Illinois Fiscal Outlook – A Workshop Takeaway

Just how bleak is the long-term fiscal forecast for Illinois? And what are the possible solutions, if any, to the state’s financial troubles? These were among the challenging questions raised at the Illinois Fiscal Outlook Breakfast, held by the Federal Reserve Bank of Chicago and the Institute of Government and Public Affairs (IGPA) on February 27, 2015.

The event was attended by about 75 people from various companies, government offices, and universities across Illinois. Richard Dye, Co-Director of the Fiscal Future Project (FFP) within IGPA, was the primary speaker. He presented IGPA’s latest report, “Apocalypse Now? The Consequences of Pay-Later Budgeting in Illinois: Updated Projections from IGPA’s Fiscal Futures Model,” released in January. Dye was joined by panelists Woods Bowman, Professor Emeritus at DePaul University, Laurence Msall, President of the Civic Federation, and Senator Daniel Biss of Illinois’s 9th Legislative District.

The primary goal of the FFP study is to assess total state spending using a model that investigates the long-run fiscal troubles and consequences of potential state choices. The model allows analysis of a longer term than previous studies have examined, projecting out through 2026. The study expands on previous research that has focused on general spending by assessing the state’s All Funds Budget. Moving funds around within fiscal years or transferring assignments across years can lead to variations in General Funds measurements. These distortions are eliminated using the more-encompassing All Funds Budget evaluation.

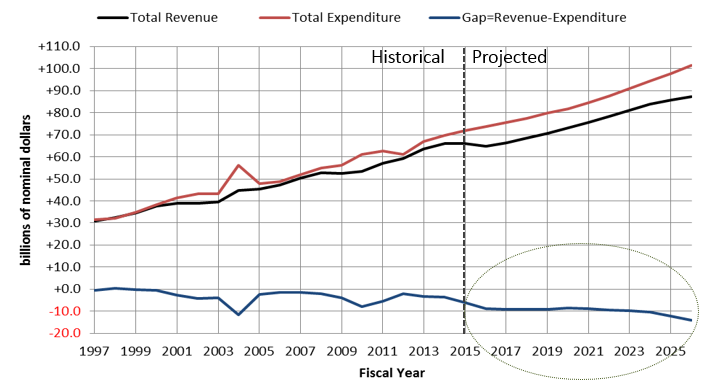

The Fiscal Futures Model focuses on the Structural Budget Gap, calculated as the difference between Total Sustainable Revenue (which excludes new borrowing, decreased fund balances, and other one-time sources) and Total Spending. Overall, the study presents a grim outlook for Illinois’s fiscal future. Dye and his colleagues found that the state has run a cash deficit consistently since 2001, contributing to a large and growing structural deficit. They predict that this deficit will remain at about $9 billion for fiscal years 2016 to 2022, reaching $14 billion by 2024 if existing laws and spending trends continue (see figure below). Given that the state’s projected total spending is $74 billion for fiscal year 2016, drastic cuts would have to be made in order to address the deficit. Furthermore, not all spending can be cut due in part to contractual obligations and because cutting other spending would increase unfunded liabilities or decrease revenue from federal matching, which means the possible solutions are limited.

Figure 1

The primary culprit in this large deficit, according to the FFP, is “pay-later budgeting,” which they define as “Illinois’s persistent practice of spending more than the inflow of taxes and other sustainable revenue can recover.” This essentially means borrowing based on IOUs or other liabilities in order to pay off the current deficit, thereby crowding out other spending. The largest contributors to these accumulated IOUs are unfunded pension liabilities, making up $106.5 billion of the $159 billion total sum. While there is a schedule to pay back some of these IOUs, others, including unfunded retiree health cost liabilities and unpaid bills, have no defined pay-back schedule. This will likely result in more crowding out of spending in the future. Adding to the state’s troubles is the fact that the temporary income tax increase implemented in 2011 expired on January 1, 2015. Spending, however, was not cut to sustainable levels in order to compensate for the reduced income tax revenue. The FFP predicts that Illinois tax revenue will drop $2 billion in fiscal year 2015, and $4 billion in fiscal year 2016, clearly exacerbating the state’s fiscal woes.

