Groundhog Day for Chicago’s Economy?

Has the Chicago area lost its mojo? Given the poor economic conditions pervading so many regions of the United States, Chicagoans are not alone in asking whether their path of growth and development has gone off track. When the nation’s economy as a whole is down, it is especially difficult for individual regions to interpret economic signals concerning their long-term performance, but the tendency is to read them negatively. For Chicagoans, recent anecdotal evidence may also have shaded their views about the future of the wider Chicagoland area. For instance, Chicago lost its confident bid for the Olympic games this past fall in the first round; Oprah Winfrey announced the relocation of her iconic show to another locale—and, incidentally, from broadcast syndication to her own cable network; several large trade shows announced new venues or possible moves away from Chicago; and the planned mixed-use residential tower—The Spire—halted construction. Such events hardly settle the case; many positive developments mark Chicago’s past decade. In particular, Chicago’s two prominent financial exchanges—the Chicago Mercantile Exchange and the Chicago Board of Trade—moved successfully into the era of electronic trading; and they then merged into the world’s largest (CME Group), expanding even further by recently acquiring the New York Mercantile Exchange (NYMEX). The city’s Millennium Park opened to worldwide acclaim; Trump Tower was completed; and the famed Art Institute opened its Modern Wing—the largest expansion in the museum’s history. Additionally, Chicago’s design and architectural talent played an integral part in the completion of the world’s tallest building in Dubai.

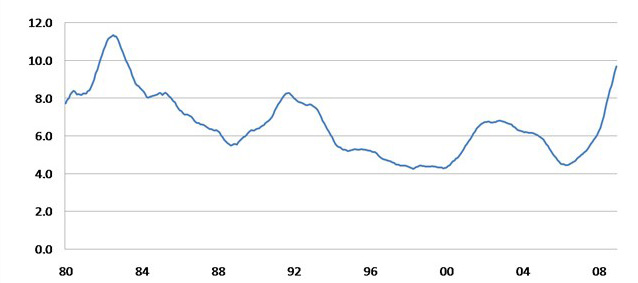

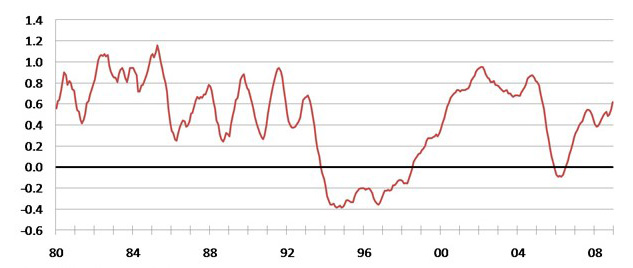

Even with such accomplishments, Chicagoans have a more fundamental reason to pause when assessing their economic direction and performance. Following some very painful years of restructuring that took place during the 1970s and 1980s, the Chicago area economy and its central city experienced a surprising revival from the late 1980s through the 1990s. The revival led many local leaders to believe that the region had begun a new improved course of growth and development. The charts below first show the metropolitan area’s unemployment rates since 1980. Following the 1981–82 national recession, when the local unemployment rate had soared to above 11 percent , the unemployment rate began to fall steeply; it rose again during the 1990–91 recession, but it then continued to fall to just above 4 percent by the year 2000. By comparing the Chicago area’s unemployment rate with the nation, we can see that Chicago’s labor market tightness exceeded the nation’s during the mid to late 1990s, before rising above the nation’s once again over the recent decade to date. Was Chicago’s strong economic performance during the 1990s an aberration?

1. Unemployment rate, Chicago MSA — 12-month moving average (%)

2. Unemployment rate, Chicago MSA minus U.S. — 12-month moving average (%)

Chicago’s turnaround following the 1980s was remarkable in that a fundamental restructuring supported it. Specifically, though the metropolitan area shed much of its manufacturing base, its work force shifted increasingly into professional and business services. In response, many Chicagoans crafted a new image of their metropolitan region: Instead of being a “hog butcher for the world” and the regional locus for manufacturing and transportation, Chicago (at least in the mind of its citizens) was moving into a new role as a global city, one whose economic connections were being forged with other world business capitals. Chicago was seen as a city casting off its roots for something better.

During this time, a central city revival contributed greatly to the wider metro economy. For example, Chicago became a magnet for young educated workers who occupied jobs in the rapidly growing business and professional services sectors. The central city’s quality of life and amenities reputedly brought in “knowledge workers,” in turn attracting companies or those parts of companies that desired access to the young, highly skilled labor pool. The number of central area jobs in professional and business and financial services grew robustly; and the city’s unemployment rate improved, gaining ground on that of its suburbs from the early 1990s onward. The central city gained population during the 1990s for the first time (counting the decade’s total) since the 1940s, although immigration of lower-skilled workers from Central America accounted for a majority of the gains.

Chicago’s performance in the current decade looks much less sanguine. As seen in the charts above, the metro area’s unemployment rate rose rapidly during both recessions of the 2000-09 decade, lingering above the national average for much of the first several years. Shortly after the 2001 recession, a gap of one-half percentage points or more opened up to Chicago’s disadvantage, and it did not dissipate until 2006. And over the past year or more, the Chicago unemployment rate has once again been running 0.5 percentage points or more above the nation’s.

