detroit carmakers began to deteriorate once again. In hindsight, corrective actions taken at the time—such as the 2007 labor contracts that addressed automakers’ health care liabilities—could not succeed in light of the sharp recession that followed soon afterward. Rattner’s account illustrates how in Detroit past corporate culture and structure, shaped chiefly during times of success, persisted even in the face of rapidly changing industry conditions.

After the recent restructuring, what’s next for this key manufacturing sector? It is too early to tell for how long the lessons learned over the past two years will be followed. But we know that the structure of the auto industry has changed profoundly during the past 30 years.4 Instead of the Big Three (GM, Ford, and Chrysler), there are now six large companies (GM, Toyota, Ford, Honda, Chrysler, and Nissan) all of them with a global presence, representing 80% of the U.S. market. All of them produce a significant share of their products in North America. And all of them will have to respond to major uncertainties on the regulatory and technological front. The implementation of stricter fuel efficiency standards is under way, and there are a large variety of technical solutions from which to choose, ranging from improvements to the tried-and-true internal combustion engine to all-electric vehicles. Given such an array of options for new products, each automaker will have to make key decisions that will affect its competitiveness. Which company can most efficiently and flexibly produce vehicles? Which can best draw on the capabilities and innovation residing in the auto supply chain? And which can offer the right mix of technology?

The answers to these key questions will continue to shape the Midwest economy and its automotive communities for many years to come.5 Owing to the profound changes resulting from the industry downturn and restructuring, public policies from the community level to the federal level will likely be shaped to address the auto industry and its communities.6

1. Light vehicle sales (autos and light trucks) — S.A.A.R., millions of units

Source: Bureau of Economic Analysis/Haver Analytics.

Footnotes

1 Steven Rattner, 2010, Overhaul—An Insider’s Account of the Obama Administration’s Emergency Rescue of the Auto Industry, New York: Houghton Mifflin Harcourt Publishing Company.

2 For a long-term perspective on Detroit’s decline, see this Economic Perspectives.

3 See for example Paul Ingrassia and Joseph White, 1994, Comeback—The Fall and Rise of the American Automobile Industry, New York: Simon and Schuster.

4 See this presentation.

5 See, e.g., a recent Brookings report on economic recovery in the Midwest.

6 See here for a conference on workforce adjustment.