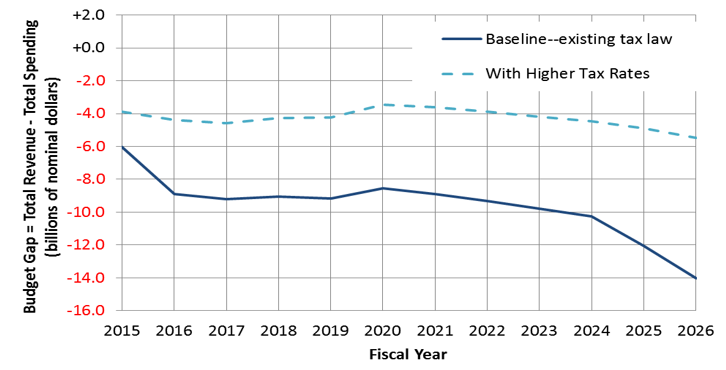

The study concludes that eliminating the $9 billion deficit will require either devastating cuts in discretionary spending, a 25% increase in state-controlled revenues, twice what would come from postponing the income tax rate cuts (see figure below), or some unpleasant combination of tax increases and cuts in spending.

Figure 2

Note: Revenue excludes new borrowing

Bowman followed up by highlighting three financial problems that cast a long shadow over Illinois’s fiscal troubles. The first, as previously emphasized by Dye, is the need for sustainable long-term pension funding. The second is legacy costs, which are the obligations to pay for services the state purchased in previous years. Finally, a new Governor and the potential for conflict between a Republican Governor and Democratic state legislature raise new uncertainty regarding feasible political options. Bowman suggested the state might consider a value-added tax, essentially a broad-based consumption tax, that could be relatively elastic with respect to income and act as a sustainable partial solution over time. He concluded with a proposal of placing a surcharge on certain fees, such as fees for license plates, as another temporary revenue enhancement.

Msall highlighted the bad trend by Illinois of failing to tie temporary revenues to temporary spending limits and the long-term harm this can have on the state’s deficit. The Civic Federation designed a Roadmap to lay out parameters of the state’s problems and potential solutions. However, given Governor Rauner’s budget and the drop in income tax revenue that set in on January 1, the goals laid out in the Roadmap, including fixing the fiscal cliff for fiscal year 2015 and controlling state spending, will not be reachable.

Msall suggested several possible strategies to reduce the state’s deficit, including retroactively postponing the completion of the income tax rollback. Specifically, the Civic Federation proposes retroactively increasing the income tax rate to 4.25% and 6.0% for individuals and corporations, respectively, as of January 1, 2015. The Roadmap then advises that Illinois roll back the rates to 4.0% and 5.6% for individuals and corporations, respectively, on January 1, 2018. Msall noted that of the 41 states that collect an income tax, only three, including Illinois, do not tax pension income. The Civic Federation sees this as a lost opportunity for additional state revenue and proposes implementing a tax on non-Social Security retirement income for individuals with over $50,000 in total income. The Civic Federation’s plan also supports eliminating the sales tax exemption for food and non-prescription drugs through fiscal year 2019 in order chip away at the deficit. To reduce the impact on low-income individuals, the Roadmap proposes expanding the earned income tax credit, from 10% of the federal credit to 15% by fiscal year 2018.

The widespread problems the state is facing spill over to affect local governments, including Chicago, Msall explained. Based on the current trend, the city may soon be forced to choose between not funding contributions, thereby violating pension laws, or increasing taxes, which would adversely affect the city’s appeal as a place to live. Given the city’s recent credit rating downgrade by Moody’s from Baa1 to Baa2, the choices ahead will be difficult.

State Senator Biss outlined the historical series of irresponsible fiscal decisions and policy actions that have dragged Illinois into its current fiscal deficit. He also highlighted an absence of meaningful spending cuts in Governor Rauner’s budget that would be necessary to compensate for the reduced revenue. Biss described a common problematic habit in electoral politics of searching for large overall fixes to problems the state faces in order to give the outward appearance of progress. This often results in attempts to reform the internal structure of the government in an effort to weed out waste and fraud, which often don’t actually contribute to the financial troubles as much as politicians proclaim. What Illinois needs instead, he said, is to find ways of creating more revenue or cutting actual expenditures.

The undetermined status of Senate Bill 0001, sponsored by Biss, among others, contributes to the current uncertainty about Illinois’s fiscal future. This Bill’s purpose is to implement pension reform that will create substantial budgetary savings and help Illinois make actuarially required payments that are in line with national actuarial standards. However, because the bill is currently under review by the Illinois Supreme Court, the actions available to the state government are unclear. Biss concluded that the only way to dig Illinois out of its deficit is to implement many small to medium changes across society, not necessarily evenly distributed, but carefully prioritized to have the most widespread and effective impact. For example, Biss said a comprehensive pension reform package is imperative to maintaining the state’s ability to fund key areas of state government. He cautioned that portions of Governor Rauner’s budget unfairly target poor, working-class families by reducing funding to programs that benefit them, including Medicaid, foster care, and community colleges. Regardless of the actions the state does decide to take, the path forward will not be pleasant, he warned. But by committing to a “shared sacrifice” strategy of distributing cuts across the board, Illinois will hopefully be able to make steady progress out of the current fiscal trap.