Were some especially negative but transitory factors at play earlier in the 2000s’ decade that would suggest that the outlook for the coming years should be revised upward? Yes, to some degree. Chicago’s sizable manufacturing sector declined disproportionately compared with that of the nation in the early part of the recent decade. In part, the Chicago area’s manufacturing base was steeped in telecommunications equipment, which was especially hard hit nationally. Although the current national downturn in manufacturing is also very steep, Chicago’s manufacturing job base is weathering the recession modestly better than the nation’s.

The post-9/11 fallout in travel and tourism also left Chicago vulnerable earlier in the decade. And while the current economic environment has also been very challenging for the travel-related segments, these segments have fared better than earlier in the decade.

Chicago’s lagging post-recessionary recovery earlier in the decade can also be traced to its hefty professional and business services sectors. After 2001, Chicago’s payroll job growth in these sectors lagged the end of the U.S. recession by two full years. Many of these industries behave like investment or capital goods (e.g., real objects owned by individuals, organizations, or governments to be used in expanding production and sales of other goods or services). That is, during post-recessionary periods companies do not begin to expand their purchases of capital goods until their existing capacity begins to strain and the prospects for market expansion become buoyant. Looking forward, this means that these important business sectors for Chicago may once again experience a sustained period of growth. But the current economic signal is unclear as to whether the Chicago area economy is in a lull, or whether its long-term growth prospects have dampened.

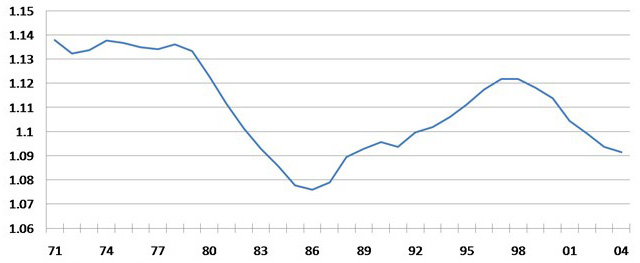

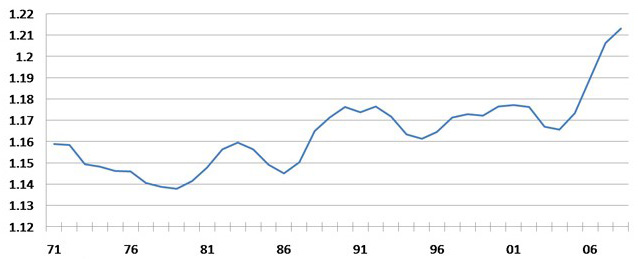

Hindsight does give us some perspective as to the degree to which the Chicago metro area economy has truly divorced itself from its regional business roots to connect with a newly emerging structure in global markets. One chart below shows a ratio of broad economic activity—namely, per capita income—for the Chicago region to that of all other metropolitan areas over the past four decades; the other chart shows the ratio of per capita income of the Chicago area to that of the industrial Midwest states of Illinois, Indiana, Wisconsin, Michigan, and Indiana. First, in comparing Chicago’s per capita income to that of all other U.S. metropolitan regions, Chicago’s relative income is seen to fall modestly in the 1970s and then steeply over the first half of the 1980s. But then, from the mid-1980s throughout the 1990s, per capita income gained steadily on the U.S. average; by this metric, Chicagoans were correct about their economy’s performance: It had truly been on the rise over that period.

3. Per capita income, ratio of Chicago MSA to U.S. Metro Areas — 3-year moving average

4. Per capita income, ratio of Chicago MSA to Great Lakes states — 3-year moving average

However, it is more difficult to draw the conclusion that the Chicago area had successfully restructured its jobs base away from its surrounding region to become a global city. Whether Chicago had become more of an interconnected global financial and business center, such as New York or London, is still an open question. As seen above, for much of the 1990s, the Chicago region’s per capita income made little if any gains on the Great Lakes region. Rather, by way of explanation, the surrounding Midwest region was also experiencing a comeback of the same degree 1. Domestic automakers were well on their way to profitability in producing energy-hungry passenger vans and sport utility vehicles. Meanwhile, rapid growth in the developing world supported Midwest production of capital goods machinery, such as farm and construction equipment. The Chicago regional economy continued to restructure toward high-skilled service provision, but its linkages may have remained somewhat parochial. That is, the Chicago area’s own growth appears to have been achieved through the provision of professional and transportation services to its traditional Midwest business partners.

In reappraising the era of the 1990s (especially in light of the Chicago region’s recent subpar economic performance), Chicago leaders and analysts may be motivated to look more carefully at possible directions for the future. Relative to some other Midwest and Northeast cities, the Chicago area has many assets, such as its prodigious base of professional services and a vibrant central city, which may provide ample opportunities for growth. Yet the future of Chicago’s economic direction and structure remain somewhat murky.

Footnotes

1 In the current decade, Chicago’s gain on the surrounding region largely reflects rapidly falling incomes and economic activity in Michigan.